By Modupe Gbadeyanka

Last Thursday, the Central Bank of Nigeria (CBN) and the Securities and Exchange Commission (SEC) released guidelines for the settlement of all types of securities in the country.

This, we learnt, was part of their statutory mandate of promoting and facilitating the development of efficient and effective systems for settlement of transactions in Nigeria.

Business Post gathered that the guidelines cover the settlement procedures and settlement cycle for the trades executed in the Nigerian Stock Exchange (NSE) traded securities, FMDQ Over The Counter (OTC) Securities, NASD Over The Counter (OTC) Securities, Nigerian Commodity Exchange (NCX) traded securities and Afex Commodities Exchange.

The rules also set out procedures for the settlement of securities, including the rights and obligations of the parties involved in every transaction.

It was posted on SEC website that the general rule is that any securities transaction must trade or be reported through a licensed Exchange in line with the standard settlement guidelines.

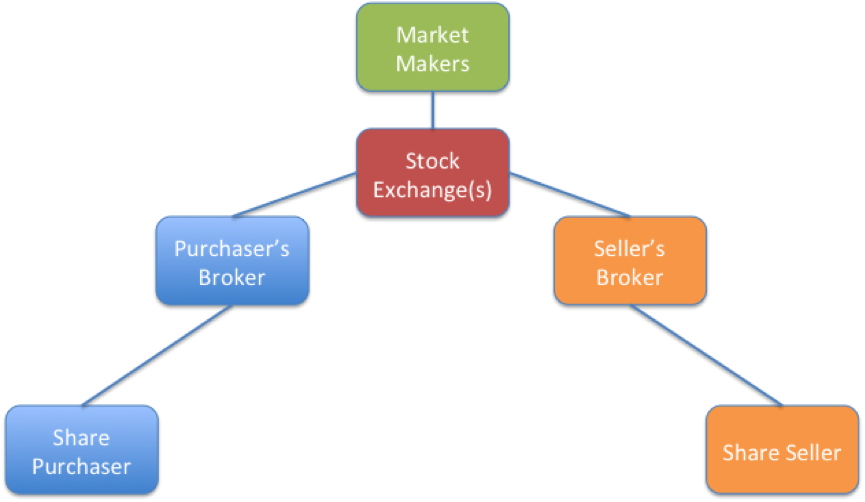

Furthermore, parties to Securities Settlement include but not limited to Capital Market Registrars, CBN, NSE, Central Securities Clearing System (CSCS) PLC (Central Securities Depository -Clearing & Settlement Agent), Deposit Money Banks (DMBs), Custodians, Dealing Members Firms Page, Discount Houses and Nigerian Commodity Exchange (NCX).

“After each day’s transaction (Day T), the clearing/settlement agent (CSCS) shall generate the financial obligations of each dealing positions of the dealing member firms based on their respective settlement banks to arrive at net position per settlement banks,” SEC said.

In addition, for Federal Government securities, after each day’s transaction (Day T), the clearing/settlement agent shall generate the financial obligations of each dealing member firms.

Also, the clearing/settlement agent shall generate the financial positions of the dealing member firms based on their respective settlement banks to arrive at net position per settlement banks.

On federal government securities (primary auction), the guideline directed that among other things, after the release of auction result, the Government Securities Issuing Agent shall notify each successful Bidder (primary dealer) their financial obligations. The successful Bidder shall fund its account with the Government Securities Issuing Agent for settlement on or before Day T+2.

SEC explained that the main aim of this guideline is to promote competitive, efficient, safe and sound post trading arrangements in Nigeria, which should ultimately lead to greater confidence in securities markets and better investor protection and should in turn limit systemic risk.