Economy

NPDC Attains 100% Local Content Input in Edo Gas Project

By Dipo Olowookere

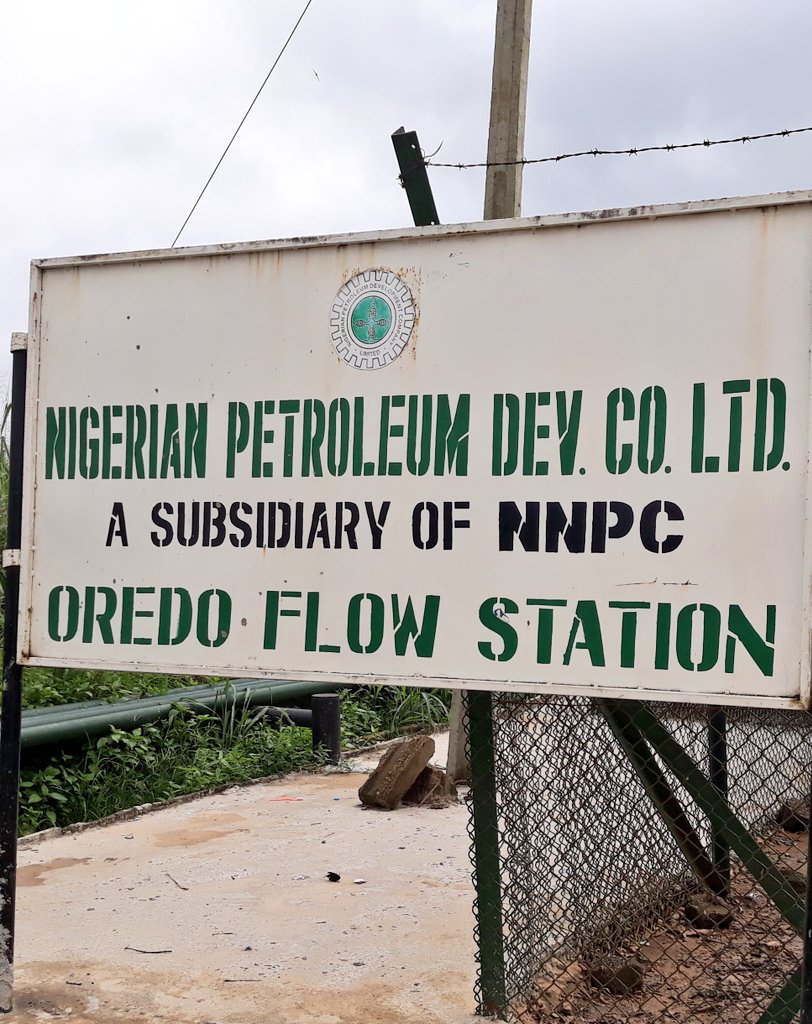

The Nigerian Petroleum Development Company (NPDC), an Upstream Subsidiary of the Nigerian National Petroleum Corporation (NNPC), has achieved a 100 per cent local content input in the development of Oredo Integrated Gas Handling Facility.

Group Managing Director of NNPC, Dr Maikanti Baru, declared this Wednesday during a tour of the NPDC’s Oredo Flow Station, Oredo Gas-to-Pan-Ocean Facility, Oredo Integrated Gas Handling Facility (IGHF), as well as the Oredo LPG Dispensing Facility, all in Edo State.

Commending NPDC on the feat, Mr Baru said he was proud that a world-class facility was being put in place by a Nigerian engineering contractor in conjunction with another Nigerian company, the NPDC.

“From engineering, construction to erection of the various units, we feel very encouraged by the huge man-hours which you are putting in here, day and night, with full local content,” Mr Baru told over 500 workers at the site.

The IGHF is currently at 80 percent completion. When completed in December, it will make provision for dehydration of gas and liquid extraction. It is expected to also produce both Liquefied Petroleum Gas (LPG) and Propane, in addition to dry gas to the Escravos Lagos Pipeline System (ELPS).

He described the Oil Mining Lease (OML) 111, where the gas projects are located, as one of the most significant assets of the NPDC because it is where the corporation’s staff and their contractors design, build and operate facilities hitherto operated by the International Oil Companies (IOCs).

“You could see that right from the well-design through to reception of the various liquids to the processing and disposal of the various outputs, it is fully indigenous. So, it cannot be better than this,” he added.

He said as a National Oil Company (NOC), the corporation was using this to showcase its ability to intervene, stressing that “we are not just a player, we are also building capacity that can enable us intervene by taking over any assets whenever any contractor decides to opt out,” he added.

Mr Baru stated that the project’s funding constraints would be addressed soonest, stressing that NNPC was considering alternative means to support and complete the project.

“All these projects are located within OML 111, one of our critical assets which we are keen on deriving maximum benefits from,” he stated.

Earlier, Managing Director of NPDC, Mr Yusuf Matashi, thanked the NPDC Board led by the GMD, for coming down to inspect the gas facilities, saying it was the first time the company was witnessing a highly-synchronised support towards these projects.

He said the LPG Dispensing Facility strategically offered 40% solution for Nigeria’s domestic LPG market which would translate into extra cash flow for the company.

“Another advantage is that it will ensure ease of distribution and penetration into the market. You can take LPG to every nook and cranny of the country from here. So, it is quite strategic,” he noted.

The MD said in line with NPDC’s Corporate Social Responsibility (CSR) efforts, the company had engaged youths within the host community area, with a number of them fully involved in the local contracts around the project as well as the pipeline Right Of Way (ROW).

“We have also completed a Skills Acquisition Centre which is currently being furnished in line with the component of the project. We intend to commission the centre even before the project is completed. From our records, this is one project that has engendered cordial relationship with the Oredo community and we hope to replicate similar understanding in other areas within the Niger Delta,” Mr Matashi stated.

In his remarks, the NNPC Chief Operating Officer, Upstream, Mallam Bello Rabiu, who expressed happiness that the project would be delivered within time and budget, also charged the workers to double the over one million man-hours achieved so far in the project without any incidence.

While further assuring of timely funding for the project, the NNPC Chief Financial Officer, (CFO) Mr Isiaka Abdulrazaq, commended the NPDC Management for performing impressively on the project and for its drive towards making NPDC the E&P Company of choice in Nigeria.

Located 34km southeast of Benin City, the OML 111 is an onshore field comprising five fields viz: Oki-Oziengbe-South, Aroh North, Koko, Oghama as well as Oredo, which has twelve (12) out of its fifteen (15) wells currently producing.

Economy

Presco Acquires 10,000-Hectare Nsadop, Boki Plantations After $100m Deal

By Aduragbemi Omiyale

Days after announcing the injection of $100 million from SIAT NV, Presco Plc has acquired about 10,000 hectares across the Nsadop and Boki plantations in Cross River State.

The fully integrated edible oils group disclosed in a statement made available to Business Post on Friday that the strategic acquisition further consolidates its position as the dominant player in Nigeria’s palm oil industry.

The plantations is part of efforts to significantly expand Presco’s production footprint and strengthen its ability to meet the rapidly growing domestic demand for edible oil products.

By integrating these estates into the group, Presco will unlock new agronomic potential and secure a broader raw material base to support higher processing and refining throughput across its value chain.

By expanding its plantation base by 10,000 hectares, Presco advances national food security, reduces reliance on imports, and supports the federal government’s drive toward industrial self-sufficiency.

As these estates are upgraded and integrated, they are expected to generate meaningful productivity and profitability upside, delivering sustainable long-term value for shareholders while strengthening Presco’s role as a key driver of the country’s agro-industrial transformation.

Presco said it would apply its proven model of sustainable agriculture, community development, and responsible land stewardship to Nsadop and Boki.

The company plans to work closely with host communities, replicating its established social investment framework, supporting job creation, and ensuring a stable and mutually beneficial operating environment.

“This acquisition is a decisive execution of the commitments we made to our shareholders. During the launch of our recent Rights Issue, we pledged to accelerate our plantation expansion and position Presco for its next phase of growth.

“Today’s announcement delivers on that promise. Nsadop and Boki are strategically located estates that complement our existing operations and expand the scale required to power our mills and refineries at higher capacity,” the chief executive of Presco, Mr Reji George, said.

“This move is not only about expanding land, it is about strengthening our leadership, securing long-term supply, and reinforcing our belief in the future of Nigeria’s agribusiness sector,” he added.

Economy

FG Launches Platform to Settle Natural Gas Trade

By Adedapo Adesanya

The federal government has unveiled Africa’s first gas trading licence, clearing house and settlement leeway platform to ensure efficient and transparent trading of natural gas.

The government, through the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) in partnership with the Securities and Exchange Commission (SEC) granted a license to JEX Markets Limited to establish and operate the online platform for gas trading and exchange.

Minister of State for Petroleum Resources (Gas), Mr Ekperikpe Ekpo, at the launch said the platform would pave the way for easy natural gas business, transparent pricing and secure payment mechanisms hallmarks that align with the national energy policies and global best practices.

According to him, the initiative is critical for the success of the ‘decade of gas’, noting that the trading environment and the benefits that come with it will strengthen the level of industrialisation and ensure the injection of private investments into the gas processing and transport sectors.

“This launch is completely consistent with the Renewed Hope Agenda of His Excellency, President Bola Ahmed Tinubu, who stated that natural gas will play the central role in the energy security, industrialisation, and economic diversification. The President’s vision requires a regulatory environment that is predictable, trusted, and designed to unlock value,” he said.

Mr Ekpo said the country is richly endowed with natural gas reserves, among the biggest in the world, but if the underlying market where the gas will flow is not efficient, reliable, and well-regulated, it will not be possible for us to realise the ultimate potential of the resource.

“The gas trading licence introduced today is decisive on this front, paving the way for a new, regulated market where reliable traders will feel safe doing business, where businesses can plan, and where investors can invest, knowing that it will safeguard both their capital and the public interest.

“The licence is founded upon sound regulations and guidelines governing technical competence, commercial capability, financial soundness, and responsible operations. Among the responsibilities of the licence holders is the adherence to the various rules on gas measurement, tariffs, pricing, and assignments,” he said.

On his part, NMDPRA Chief Executive, Mr Farouk Ahmed, also said Nigeria holds over 209 trillion cubic feet (TCF) of proven gas reserves, which is the largest in Africa and an estimated 600 TCF of potential reserves.

He said despite the potential, Nigeria’s domestic gas market has remained underdeveloped and constrained by pricing opacity, high transaction costs, limited flexibility, market illiquidity, poor sanctity of gas contracts, restricted access to gas and low investments in the sector.

Mr Ahmed noted that the presentation of a Gas Trading License (GTL) and a Clearing House and settlement Authorisation to JEX Markets Limited is in compliance with the provisions of section 159 of the Petroleum Industry Act (PIA) 2021 for the trading and settlement of wholesale gas in Nigeria.

The implementation and full operationalisation of this provision of the PIA will further unlock the extensive opportunity and investment potentials of the gas industry through the improved supply and utilisation of the country’s vast gas resource in our strategic economic sectors of power, Industry and transportation.”

Economy

PZ Cussons Stocks Soar After Cancelation of Exit from Nigeria, Others

By Adedapo Adesanya and Aduragbemi Omiyale

The shares of PZ Cussons appreciated by 9.36 per cent on the floor of the Nigerian Exchange (NGX) Limited on Thursday to N45.00 from N41.15 on Wednesday.

This was buoyed by news that the company has halted its Nigeria exit plans and unveiled fresh expansion targets driven by renewed growth momentum in its key markets of the country as well as others.

This followed the conclusion of a strategic review, outlining an ambitious plan to strengthen the company’s presence across key markets on the continent including Nigeria, Kenya, and Ghana.

The company in a statement on its website on Thursday noted that the renewed focus formed part of a broader strategy to build a portfolio balanced between Developed markets such as the United Kingdom and Australia/New Zealand, and emerging markets including Indonesia and Nigeria.

The review, which began in April 2024, had included the sale of the Group’s 50 per cent stake in PZ Wilmar Ltd., its non-core edible oils joint venture in Nigeria to its partner, Wilmar International, for $70 million.

According to the company, the review attracted substantial interest from potential buyers.

However, the Board resolved that shareholder value would be better maximised by retaining the Africa business and pursuing long-term growth.

PZ Cussons stated that its new strategic direction for Africa would focus on building a winning portfolio of “locally loved brands,” anchored on three major pillars.

The first pillar was core growth across Nigeria, Kenya, and Ghana.

This will involve plans to deepen brand-building efforts, expand distribution, improve in-store execution, strengthen revenue-growth management, and enhance digital engagement.

The firm noted that its Nigerian subsidiary had doubled the number of directly served retail outlets since the 2022 financial year, boosting recent performance.

The second pillar targets category expansion into adjacencies such as men’s grooming and beauty, leveraging established brands including Venus, Imperial Leather and Premier.

The third pillar focuses on pan-African expansion, with new markets expected to be supplied through its existing operations in Nigeria and Kenya.

Highlighting Africa’s long-term potential, the Group said the continent’s population was projected to grow by more than 900 million over the next 25 years.

This represented over half of global population growth. Nigeria alone is expected to add over 100 million people, supported by rapid urbanisation and an expanding middle class.

PZ Cussons added that recent economic and currency improvements had supported double-digit revenue growth in the first half of its financial year.

The board expressed confidence in the company’s prospects, citing deep local insights, decades of brand heritage and strong manufacturing and distribution capabilities, especially as several multinationals had exited the market in recent years.

It noted that nearly 80 per cent of revenue in Nigeria was generated from brands that hold the number-one or number-two position in their categories.

“In the 2025 financial year, Africa contributed £141 million in revenue and £16 million in adjusted operating profit, representing 27 per cent and 30 per cent of the Group’s totals respectively.

“Following the divestment from PZ Wilmar, its Africa operations now comprise Family Care and Electricals in Nigeria, and Family Care businesses in Ghana and Kenya.

“The Group holds a 73.3 per cent stake in PZ Cussons Nigeria Plc,” the statement said.

Commenting, Mr Jonathan Myers, Chief Executive Officer of PZ Cussons, said, “Since embarking on the strategic review of Africa, we have identified or agreed the sale of non-core or surplus assets totalling over £70 million.

“This, combined with continued cash generation of the Group, has significantly strengthened our balance sheet.

“After a thorough review of the remainder of the Africa business and careful evaluation of the offers received, the Board believes it is in the best interest of our stakeholders to retain the business.

“Africa is a market of great opportunity. Given PZ Cussons’ deep heritage there, and given the strength of our brands and operational capabilities, we are well-placed to win over the longer term.

“Benefitting from a more stable economic environment in recent months and with positive fiscal reform, momentum in our Africa business is strong, with double-digit revenue growth in the first half of the financial year.

“We will now look to build on this strong performance and extend our category leadership, with nearly 80 per cent of our revenue in Nigeria already coming from brands with #1 or #2 positions.

“With plans underpinned by appropriate guardrails established to reduce risk and manage volatility, we are confident that we have a business that is set up for success.

“We expect Africa to be a significant contributor to overall Group revenue growth as we seek to build a winning portfolio of locally-loved brands, balanced between Developed and Emerging markets.”

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn