Economy

Flour Mills Increases Dividend Payout by 30% as Revenue Hits N1.2trn

By Dipo Olowookere

The board of Flour Mills of Nigeria Plc is proposing to pay shareholders of the company a dividend of N2.15 per unit for its 2022 financial year, which ended on March 31, 2022. This amount is higher than the N1.65 paid in the previous accounting period, reflecting an increase in dividend payout by 30.3 per cent.

The firm, in its audited results released on Tuesday, said the year under review was profitable as the pre-tax profit jumped by 10.48 per cent to N41.1 billion from N37.2 billion, while the net profit appreciated by 8.95 per cent to N28.0 billion from N25.7 billion, with the earnings per share (EPS) at N6.26 compared with the previous year’s N6.38.

Analysis of the results revealed that in the fiscal year, Flour Mills posted an annual turnover of N1.2 trillion in contrast to the N771.6 billion achieved a year earlier and this was largely due to improvement in the earnings from the sale of goods. It also recorded a significant improvement in income from the services it rendered in the period under consideration as it accounted for N45.6 billion versus the N29.2 billion earned from the same income stream in 2021, which is mainly from support services.

From the revenue generated in FY 2022, the food business raked in N748.8 billion versus N478.3 billion last year, the agro-allied business, which involves the sale of Golden Penny Vegetable Oil, Soya Oil and Margarine products, the company generated N213.4 billion as against the N139.4 billion a year earlier, while the sugar arm of the organisation contributed N156.0 billion to the total earnings compared with the N124.6 billion in FY 2021.

However, Business Post observed that despite the 55.6 per cent increase in the gross earnings for the year, the gross profit only moved higher by 1.2 per cent to N108.1 billion from N106.8 billion.

This was largely due to the higher cost of sales as it finished the year at N1.1 trillion compared with the N664.9 billion in the previous year.

A chunk of this was the higher cost of raw and packing materials (N958.0 billion versus N583.6 billion in 2021), an increase in fuel and oil to N23.1 billion from N17.8 billion, a jump in factory repairs and maintenance to N16.1 billion from N11.8 billion and an increase in other production expenses to N12.5 billion from N8.6 billion.

A further look into the financial statements showed that Flour Mills was able to cut down its selling and distribution expenses to N11.1 billion from N12.1 billion, but the administrative costs rose to N31.8 billion from N29.1 billion, leaving the company with an operating profit of N65.5 billion in contrast to N52.2 billion in the previous accounting year.

Economy

Lagos Unveils Roadmap to Establish West Africa’s International Financial Hub

By Adedapo Adesanya

Nigeria’s commercial nerve centre, Lagos State, has announced plans to establish West Africa’s premier International Financial Centre to unlock international investment, innovation, and sustainable growth.

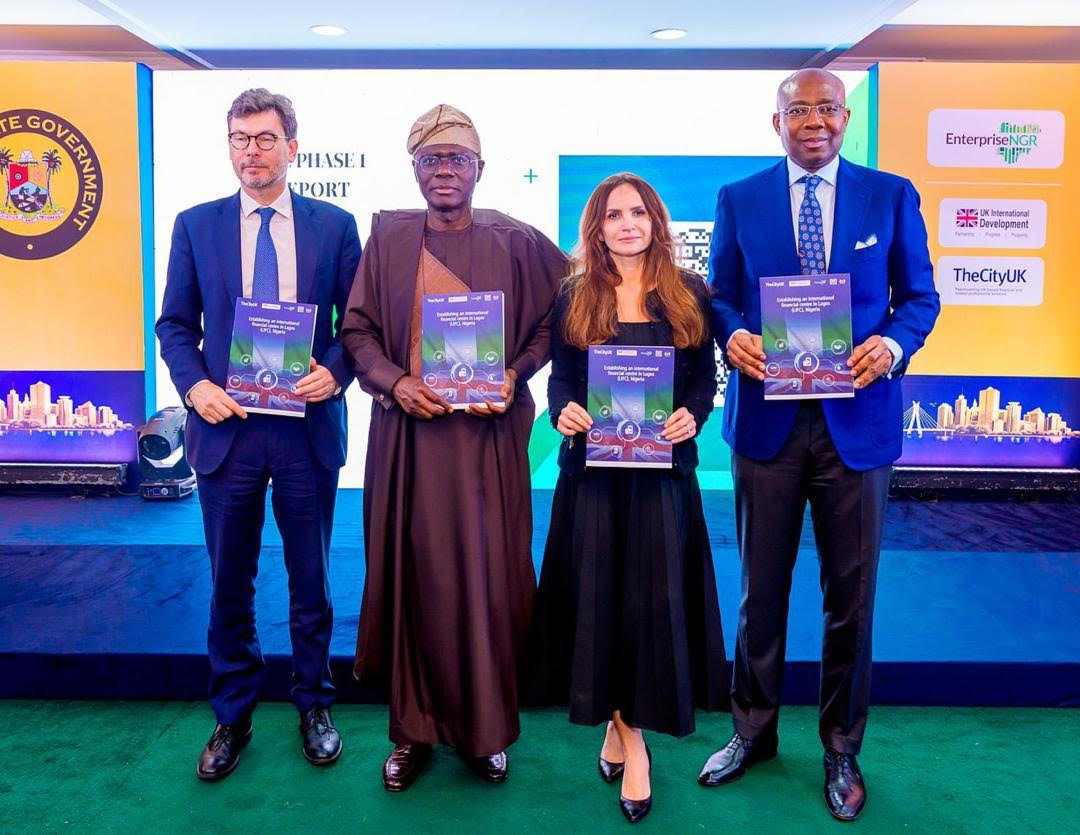

TheCityUK, in partnership with the UK Government, Lagos State Government, Lagos International Financial Centre Council (LIFCC), and EnterpriseNGR, on Monday unveiled a landmark report, Establishing an International Financial Centre in Lagos (LIFC), Nigeria, outlining a strategic roadmap to achieve the goal.

The establishment of a Lagos International Financial Centre aligns with Nigeria’s Agenda 2050 and the Lagos State Development Plan 2052 to deliver long-term economic prosperity, deepen financial markets, and attract productive global investment.

According to a statement, the project is hinged on a public-private partnership bringing visionary leadership from the government together with private sector companies seeking to tap into Nigeria’s young, dynamic market to deliver economic growth.

The unveiling was done at the State House Marina with guests including Lagos State Governor, Mr Babajide Sanwo-Olu, British Deputy High Commissioner Mr Jonny Baxter, and EnterpriseNGR Board Chairman and CEO, Mr Aigboje Aig-Imoukhuede and Mr Obi Ibekwe.

Lagos International Financial Centre Council will support Nigeria’s ambition to become an upper-middle-income country by 2050, driving inclusive growth, reducing poverty, and creating high-value jobs, especially for Nigeria’s talented youth, as per the report, adding that it will benefit from the strong UK-Nigerian co-operation, building on best practices and global benchmarks to align the LIFC with international standards.

The report proposes creating an independent International Financial Centre in Lagos to enhance regulatory clarity, simplify tax and policy frameworks, and boost investor confidence. It recommends an initial focus on Green and Sustainable Finance, FinTech and Innovation, and Commodities and Capital Markets, supported by strong governance, legal reforms, stakeholder collaboration, and targeted talent development.

Speaking on this, Governor Sanwo-Olu said, “Lagos is fully committed to the birth of the International Financial Centre. We know that it is a veritable means of supporting seamless trading and to enhance competitiveness of financial markets.

“As Nigeria’s largest economic and financial centre, Lagos plays a critical role in driving the nation’s capital markets. We need to create an ecosystem that will help to facilitate investment flows, enhance market liquidity, and promote financial literacy.

“The LIFC initiative will not only strengthen our market infrastructure but also unlock new opportunities for public-private partnerships in technology and capital market development. It will support seamless trading, attract foreign investment and enhance the competitiveness of financial markets.”

On his part, Mr Jonny Baxter, British Deputy High Commissioner, commented, “The launch of the Lagos International Financial Centre report reflects the deepening of the UK-Nigeria partnership, combining Lagos’s comparative strengths with UK expertise. Anchored in clear, evidence‑based analysis and launched at a pivotal moment in Nigeria’s reform journey, the LIFC has the potential to unlock major domestic and international investment, deepen capital markets, create jobs, and drive sustainable economic growth across the country, not just in Lagos State.”

Mrs Nicola Watkinson, Managing Director, International, TheCityUK, said, “Nigeria is a high-growth, dynamic and large market and the Lagos International Financial Centre could be vital to its future. By building a modern, integrated business and regulatory environment and financial ecosystem, the LIFC will support the attraction of global and domestic capital, deepen domestic markets, facilitate innovation in FinTech and green finance, and create high‑value jobs for Nigeria’s youth.

“Supporting the development of Lagos as an international financial centre is a clear example of how the UK and Nigeria are deepening their strategic partnership.”

Economy

Nigeria Now Consolidating Reforms for Economic Stability—Edun

By Adedapo Adesanya

The Minister of Finance and Coordinating Minister of the Economy, Mr Wale Edun, has stressed that Nigeria was now consolidating its macroeconomic reforms to sustain economic stability in an increasingly volatile global environment.

The Minister spoke at a high-level panel on Fiscal Policy in a Shock – Prone World at the ongoing Al Ula conference for Emerging Market Economies in Riyadh, Saudi Arabia.

“Nigeria’s macroeconomic and fiscal reforms are working. Momentum must be maintained, and the benefits channelled towards long-term growth and resilience,” he stated.

He said the government is also leveraging digital tools to improve revenue assurance, while deepening fiscal and monetary coordination and promoting realistic budgeting practices to ensure durable fiscal discipline.

He noted that despite accounting for a significant share of global growth, population and natural resources, emerging economies remain under-represented in global financial decision-making.

Mr Edun also highlighted the growing strategic importance of Gulf nations in the evolving global economic landscape.

He said countries in the Gulf are increasingly shaping global trade routes, investment flows and sources of capital, making them critical partners for emerging economies such as Nigeria.

The finance minister stressed Nigeria’s commitment to building stronger partnerships that promote a more inclusive and equitable global financial system.

He said Nigeria was positioning itself to engage constructively with global partners to support reforms that unlock growth, stability and shared prosperity.

Mr Edun’s call comes amid mounting global economic pressures. Many emerging economies are grappling with high debt levels, elevated inflation, volatile capital flows and tightening global financial conditions.

Rising interest rates in advanced economies have increased debt-servicing costs, while currency volatility has strained fiscal and external balances across Africa and other developing regions.

Global trade is also facing increased fragmentation due to geopolitical tensions, supply chain disruptions and protectionist tendencies.

These trends have disproportionately affected emerging markets that depend heavily on trade, foreign investment and access to international finance.

For Nigeria, the push for a global economic reset aligns with ongoing domestic reforms aimed at stabilising the macroeconomic environment.

The country has embarked on exchange rate reforms, fiscal consolidation and efforts to attract long-term investment to support growth and job creation.

Mr Edun has repeatedly argued that without reforms to the global financial system, domestic policy efforts in emerging economies risk being undermined by external shocks.

At the Al Ula conference, he reiterated that a more balanced global system would enhance resilience, improve access to finance and support sustainable development.

He said Nigeria would continue to engage in global policy conversations to ensure that emerging economies are not only rule-takers but active shapers of the new global economic order.

Economy

Lagos Lists N230bn Series 4 10-Year Bond on Stock Exchange

By Aduragbemi Omiyale

The N230 billion 10-year bond issued to investors by the Lagos State government has been listed on the Nigerian Exchange (NGX) Limited.

It was the Series 4 of the state government’s N1 trillion Debt and Hybrid Instruments Issuance Programme, which was sold at a coupon rate of 16.25 per cent.

It was offered for sale to bondholders in November 2025, with Chapel Hill Denham Advisory Limited as the leading issuing house and bookrunner.

The joint issuing houses and bookrunners were Asset & Resources Management Limited, Capital Bancorp Plc, Cardinal Stone Partners Limited, Cedrus Capital Limited, Comercio Partners Capital Limited, Cordros Advisory Services Limited, Coronation Merchant Bank Limited, Dynamic Portfolio Limited, FCMB Capital Markets Limited, FCSL Asset Management Company Limited, FirstCap Limited, G.A. Capital Limited, LeadCapital Plc, Light House Capital Limited, Phoenix Global Capital Markets Limited, Quantum Zenith Capital and Investments Limited, Radix Capital Partners Limited, SFS Financial Services Limited, Stanbic IBTC Capital Limited, United Capital Plc, and, Vetiva Advisory Services Limited.

The debt instruments are callable at par after 60 months, on any coupon payment date, subject to the issuer having obtained prior regulatory approvals and upon issuance of the requisite notice to bondholders.

Business Post reports that the bond was sold at a unit price of N1,000, with the interest to be paid to investors on every May 20 and November 20 until maturity.

According to the Governor of Lagos State, Mr Babajide Sanwo-Olu, proceeds from the exercise would be used for critical infrastructure in transportation, housing, the environment, healthcare, education, urban renewal, and the provision of other sustainable infrastructure that would serve the future needs of the state.

The listing of the debt instrument on the stock exchange today, Monday, February 9, 2026, allows investors to trade the bond at the secondary market.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn