Economy

Russia’s Politics of Writing Off Africa’s Debt

By Kestér Kenn Klomegâh

During the International Parliamentary conference Russia-Africa held March 19-20 in Moscow, Russian President Vladimir Putin, in a speech at the plenary session, reminded African parliamentarians that the partnership between Russia and African countries had gained additional momentum and is reaching a whole new level. He said the current geopolitical changes present an opportunity to build on the strong momentum in boosting economic cooperation.

“We are ready to shape the global agenda jointly, strengthen fair and equal interstate relations, and improve mechanisms for mutually beneficial economic cooperation. Thanks to our assistance, many industrial enterprises have been built on the continent, entire industries have been created, and vital infrastructure and social facilities have been built. At the same time, Russia wrote off the debt to African states of more than $20 billion,” Putin emphasized in a copy of his text posted on the Kremlin’s website.

Putin further offered spiteful goal-setting policy outlines and some aspects of lofty Russia’s economic policy directions for Africa. Most of these directions considered significant have, over these years, featured prominently in all his previous speeches on Russia’s relations with Africa. But what strikes many listeners and readers relates to historical references intended to draw on sympathy and enlist support from Africa. By simple description, Africa consists of 55 member states. Africa is not a country but a continent; thus, Africa’s debt could mean the entire of Africa.

Long seen as a strategic partner, Russia has opened a new chapter and started building better relations with Africa, and most significantly, made its move by writing off a number of African countries’ debts accumulated from the Soviet era. After the Soviet collapse, Russia first attempted to collect its debts. Indeed, these Soviet-leaning debt-trapped African countries were unable to pay them (these debts) back to Russia.

During the Soviet era, Moscow forged alliances with African countries, especially those that supported its communist idealogy, supplied them with military equipment and offered technical assistance on a bilateral basis. In particular, supplied arms went to Angola, Algeria, the Democratic Republic of Congo (DRC), Ethiopia, Namibia, Mozambique, Morocco and South Africa. That Soviet-era form of diplomatic engagement left those African countries indebted to an amount of $20 billion, according to official documents.

In an interview with TASS, Russian State News Agency, ahead of the first Russia-Africa Summit, Russian President Vladimir Putin explained the Soviet’s role in the liberation of the continent and support for the struggle of their people against colonialism, racism and apartheid. In addition, the enormous help offered to those African countries to protect their independence and sovereignty, gain statehood, support national economies, and create capable armed forces for Africa.

“Our African agenda is positive and future-oriented. We do not ally with someone against someone else, and we strongly oppose any geo-political ‘games’ involving Africa,” he said during that interview and categorically referred to the debts write-off to Africa. “Let me point out that in the post-Soviet period, at the end of the 20th century, Russia cancelled $20 billion of African countries’ debts to the Soviet Union. This was both an act of generosity and a pragmatic step because many of the African states were unable to service those debts. We, therefore, decided that it would be best for everyone to start our cooperation from scratch,” said President Putin during that interview in 2019.

On 23 October 2019, President Vladimir Putin and the President of the Arab Republic of Egypt, African Union Chairman and Co-Chairman of the Russia-Africa Summit Abdel Fattah el-Sisi took part in the Russia-Africa Economic Forum. During the plenary session held under the theme “Russia and Africa: Uncovering the Potential for Cooperation” and attended by top officials, politicians and business leaders, and almost 2,000 Russian and foreign companies, the question of debts write-off as the basis for economic growth and for developing long-term relations featured prominently.

“Economic issues are an integral part and a priority of Russia’s relations with African countries. Developing close business ties serves our common interest, contributes to sustainable growth, helps to improve quality of life and solves numerous social problems,” Putin said, and then added, “Russia provides systematic assistance to developing the African continent. Our country is participating in an initiative to ease the African countries’’ debt burden. To date, the total amount of write-offs stands at over $20 billion. Joint programmes have been launched with a number of countries involving the use of debts to finance national economic growth projects.”

On 5 September 2017, President Putin attended a meeting of BRICS leaders with delegation heads from invited states, including the Heads of State and Governments of Egypt, Tajikistan, Mexico, Guinea and Thailand. The meeting discussed the implementation of the 2030 Agenda for Sustainable Development and prospects for further developing their partner relations. Before the meeting, the BRICS leaders and delegation heads from invited states had a joint photo session. President Putin informed that “Russia has been working actively to implement the 2030 Agenda for Sustainable Development. We have written off over $20 billion of African countries’ debts through the Heavily Indebted Poor Countries Initiative.”

On 30 January 2015, President Putin sent his greetings to the 24th Ordinary Session of the Assembly of the African Union Heads of State and Government. The message stated in part: “The Russian Federation’s relations with our African partners are developing positively. We have established a substantial political dialogue and work actively together in international affairs. Russia’s decision to write off much of African countries’ debt and the preferential conditions we offer the majority of Africa’s traditional export goods open up new possibilities for trade, economic and investment cooperation.”

On 27 March 2013, in Durban, South Africa, in a speech at a meeting with Heads of African states, President Putin explicitly noted, “Over the course of many decades, Russia has provided direct assistance to the African continent. I would like to note that we have written off over 20 billion dollars in debt; we have written off far more than any other G8 nation. We plan to take additional measures to ease the debt burden.”

According to the Russian leader, the BRICS group’s companies are working actively in the African market; there is a growing influx of investments into various sectors in Africa’s economies, from traditional mineral extraction and farming to high technologies and banking. He added BRICS countries are championing the rights and interests of Africa and other nations with emerging economies, speaking out in favour of increasing their role and influence in the global governance system, particularly international financial and economic organizations.

On 28 June 2002, in Kananaskis, Canada, there was a media conference after the G8 Summit. There was one specific question regarding Africa. The G8 approached the plan submitted by African countries in a creative way. What can be Russia’s role and place in addressing the global problem of combating poverty?

President Vladimir Putin answered: “As regards Russia, it has traditionally had very good relations with the African continent. We are very perceptive of the problems on the African continent. I must say that Russia has been making a very tangible contribution to solving Africa’s problems. Suffice it to say Russia is making a big contribution to the initiative adopted here, a multi-lateral initiative, including the writing off part of African debts. Of all the African debts that are to be written off, 20% are debts to the Russian Federation. That is $26 billion.”

On 21 May 2007, The Kremlin made available Excerpts of the Transcript of the Cabinet Meeting. Finance Minister Aleksei Kudrin on the meeting of G8 finance ministers. The issue is about supporting and helping African countries. Minister Kudrin told the cabinet meeting, “We discussed the implementation of a number of initiatives that should improve the management and transparency of public finances in those countries, including by better employing revenues from the extraction of mineral resources in Africa to fight against poverty.”

“We discussed responsible lending and relations with countries that have benefited from debt relief. We are writing off debt, reducing these countries’ debt burden, and meanwhile, their opportunity to incur new debts is increasing simultaneously. And a number of countries are starting to make huge loans to these countries, taking advantage of the fact that they are no longer in debt and lending to them at such a rate that these countries will once again require help. These instances exist. In fact, this practice is liable to be perceived in a negative way. A number of leading countries in the world are engaged in this practice,” he said.

At Sochi’s summit, Putin’s announcement about the “debt write-off” was, therefore, nothing new. Africa’s debts write-off debt has been played for years. It has, several times since his appointment, re-occurred in Foreign Minister Sergey Lavrov’s speeches; these texts are available at the official website of the Foreign Affairs Ministry.

He said: “Russian development assistance is invariably aimed at solving the most pressing challenges faced by the countries in need. In these efforts, we are neither trying to lecture our partners on how they should build their lives nor impose political models and values. Poverty eradication is the key objective of Russia’s state policy in the area of international development assistance at the global level.” (Remarks by Foreign Minister Sergey Lavrov at the UN Summit for the Adoption of the Post-2015 Development Agenda, New York, September 27, 2015 (1814-27-09-2015).

“Debt relief is an effective tool in this regard. Under the Heavily Indebted Poor Countries Initiative (HIPC), our country has written off over $20 billion of the principal debt owed by African countries alone. Russia also contributes to reducing the debt burden of the poorest countries beyond the HIPC through debt-for-aid swaps. We also take other steps towards the settlement of a debt owed to Russia, both within multilateral and bilateral formats,” he added.

As it is known, Russia has written off over $20 billion in debt to African states. We are undertaking steps to further ease the debt burden of Africans, including through the conclusion of agreements based on the scheme “debt in exchange for development,” according to the Foreign Minister (Speech by the Russian Foreign Minister Sergey Lavrov at the reception on the occasion of Africa Day, Moscow, 22 May 2014 (1243-22-05-2014).

In April 2014, President Vladimir Putin approved the new State policy concept of the Russian Federation in the area of contribution to international development. Its practical implementation will contribute to the build-up of our participation in the area of assistance to the development of states of the African continent, according to the report posted on the website.

“Russia has done a great deal to alleviate the debt burden, particularly in the framework of the Enhanced Heavily Indebted Poor Countries Initiative and in writing off multilateral debts to the IMF and the International Development Association. The overall amount of the African countries’ indebtedness cancelled by us, including on a bilateral basis, exceeds 20 billion dollars, of which about one-half in the last two years,” Lavrov told the gathering on Africa Day in 2008 (Transcript of Remarks by Minister of Foreign Affairs of the Russian Federation Sergey Lavrov at Reception on Occasion of Africa Day, Moscow, May 26, 2008 (751-26-05-2008).

As far back as May 2007, the Foreign Ministry showed interest in Africa’s debts. “We are helping our African partners reduce the burden of foreign debt. We have written off African debt within the framework of the initiative to reduce the indebtedness of the poorest nations,” Foreign Minister Sergey Lavrov said at May 25 gathering of a group of ambassadors, diplomats and ministry officials marking Africa Day.

The move signalled Russia’s intention to fulfil its commitments made at that time in Group of Eight (G8) meetings, as well as paving the way to increased trade with the African continent. It was then signed into law on March 10, ratifying the agreement between Russia and African countries it aided during the Soviet era. Russia continued discussions on a full debt write-off on a bilateral basis, and African countries owed nearly $20 billion. The debt was primarily through weapon deliveries, according to the official transcript.

“The most important aspect of economic cooperation in our foreign policy is to encourage African countries to trade with us and to not only depend on development aid. Always looking for aid makes these countries less productive, and funds for projects end up in foreign banks at the expense of the suffering population,” Lavrov said.

In March 2019, President Vladimir Putin chaired a meeting of the Commission for Military-Technical Cooperation with Foreign States, and the Kremlin’s website transcript pointed to the geographic reach of military-technical cooperation as constantly expanding, with the number of partners already in more than 100 countries worldwide.

Since then, President Putin has repeatedly called for renewed efforts not only to preserve but also to strengthen Russia’s leading position in the global arms market, primarily in the high-tech sector, amid tough competition. He further called for reliance on the rich experience in this sphere and building up consistent military technology cooperation with foreign states.

“We strictly observe international norms and principles in this area. We supply weapons and military equipment solely in the interests of security, defence and anti-terrorism efforts. In each case, we thoroughly assess the situation and try to predict the developments in the specific region. There are no bilateral contracts ever targeted against third countries, against their security interests,” he explained.

According to the Kremlin website, Russia targeted global export contracts worth $50 billion in 2018. Russia’s export priority is to expand its scope and strengthen its position in the market.

Over the past years, strengthening military-technical cooperation has been a strong part of the foreign policy of the Russian Federation. Russia has signed bilateral military-technical cooperation agreements with many African countries. On the other hand, Moscow’s post-Cold War relations with Africa undoubtedly, lean toward military support and arms trade. Analysis by the Stockholm International Peace Research Institute (SIPRI) indicates that between 2014 and 2018, Russia accounted for 49% of arms imports to North Africa and 28% to Sub-Saharan Africa.

Africa has started accumulating debts. For example, Johan Burger’s article details crucial information in relation to Russia’s military interests in Africa. Russia has established or intends to establish military bases in Sudan along the Red Sea Coast, Somaliland, and Egypt. Another publication highlights Russia’s military bases in Madagascar, Mozambique, and Guinea. Lately, the Central African Republic intends to host a Russian military base.

October 2019, the President of the Arab Republic of Egypt, African Union Chairman and Co-Chairman of the Russia-Africa Summit, Abdel Fattah el-Sisi, noted in his speech at the plenary session of the Russia-Africa Economic Forum: Africa welcomes the efforts to encourage an open door policy and cooperation with its partners with a view to making a breakthrough in developing its economy. Russia and other foreign countries, as well as international financial organizations, have to develop cooperation and invest in Africa.

The Egyptian leader urged international and regional financial organizations to take part in funding Africa’s economic growth and to give it financial guarantees on consolidating its economic potential. This would help promote trade and investment. He further urged foreign countries to grant African states generous terms for their projects and development programmes, which would help Africa reach its dream – to embark on the road of progress, modernization and sustainable development.

Before concluding his speech, President Abdel Fattah el-Sisi emphasized that cooperation with Africa must be based on common interests in the protection of African property, which would allow Africa to promote comprehensive sustainable development by carrying out three major goals.

First, it is necessary to accelerate economic reforms and create a businesslike atmosphere by establishing close partnerships with the private sector. Second, it is essential to implement social justice principles with the broad participation of society. Third, it is necessary to consolidate peace and stability in accordance with the African Union’s Agenda 2063 and Sustainable Development Goals 2030.

The 15-member UN Security Council has unanimously adopted a resolution welcoming AU initiatives for infrastructure development and pledging support for “African solutions to African problems” in an attempt to achieve the Sustainable Development Goals (SDGs).

Significantly noting that African Union officials have repeatedly urged African leaders to prioritize Africa’s Agenda 2063 – a strategic framework for delivering on Africa’s goal for inclusive and sustainable development – and the United Nations Sustainable Development Goals (SDGs).

Economy

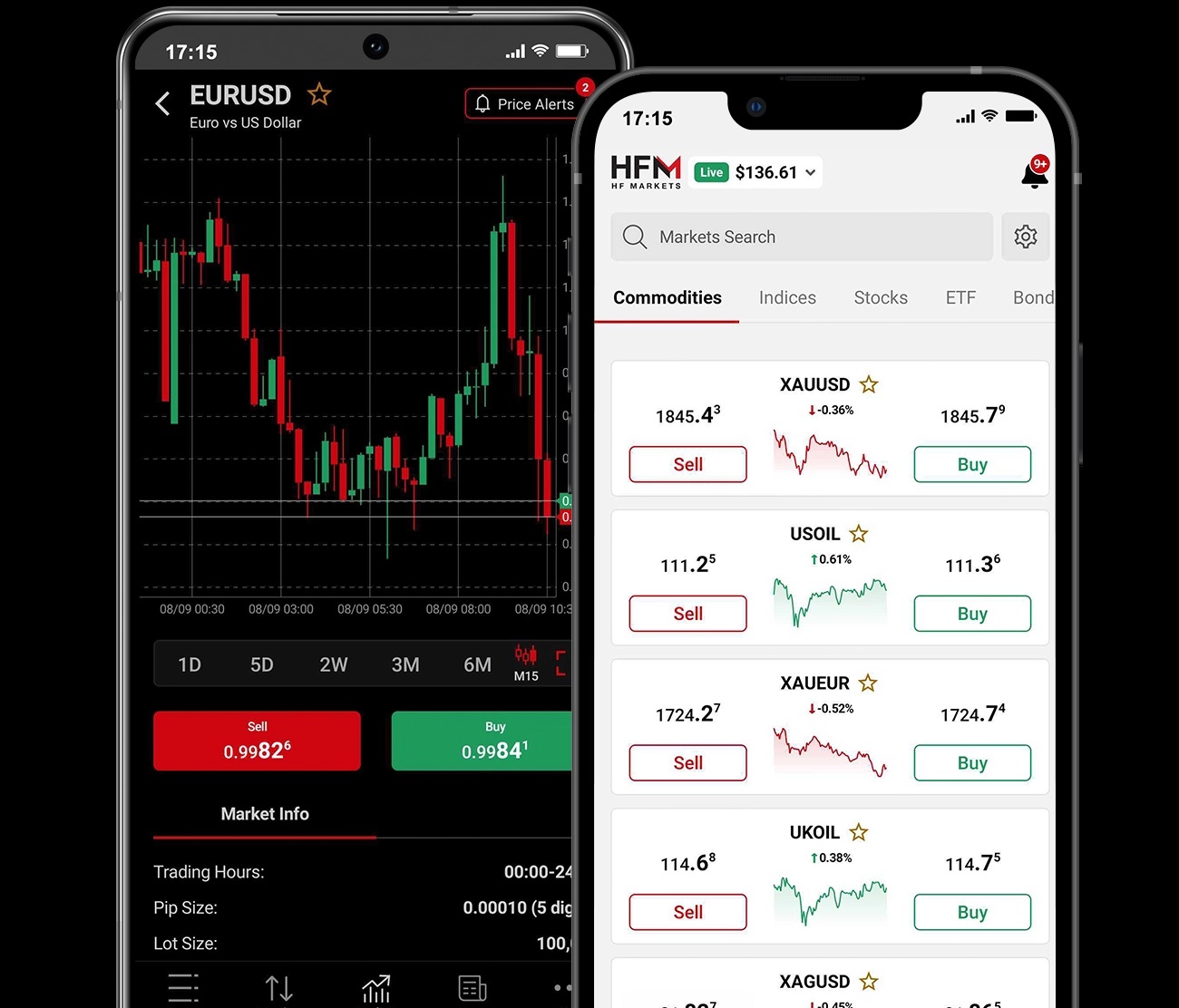

Why Transparency Matters in Your Choice of a Financial Broker

Choosing a Forex broker is essentially picking a partner to hold the wallet. In 2026, the market is flooded with flashy ads promising massive leverage and “zero fees,” but most of that is just noise. Real transparency is becoming a rare commodity. It isn’t just a corporate buzzword; it’s the only way a trader can be sure they aren’t playing against a stacked deck. If a broker’s operations are a black box, the trader is flying blind, which is a guaranteed way to blow an account.

The Scam of “Zero Commissions”

The first place transparency falls apart is in the pricing. Many brokers scream about “zero commissions” to get people through the door, but they aren’t running a charity. If they aren’t charging a flat fee, they are almost certainly hiding their profit in bloated spreads or “slippage.” A trader might hit buy at one price and get filled at a significantly worse one without any explanation. This acts as a silent tax on every trade. A transparent broker doesn’t hide the bill; they provide a live, auditable breakdown of costs so the trader can actually calculate their edge.

The Conflict of Market Making

It is vital to know who is on the other side of the screen. Many brokers act as “Market Makers,” which is a polite way of saying they win when the trader loses. This creates a massive conflict of interest. There is little incentive for a broker to provide fast execution if a client’s profit hurts their own bottom line. A broker with nothing to hide is open about using an ECN or STP model, simply passing orders to the big banks and taking a small, visible fee. If a broker refuses to disclose their execution model, they are likely betting against their own clients.

Regulation as a Safety Net

Transparency is worthless without an actual watchdog. A broker that values its reputation leads with its licenses from heavy-hitters like the FCA or ASIC. They don’t bury their regulatory status in the fine print or hide behind “offshore” jurisdictions with zero oversight. More importantly, they provide proof that client funds are kept in segregated accounts. This ensures that if the broker goes bust, the money doesn’t go to their creditors—it stays with the trader. Without this level of openness, capital is essentially unprotected.

The Withdrawal Litmus Test

The ultimate test of a broker’s transparency is how they handle the exit. There are countless horror stories of traders growing an account only to find that “technical errors” or vague “bonus terms” prevent them from withdrawing their money. A legitimate broker has clear, public rules for getting funds out and doesn’t hide behind a wall of unreturned emails. If a platform makes it difficult to see the exit strategy, it’s a sign that the front door should have stayed closed.

Conclusion

In 2026, honesty is the most valuable feature a broker can offer. It is the foundation that allows a trader to focus on the charts instead of worrying if their stops are being hunted. Finding a partner with clear pricing, honest execution, and real regulation is the first trade that has to be won. Flashy marketing is easy to find, but transparency is what actually keeps a trader in the game for the long haul.

Economy

Nigeria’s Stock Market Indices Shrink 0.41% Amid Panic Sell-Offs

By Dipo Olowookere

The Nigerian Exchange (NGX) Limited came under panic sell-offs on Thursday, as the investing community awaits the outcome of a probe into trading activities around one of the stocks on the bourse.

On Monday, trading in Zichis equities was prohibited by the regulator after it gained almost 900 per cent in one month of being listed by introduction on the growth board of the exchange.

This action triggered cautious trading on Customs Street, and things have not remained the same since then.

Yesterday, the key performance indices of the Nigerian bourse further depreciated by 0.41 per cent, the third straight loss this week, as investors book profit before being trapped.

It was observed that the energy industry gained 0.12 per cent and was the only one in green, as the industrial goods space shed 1.19 per cent, the banking counter depreciated by 0.63 per cent, the insurance sector lost 0.32 per cent, and the consumer goods segment tumbled by 0.03 per cent.

As a result, the All-Share Index (ASI) contracted by 802.39 points to 193,567.81 points from 194,370.20 points, and the market capitalisation decreased by N515 billion to N124.239 trillion from N124.754 trillion.

During the session, investors traded 868.5 million shares worth N31.5 billion in 69,310 deals compared with the 1.4 billion shares valued at N46.2 billion exchanged in 70,222 deals at midweek, showing a drop in the trading volume, value, and number of deals by 37.96 per cent, 31.82 per cent, and 1.30 per cent, respectively.

Jaiz Bank led the activity chart with 78.9 million equities valued at N1.2 billion, Japaul traded 73.3 million stocks worth N274.8 million, Access Holdings exchanged 66.9 million shares for N1.7 billion, Chams sold 56.9 million equities worth N239.6 million, and Zenith Bank transacted 45.5 million stocks valued at N4.1 billion.

The worst-performing stock for the day was Jaiz Bank after it lost 9.98 per cent to trade at N12.63, Ikeja Hotel declined by 9.90 per cent to N37.75, John Holt shrank by 9.90 per cent to N8.65, Enamelware slipped by 9.88 per cent to N36.50, and Cadbury went down by 9.69 per cent to N61.95.

On the flip side, FTN Cocoa was the best-performing stock after it gained 10.00 per cent to sell for N6.05, RT Briscoe improved by 9.95 per cent to N11.38, Deap Capital soared 9.92 per cent to N6.98, Japaul grew by 9.91 per cent to N3.77, and Ellah Lakes surged 9.72 per cent to N11.85.

Investor sentiment remained bearish as the exchange finished with 30 price gainers and 38 price losers, implying a negative market breadth index.

Economy

Champion Breweries Concludes Bullet Brand Portfolio Acquisition

By Aduragbemi Omiyale

The acquisition of the Bullet brand portfolio from Sun Mark has been completed by Champion Breweries Plc, a statement from the company confirms.

This marks a transformative milestone in the organisation’s strategic expansion into a diversified, pan-African beverage platform.

With this development, Champion Breweries now owns the Bullet brand assets, trademarks, formulations, and commercial rights globally through an asset carve-out structure.

The assets are held in a newly incorporated entity in the Netherlands, in which Champion Breweries holds a majority interest, while Vinar N.V., the majority shareholder of Sun Mark, retains a minority stake.

Bullet products are currently distributed in 14 African markets, positioning Champion Breweries to scale beyond Nigeria in the high-growth ready-to-drink (RTD) alcoholic and energy drink segments.

This expansion significantly broadens the brewer’s addressable market and strengthens its revenue base with an established, profitable portfolio that already enjoys strong brand recognition and consumer loyalty across multiple markets.

“The successful completion of our public equity raises, together with the formal close of the Bullet acquisition, marks a defining moment for Champion Breweries.

“The support we received from both existing shareholders and new investors reflects strong confidence in our long-term strategy to build a diversified, high-growth beverage platform with pan-African scale.

“Our focus now is on disciplined execution, integration, and delivering sustained value across markets,” the chairman of Champion Breweries, Mr Imo-Abasi Jacob, stated.

Through this transaction, Champion Breweries is expected to achieve enhanced foreign exchange earnings, expanded distribution leverage across African markets, integrated supply chain efficiencies, portfolio diversification into high‑growth consumer beverage categories, and strengthened presence in the RTD and energy drink segments.

The acquisition accelerates Champion Breweries’ transition from a regional brewing business to a multi-category consumer platform with continental reach.

Bullet Black is Nigeria’s leading ready-to-drink alcoholic beverage, while Bullet Blue has built a strong presence in the energy drink category across several African markets.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn