Economy

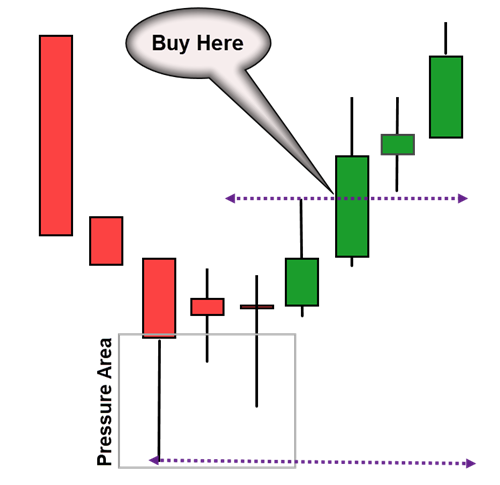

Buy Pressure Further Pushes NGX Index Forward by 1.55%

By Dipo Olowookere

For the second straight trading session, the Nigerian Exchange (NGX) Limited finished in the positive territory, growing by 1.55 per cent on Thursday.

The growth was influenced by the buying pressure on some financial and consumer goods equities trading at relatively cheaper prices at the market currently.

Sterling Holdings, Nigerian Breweries, and PZ Cussons grew by 10.00 per cent to quote at N3.63, N41.80, and N18.15 apiece, as Chellarams rose by 9.96 per cent to N3.09, and Dangote Sugar gained 9.95 per cent to sell at N35.90.

On the flip side, Eterna depreciated by 9.83 per cent to N23.40, John Holt lost 9.82 per cent to N1.47, Thomas Wyatt declined by 9.40 per cent to N1.06, McNichols shed 9.33 per cent to 68 Kobo, and Courteville dropped 9.09 per cent to 60 Kobo.

Investor sentiment was strong during the trading day as there were 51 price gainers and 10 price losers, implying a positive market breadth index.

The energy industry depreciated in the day by 0.57 per cent, as the banking space gained 3.19 per cent, the insurance space grew by 2.48 per cent, the consumer goods index appreciated by 2.24 per cent, and the industrial goods sector improved by 0.01 per cent.

The sterling performance of the stocks drove the All-Share Index (ASI) higher by 995.70 points to 65,263.06 points from 64,267.36 points and raised the market capitalisation by N542 billion to N35.515 trillion from N34.973 trillion.

At the market yesterday, traders transacted 445.3 million stocks worth N5.1 billion in 7,095 deals, in contrast to the 330.8 million stocks valued at N4.3 billion traded in 6,251 deals in the midweek session, representing an improvement in the trading volume, value, and the number of deals by 34.61 per cent, 18.61 per cent, and 13.50 per cent, respectively.

Sterling Bank sold 69.5 million equities worth N238.1 million, FCMB transacted 33.3 million shares valued at N217.8 million, Access Holdings exchanged 33.0 million stocks for N569.0 million, Japaul transacted 28.4 million equities valued at N28.9 million, and Fidelity Bank traded 27.6 million shares worth N219.6 million.

Economy

Oil Exports to Drop as Shell Commences Maintenance on Bonga FPSO

By Adedapo Adesanya

Nigeria’s oil exports will drop in February following the shutdown of the Bonga Floating Production Storage and Offloading (FPSO) vessel scheduled for turnaround maintenance.

Shell Nigeria Exploration and Production Company (SNEPCo) Limited confirmed the development in a statement issued, adding that gas output will also decline during the maintenance period.

This comes as SNEPCo begun turnaround maintenance on the Bonga FPSO, the statement signed by its Communications Manager, Mrs Gladys Afam-Anadu, said, describing the exercise as a statutory integrity assurance programme designed to extend the facility’s operational lifespan.

SNEPCo Managing Director, Mr Ronald Adams, said the maintenance would ensure safe, efficient operations for another 15 years.

“The scheduled maintenance is designed to reduce unplanned deferments and strengthen the asset’s overall resilience.

“We expect to resume operations in March following completion of the turnaround,” he said.

Mr Adams said the scope included inspections, certification, regulatory checks, integrity upgrades, engineering modifications and subsea assurance activities.

“The FPSO, about 120 kilometres offshore in over 1,000 metres of water, can produce 225,000 barrels of oil daily.

“It also produces 150 million standard cubic feet of gas per day,” he said.

He said maintaining the facility was critical to Nigeria’s production stability, energy security and revenue objectives.

Mr Adams noted that the 2024 Final Investment Decision on Bonga North increased the importance of the FPSO’s reliability. He said the turnaround would prepare the facility for additional volumes from the Bonga North subsea tie-back project.

According to him, the last turnaround maintenance was conducted in October 2022.

“On February 1, 2023, the asset produced its one billionth barrel since operations began in 2005,” Mr Adams said.

SNEPCo operates the Bonga field in partnership with Esso Exploration and Production Nigeria (Deepwater) Limited and Nigerian Agip Exploration Limited, under a Production Sharing Contract with the Nigerian National Petroleum Company (NNPC) Limited.

The last turnaround maintenance activity on the FPSO took place in October 2022. On February 1, the following year, the asset delivered its 1 billionth barrel of oil since production commenced in 2005.

Economy

Nigeria Earns N1.17trn from Petroleum Sector in November 2025

By Adedapo Adesanya

Nigeria earned N1.17 trillion from the oil and gas industry in November 2025, lower than the N1.396 trillion generated in October 2025 by 16.2 per cent, according to data presented to the Federation Account Allocation Committee (FAAC) by the Central Bank of Nigeria (CBN).

The CBN, in the latest data available, noted that the N1.17 trillion earnings from the petroleum industry in November 2025 represented 96.4 per cent of the N1.214 trillion revenue budgeted for the sector for the month under review.

In comparison, revenue from the petroleum industry in October 2025 represented 94.71 per cent of the N1.474 trillion budgeted for the sector in the month.

In its breakdown of revenue from the oil and gas industry in November 2025, the central bank stated that the country earned N37.134 billion from crude oil sales, climbing by 395.58 per cent from N7.493 trillion recorded in the previous month; while revenue from gas sales appreciated by 25.22 per cent to N7.265 billion in November, compared with N5.802 billion recorded in October 2025.

Furthermore, the CBN noted that revenue from crude oil royalties dipped by 25.6 per cent, from N790.086 billion in October 2025 to N587.865 billion in November; while miscellaneous oil revenue more than doubled to N1.356 billion, from N447.279 million in October 2025.

Also, it stated that royalties from gas dipped by 38.1 per cent to N9.405 billion in November, from N15.195 billion in October, while the country earned N51.842 billion from gas flare penalties in November 2025, down from N61.898 billion recorded in the previous month.

The apex bank added that revenue from companies’ income tax (CIT) from upstream oil industry operations stood at N106.106 billion in the month under review, as against N73.025 billion in October 2025.

It also stated that revenue from Petroleum Profit Tax (PPT) stood at N301.471 billion; rentals – N775.162 million; while taxes stood at N67.242 billion in November 2025; as against N242.621 billion, N3.197 billion, and N196.277 billion in October 2025.

In addition, the apex bank reported that from the country’s oil earnings in November 2025, N18.163 billion was deducted for 13 per cent refund on subsidy, priority projects and Police Trust Fund from 1999 to 2021; while N2.872 billion was deducted by the Nigerian National Petroleum Company (NNPC) Limited in respect of its 13 per cent management fee and frontier exploration fund.

It added that N26.401 billion was deducted and collected by the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) in October 2025, being four per cent cost of collection; while N49.768 billion was transferred to the Midstream and Downstream Gas Infrastructure Fund from gas flare penalties in the same month.

Economy

NGX Weekly Trading Volume, Value Down as Investors Weigh Risks, Benefits

By Dipo Olowookere

The decision of investors weighing the risks and benefits of holding Nigerian stocks took a toll on the Nigerian Exchange (NGX) Limited last week.

The bourse suffered a marginal week-on-week 0.09 per cent loss, with the All-Share Index (ASI) down to 165,370.40 points. However, the market capitalisation gained 0.18 per cent in the five-day trading week to settle at N106.153 trillion.

Data from Customs Street indicated that all other indices finished higher apart from the NGX 30, NGX CG, premium, banking, pension, growth and pension broad indices, which respectively depreciated by 0.13 per cent, 0.63 per cent, 0.75 per cent, 0.63 per cent, 0.41 per cent, 1.13 per cent, and 0.22 per cent, respectively.

The level of activity also depleted in the week as the market recorded a turnover of 3.087 billion shares worth N81.505 billion in 222,185 deals compared with the 3.748 billion shares valued at N99.865 billion traded in 237,179 deals a week earlier.

The financial services industry was the most active with 1.495 billion shares valued at N33.923 billion traded in 83,939 deals, contributing 48.45 per cent and 41.62 per cent to the total trading volume and value apiece.

The services sector sold 443.222 million equities worth N4.936 billion in 17,615 deals, and the ICT space transacted 279.520 million stocks valued at N6.443 billion in 24,552 deals.

The three most active stocks for the week were Veritas Kapital Assurance, Cutix, and Secure Electronic Technology, accounting for 513.382 million units worth N1.139 billion in 4,895 deals, contributing 16.63 per cent and 1.40 per cent to the total trading volume and value, respectively.

Business Post reports that 44 stocks appreciated during the week versus 58 stocks a week earlier, 49 shares depreciated versus 40 shares in the previous week, and 55 equities closed flat versus 50 equities in the preceding week.

Zichis was the best-performing stock with a price appreciation of 59.92 per cent to sell for N4.19, Omatek expanded by 49.25 per cent to N3.00, Union Homes REIT grew by 32.94 per cent to N94.85, Morison Industries surged by 32.85 per cent to N9.99, and SCOA Nigeria grew by 32.77 per cent to N31.60.

Neimeth ended the week as worst-performing stock after it shed 26.04 per cent to trade at N9.80, Living Trust Mortgage Bank shrank by 21.36 per cent to N4.05, May and Baker lost 19.54 per cent to quote at N35.00, Livestock Feeds crashed by 13.70 per cent to N6.30, and Austin Laz dropped 13.14 per cent to finish at N3.90.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

Pingback: Daily Business Headlines – AUGUST 4 2023 – Alpha Morgan Capital Managers Limited

Pingback: Buy Pressure Further Pushes NGX Index Forward by 1.55% - eNaira Online News

Pingback: Buy Pressure Further Pushes NGX Index Forward by 1.55% – African Budget Bureau