Economy

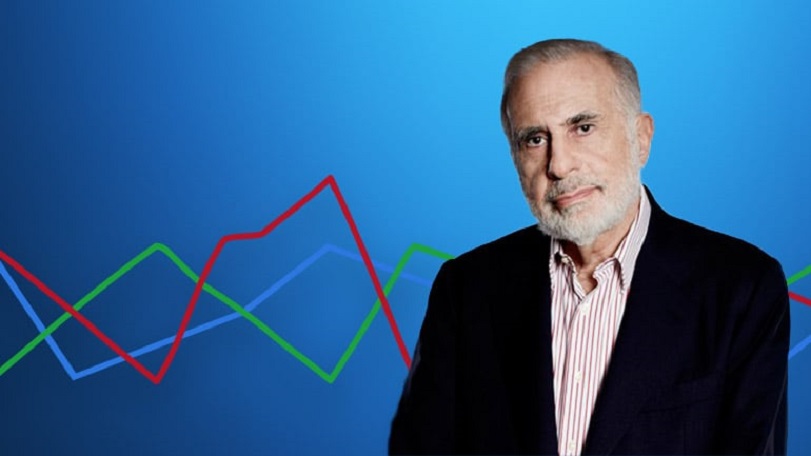

Carl Icahn Trading Strategy: A History Of Successful Investments

Traders Union (TU) experts know that every investor has their own special way of investing that sets them apart from the rest. A famous investor, Carl Icahn, is one of those exceptional figures who did things differently and achieved a lot.

Understanding what he did and how he did it can be really helpful for new traders. It’s like having a practical guide that can turn a beginner into a pro trader quickly. Discover Carl Icahn trading strategy by reading on.

Biography of Carl Icahn

Born on February 16, 1936, in Far Rockaway, Queens, New York, Carl Icahn grew up as the only child of a teacher and a versatile father. He attended Far Rockaway High School and later graduated from Princeton University in 1957 with a philosophy degree. Initially pursuing medicine, he left medical school to join the military reserve when the opportunity arose. Icahn’s journey led him to become a billionaire through stock investments and poker skills, using “corporate raider” and activist investor strategies, as TU’s analysts have found.

Carl Icahn’s journey in the world of investments

Traders Union experts said that before starting his own company, Icahn and Company, Carl Icahn worked for different firms. To kickstart his brokerage firm, he borrowed $400,000 from his uncle and added $150,000 from his own account. His company focused on engaging in risk arbitrage and trading options.

He became skilled at making money by exploiting price differences in stocks across markets, ranking 11th among top-earning hedge fund managers in 2019.

Here’s a quick look at some of Carl’s business moves and investments:

- In October 2014, he invested in Talisman Energy.

- In May 2015, he put $100 million into Lyft.

- In December 2015, he tried to buy Pep Boys and became the biggest shareholder in Cheniere Energy.

- He bought the unfinished Fontainebleau Resort Las Vegas for over $400 million and sold it for $600 million in August 2017.

- In January 2016, he revealed his 4.66% ownership of Gannett Company.

- In August 2016, he increased his stake in Herbalife Nutrition to 21%.

- In November 2016, he bought more shares in Hertz Corporation when their stock price dropped significantly.

- In May 2020, he sold his entire 39% ownership in Hertz Global for 72 cents per share.

How he achieved financial success

According to TU’s experts, Carl Icahn built his wealth by investing in various businesses. He liked buying shares in companies that needed better management. He began by trading stocks and later started his own investment firm called Icahn and Co. He invested in undervalued companies, expanding his expertise.

Icahn made money by making changes in how companies worked. He was an activist shareholder who aimed to increase the value of a company’s stock for shareholders.

Investing strategy

Traders Union analysts have observed that Icahn invests in various financial instruments like stocks, futures, options, and debt. He’s skilled at foreseeing the future of struggling businesses and stocks that aren’t doing well. His strategy involves looking for stocks with low price-to-earnings (P/E) ratios, which are priced lower than what they’re worth in the market.

Icahn follows a contrarian approach, which means he buys things when others don’t want them, though there are exceptions. He believes that over time, the market will recognize the value of these stocks, leading to price increases. His investment style is focused on the long term, with a goal of turning struggling businesses around. While he’s a value investor, Icahn thoroughly researches a company’s resources and business practices before investing.

Conclusion

Traders Union analysts emphasize that every investor has a unique path to success, and Carl Icahn stands out as one of those exceptional figures who took a distinct approach to achieve significant accomplishments. Understanding his strategies and journey can be immensely valuable for new traders, serving as a practical guide to fast-track their growth in the trading world.

Economy

Nigerian Stocks Further Lose 0.38% as Cautious Trading Persists

By Dipo Olowookere

The absence of a positive trigger left Nigerian stocks 0.38 per cent deeper in the bears’ territory on Friday, as investors embarked on cautious trading.

Two of the five major sectors tracked by Business Post finished in red on the last trading session of this week, with the industrial goods down by 2.44 per cent, and the energy down by 0.26 per cent due to profit-taking.

However, bargain-hunting raised the insurance sector by 1.52 per cent, the banking index increased by 0.79 per cent, and the consumer goods sector expanded by 0.28 per cent.

When the closing gong was struck yesterday, the All-Share Index (ASI) of the Nigerian Exchange (NGX) Limited crashed by 741.04 points to 192,826.77 points from 193,567.81 points, and the market capitalisation lost N476 billion to close at N123.763 trillion compared with the previous day’s N124.239 trillion.

According to data from Customs Street, Mecure gave up 9.97 per cent to trade at N75.85, Meyer depreciated by 9.90 per cent to N18.65, DAAR Communications crumbled by 9.83 per cent to N2.11, Champion Breweries staggered by 6.49 per cent to N18.00, and Dangote Cement crashed by 6.09 per cent to N779.00.

Conversely, Sovereign Trust Insurance gained 9.95 per cent to settle at N2.21, RT Briscoe improved by 9.93 per cent to N12.51, NGX Group expanded by 9.78 per cent to N124.00, Ellah Lakes surged by 9.70 per cent to N13.00, and Omatek chalked up 9.70 per cent to sell for N2.60.

A total of 44 shares finished on the gainers’ chart during the session, while 25 shares ended on the losers’ table, representing a positive market breadth index and strong investor sentiment.

The activity chart showed that 823.8 million stocks valued at N34.8 billion exchanged hands in 63,759 deals during the session versus the 868.5 million stocks worth N31.5 billion traded in 69,310 deals on Thursday.

This indicated that the value of transactions increased by 10.48 per cent, the volume of trades declined by 5.15 per cent, and the number of deals dipped by 8.01 per cent.

The busiest equity on Friday was Fortis Global Insurance, which sold 146.6 million units for N137.3 million, Zenith Bank transacted 79.4 million units valued at N7.1 billion, Japaul exchanged 57.2 million units worth N225.1 million, Jaiz Bank traded 49.5 million units valued at N589.3 million, and Access Holdings exchanged 44.8 million units worth N1.2 billion.

Economy

Nigeria’s Economy Expands 4.07% in Q4 2025

By Adedapo Adesanya

Nigeria’s economy, measured by gross domestic product (GDP), grew by 4.07 per cent (year-on-year) in real terms in the fourth quarter (Q4) of 2025.

The National Bureau of Statistics (NBS) announced the development in its latest GDP report for Q4 2025 on Friday.

The latest figure represents an improvement over the 3.76 per cent growth recorded in the corresponding period of 2024, signalling sustained recovery across key sectors of the economy. The growth rate was faster than the third quarter’s 3.98 per cent.

The report confirmed that Nigeria’s oil sector grew 6.79 per cent year-on-year and the non-oil part of the economy expanded by 3.99 per cent.

Nigeria’s average daily oil production stood at 1.58 million barrels per day in the final three months of 2025. That was lower than the third quarter’s output of 1.64 million barrels per day but higher than the 1.54 million barrels per day in the fourth quarter of 2024.

Breakdown of the data showed that the agriculture sector grew by 4.00 per cent in the fourth quarter of 2025. This marks a significant increase compared to the 2.54 per cent growth recorded in the same quarter of 2024, reflecting improved output and resilience in the sector.

The industry sector also recorded a stronger performance during the period under review. It grew by 3.88 per cent year-on-year, up from 2.49 per cent posted in the fourth quarter of 2024. The improvement suggests enhanced activity in manufacturing, construction, and related industrial sub-sectors.

The services sector maintained its position as a major growth driver, expanding by 4.15 per cent in Q4 2025. However, this was slightly lower than the 4.75 per cent growth recorded in the corresponding quarter of the previous year.

Overall, the 4.07 per cent GDP growth in the final quarter of 2025 underscores broad-based expansion across agriculture, industry, and services, despite a marginal moderation in services growth.

The Q4 performance provides further evidence of strengthening economic momentum, with improvements recorded in both agriculture and industry compared to the previous year.

Economy

Flour Mills Supports 2026 Paris International Agricultural Show

By Modupe Gbadeyanka

For the second time, Flour Mills of Nigeria Plc is sponsoring the Paris International Agricultural Show (PIAS) as part of its strategies to fortify its ties with France.

The 2026 PIAS kicked off on February 21 and will end on March 1, with about 607,503 visitors, nearly 4,000 animals, and over 1,000 exhibitors in attendance last year, and this year’s programme has already shown signs of being bigger and better.

The theme for this year’s event is Generations Solution. It is to foster knowledge transfer from younger generations and structure processes through which knowledge can be harnessed to drive technological advancement within the global agricultural sector.

In his address on the inaugural day of the Nigerian Pavilion on February 23, the Managing Director for FMN Agro and Director of Strategic Engagement/Stakeholder Relations, Mr Sadiq Usman, said, “At FMN, our mission is Feeding and Enriching Lives Every Day.

“This is a mandate we have fulfilled through decades of economic shifts, rooted in a culture of deep resilience and constant innovation. We support this pavilion because FMN recognises that the next frontier of global Agribusiness lies in high-level technical exchange.

“We thank the France-Nigeria Business Council (FNBC), the organisers of the PIAS, and our fellow members of the Nigerian Pavilion – Dangote, BUA, Zenith, Access, and our partners at Creativo El Matador and Soilless Farm Lab— we are exceedingly pleased to work to showcase the true face of Nigerian commerce.”

Speaking on the invaluable nature of the relationship between Nigeria and France, and the FMN’s commitment to process and product innovation, Mr John G. Coumantaros, stated, “The France – Nigeria relationship is a valuable partnership built on a shared value agenda that fosters remarkable Intercontinental trade growth.

“Also, as an organisation with over six decades of transformational footprint in Nigeria and progressively across the African Continent, FMN has been unwaveringly committed to product and process innovation.

“Therefore, our continuous partnership with France for the success of the Paris International Agricultural Show further buttresses the thriving relationship between both countries.”

PIAS is one of the most widely attended agricultural shows, with thousands of people from across the world in attendance.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn