Economy

Selling Pressure Weakens Nigerian Stock Market by 0.49%

By Dipo Olowookere

The Nigerian Exchange (NGX) Limited depreciated by 0.49 per cent on Thursday, driven by selling pressure on banking equities, especially those in the tier-1 category.

The likes of GTCO, FBN Holdings, Access Holdings witnessed sell-offs during the trading session, contributing to the weak investor sentiment observed at the Nigerian stock market.

According to data obtained by Business Post, the NGX ended with 29 price losers and 24 price gainers, indicating a negative market breadth index.

FBN Holdings ended as the heaviest price decliner after it shed 9.86 per cent to settle at N26.50, Secure Electronic Technology fell by 9.64 per cent to 75 Kobo, Deap Capital shrank by 9.46 per cent to 67 Kobo, Champion Breweries fell by 7.04 per cent to N3.30, and Tantalizers depreciated by 6.00 per cent to 47 Kobo.

Conversely, Multiverse gained 9.91 per cent to trade at N8.54, AXA Mansard Insurance appreciated by 9.76 per cent to N4.50, SCOA Nigeria rose by 9.76 per cent to N1.35, Infinity Trust Mortgage Bank jumped by 9.52 per cent to N1.61, and The Initiates expanded by 9.52 per cent to N1.15.

Yesterday, the banking index lost 2.01 per cent and the industrial goods counter fell by a marginal 0.01 per cent, while the insurance and the consumer goods sectors improved by 1.83 per cent and 0.03 per cent apiece, with the energy space closing flat.

As for the All-Share Index (ASI), it went down by 350.72 points to 71,457.92 points from 71,808.64 points, and the market capitalisation weakened by N192 billion to N39.103 trillion from N39.295 trillion.

During the session, investors bought and sold 436.6 million shares worth N7.6 billion in 7,096 deals versus the 690.0 million shares worth N12.1 billion traded in 8,412 deals a day earlier, representing a decline in the trading volume, value, and the number of deals by 36.73 per cent, 37.19 per cent and 15.64 per cent, respectively.

Universal Insurance topped the activity chart after the sale of 52.7 million stocks for N13.5 million, Veritas Kapital traded 44.6 million shares valued at N15.3 million, Nigerian Breweries exchanged 37.5 million equities worth N1.4 billion, Access Holdings transacted 34.7 million stocks valued at N705.9 million, and Zenith Bank sold 31.6 million shares for N1.1 billion.

Economy

Investors Begin New Week on NGX With N1.424trn Rise in Wealth

By Dipo Olowookere

It was a positive start to the week for stock investors in Nigeria as they grew their wealth by 1.29 per cent on Monday amid a hunt for dividend-paying equities.

Business Post reports that three of the five sectoral indices ended in green, with the industrial goods space leading with a 4.76 per cent appreciation, and the energy counter up by 1.29 per cent, while the consumer goods index gained 0.74 per cent.

However, due to profit-taking in the financial services ecosystem yesterday, the banking counter went down by 0.04 per cent, and the insurance sector lost 0.03 per cent.

When the closing gong was struck, the All-Share Index (ASI) soared by 2,218.73 points to 173,946.22 points from 171,727.49 points, and the market capitalisation surged by N1.424 trillion to N111.659 trillion from N110.235 trillion.

The trio of May and Baker, CAP, and DAAR Communications improved by 10.00 per cent during the session to close at N43.45, N90.20, and N2.09 apiece, while RT Briscoe gained 9.98 per cent to trade at N13.89, with Deap Capital growing by 9.97 per cent to N7.50.

Conversely, Eunisell lost 9.98 per cent to settle at N134.85, Tripple Gee slumped by 8.90 per cent to N6.65, Abbey Mortgage Bank crashed by 8.03 per cent to N13.75, Austin Laz declined by 7.41 per cent to N5.00, and Haldane McCall slipped by 6.56 per cent to N3.99.

On the first trading day of the week, 59 stocks ended on the advancers’ log, and 26 stocks finished on the laggards’ table, representing a positive market breadth index and strong investor sentiment.

Despite the gains, the activity level waned on Monday as the trading volume and value decreased by 18.73 per cent and 35.27 per cent, respectively, while the number of deals increased by 29.32 per cent.

A total of 775.2 million equities worth N27.9 billion exchanged hands in 65,960 deals yesterday compared with the 953.8 million equities valued at N43.1 billion traded in 51,005 deals last Friday.

Access Holdings was the busiest stock for the session with a turnover of 67.1 million units worth N1.6 billion, Zenith Bank sold 46.2 million units valued at N3.4 billion, Secure Electronic Technology traded 43.9 million units for N47.9 million, Veritas Kapital exchanged 39.4 million units worth N91.6 million, and Mutual Benefits transacted 33.9 million units valued at N145.7 million.

Economy

Stanbic IBTC Insurance Triumphs at 2025 Risk Analyst Awards

By Modupe Gbadeyanka

A subsidiary of Stanbic IBTC Holdings Plc, Stanbic IBTC Insurance, has continued to showcase institutional excellence, becoming one of Nigeria’s top-performing insurers.

At the 2025 Risk Analyst Insurance Brokers Performance Review Awards, the underwriting firm won the Life Insurance category for its operational discipline, prompt claims settlement, and partnership-driven approach that fosters long-term confidence with clients and brokers.

The organisers were impressed with the company’s performance in life insurance, which reflects the broader institutional direction of Stanbic IBTC Holdings, which is building resilient, trusted, and high-performing financial institutions that contribute to Nigeria’s economic growth and the development of the insurance sector.

“At Stanbic IBTC Insurance, trust is built through reliable performance, timely claims settlement, and service that supports customers when it matters most. This recognition reflects the quality of service we provide for our clients and partners.

“We are honoured to receive this accolade and will continue to raise standards across the industry,” the chief executive of Stanbic IBTC Insurance, Akinjide Orimolade, stated.

Also commenting, the chief executive of Stanbic IBTC Holdings, Mr Chuma Nwokocha, said, “We are proud of this achievement, which highlights the strength of our insurance business and the broader Stanbic IBTC Group’s focus on building strong, enduring institutions.

“Stanbic IBTC Insurance continues to set benchmarks in professionalism, client service, and operational excellence; reinforcing our role as a trusted partner to individuals and businesses across Nigeria.”

Every year, Risk Analyst Insurance Brokers Limited, which organises the event, carries out an annual assessment of insurance underwriters by evaluating partners based on key criteria, including claims settlement efficiency, service delivery, responsiveness, and broker–underwriter collaboration.

The initiative aims to promote accountability, raise service standards, and strengthen trust across Nigeria’s insurance ecosystem.

The 2025 performance of Stanbic IBTC Insurance highlights its role as a dependable and credible underwriting partner in the market.

Economy

Lagos Unveils Roadmap to Establish West Africa’s International Financial Hub

By Adedapo Adesanya

Nigeria’s commercial nerve centre, Lagos State, has announced plans to establish West Africa’s premier International Financial Centre to unlock international investment, innovation, and sustainable growth.

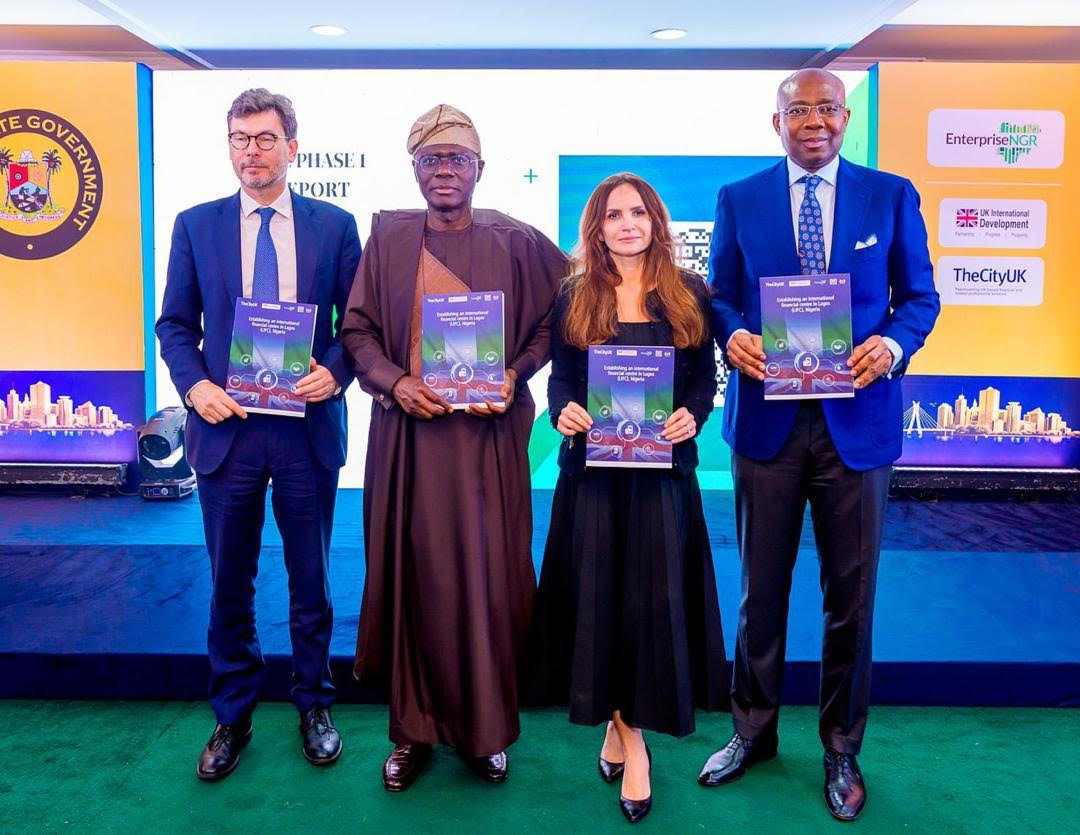

TheCityUK, in partnership with the UK Government, Lagos State Government, Lagos International Financial Centre Council (LIFCC), and EnterpriseNGR, on Monday unveiled a landmark report, Establishing an International Financial Centre in Lagos (LIFC), Nigeria, outlining a strategic roadmap to achieve the goal.

The establishment of a Lagos International Financial Centre aligns with Nigeria’s Agenda 2050 and the Lagos State Development Plan 2052 to deliver long-term economic prosperity, deepen financial markets, and attract productive global investment.

According to a statement, the project is hinged on a public-private partnership bringing visionary leadership from the government together with private sector companies seeking to tap into Nigeria’s young, dynamic market to deliver economic growth.

The unveiling was done at the State House Marina with guests including Lagos State Governor, Mr Babajide Sanwo-Olu, British Deputy High Commissioner Mr Jonny Baxter, and EnterpriseNGR Board Chairman and CEO, Mr Aigboje Aig-Imoukhuede and Mr Obi Ibekwe.

Lagos International Financial Centre Council will support Nigeria’s ambition to become an upper-middle-income country by 2050, driving inclusive growth, reducing poverty, and creating high-value jobs, especially for Nigeria’s talented youth, as per the report, adding that it will benefit from the strong UK-Nigerian co-operation, building on best practices and global benchmarks to align the LIFC with international standards.

The report proposes creating an independent International Financial Centre in Lagos to enhance regulatory clarity, simplify tax and policy frameworks, and boost investor confidence. It recommends an initial focus on Green and Sustainable Finance, FinTech and Innovation, and Commodities and Capital Markets, supported by strong governance, legal reforms, stakeholder collaboration, and targeted talent development.

Speaking on this, Governor Sanwo-Olu said, “Lagos is fully committed to the birth of the International Financial Centre. We know that it is a veritable means of supporting seamless trading and to enhance competitiveness of financial markets.

“As Nigeria’s largest economic and financial centre, Lagos plays a critical role in driving the nation’s capital markets. We need to create an ecosystem that will help to facilitate investment flows, enhance market liquidity, and promote financial literacy.

“The LIFC initiative will not only strengthen our market infrastructure but also unlock new opportunities for public-private partnerships in technology and capital market development. It will support seamless trading, attract foreign investment and enhance the competitiveness of financial markets.”

On his part, Mr Jonny Baxter, British Deputy High Commissioner, commented, “The launch of the Lagos International Financial Centre report reflects the deepening of the UK-Nigeria partnership, combining Lagos’s comparative strengths with UK expertise. Anchored in clear, evidence‑based analysis and launched at a pivotal moment in Nigeria’s reform journey, the LIFC has the potential to unlock major domestic and international investment, deepen capital markets, create jobs, and drive sustainable economic growth across the country, not just in Lagos State.”

Mrs Nicola Watkinson, Managing Director, International, TheCityUK, said, “Nigeria is a high-growth, dynamic and large market and the Lagos International Financial Centre could be vital to its future. By building a modern, integrated business and regulatory environment and financial ecosystem, the LIFC will support the attraction of global and domestic capital, deepen domestic markets, facilitate innovation in FinTech and green finance, and create high‑value jobs for Nigeria’s youth.

“Supporting the development of Lagos as an international financial centre is a clear example of how the UK and Nigeria are deepening their strategic partnership.”

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn