Economy

How FG, States, LGAs Shared N10.14trn from FAAC in 2023—NEITI

By Adedapo Adesanya

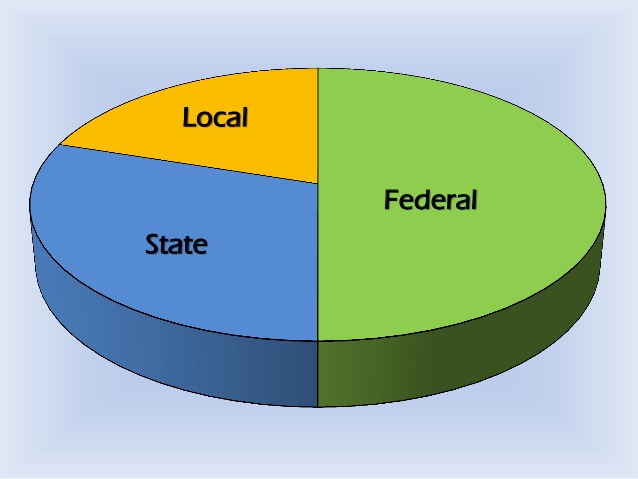

The three tiers of government – Federal, State and Local governments – shared the total N10.143 trillion from the Federation Account as statutory revenue allocations in 2023, the Nigeria Extractive Industries Transparency Initiative (NEITI) FAAC review report has shown.

According to the report released on Tuesday, the N10.143 trillion disbursements made in 2023 were 23.6 per cent or N1.934 trillion higher than the N8.209 trillion allocated in 2022.

A breakdown of the revenue receipts showed that the federal government received N3.99 trillion, representing 39.37 per cent of the total allocation. N3.585 trillion representing 35.34 per cent was shared among the 36 states while the 774 local government councils of the federation shared 2.56 trillion equivalent to 25.28 percent in the period.

According to the report, “the first quarter of 2023 increased by N579.71 billion (33.19 per cent) when compared to the first quarter of 2022. The second quarter increased by 10.32 per cent, the third quarter by 27.49 per cent and the fourth quarter had an increase of 23.42 per cent respectively.

“The federal government’s share increased by N574.21 billion (16.79 per cent) from the N3.42 trillion it received in 2022 to N3.99 trillion in 2023. The State governments shared N3.59 trillion in 2023 compared to the N2.76 trillion they got in 2022, showing an increase of 29.99 per cent. Similarly, local government councils’ share of federation allocation was N2.57 trillion in 2023 compared to N2.032 trillion in 2023 which amounts to a 26.22 per cent increase.

“While total distributed revenue from the Federation Account recorded an overall increase of 23.56 per cent in 2023, the increase accruing to each tier of government varied, largely due to the type of revenue item contributing to the inflows into the Federation Account.

“In the same period (2023), states and local governments recorded increases in their allocations of 29.99 per cent and 26.22 per cent, respectively. The increase in allocation to the federal government, however, was 16.79 per cent.”

The report also noted that while total revenues distributed from the Federation Account recorded an overall increase of 23.56 per cent in 2023, the increase accruing to each tier of government varied, largely due to the type of revenue streams contributing to the inflows into the Federation Account.

State-by-state share of the allocations showed that Delta State received the largest share of N402.26 billion (gross). The figure includes the state’s share of oil and gas derivation revenue. Delta was followed by Rivers State which received N398.53 billion while Akwa-Ibom State received the third largest allocation of N293.58 billion.

On the share of derivation revenue, nine states received the 13 per cent allocated to mineral-producing states from the proceeds from mineral revenue.

Commenting on the report, Mr Orji Ogbonnaya Orji, the Executive Secretary of NEITI, attributed the increase to improved revenue remittances to the Federation Account due to the removal of petrol subsidy and the floating of the exchange rate by the new administration.

He explained that the agency embarked on the NEITI FAAC Quarterly Review to enhance public understanding of Federation Account allocations and disbursements as published by the government.

He said, “The ultimate objective of this disclosure is to strengthen knowledge, and awareness and promote public accountability of all institutions in public finance management.

“The government (the National Assembly and the Executive) should adopt more conservative estimates for crude oil prices and output to enhance budgetary performance, reduce budget deficits and borrowing and strengthen fiscal stabilization.”

“NEITI’s FAAC Quarterly Reviews also underlined the need for States to join hands with the federal government to deal with insecurity in rural communities where agro-based businesses thrive, pay attention to internally generated revenues through innovations and leadership that are citizen-centred.”

Economy

Brent Climbs to $71 on Fears of US Military Action Against Iran

By Adedapo Adesanya

The price of Brent crude oil grade went up by 0.14 per cent or 10 cents to $71.76 per barrel on Friday as investors worried about US military action against Iran, as President Donald Trump presses the Islamic Republic to halt nuclear weapon development.

However, the US West Texas Intermediate (WTI) crude oil grade finished at $66.39 a barrel after going down by 4 cents or 0.06 per cent.

The market awaited developments in the struggle between Iran and the US after President Trump said, “We have to make a meaningful deal, otherwise bad things happen,” referring to Iran.

The main concern for the crude oil market is that military activity will lead to a supply disruption if Iran decides to block shipping in the Strait of Hormuz. About 20 per cent of the world’s oil consumption passes through that waterway. Conflict in the area could limit oil entering the global market and push up prices.

There is the fear that a potential US military campaign in Iran could disrupt shipping in the Middle East are also adding upward pressure on supertanker rates.

Traders and investors ramped up purchases of call options on Brent crude in recent days, betting on higher prices.

Also supporting oil were reports of falling crude stocks and limited exports in the world’s biggest oil-producing and exporting countries. US crude inventories dropped by 9 million barrels as refining utilisation and exports climbed, an Energy Information Administration (EIA) report showed on Thursday.

Markets were also considering the impact of ample supply, with talks of the Organisation of the Petroleum Exporting Countries and its allies (OPEC+) leaning towards a resumption in oil output increases from April.

Eight OPEC+ producers – Saudi Arabia, Russia, the United Arab Emirates, Kazakhstan, Kuwait, Iraq, Algeria and Oman will meet on March 1. The eight members raised production quotas by about 2.9 million barrels per day from April to the end of December 2025, equating to about 3 per cent of global demand, and froze further planned increases for January through March 2026 because of seasonally weaker consumption.

Meanwhile, the oil market shrugged off a US Supreme Court decision ruling unconstitutional President Trump’s use of a law to levy tariffs in national emergencies.

Economy

PENGASSAN Kicks Against Tinubu’s Executive Order on Oil, Gas Revenues

By Adedapo Adesanya

The Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN) has faulted the Executive Order signed by President Bola Tinubu on oil and gas revenues.

President Tinubu this week signed the Executive Order, titled The Upstream Petroleum Operations Cost Efficiency Incentives Order (2025), to safeguard and enhance oil and gas revenues for the Federation, curb wasteful spending, eliminate duplicative structures in the sector, and redirect resources for the benefit of the Nigerian people.

However, at a press conference in Abuja, PENGASSAN president, Mr Festus Osifo, argued that the tax incentives granted to oil companies by the President may not help in the reduction of cost if insecurity is not addressed.

“The Executive Order signed by the President yesterday is a direct attack on the provisions of the Petroleum Industry Act (PIA)—specifically Sections 8, 9, and 64,” Mr Osifo said.

“What the President has done is use an Executive Order to set aside a law of the Federal Republic of Nigeria. This is deeply troubling. What signal are we sending to investors and the international community?

“We are effectively telling them that the law of the land can be set aside by a simple executive decree. This is an aberration and should never have happened.”

According to a statement by the presidential spokesperson, Mr Bayo Onanuga, the President signed the EO in pursuance of Section 5 of the Constitution of the Federal Republic of Nigeria (as amended).

The Executive Order is anchored on Section 44(3) of the Constitution, which vests ownership, control, and derivative rights in all minerals, mineral oils, and natural gas in, under, and upon any land in Nigeria—including its territorial waters and Exclusive Economic Zone—in the Government of the Federation.

The directive seeks to restore the constitutional revenue entitlements of the federal, state, and local governments, which were removed in 2021 by the Petroleum Industry Act (PIA).

According to Mr Onanuga, the PIA created structural and legal channels through which substantial Federation revenues are lost via deductions, sundry charges, and fees.

Under the current PIA framework, NNPC Limited retains 30 per cent of the Federation’s oil revenues as a management fee on Profit Oil and Profit Gas derived from Production Sharing Contracts, Profit Sharing Contracts, and Risk Service Contracts. Additionally, the company retains 20 per cent of its profits for working capital and future investments.

The federal government considers the additional 30 per cent management fee unjustified, as the 20 per cent retained earnings are already sufficient to support NNPC Limited’s functions under these contracts.

Moreover, NNPC Limited also retains another 30 per cent of profit oil and profit gas under the Frontier Exploration Fund, as stipulated in sections 9(4) and (5) of the PIA.

Economy

Customs to Fast-Track Cargo Clearance at Lekki Deep Sea Port

By Adedapo Adesanya

The Comptroller-General of the Nigeria Customs Service (NCS), Mr Adewale Adeniyi, has unveiled a Green Channel initiative at the Lekki Deep Sea Port as part of efforts to simplify cargo clearance, reduce delays, and improve operational efficiency for port users.

The launch marks a major step in customs’ drive to enhance trade facilitation through technology and stakeholder collaboration.

Speaking at the event in Lagos, Mr Adeniyi said the initiative was introduced by the Lekki Deep Sea Port and approved by NCS management to address persistent challenges in container stacking and examination at major ports, which often slow cargo processing.

“This particular intervention helps to move containers right from the vessel into a dedicated place where customers can have access. And between the time the container moves from the vessel to this particular place, it is tracked,” he said.

The customs boss explained that the Green Channel is designed to ensure seamless cargo movement through a dedicated corridor with minimal bureaucratic obstacles, enabling faster turnaround time for importers and other stakeholders.

He described the initiative as a product of mutual trust between the agency and its stakeholders, stressing that compliance and cooperation are essential to its success.

“What we have done today is a product of the kind of trust that we have invested in our stakeholders and the confidence that we also have in them, that they would do this in the spirit of compliance and trade facilitation,” he said.

Mr Adeniyi added that beyond easing port operations, the Green Channel supports Nigeria’s broader economic objective of building a more competitive trade environment, noting that the initiative is expected to reduce the cost and time required to do business, ultimately boosting revenue generation for the service.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn