Economy

The Future of Casting Is Now: IAmCasting Debuts 2.0 Enhanced Features at Singapore Media Festival 2024

“Casting isn’t just about finding the right people – it’s about streamlining opportunities for creativity to thrive. With these new features, we’re enabling seamless collaboration and fostering stronger connections within the media and entertainment ecosystem,” said Irene Ang, Founder of IAmCasting.

“These features reflect our commitment to being more than just a casting platform – we are a strategic partner to the industry. By incorporating user feedback and leveraging technology, we’re making casting simpler, faster, and more inclusive,” said Jack Lim, CEO of IAmCasting.

Introducing Game-Changing Enhancements:

1. Streamlined Job Posting

- Customizable Templates: Simplify your casting calls with ready-to-use templates tailored to specific roles.

- Precise Job Segmentation: Effectively categorize roles to reach the perfect talent faster.

2. Seamlessly Simplified UX

- Guided Onboarding: A step-by-step process designed for ease, ensuring a smooth experience for talents and agencies alike.

- Quick Apply for Talents: Submit applications with just a few clicks for faster and more intuitive casting.

3. Empowering Teams with Multi-Level Account Access

- Sub-Account Management: Add team members with customized permissions for secure and efficient collaboration.

- Role-Based Access: Flexible controls ensure every user has the right tools for their role.

4. Game-Changing In-App Video Submissions

- All-in-One Review Hub: Manage all submissions in one centralized platform, boosting efficiency.

- Direct Audition Uploads: Simplify the audition process with seamless self-tape submissions.

5. Enhanced Casting Database Connectivity

- Integrated Talent Database: A connected and searchable pool of talent at your fingertips.

A Platform for Boundless Collaboration with Equal Opportunities for All

These upgrades take IAmCasting to the next level, making it easier than ever to connect talents with productions across Singapore and beyond. Users love how it breaks down geographical barriers while offering unmatched convenience and efficiency.

Since its launch last December, IAmCasting has welcomed close to 3,000 talents from Singapore, Malaysia, Indonesia, The Philippines, Thailand, and the U.S. to its platform. With over 40 talent agencies and production companies on board and joining, the community continues to grow, with even more partners expected to come onboard.

IAmCasting isn’t just about linking talents to jobs – it’s about building a vibrant community where ideas come to life, experiences are exchanged, and mentorship brings people together. It’s a space where every creative talent has the chance to shine and succeed.

“Our mission at IAmCasting has always been to empower talents and industry professionals by fostering seamless connections and meaningful opportunities. With the launch of our new 2.0 features, we’re enriching collaboration, igniting creativity, and creating a casting experience that enables everyone in the creative community to flourish and thrive,” said Jack Lim, CEO of IAmCasting.

Transforming the Industry with IAmCasting

IAmCasting is revolutionizing talent discovery by eliminating geographical and time barriers, enabling seamless searches anytime, anywhere.

The platform bridges industry professionals – media owners, production houses, casting agencies, event organizers, and brand owners – with a diverse array of creative talents, including actors, models, hosts, content creators, singers, and athletes. With its unique and enhanced features, IAmCasting further streamlines the casting process, offering access to a broader talent pool and more job opportunities. This innovation reduces casting timelines from months to days, driving efficiency and opening new horizons for the media and entertainment industry.

Hashtag: #IAmCasting #Casting #Media&Entertainment #AsianTalents #IAmCastingRU #CastingReimagined #CastingCalls

![]() https://www.iamcasting.asia

https://www.iamcasting.asia![]() https://www.linkedin.com/company/iamcastingasia

https://www.linkedin.com/company/iamcastingasia![]() https://www.facebook.com/IAmCasting.asia/

https://www.facebook.com/IAmCasting.asia/![]() https://www.instagram.com/iamcasting.asia/

https://www.instagram.com/iamcasting.asia/![]() https://www.tiktok.com/@iamcasting

https://www.tiktok.com/@iamcasting

The issuer is solely responsible for the content of this announcement.

About IAmCasting

IAmCasting (formerly known as TADAA! Casting) is an online platform that connects industry talents such as models, actors, celebrities, singers, content creators, sports stars and performers with clients and opportunities across the globe without being limited by physical, geographical and time restrictions. IAmCasting aims to create a vibrant community where talents can grow and thrive through the exchange of experiences on an international stage.

![]()

Economy

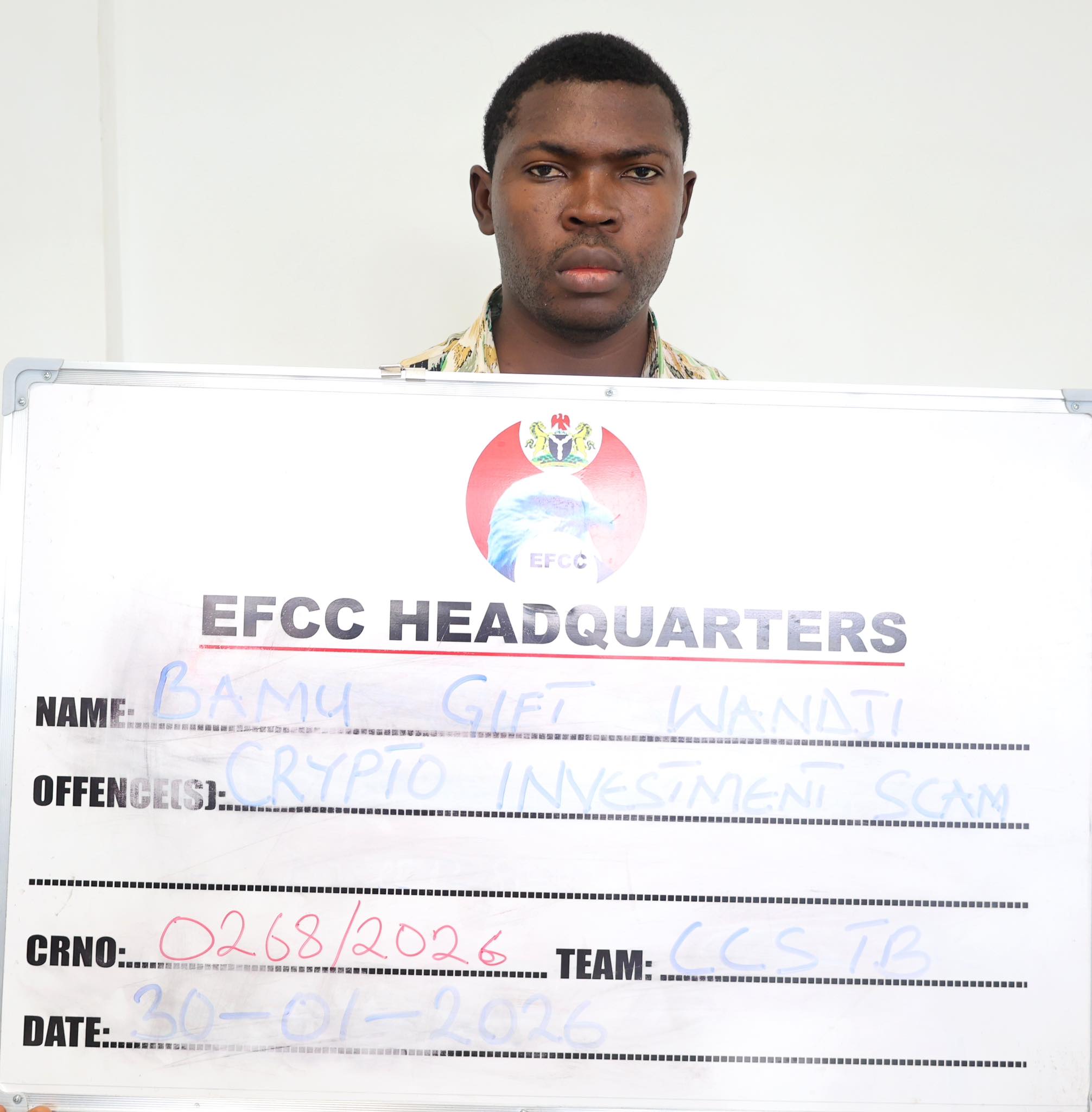

Crypto Investor Bamu Gift Wandji of Polyfarm in EFCC Custody

By Dipo Olowookere

A cryptocurrency investor and owner of Polyfarm, Mr Bamu Gift Wandji, is currently cooling off in the custody of the Economic and Financial Crimes Commission (EFCC).

He was handed over to the anti-money laundering agency by the Nigerian Security and Civil Defence Corps (NSCDC) on Friday, January 30, 2026, after his arrest on Monday, January 12, 2026.

A statement from the EFCC yesterday disclosed that the suspect was apprehended by the NSCDC in Gwagwalada, Abuja for running an investment scheme without the authorisation of the Securities and Exchange Commission (SEC), which is the apex capital market regulator in Nigeria.

It was claimed that Mr Wandji created a fraudulent crypto investment platform called Polyfarm, where he allegedly lured innocent Nigerians to invest in Polygon, a crypto token that attracts high returns.

Investigation further revealed that he also deceived the public that his project, Polyfarm, has its native token called “polyfarm coin” which he sold to the public.

In his bid to promote the scheme, the suspect posted about this on social media platforms, including WhatsApp, X (formally Twitter) and Telegram. He also conducted seminars in some major cities in Nigeria including Kaduna, Lagos, Port Harcourt and Abuja where he described the scheme as a life-changing programme.

Further investigation revealed that in October, 2025, subscribers who could not access their funds were informed by the suspect that the site was attacked by Lazarus group, a cyber attacking group linked to North Korea.

Further investigations showed that Polyfarm is not registered and not licensed with SEC to carry out crypto transactions in Nigeria. Also, no investment happened with subscribers’ funds and that the suspect used funds paid by subscribers to pay others in the name of profit.

Investigation also revealed that native coin, polyfarm coin was never listed on coin market cap and that the suspect sold worthless coins to the general public.

Contrary to the claim of the suspect that his platform was attacked, EFCC’s investigations revealed that the platform was never attacked or hacked by anyone and that the suspect withdrew investors’ funds and utilized the same for his personal gains.

The EFCC, in the statement, disclosed that Mr Wandji would be charged to court upon conclusion of investigations.

Economy

Nigerian Stocks Shed 0.09% on Mild Profit-Taking

By Dipo Olowookere

Profit-takers pounced on the Nigerian Exchange (NGX) Limited on Friday, weakening it by 0.09 per cent at the close of transactions.

Investors toned down on their hunger for Nigerian stocks during the last trading session of the week, with selling pressure mainly on the banking space, which shed 0.78 per cent.

The bourse crumbled despite the other sectors closing green, with the consumer goods up by 0.10 per cent, and the energy index up by 0.02 per cent, while the industrial index closed flat.

Livestock Feeds depreciated by 10.00 per cent to sell for N6.30, Learn Africa declined by 10.00 per cent to N8.10, Living Trust Mortgage Bank also slipped by 10.00 per cent to N4.05, Deap Capital gave up 9.97 per cent to trade at N9.39, and Industrial and Medical Gases lost 9.61 per cent to finish at N31.50.

On the flip side, Zichis appreciated by 9.97 per cent to N4.19, Abbey Mortgage Bank gained 9.94 per cent to quote at N9.40, RT Briscoe jumped by 9.93 per cent to N7.86, Haldane McCall grew by 9.90 per cent to N4.33, and Omatek increased by 9.87 per cent to N3.00.

Business Post reports that the market breadth index was positive despite the poor outcome, recording 33 price gainers and 31 price losers, representing strong investor sentiment.

The All-Share Index was down by 156.91 points during the session to 165,370.40 points from the 165,527.31 points achieved a day earlier, and the market capitalisation depleted by N184 billion to N106.153 trillion from N105.969 trillion.

Trading data showed that 687.4 million equities valued at N15.0 billion exchanged hands in 41,553 deals yesterday compared with the 691.4 million equities worth N15.4 billion traded in 38,665 deals on Thursday, implying a jump in the number of deals by 7.47 per cent, and a slip in the trading volume and value by 2.60 per cent, respectively.

The busiest stock on Friday was Veritas Kapital with 80.5 million units worth N197.0 million, Secure Electronic Technology transacted 79.3 million units valued at N87.5 million, Deap capital transacted 33.3 million units for N340.5 million, Access Holdings sold 31.0 million units valued at N703.0 million, and Zenith Bank exchanged 30.6 million units worth N2.2 billion.

Economy

NASD Exchange Rises 0.20%

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange appreciated by 0.20 per cent on Friday, January 30, supported by the gains achieved by two securities on the platform.

During the session, Okitipupa Plc went up by N15.70 to finish at N234.60 per share versus the previous day’s N218.90 per share and Paintcomm Investment Plc expanded by 5 Kobo to close at N11.05 per unit compared with the previous day’s N11.00 per unit.

It was observed that yesterday, there were three price losers led by Geo-Fluids Plc, which dropped 60 Kobo to sell at N5.75 per share versus N6.35 per share, Afriland Properties Plc declined by 35 Kobo to close at N13.65 per unit compared with Thursday’s closing price of N14.00 per unit, and Industrial and General Insurance (IGI) Plc depreciated by 3 Kobo to 66 Kobo per share from 69 Kobo per share.

At the close of business, the NASD Unlisted Security Index (NSI) rose by 7.34 points to 3,630.11 points from 3,622.77 points and the market capitalisation grew by N4.39 billion to N2.171 trillion from N2.167 trillion.

A total of 287,618 units of securities exchanged hands on Friday compared with the previous day’s 1.9 million units of securities, indicating a decline in the volume of trades by 85.6 per cent.

The value of transactions, according to data, was down by 77.2 per cent to N3.1 million from N13.4 million, but the number of deals increased by 31.3 per cent to 21 deals from 16 deals.

Central Securities Clearing System (CSCS) Plc remained the most traded stock by value (year-to-date) with 15.4 million units exchanged for N623.0 million, followed by FrieslandCampina Wamco Nigeria Plc with 1.6 million units traded for N108.5 million, and Geo-Fluids Plc with 9.1 million units valued at N61.1 million.

CSCS Plc also ended the session as the most active stock by volume (year-to-date) with 15.4 million units sold for N623.0 million, followed by Mass Telecom Innovation Plc with 10.1 million units worth N4.1 million, and Geo-Fluids Plc with 9.1 million units valued at N61.1 million.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn