Media OutReach

Octa broker’s take on CBDCs vs. crypto: key insights for traders in 2025

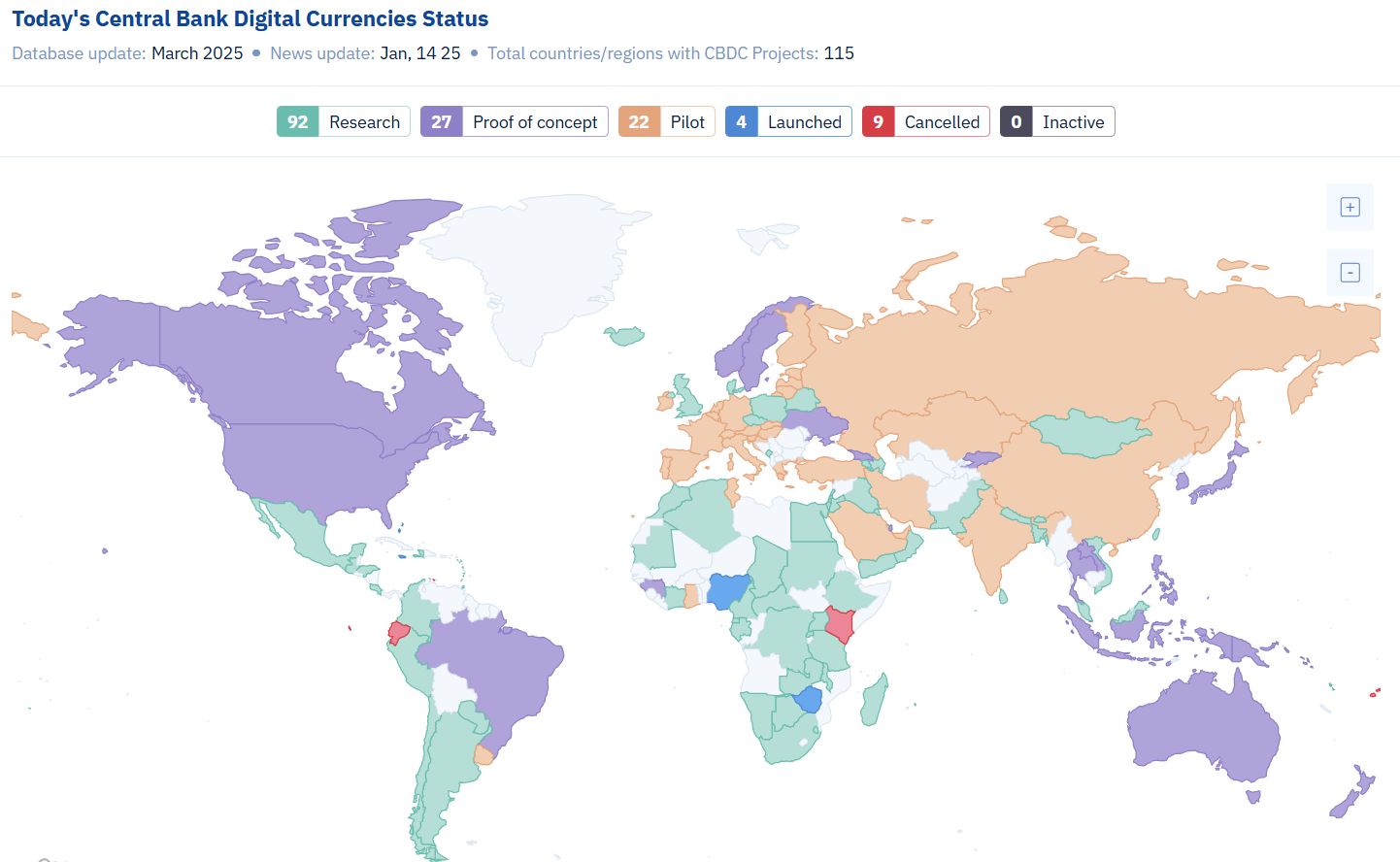

According to recent data, over 130 countries representing 98% of global GDP are now exploring CBDCs in some form, including pilots, development, or research (albeit few have fully adopted them). This rise reflects both technological momentum and regulatory intent to reclaim control over digital currency ecosystems, especially as private stablecoins and decentralised crypto assets have proliferated.

The main differences between CBDCs and cryptocurrencies

Stability and trust

While cryptocurrencies like Bitcoin or Ethereum operate in highly volatile and speculative environments, CBDCs are anchored to fiat currencies and issued by central banks. This offers higher value stability and institutional backing, reducing the risk profile for users.

Design and oversight

CBDCs are programmable but centrally managed. Governments can impose compliance measures and offer consumer protection in ways decentralised crypto systems cannot. Moreover, unlike crypto assets, CBDCs are not mined or privately issued, ensuring state control over monetary supply and transaction oversight.

Kar Yong Ang, financial market analyst at Octa, notes: ‘CBDCs offer a new model of digital liquidity—blending state trust and legal tender with tech efficiency. For traders, this opens doors to a more secure and transparent digital finance ecosystem.’

The global race to develop CBDCs and the drivers behind it

Here are three key reasons why central banks invest resources in CBDSs:

- The decline of cash and rise of digital payments. As societies increasingly favour digital over physical money, central banks face pressure to modernise public currency formats. In Sweden, for example, cash transactions make up less than 10% of payments. CBDCs are seen as a public alternative to private payment apps and platforms, ensuring monetary sovereignty in the digital realm.

- Controlling private stablecoin risks. Private stablecoins like USDT and USDC have raised concerns over systemic risk and shadow banking practices. A CBDC can serve as a stable counterbalance to these instruments, offering liquidity and legal clarity in fast-evolving financial markets.

- Financial inclusion and transparency. CBDCs can increase financial inclusion by offering digital wallets to unbanked populations, especially in developing economies. They also offer governments more visibility into money flows, enhancing tax collection and curbing illicit finance—though this has sparked debate around surveillance and privacy.

Pros and cons of CBDCs

CBDCs offer notable advantages: their value is typically pegged to fiat currencies, ensuring greater price stability than most cryptocurrencies. With full state backing, they function as legal tender and may include programmable features like conditional payments. For underbanked populations, they also present a path toward improved financial access.

However, concerns remain. Privacy is a major issue, as CBDCs could give governments visibility into personal transactions. They also pose cybersecurity risks, potentially becoming targets for large-scale attacks. Moreover, they could interfere with traditional monetary policy and financial market dynamics if not carefully designed. For instance, commercial banks could experience deposit runs if individuals perceive CBDCs as a safer alternative to traditional money for savings.

Real-world cases

Although the majority of countries still research CBDC and their application in the economy, some have already implemented them.

- Bahamas. The Sand Dollar became the first nationwide CBDC in 2020. It now serves all islands through a network of mobile-based wallets.

- Nigeria. The eNaira, launched in 2021, has seen a slow adoption of less than 0.5% as of 2025. The government continues to offer incentives to boost usage.

- China. The e-CNY has been piloted in over 25 cities and integrated into public transit and e-commerce platforms. Its scale makes it the most advanced major-economy CBDC.

Looking ahead: the road to adoption

While CBDCs promise greater efficiency and offer more tools for governments to implement social objectives, they also pose new governance challenges. To thrive, states will have to balance innovation with civil liberties, infrastructure resilience, and global interoperability. As the world of digital currencies continues to develop, CBDCs are increasingly important for progressive traders to grasp. Keeping up with developments can give a vital advantage in understanding the future of money.

___

Disclaimer: This content is for general informational purposes only and does not constitute investment advice, a recommendation, or an offer to engage in any investment activity. It does not take into account your investment objectives, financial situation, or individual needs. Any action you take based on this content is at your sole discretion and risk. Octa and its affiliates accept no liability for any losses or consequences resulting from reliance on this material.

Trading involves risks and may not be suitable for all investors. Use your expertise wisely and evaluate all associated risks before making an investment decision. Past performance is not a reliable indicator of future results.

Availability of products and services may vary by jurisdiction. Please ensure compliance with your local laws before accessing them.

Hashtag: #Octa

The issuer is solely responsible for the content of this announcement.

Octa

![]() Octa is an international CFD broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.

Octa is an international CFD broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.

The company is involved in a comprehensive network of charitable and humanitarian initiatives, including the improvement of educational infrastructure and short-notice relief projects supporting local communities.

In Southeast Asia, Octa received the ‘Best Trading Platform Malaysia 2024’ and the ‘Most Reliable Broker Asia 2023’ awards from Brands and Business Magazine and International Global Forex Awards, respectively.

Media OutReach

AEON Bank Helps Ease Festive Season’s Budget Constraints with No-Hassle Personal Financing-i

From December 2025 till March 2026, the bustling seasons present convergence of multiple spending needs for many households. Acknowledging that this might raise the need for flexible liquidity, AEON Bank provides a solution to address such budgetary constraints in the form of the PF-i; an inclusive, hassle-free financing facility, easily accessible via its digital banking app.

Optimising a Risk-Based Pricing (RBP) framework to determine a competitive and personalised profit rate, AEON Bank ensures that customers can seamlessly apply for PF-i online, as long as they are Malaysian citizens aged 18 to 55, with a minimum monthly gross income of RM2,500 – be it salaried employees or self-employed individuals, freelancers, as well as gig economy workers.

Aligned with Shariah banking principles, PF-i offers financing facility from RM1,000 up to RM100,000 with flexible tenure options ranging from 3 to 84 months, allowing for repayments tailored to individual budget needs. The Flat Profit Rate starting from 3.88% p.a. and a nominal Wakalah Fee of RM1 is applicable upon acceptance.

The entire process, from the application to fund disbursement are all managed online via the AEON Bank app. This simplifies the process and eliminates the need for physical paperwork or branch visits. To apply for PF-i, customers simply need to follow these steps :

- Step 1 : Activated Savings Account-i pre-requisite

Download the AEON Bank app and activate the Savings Account-i, prior to applying for PF-i.

- Step 2 : Eligibility check and employment details

Applicants must be Malaysian citizens aged 18 and above, earning a minimum monthly gross income of RM2,500 – either as salaried employees, self-employed or gig workers.

- Step 3 : Financing selection

Select the preferred financing amount ranging from RM1,000 up to RM100,000 and flexible repayment tenure, with options between 3 to 84 months.

- Step 4 : Supporting document submission

Upload the latest EPF (KWSP) statement, reflecting the latest consecutive 6-months contributions (for salaried workers) or latest consecutive 6-month bank statement (for self-employed/gig workers).

- Step 5 : Approval and fund disbursement

Applications will be processed immediately and upon approval, funds will be disbursed directly into the applicant’s AEON Bank Savings Account-i. Repayments will be automatically deducted via monthly auto-debit.

PF-i enables Malaysians to access a Shariah compliant financing facility to ease their needs; be it an emergency financial support, family budget constraint, small renovation, vehicle repair or a much needed financial aid to bridge the temporary cashflow gaps.

For comprehensive details on the Personal Financing-i (PF-i), including full terms and conditions, click here to browse the website and scan the QR Code to download the AEON Bank app: https://www.aeonbank.com.my/api/qr-handler

Hashtag: #AEONBank #DigitalBanking #IslamicDigitalBank #ShariahCompliant #FinancialInclusion #IslamicFintech #PersonalFinancing

![]() https://www.aeonbank.com.my/

https://www.aeonbank.com.my/![]() https://www.linkedin.com/company/aeonbankmy/?viewAsMember=true

https://www.linkedin.com/company/aeonbankmy/?viewAsMember=true![]() https://x.com/aeonbankmy

https://x.com/aeonbankmy![]() https://www.facebook.com/aeonbankmalaysia

https://www.facebook.com/aeonbankmalaysia![]() https://www.instagram.com/aeonbankmy

https://www.instagram.com/aeonbankmy

The issuer is solely responsible for the content of this announcement.

AEON Bank (M) Berhad

AEON Bank (M) Berhad is the first digital Islamic bank in Malaysia, licensed and regulated by Bank Negara Malaysia and the Ministry of Finance. Officially launched on 26 May 2024, we currently offer a suite of Shariah-compliant products and services under the Personal Banking and Business Banking (AEON Bank Biz).

Our Personal Banking offerings are 100% accessible via the AEON Bank app, namely the deposit Savings Account-i, AEON Bank x Visa Debit Card-i, Personal Financing-i, Term Deposit-i, Savings Pots, DuitNow QR, utility bill payments, personal financial management and budgeting tools with Neko Sensei, and a range of digital payment services with strategic partners and merchants, as well as Neko Missions, Malaysia’s first gamified digital banking interactive rewards programme.

On 8 August 2025, AEON Bank (M) Berhad officially launched AEON Bank Biz, anchored by the Current Business Account-i and integrated cash management capabilities, with the initial onboarding of vendors from AEON Credit Service (M) Berhad and suppliers within the broader AEON ecosystem. The targeted approach is designed to create an integrated value chain linking AEON’s retail and financial services networks, supporting strategic growth and greater inclusivity. AEON Bank Biz offers streamlined processes for account onboarding, credit assessments and financial services, utilising AI-driven fintech solutions to enable simplified procedures, faster approvals, and an enhanced digital banking experience for business owners and entrepreneurs. AEON Bank Biz’s products and services will soon be extended to more local businesses and entrepreneurs across Malaysia.

Being part of the AEON Group conglomerate, AEON Bank (M) Berhad is equally held by AEON Financial Service Co. Ltd. (AFS Japan) and AEON Credit Service (M) Berhad (ACSM). AFS Japan is responsible for the AEON Group’s financial services businesses, with strong roots in the retail sector which operates in Japan and 10 countries across Asia and it is. AEON Group is Japan’s largest retail group and it is a pure holding company that comprises eight core businesses.

AEON Group Malaysia consists of several entities, namely, AEON Co. (M) Bhd, AEON Credit Service (M) Berhad, AEON Bank (M) Berhad, AEON BiG (M) Sdn Bhd, AEON Fantasy (M) Sdn Bhd, AEON Delight (M) Sdn Bhd, AEON Global Supply Chain Sdn Bhd and Malaysian AEON Foundation (MAF). AEON Group has been a recognizable household brand with more than 200 years of history and evolution in Japan since the Edo era, along with 4 decades of growth in Malaysia, providing consumers with daily financial solutions and diversified retail convenience.

Our cloud native agility and AI optimisation, combined with the strength of our Shariah DNA, Malaysian roots and Japanese heritage are our distinguishing factors, while the integration with the AEON ecosystem gives us a competitive advantage of being the only bank in Malaysia with its own nationwide retail network. On top of that, AEON Points loyalty programme offers customers value-added benefits and meaningful rewards, as the AEON Points can be redeemed into cash value, deposited directly into customers’ AEON Bank Savings Account-i.

AEON Bank (M) Berhad is committed to provide accessible financial solutions for Malaysians and we aim to empower the community in pursuing their financial aspirations and achieve economic independence, hence fostering a more inclusive financial future for all. We will continue to contribute towards the Islamic banking development in the region and the nation’s digital economy.

Media OutReach

AEON Bank Helps Ease Festive Season’s Budget Constraints with No-Hassle Personal Financing-i

From December 2025 till March 2026, the bustling seasons present convergence of multiple spending needs for many households. Acknowledging that this might raise the need for flexible liquidity, AEON Bank provides a solution to address such budgetary constraints in the form of the PF-i; an inclusive, hassle-free financing facility, easily accessible via its digital banking app.

Optimising a Risk-Based Pricing (RBP) framework to determine a competitive and personalised profit rate, AEON Bank ensures that customers can seamlessly apply for PF-i online, as long as they are Malaysian citizens aged 18 to 55, with a minimum monthly gross income of RM2,500 – be it salaried employees or self-employed individuals, freelancers, as well as gig economy workers.

Aligned with Shariah banking principles, PF-i offers financing facility from RM1,000 up to RM100,000 with flexible tenure options ranging from 3 to 84 months, allowing for repayments tailored to individual budget needs. The Flat Profit Rate starting from 3.88% p.a. and a nominal Wakalah Fee of RM1 is applicable upon acceptance.

The entire process, from the application to fund disbursement are all managed online via the AEON Bank app. This simplifies the process and eliminates the need for physical paperwork or branch visits. To apply for PF-i, customers simply need to follow these steps :

- Step 1 : Activated Savings Account-i pre-requisite

Download the AEON Bank app and activate the Savings Account-i, prior to applying for PF-i.

- Step 2 : Eligibility check and employment details

Applicants must be Malaysian citizens aged 18 and above, earning a minimum monthly gross income of RM2,500 – either as salaried employees, self-employed or gig workers.

- Step 3 : Financing selection

Select the preferred financing amount ranging from RM1,000 up to RM100,000 and flexible repayment tenure, with options between 3 to 84 months.

- Step 4 : Supporting document submission

Upload the latest EPF (KWSP) statement, reflecting the latest consecutive 6-months contributions (for salaried workers) or latest consecutive 6-month bank statement (for self-employed/gig workers).

- Step 5 : Approval and fund disbursement

Applications will be processed immediately and upon approval, funds will be disbursed directly into the applicant’s AEON Bank Savings Account-i. Repayments will be automatically deducted via monthly auto-debit.

PF-i enables Malaysians to access a Shariah compliant financing facility to ease their needs; be it an emergency financial support, family budget constraint, small renovation, vehicle repair or a much needed financial aid to bridge the temporary cashflow gaps.

For comprehensive details on the Personal Financing-i (PF-i), including full terms and conditions, click here to browse the website and scan the QR Code to download the AEON Bank app: https://www.aeonbank.com.my/api/qr-handler

Hashtag: #AEONBank #DigitalBanking #IslamicDigitalBank #ShariahCompliant #FinancialInclusion #IslamicFintech #PersonalFinancing

![]() https://www.aeonbank.com.my/

https://www.aeonbank.com.my/![]() https://www.linkedin.com/company/aeonbankmy/?viewAsMember=true

https://www.linkedin.com/company/aeonbankmy/?viewAsMember=true![]() https://x.com/aeonbankmy

https://x.com/aeonbankmy![]() https://www.facebook.com/aeonbankmalaysia

https://www.facebook.com/aeonbankmalaysia![]() https://www.instagram.com/aeonbankmy

https://www.instagram.com/aeonbankmy

The issuer is solely responsible for the content of this announcement.

AEON Bank (M) Berhad

AEON Bank (M) Berhad is the first digital Islamic bank in Malaysia, licensed and regulated by Bank Negara Malaysia and the Ministry of Finance. Officially launched on 26 May 2024, we currently offer a suite of Shariah-compliant products and services under the Personal Banking and Business Banking (AEON Bank Biz).

Our Personal Banking offerings are 100% accessible via the AEON Bank app, namely the deposit Savings Account-i, AEON Bank x Visa Debit Card-i, Personal Financing-i, Term Deposit-i, Savings Pots, DuitNow QR, utility bill payments, personal financial management and budgeting tools with Neko Sensei, and a range of digital payment services with strategic partners and merchants, as well as Neko Missions, Malaysia’s first gamified digital banking interactive rewards programme.

On 8 August 2025, AEON Bank (M) Berhad officially launched AEON Bank Biz, anchored by the Current Business Account-i and integrated cash management capabilities, with the initial onboarding of vendors from AEON Credit Service (M) Berhad and suppliers within the broader AEON ecosystem. The targeted approach is designed to create an integrated value chain linking AEON’s retail and financial services networks, supporting strategic growth and greater inclusivity. AEON Bank Biz offers streamlined processes for account onboarding, credit assessments and financial services, utilising AI-driven fintech solutions to enable simplified procedures, faster approvals, and an enhanced digital banking experience for business owners and entrepreneurs. AEON Bank Biz’s products and services will soon be extended to more local businesses and entrepreneurs across Malaysia.

Being part of the AEON Group conglomerate, AEON Bank (M) Berhad is equally held by AEON Financial Service Co. Ltd. (AFS Japan) and AEON Credit Service (M) Berhad (ACSM). AFS Japan is responsible for the AEON Group’s financial services businesses, with strong roots in the retail sector which operates in Japan and 10 countries across Asia and it is. AEON Group is Japan’s largest retail group and it is a pure holding company that comprises eight core businesses.

AEON Group Malaysia consists of several entities, namely, AEON Co. (M) Bhd, AEON Credit Service (M) Berhad, AEON Bank (M) Berhad, AEON BiG (M) Sdn Bhd, AEON Fantasy (M) Sdn Bhd, AEON Delight (M) Sdn Bhd, AEON Global Supply Chain Sdn Bhd and Malaysian AEON Foundation (MAF). AEON Group has been a recognizable household brand with more than 200 years of history and evolution in Japan since the Edo era, along with 4 decades of growth in Malaysia, providing consumers with daily financial solutions and diversified retail convenience.

Our cloud native agility and AI optimisation, combined with the strength of our Shariah DNA, Malaysian roots and Japanese heritage are our distinguishing factors, while the integration with the AEON ecosystem gives us a competitive advantage of being the only bank in Malaysia with its own nationwide retail network. On top of that, AEON Points loyalty programme offers customers value-added benefits and meaningful rewards, as the AEON Points can be redeemed into cash value, deposited directly into customers’ AEON Bank Savings Account-i.

AEON Bank (M) Berhad is committed to provide accessible financial solutions for Malaysians and we aim to empower the community in pursuing their financial aspirations and achieve economic independence, hence fostering a more inclusive financial future for all. We will continue to contribute towards the Islamic banking development in the region and the nation’s digital economy.

Media OutReach

Empowering Website Operations Across ASEAN with AI and Teamwork

Japan’s MONJI+—A WebOps Enablement Platform Inspired by Voices from 77 Countries—Launches Its English Edition

OSAKA, JAPAN – Media OutReach Newswire – 24 December 2025 – ALAKI Inc., celebrating its 15th anniversary, has officially launched the English edition of MONJI+, an evolution of its 2018-born feedback tool MONJI β, now reimagined as a comprehensive WebOps Enablement Platform.

Alongside its free plan, available indefinitely, MONJI+ begins its full-scale expansion into the ASEAN market, helping teams elevate their website operations. In addition, a free Academic Edition is now offered to educational institutions to foster the next generation of web and IT talent.

Since its launch in Japan in 2018, MONJI β has been adopted by web agencies, corporations, and advertising firms worldwide—across 77 countries and regions—streamlining feedback workflows for website management and development.

In everyday website operations, teams often face:

- Feedback scattered across tools and channels

- Miscommunication between internal teams and agencies

- Unclear priorities that fail to drive results

- Knowledge loss when members change

- Valuable learnings buried and forgotten

MONJI+ connects creation, publishing, maintenance, and optimization into a single workflow—eliminating silos and enabling all members to move forward toward shared goals.

▶️ See how MONJI+ transforms your workflow

Since its official launch in Japan in January 2025, MONJI+ has rapidly spread among enterprises and educational institutions. It is increasingly adopted as a practical standard among agencies and in-house teams, improving productivity and measurable outcomes.

During forums and seminars held alongside the Expo 2025 Osaka, Kansai, Japan, ALAKI engaged with government representatives and industry leaders from around the world.

The feedback was clear: inefficiencies in website operations, lack of improvement cycles, and a shortage of web marketing expertise are universal challenges. But one issue stood out above all—the shortage of skilled web and IT professionals.

Some governments even requested that MONJI+ contribute to national web/IT talent development, not just productivity gains. Following the Expo, inquiries from multiple countries confirmed the demand, prompting the official release of the English edition of MONJI+.

As part of its ASEAN expansion, ALAKI visited SWITCH 2025 (Singapore Week of Innovation & Technology), held from October 29–31. Through dialogues with government agencies, corporations, startups, and academic institutions, the importance of website operations productivity and digital talent development was reaffirmed.

Insights from leading ASEAN web and IT innovators will continue to shape the evolution of MONJI+.

Eliminate inefficiencies and dependency on individuals—enhancing both productivity and performance in website operations.

- Workflow Efficiency: Centralize feedback and progress tracking to prevent oversights

- Error Reduction: Detect typos automatically with AI proofreading

- Results-Oriented: Integration with analytics tools helps identify improvement areas instantly

- Team Collaboration: Share real-time updates across internal and external members

- Knowledge Building: Use the Wiki feature to retain expertise and reduce training costs

MONJI+ evolves beyond a simple management tool—it becomes an AI-driven partner that learns from operational data to support human decision-making and creativity.

Our vision: a human-in-the-loop “Agentic WebOps” environment that helps teams achieve outcomes with AI-assisted decision support.

Available AI Features:

- AI typo and error detection for feedback

- AI chatbot assistance

Upcoming AI Features (Examples):

- Content suggestion and creation

- Feedback trend analysis and improvement recommendations

- Design assistance

- Webpage performance analysis and enhancement

- Global Marketing Agency (Singapore): “Sharing the same interface greatly improved collaboration across our international offices.”

- Web Production Agency (Japan): “Centralized feedback management accelerated delivery times by roughly 30%.”

- E-commerce Company (Japan): “By linking with an analytics tool, we identified key improvement areas instantly—our conversion rate increased by over 20%.”

- Recruitment Platform (Japan): “With AI detecting typos automatically, our job listing checks became faster and more reliable.”

Discover how MONJI+ envisions the future of website operations.

“Website operations shouldn’t be about chasing scattered messages—it should be about generating results that matter. With MONJI+, we unify feedback, workflow, and analytics, while AI suggests the next strategic move. Our mission is to help ASEAN teams reach outcomes faster and more reliably.”

— Yuji Yamauchi, Founder & CEO, ALAKI Inc.

Getting started is easy, with no credit card required. MONJI+ aims to be the shared foundation for website operations, accessible to everyone.

- Forever-Free Plan: Access essential functions without time limits

- 30-Day Free Trial: Experience all features in a live environment

▶️ Start your free 30-day trial now

To empower the next generation of web and IT professionals, MONJI+ offers an Academic Edition free of charge to universities, vocational schools, and online programs. Students and educators can experience real-world website operations, gain practical skills, and collaborate through shared projects.

▶️ Learn more about the Academic Edition

Hashtag: #MONJI+

The issuer is solely responsible for the content of this announcement.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn