Economy

NLC Urges FG to Sell Crude in Naira for Lower Fuel Prices

By Aduragbemi Omiyale

The federal government has been urged to consider selling crude in Naira to private refinery like Dangote Petroleum Refinery to allow Nigerians enjoy lower fuel prices.

This appeal was made by the Lagos State Chapter of the Nigerian Labour Congress (NLC) when its officials visited Dangote Refinery in Lagos recently.

The labour union commended the oil facility owned by Mr Aliko Dangote, describing it as a transformative national asset, capable of bridging Nigeria’s fuel supply gap, boosting employment, and restoring public confidence in the country’s industrial capacity.

It asked the government to prioritise the sale of crude oil to the Dangote Refinery in Naira, arguing that forcing the company to import crude or purchase locally in dollars undermines the promise of lower fuel prices for ordinary Nigerians.

The chairman of the chapter, Ms Funmi Sessi, said, “Today, we have seen the massive Dangote Refinery project, as well as the fertiliser plant. We have also observed some of Dangote’s other investments in this axis. It is truly enormous and highly impressive.

“I believe what we have seen is a clear effort to bridge the gap in the availability of essential products in the country and to create job opportunities for Nigerians and others as well as industrialise the country.”

The union acknowledged that following the federal government’s removal of petrol subsidies, Nigerians experienced an unprecedented surge in the cost of Premium Motor Spirit (PMS). However, the entrance of Dangote Petroleum Refinery into the market helped to stabilise prices.

“It wasn’t until Dangote came into the picture that we started seeing some relief. His intervention significantly crashed the escalated prices of PMS and other refined products. That’s a clear demonstration of private sector leadership,” she stated.

“This country has crude oil in abundance. So, why is Dangote still being made to import crude or pay for it in hard currency?” the NLC queried, noting, “If the government is truly committed to reducing fuel prices and supporting local refining, it must sell crude oil to Dangote in Naira.”

The union stressed that sourcing crude locally in local currency would significantly lower operational costs and, by extension, lead to a more sustainable reduction in fuel prices.

“With a daily capacity of 650,000 barrels, this refinery can serve Nigeria and even the West African sub-region. We also see big ships taking fertilisers to other countries. The government must maximise,” the NLC stated.

The group further said, “When government-owned refineries failed, one man stepped up. Aliko Dangote didn’t just make promises; he fulfilled them. He has proven that Nigeria can not only refine its own products but also meet international quality standards.”

The union also hailed the refinery’s production of Euro 5-compliant fuel, which features significantly reduced sulphur content, aligning with international environmental standards and boosting Nigeria’s credibility in the global petroleum market.

“This is the kind of pride we want to see — a Nigerian company producing at global standards. It is changing the narrative and elevating Nigeria’s position globally. It’s time the government supports and maximises the capacity of this asset.”

In addition to fuel, the NLC noted the group’s fertiliser company, which is already exporting to international markets. It urged the government to leverage these capabilities to enhance food security and reduce dependence on imported agricultural inputs.

In his remarks, the Vice President for Oil and Gas at Dangote Industries Limited, Mr Devakumar Edwin, said the planned deployment of 4,000 Compressed Natural Gas (CNG)-powered trucks to support the distribution of refined petroleum products across Nigeria is aimed at ensuring that the benefits of domestic refining and the resulting reduction in fuel prices are fully passed on to Nigerian consumers.

Mr Edwin stated that the introduction of the CNG-powered fleet is a strategic step to reduce logistics costs in fuel distribution — a major factor in the final pump price.

“The deployment of these 4,000 CNG-powered trucks will help us pass down the benefits of domestic refining and the reduction in product prices to consumers,” Mr Edwin said. “The aim is to support logistics and make distribution more efficient, not to displace any existing players in the sector.”

He further explained that the use of CNG-powered trucks, in addition to being more environmentally friendly, will significantly reduce transportation expenses, ultimately making refined products more affordable for Nigerians.

Mr Edwin also highlighted the wider impact of Dangote’s industrial ventures, particularly in stimulating competition and growth in key sectors of the Nigerian economy. He cited the Dangote Sugar Refinery as an example, noting that its success paved the way for other companies, including BUA Group and Nigerian Flour Mills to invest in sugar production.

“We’ve seen it with sugar, and we’ve seen it with cement. The success of Dangote Cement led to the emergence of players like BUA, Mangal, and the expansion of Lafarge,” he said. “In the same way, the success of this refinery will drive the emergence of more private refineries in Nigeria.”

According to him, the Dangote Refinery is not only helping to address Nigeria’s long-standing reliance on imported refined products but is also setting the pace for a sustainable and competitive refining industry that will benefit the broader economy.

He noted that the Dangote Group has become a nurturing ground for Nigerian engineers, scientists and technicians, many of whom have gone on to work as expatriates in various countries. He assured the labour leaders of the company’s steadfast commitment to human capital development, staff welfare, and the overall wellbeing of the economy, emphasising that Aliko Dangote is a patriotic Nigerian fully dedicated to the nation’s progress.

Economy

LIRS Shifts Deadline for Annual Returns Filing to February 7

By Aduragbemi Omiyale

The deadline for filing of employers’ annual tax returns in Lagos State has been extended by one week from February 1 to 7, 2026.

This information was revealed in a statement signed by the Head of Corporate Communications of the Lagos State Internal Revenue Service (LIRS), Mrs Monsurat Amasa-Oyelude.

In the statement issued over the weekend, the chairman of the tax collecting organisation, Mr Ayodele Subair, explained that the statutory deadline for filing of employers’ annual tax returns is January 31, every year, noting that the extension is intended to provide employers with additional time to complete and submit accurate tax returns.

According to him, employers must give priority to the timely filing of their annual returns, noting that compliance should be embedded as a routine business practice.

He also reiterated that electronic filing through the LIRS eTax platform remains the only approved method for submitting annual returns, as manual filings have been completely phased out. Employers are therefore required to file their returns exclusively through the LIRS eTax portal: https://etax.lirs.net.

Describing the platform as secure, user-friendly, and accessible 24/7, Mr Subair advised employers to ensure that the Tax ID (Tax Identification Number) of all employees is correctly captured in their submissions.

Economy

Airtel on Track to List Mobile Money Unit in First Half of 2026—Taldar

By Adedapo Adesanya

The chief executive of Airtel Africa Plc, Mr Sunil Kumar Taldar, has disclosed that the company is still on track to list its mobile money business, Airtel Money, before the end of June 2026.

Recall that Business Post reported in March 2024 that the mobile network operator was considering selling the shares of Airtel Money to the public through the IPO vehicle in a transaction expected to raise about $4 billion.

The firm had been in talks with possible advisors for a planned listing of the shares from the initial public offer on a stock exchange with some options including London, the United Arab Emirates (UAE), or Europe.

However, so far no final decisions have been made regarding the timing, location, or scale of the IPO.

In September 2025, the telco reportedly picked Citigroup Incorporated as advisors for the planned IPO which will see Airtel Money become a standalone entity before it can attain the prestige of trading on a stock exchange.

Mr Taldar, noted that metrics continued to show improvements ahead of the listing with its customer base hitting 52 million, compared to around 44.6 million users it had as of June 2025.

He added that the subsidiary processed over $210 billion in a year, according to the company’s nine-month financial results released on Friday.

“Our push to enhance financial inclusion across the continent continues to gain momentum with our Mobile Money customer base expanding to 52 million, surpassing the 50 million milestone. Annualised total processed value of over $210 billion in Q3’26 underscores the depth of our merchants, agents, and partner ecosystem and remains a key player in driving improved access to financial services across Africa.

“We remain on track for the listing of Airtel Money in the first half of 2026,” Mr Taldar said.

Estimating Airtel Money at $4 billion is higher than its valuation of $2.65 billion in 2021. In 2021, Airtel Money received significant investments, including $200 million from TPG Incorporated at a valuation of $2.65 billion and $100 million from Mastercard. Later that same year, an affiliate of Qatar’s sovereign wealth fund also acquired an undisclosed stake in the unit.

The mobile money sector in Africa is expanding rapidly, driven by a young population increasingly adopting technology for financial services, making the continent a key market for fintech companies.

Economy

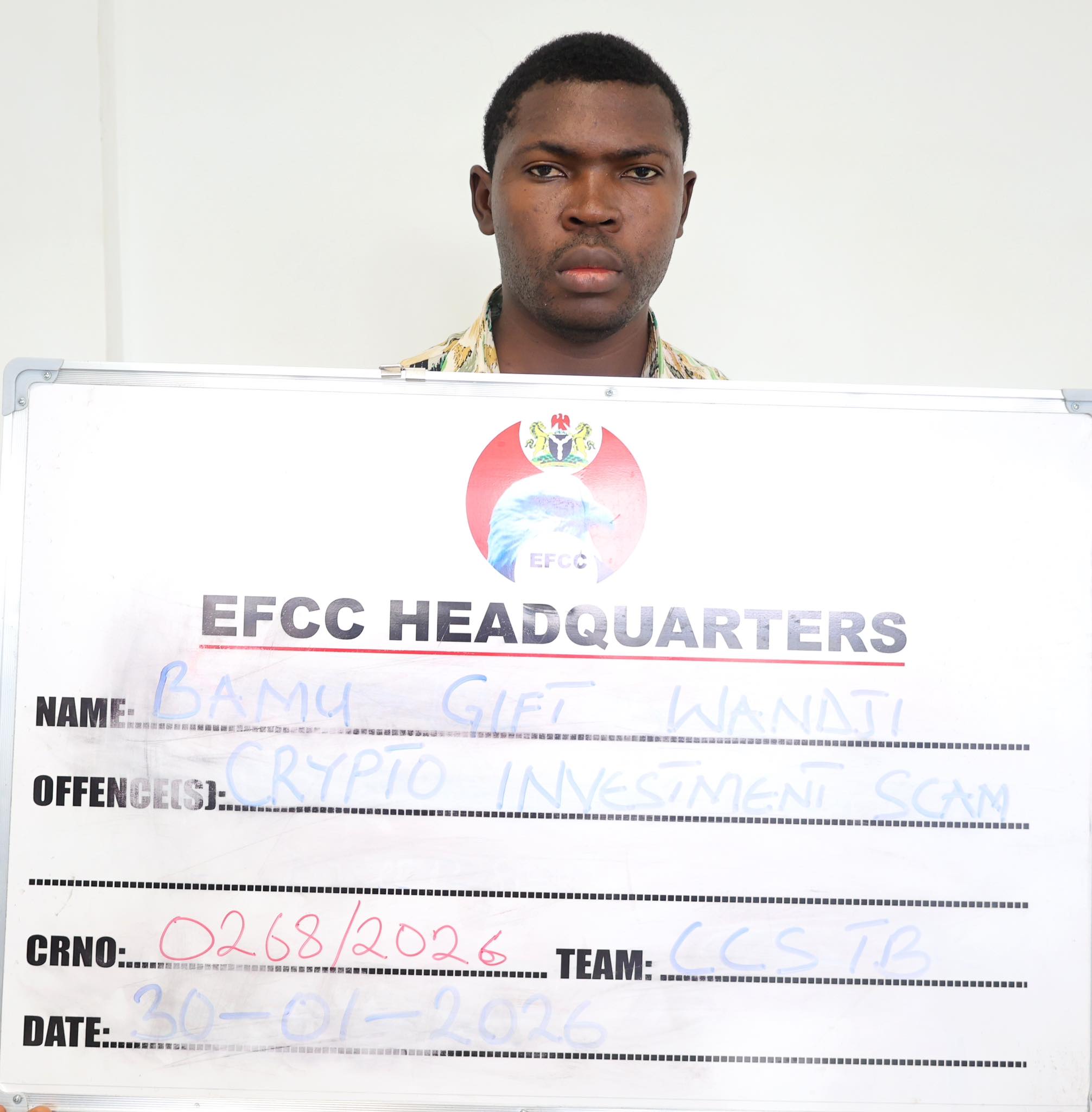

Crypto Investor Bamu Gift Wandji of Polyfarm in EFCC Custody

By Dipo Olowookere

A cryptocurrency investor and owner of Polyfarm, Mr Bamu Gift Wandji, is currently cooling off in the custody of the Economic and Financial Crimes Commission (EFCC).

He was handed over to the anti-money laundering agency by the Nigerian Security and Civil Defence Corps (NSCDC) on Friday, January 30, 2026, after his arrest on Monday, January 12, 2026.

A statement from the EFCC yesterday disclosed that the suspect was apprehended by the NSCDC in Gwagwalada, Abuja for running an investment scheme without the authorisation of the Securities and Exchange Commission (SEC), which is the apex capital market regulator in Nigeria.

It was claimed that Mr Wandji created a fraudulent crypto investment platform called Polyfarm, where he allegedly lured innocent Nigerians to invest in Polygon, a crypto token that attracts high returns.

Investigation further revealed that he also deceived the public that his project, Polyfarm, has its native token called “polyfarm coin” which he sold to the public.

In his bid to promote the scheme, the suspect posted about this on social media platforms, including WhatsApp, X (formally Twitter) and Telegram. He also conducted seminars in some major cities in Nigeria including Kaduna, Lagos, Port Harcourt and Abuja where he described the scheme as a life-changing programme.

Further investigation revealed that in October, 2025, subscribers who could not access their funds were informed by the suspect that the site was attacked by Lazarus group, a cyber attacking group linked to North Korea.

Further investigations showed that Polyfarm is not registered and not licensed with SEC to carry out crypto transactions in Nigeria. Also, no investment happened with subscribers’ funds and that the suspect used funds paid by subscribers to pay others in the name of profit.

Investigation also revealed that native coin, polyfarm coin was never listed on coin market cap and that the suspect sold worthless coins to the general public.

Contrary to the claim of the suspect that his platform was attacked, EFCC’s investigations revealed that the platform was never attacked or hacked by anyone and that the suspect withdrew investors’ funds and utilized the same for his personal gains.

The EFCC, in the statement, disclosed that Mr Wandji would be charged to court upon conclusion of investigations.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn