Economy

SEC Alerts Nigerians of AI-Generated Investment Scams

By Aduragbemi Omiyale

Nigerians have been warned to be careful of artificial intelligence (AI)-driven scams targeting unsuspecting investors with promises of guaranteed profits and fake celebrity endorsements.

This alarm was raised by the Securities and Exchange Commission (SEC), explaining that fraudsters are increasingly turning to deepfake videos and AI-generated content to lure victims, pointing that manipulated videos featuring politicians, celebrities, and TV hosts are being shared through Facebook ads, Instagram reels, and Telegram groups to give fraudulent platforms an air of credibility.

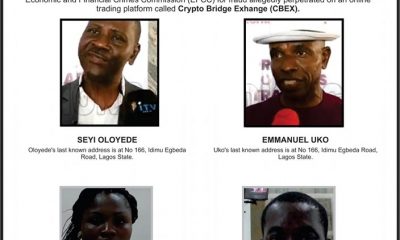

The commission recalls that platforms such as CBEX, Silverkuun, and TOFRO were operating illegally by advertising AI-powered trading systems that promise unrealistic returns.

To counter the growing threat, the SEC explained that it is adopting advanced surveillance systems capable of detecting fraudulent activity in real time, adding that partnerships with the Central Bank of Nigeria (CBN) and the Nigerian Financial Intelligence Unit (NFIU) are being strengthened to enable data-sharing and joint enforcement actions.

“These platforms are not registered or regulated by the SEC, yet they continued to mislead the public with false claims of AI-driven investments. They posed serious risks to investors hence the commission issued series of disclaimers against their activities.

“Scammers are exploiting AI to fabricate endorsements and testimonials that appear genuine. This has made traditional fraud detection methods less effective, hence the need for tech-enabled regulation and greater public awareness.

“We are moving from reactive to predictive oversight. This is essential in combating fraud and systemic risks in our market,” the agency stated.

The regulator said it has also engaged social media companies to clamp down on misleading ads and cautioned influencers against promoting unlicensed investment schemes, warning “Any influencer or blogger found to be complicit in promoting illegal platforms will face regulatory sanctions or even prosecution.”

It urged Nigerians to take extra precautions before investing, stressing that any scheme promising daily profits, zero risk, or celebrity-backed endorsements should be treated with suspicion.

“Any investment that guarantees unrealistic returns or uses manipulated videos of public figures should immediately raise a red flag,” it noted, encouraging Nigerians to verify the registration status of any investment platform on its website, where a list of licensed Capital Market Operators is available.

It added that investors should confirm that registration numbers displayed on company websites match the details on the SEC portal and avoid platforms that only operate through Telegram or WhatsApp without a verifiable office address, asking them to report suspicious platforms or fraudulent ads directly to it via email at [email protected], by phone at +234 9 462 1168, or through its online complaints portal.

Economy

Eyesan Assures Investors of Transparency, Merit in Oil Licensing Bid

By Adedapo Adesanya

The chief executive of the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), Mrs Oritsemeyiwa Eyesan, has assured investors of a transparent, merit-based and competitive process for Nigeria’s 2025 oil and gas licensing round.

Mrs Eyesan, gave the assurance on Wednesday while speaking at a Pre-Bid Webinar organised by the commission, noting that only applicants with strong technical, financial credentials, professionalism and credible plans would proceed to the critical stage of the bidding process.

The NUPRC in December 1, 2025 inaugurated Nigeria’s 2025 Licensing Bid Round, offering 50 oil and gas blocks across frontier, onshore, shallow water, and deepwater terrains for potential investors.

The basins included Niger Delta basin, with 35 blocks, Benin (Frontier) with three blocks, Anambra (Frontier), with four blocks, Benue (Frontier), with four blocks and Chad (Frontier) with four blocks on offer.

Mrs Eyesan explained that the licensing process would follow five stages: Registration and pre-qualification, data acquisition, technical bid submission, evaluation, and a commercial bid conference, with only bidders that meet strong technical and financial criteria progressing.

The NUPRC executive said the 2025 Licensing Round represented a deliberate effort by Nigeria to reposition its upstream petroleum sector for long-term investment, transparency, and value creation, amid increasing global competition for capital.

She said that energy security and supply resilience had become key global economic and geopolitical priorities, while investment capital was increasingly selective and disciplined.

“Our national priority is clear: to attract capital, grow reserves, and improve production in a responsible and sustainable manner.

“A structured and transparent licensing round is essential to achieving these objectives.

“The NUPRC is legally mandated to conduct licensing rounds in a periodic, open, transparent, and fully competitive manner and the entire 2025 process will be governed strictly by published rules,” she said.

The official further revealed that, with the approval of President Bola Tinubu, signature bonuses for the 2025 round have been set within a range designed to lower entry barriers and prioritise technical capability, credible work programmes, financial strength, and speed to production.

She emphasised that the bid process will fully comply with the Petroleum Industry Act (PIA) and remain open to public and institutional scrutiny through the Nigeria Extractive Industries Transparency Initiative (NEITI) and other oversight agencies.

Economy

Afriland Properties, Three Others Weaken NASD Exchange by 0.06%

By Adedapo Adesanya

Four price losers weakened the NASD Over-the-Counter (OTC) Securities Exchange by 0.06 per cent on Wednesday, January 28.

The decliners were led by Afriland Properties Plc, which lost N1.53 to close at N14.50 per share compared with the previous day’s N16.03 per share, Geo-Fluids Plc dropped 50 Kobo to end at N6.35 per unit versus Tuesday’s price of N6.85 per unit, Central Securities Clearing System (CSCS) Plc declined by 35 Kobo to N40.15 per share from N40.50 per share, and Food Concepts Plc decreased by 28 Kobo to sell at N2.72 per unit versus N3.00 per unit.

As a result, the market capitalisation of the bourse went down by N1.3 billion to N2.173 trillion from the N2.174 trillion it ended a day earlier, and the NASD Unlisted Security Index (NSI) fell by 2.17 points to 3,632.56 points from Tuesday’s 3,634.73 points.

In the midst of the profit-taking, some securities witnessed bargain-hunting, with Nipco Plc gaining N22.00 to close at N242.00 per share versus N220.00 per share of the previous session, FrieslandCampina Wamco Nigeria Plc improved by N4.00 to N68.00 per unit from N64.00 per unit, and Acorn Petroleum Plc added 8 Kobo to finish at N1.38 per share versus N1.30 per share.

At midweek, the volume of securities transacted by the market participants surged by 259.9 per cent to 4.7 million units from 1.3 million units, but the value of securities went down by 8.6 per cent to N52.4 million from N57.3 million and the number of deals shrank by 15.8 per cent to 32 deals from 38 deals.

CSCS Plc remained the most traded stock by value (year-to-date) with 15.3 million units exchanged for N622.4 million, followed by FrieslandCampina Wamco Nigeria Plc with 1.6 million units valued at N108.4 million, and Geo-Fluids Plc with 8.9 million units worth N60.3 million.

CSCS Plc was also the most traded stock by volume (year-to-date) with 15.3 million units sold for N622.4 million, followed by Geo-Fluids Plc with 8.9 million units exchanged for N60.3 million, and Mass Telecom Innovation Plc with 8.4 million units traded for N3.4 million.

Economy

Naira Trades N1,400 Per Dollar at Official Market

By Adedapo Adesanya

The Naira was exchanged at N1,400.28 per Dollar in the the Nigerian Autonomous Foreign Exchange Market (NAFEX) on Wednesday, January 28 after it gained 74 or 0.05 per cent against the United States Dollar, according to data from the Central Bank of Nigeria (CBN). In the preceding trading session, the value of the local currency stood at N1,401.22/$1.

However, the domestic currency further depreciated against the Pound Sterling in the official market yesterday by N4.15 to end at N1,929.99/£1 compared with Tuesday’s closing price of N1,925.84/£1 and against the Euro, it lost N3.31 to settle at N1,675.53/€1, in contrast to the preceding session’s closing price of N1,672.22/€1.

At the black market window, the Nigerian Naira maintained stability against the Dollar at N1,480/$1 at midweek, same at the GTBank forex desk, where it closed flat at N1,426/$1.

The Naira has sustained its upward momentum into early 2026, building on the gains recorded in 2025, when it posted its strongest performance in over a decade. Recent reforms in the FX market as well as structural reforms in the oil sector have eased fears and buoyed investments.

This has boosted foreign capital inflows and led to stronger diaspora remittances, keeping the exchange rate at the N1,400 mark in the medium term.

Also boosting the value of the Naira is a general weakening of the greenback in the international market as a result of geographical tensions and risk associated with US policies.

As for the cryptocurrency market, continued strength in commodities, especially record-high gold and elevated silver and copper, have overshadowed crypto markets. A weaker Dollar fueled strong rallies in these commodities, making them safer havens than crypto.

Also, the US Federal Reserve left interest rates unchanged at its meeting on Wednesday.

Solana (SOL) shrank by 2.9 per cent to $123.15, Dogecoin (DOGE) depreciated by 2.6 per cent to $0.1217, Litecoin (LTC) slid by 2.4 per cent to $68.10, Ripple (XRP) fell by 2.1 per cent to $1.87, Cardano (ADA) depleted by 1.9 per cent to $0.3506, Ethereum (ETH) went down by 1.8 per cent to $2,951.30, Bitcoin (BTC) dipped by 1.1 per cent to $88,118.29, and Binance Coin (BNB) slumped by 0.1 per cent to $889.03, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) remained unchanged at $1.00 each.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn