Economy

Fitch Upgrades Ghana’s Outlook to Stable

Ghana national flag

By Dipo Olowookere

The Outlook on Ghana’s Long-Term Foreign- and Local-Currency Issuer Default Ratings (IDR) has been upgraded by Fitch Ratings to Stable from Negative. Also, the West African nation’s IDRs have been affirmed at ‘B’.

A statement issued by the rating agency on Friday stated further that it has equally affirmed the issue ratings on Ghana’s senior unsecured foreign and local currency bonds at ‘B’, as well as the ‘BB-‘ rating on Ghana’s $1 billion partially guaranteed note.

Ghana’s Country Ceiling and Short-Term Foreign and Local Currency IDRs have been affirmed at ‘B’, Fitch said.

The agency said Ghana continues to make progress in stabilising its economy after its recent crisis period, with an expected revival in GDP growth, declining inflation, a more stable currency and increasing foreign exchange reserves.

Furthermore Fitch judges that the new government will make progress in reducing the budget deficit after the election-related slippage in 2016, albeit with continued downside risks.

Fitch expects growth to improve to 6 percent in 2017 from an estimated 3.6 percent in 2016, when it was hampered by lower than expected oil production and power cuts.

CPI inflation fell to 12.9 percent year on year in March, from a peak of 19 percent in March 2016. The cedi has recovered to 4.2/$, after depreciating to 4.7/$ in early March. The improvement in the macroeconomic environment has allowed the Bank of Ghana to cut its policy interest rate to 23.5 percent from a peak of 26 percent in 2016.

Further, rising oil production and the benefits from macroeconomic stability will support Ghana’s medium-term growth potential above 6 percent, a key rating strength.

Ghana experienced a blow-out in the 2016 budget deficit, which widened to an estimated 8.9 percent of GDP (on a cash basis) in the run-up to December general elections, compared with a government and IMF target of 5.3 percent, and an outturn of 6.3 percent in 2015.

The cash deficit includes up to USD1.3 billion (3% of GDP) in off-budget and unapproved spending. On a commitment basis, accounting for an additional $650 million in unpaid commitments, Ghana’s deficit widened to as much as 10.5 percent of GDP.

Fitch notes that some of the unapproved expenditure is presently being audited and a significant chunk may be written down, which would lower the deficit.

The election resulted in a win for the New Patriotic Party, Ghana’s centre-right party, which had been in opposition since 2009. In March, the new government announced its 2017 budget, which calls for fiscal consolidation, and measures to strengthen public financial management.

Fitch forecasts the 2017 budget deficit to narrow to 7.5 percent of GDP on a cash basis, and further to 5.5 percent in 2018.

The government’s 2017 deficit forecast of 6.5 percent of GDP is based on an expected increase in tax revenues and a cut to capital expenditures.

Fitch believes that the expected increase in tax revenues will be difficult to realise, as the budget contains significant tax cuts aimed at boosting the business climate. Fitch notes that Ghana has historically underperformed its budgeted revenue projections.

On the expenditure side, interest costs will continue to exert upward pressure. Ghana’s interest costs are 32 percent of its general government revenues, a level well above the ‘B’ median of 9 percent.

Also, a lack of transparency and accountability within the line ministries has persistently led to substantial off-budget spending and the accumulation of arrears.

Successful implementation of the measures outlined in the Public Financial Management Act, 2016 would help control expenditure and keep spending focused on the policy priorities outlined in the budget.

Gross general government debt has stabilised, experiencing a slight increase to 73 percent of GDP at end-2016, from 72 percent at end-2015.

Fitch expects the debt/GDP ratio to decline to around 71 percent by end-2017 due to strengthening of the exchange rate (62% of debt is foreign currency denominated), lower budget deficit and robust nominal GDP growth.

However, Ghana’s debt level will remain higher than peers both as a percentage of GDP (the ‘B’ median is 56% of GDP) and as a percentage of revenue. Ghana’s general government debt/revenue is 366%, compared with the ‘B’ median of 225 percent.

Fitch said Ghana’s $915 million Extended Credit Facility (ECF) with the IMF is a key support for the sovereign ratings.

The incoming government has signalled its commitment to complete the programme, but has engaged with the Fund in renegotiating some of the programme’s indicative targets and structural benchmarks.

IMF staff completed the fourth review of the ECF in March and it will go to the IMF Board for approval before the end of June, allowing for the dispersal of an additional $116 million. Fitch believes that the government remains committed to successfully completing the current programme, which is due to run until 2018.

Ghana’s ‘B’ IDRs reflect the following key rating drivers:

Ghana’s external finances are a rating weakness. Fitch forecasts the current account deficit to narrow slightly to 6.3 percent of GDP in 2017, from 6.7 percent in 2016, but remain above the ‘B’ median of 5.7 percent of GDP.

Increases in oil and gas exports will help Ghana’s export performance, but rising imports will keep the current account deficit from narrowing significantly. International reserves increased by $460 million in 2016, ending at $4.9 billion, about 2.8 months of current external payments.

Fitch says it expects that external debt payments due in 2017 will limit reserves accumulation and forecasts reserves to reach $5.2 billion at end-2017.

The ratings are supported by World Bank governance indictors and business environment indicators that are stronger than the ‘B’ median, underlined by the peaceful transition of power in December. However, the ratings are constrained by low GDP per capita, which at $1,509 is less than half the ‘B’ median, low human development indicators and dependence on commodity exports.

Economy

Stanbic IBTC Insurance Triumphs at 2025 Risk Analyst Awards

By Modupe Gbadeyanka

A subsidiary of Stanbic IBTC Holdings Plc, Stanbic IBTC Insurance, has continued to showcase institutional excellence, becoming one of Nigeria’s top-performing insurers.

At the 2025 Risk Analyst Insurance Brokers Performance Review Awards, the underwriting firm won the Life Insurance category for its operational discipline, prompt claims settlement, and partnership-driven approach that fosters long-term confidence with clients and brokers.

The organisers were impressed with the company’s performance in life insurance, which reflects the broader institutional direction of Stanbic IBTC Holdings, which is building resilient, trusted, and high-performing financial institutions that contribute to Nigeria’s economic growth and the development of the insurance sector.

“At Stanbic IBTC Insurance, trust is built through reliable performance, timely claims settlement, and service that supports customers when it matters most. This recognition reflects the quality of service we provide for our clients and partners.

“We are honoured to receive this accolade and will continue to raise standards across the industry,” the chief executive of Stanbic IBTC Insurance, Akinjide Orimolade, stated.

Also commenting, the chief executive of Stanbic IBTC Holdings, Mr Chuma Nwokocha, said, “We are proud of this achievement, which highlights the strength of our insurance business and the broader Stanbic IBTC Group’s focus on building strong, enduring institutions.

“Stanbic IBTC Insurance continues to set benchmarks in professionalism, client service, and operational excellence; reinforcing our role as a trusted partner to individuals and businesses across Nigeria.”

Every year, Risk Analyst Insurance Brokers Limited, which organises the event, carries out an annual assessment of insurance underwriters by evaluating partners based on key criteria, including claims settlement efficiency, service delivery, responsiveness, and broker–underwriter collaboration.

The initiative aims to promote accountability, raise service standards, and strengthen trust across Nigeria’s insurance ecosystem.

The 2025 performance of Stanbic IBTC Insurance highlights its role as a dependable and credible underwriting partner in the market.

Economy

Lagos Unveils Roadmap to Establish West Africa’s International Financial Hub

By Adedapo Adesanya

Nigeria’s commercial nerve centre, Lagos State, has announced plans to establish West Africa’s premier International Financial Centre to unlock international investment, innovation, and sustainable growth.

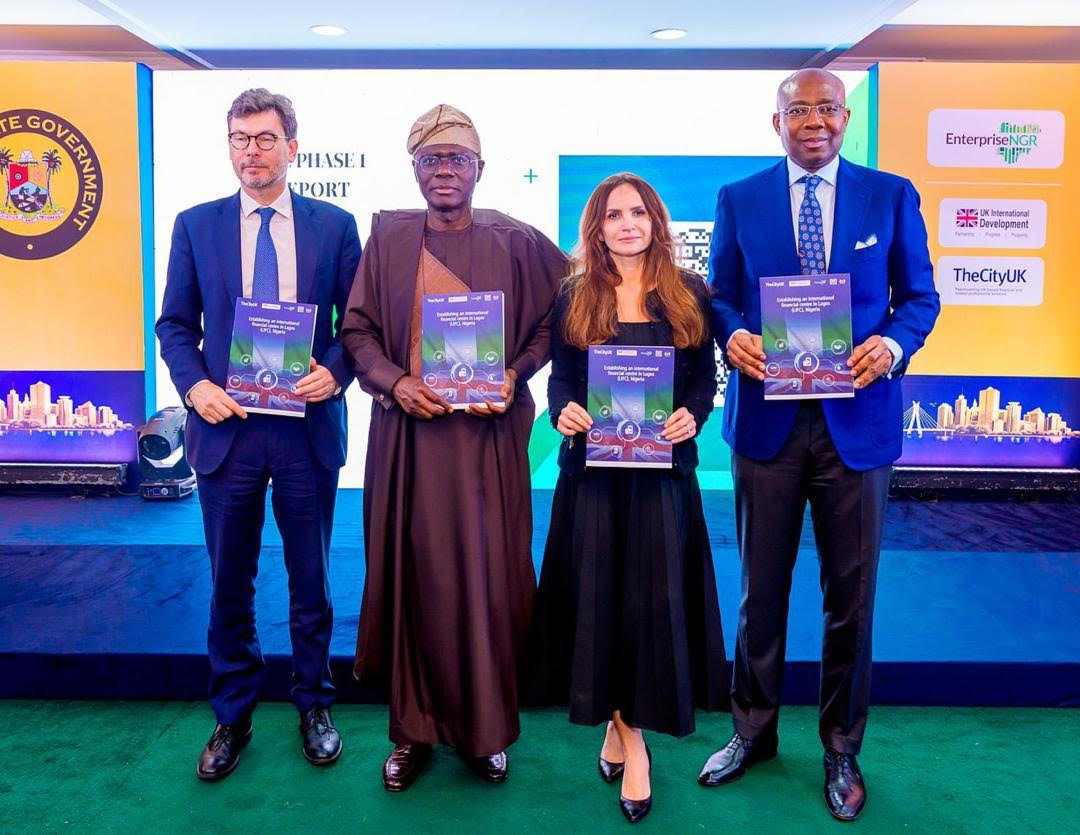

TheCityUK, in partnership with the UK Government, Lagos State Government, Lagos International Financial Centre Council (LIFCC), and EnterpriseNGR, on Monday unveiled a landmark report, Establishing an International Financial Centre in Lagos (LIFC), Nigeria, outlining a strategic roadmap to achieve the goal.

The establishment of a Lagos International Financial Centre aligns with Nigeria’s Agenda 2050 and the Lagos State Development Plan 2052 to deliver long-term economic prosperity, deepen financial markets, and attract productive global investment.

According to a statement, the project is hinged on a public-private partnership bringing visionary leadership from the government together with private sector companies seeking to tap into Nigeria’s young, dynamic market to deliver economic growth.

The unveiling was done at the State House Marina with guests including Lagos State Governor, Mr Babajide Sanwo-Olu, British Deputy High Commissioner Mr Jonny Baxter, and EnterpriseNGR Board Chairman and CEO, Mr Aigboje Aig-Imoukhuede and Mr Obi Ibekwe.

Lagos International Financial Centre Council will support Nigeria’s ambition to become an upper-middle-income country by 2050, driving inclusive growth, reducing poverty, and creating high-value jobs, especially for Nigeria’s talented youth, as per the report, adding that it will benefit from the strong UK-Nigerian co-operation, building on best practices and global benchmarks to align the LIFC with international standards.

The report proposes creating an independent International Financial Centre in Lagos to enhance regulatory clarity, simplify tax and policy frameworks, and boost investor confidence. It recommends an initial focus on Green and Sustainable Finance, FinTech and Innovation, and Commodities and Capital Markets, supported by strong governance, legal reforms, stakeholder collaboration, and targeted talent development.

Speaking on this, Governor Sanwo-Olu said, “Lagos is fully committed to the birth of the International Financial Centre. We know that it is a veritable means of supporting seamless trading and to enhance competitiveness of financial markets.

“As Nigeria’s largest economic and financial centre, Lagos plays a critical role in driving the nation’s capital markets. We need to create an ecosystem that will help to facilitate investment flows, enhance market liquidity, and promote financial literacy.

“The LIFC initiative will not only strengthen our market infrastructure but also unlock new opportunities for public-private partnerships in technology and capital market development. It will support seamless trading, attract foreign investment and enhance the competitiveness of financial markets.”

On his part, Mr Jonny Baxter, British Deputy High Commissioner, commented, “The launch of the Lagos International Financial Centre report reflects the deepening of the UK-Nigeria partnership, combining Lagos’s comparative strengths with UK expertise. Anchored in clear, evidence‑based analysis and launched at a pivotal moment in Nigeria’s reform journey, the LIFC has the potential to unlock major domestic and international investment, deepen capital markets, create jobs, and drive sustainable economic growth across the country, not just in Lagos State.”

Mrs Nicola Watkinson, Managing Director, International, TheCityUK, said, “Nigeria is a high-growth, dynamic and large market and the Lagos International Financial Centre could be vital to its future. By building a modern, integrated business and regulatory environment and financial ecosystem, the LIFC will support the attraction of global and domestic capital, deepen domestic markets, facilitate innovation in FinTech and green finance, and create high‑value jobs for Nigeria’s youth.

“Supporting the development of Lagos as an international financial centre is a clear example of how the UK and Nigeria are deepening their strategic partnership.”

Economy

Nigeria Now Consolidating Reforms for Economic Stability—Edun

By Adedapo Adesanya

The Minister of Finance and Coordinating Minister of the Economy, Mr Wale Edun, has stressed that Nigeria was now consolidating its macroeconomic reforms to sustain economic stability in an increasingly volatile global environment.

The Minister spoke at a high-level panel on Fiscal Policy in a Shock – Prone World at the ongoing Al Ula conference for Emerging Market Economies in Riyadh, Saudi Arabia.

“Nigeria’s macroeconomic and fiscal reforms are working. Momentum must be maintained, and the benefits channelled towards long-term growth and resilience,” he stated.

He said the government is also leveraging digital tools to improve revenue assurance, while deepening fiscal and monetary coordination and promoting realistic budgeting practices to ensure durable fiscal discipline.

He noted that despite accounting for a significant share of global growth, population and natural resources, emerging economies remain under-represented in global financial decision-making.

Mr Edun also highlighted the growing strategic importance of Gulf nations in the evolving global economic landscape.

He said countries in the Gulf are increasingly shaping global trade routes, investment flows and sources of capital, making them critical partners for emerging economies such as Nigeria.

The finance minister stressed Nigeria’s commitment to building stronger partnerships that promote a more inclusive and equitable global financial system.

He said Nigeria was positioning itself to engage constructively with global partners to support reforms that unlock growth, stability and shared prosperity.

Mr Edun’s call comes amid mounting global economic pressures. Many emerging economies are grappling with high debt levels, elevated inflation, volatile capital flows and tightening global financial conditions.

Rising interest rates in advanced economies have increased debt-servicing costs, while currency volatility has strained fiscal and external balances across Africa and other developing regions.

Global trade is also facing increased fragmentation due to geopolitical tensions, supply chain disruptions and protectionist tendencies.

These trends have disproportionately affected emerging markets that depend heavily on trade, foreign investment and access to international finance.

For Nigeria, the push for a global economic reset aligns with ongoing domestic reforms aimed at stabilising the macroeconomic environment.

The country has embarked on exchange rate reforms, fiscal consolidation and efforts to attract long-term investment to support growth and job creation.

Mr Edun has repeatedly argued that without reforms to the global financial system, domestic policy efforts in emerging economies risk being undermined by external shocks.

At the Al Ula conference, he reiterated that a more balanced global system would enhance resilience, improve access to finance and support sustainable development.

He said Nigeria would continue to engage in global policy conversations to ensure that emerging economies are not only rule-takers but active shapers of the new global economic order.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn