Banking

Heritage Bank Advocates Early Cashless Lessons for Children

By Modupe Gbadeyanka

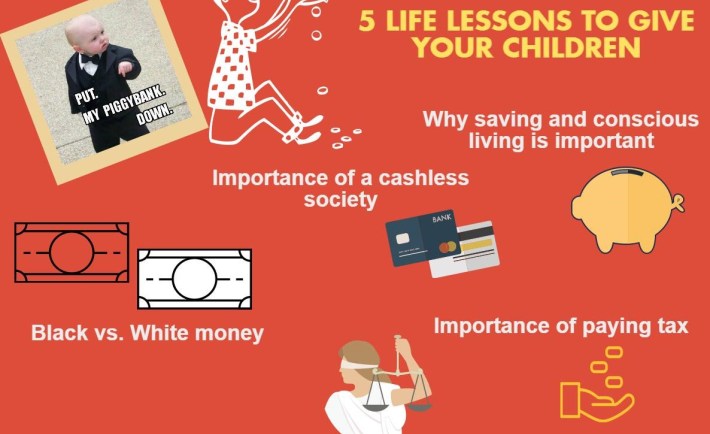

One of the lenders in the country, Heritage Bank, has called for early lessons on cashless policy of the Central Bank of Nigeria (CBN) for children to also prepare them towards performing basic banking tasks, to subsequently give them financial freedom.

This advice comes on the heels of the commemoration of the May 27 to mark Children Banking Month, with the theme, ‘Early Positioning for Glocal Relevance,’ which is part of Heritage Bank’s children financial literacy initiative.

In a statement made available to Business Post on Monday, the financial institution stressed the need to educate children on the cashless policy by showing them how prepaid card transactions work and how to use ATM cards to deposit and withdraw.

The Heritage Children Banking Month, which activities will directly impact a minimum of 350 primary and secondary schools nationwide this year, is in recognition of the pivotal role children play as the leaders of tomorrow.

Altogether Heritage bank at the end of the month would have imparted financial education on over 1,000 schools across the country since commencing this programme two year ago, an initiative that the vibrant and dynamic financial institution also considers as a corporate social responsibility.

Managing Director of Heritage Bank, Mr Ifie Sekibo, speaking on the importance of the celebration, stressed that for early positioning of your children for global and local relevance, there was need for parents to teach children on prioritize saving over spending, which is a valuable life lesson, one that takes time to learn.

According to him, opening a savings account for your child is one of the best ways to introduce that concept at an early age.

“Walking into a branch office is a good way to help your child become familiar with routine transactions involving his or her account. Your child’s online habits, even financial, can be important, too, so check for features such as monthly statements and controls on payments and transfers from savings accounts. You can teach money management and internet safety together,” Mr Sekibo said.

He noted the need for parents to develop series of simple games to teach children about money with good saving habits, which becomes part of their normal development, saving for the future is likely to become a habit.

Meanwhile, the high points of the commemoration will be the selection of 10 students between the ages of 5 to16 years from the six geo-political regions who would be invited to assume various banking roles for the day.

Children who are account holders of ‘Bud Account,’ as well as prospective account holders from each of the regions will be allowed to participate in a competition to produce 60seconds video showcasing how “Glocal you are,” which would elicit social media votes.

Best 3 videos to be used on all social media platforms on the week of children’s day would be presented a tablet each as a special prize.

The MD added: “The project is part of Heritage Bank’s contribution towards transforming the nation in paying more attention to the bud stage. This underscores our belief that if we get it right with the children, then the future of the nation is guaranteed. At Heritage Bank we believe in creating, preserving and transferring wealth.”

Whilst advising parents on opening Bud Account, Mr Sekibo noted, “when your child receives birthday money, or cash from chores, have them put some into the bank to save for bigger ticket items.”

Hundreds of exercise books, pencils, water bottles, umbrellas will be won by pupils, parents and wards in the course of the month through various engaging activities.

Banking

CBN Grants Bank of Industry Approval to Operate Non-Interest Banking

By Adedapo Adesanya

The Bank of Industry (BoI) has secured regulatory approval from the Central Bank of Nigeria (CBN) to offer Non-Interest Banking (NIB) services, marking a major expansion of its financing framework.

The approval was disclosed in a statement by the BoI Managing Director, Mr Olasupo Olusi, on Sunday, February 8, 2026.

The move is expected to strengthen the bank’s role in promoting sustainable industrial development and improving access to finance for underserved and high-impact business segments across Nigeria.

With the approval, BoI is authorised to commence non-interest banking operations, providing ethical, asset-backed financing options that prohibit interest and promote risk-sharing.

The initiative aligns with growing demand for alternative financing structures that support inclusive growth and social development objectives.

Mr Olusi described the approval as a significant milestone in the bank’s growth and long-term development agenda, adding that it positions BoI to deepen its contribution to Nigeria’s industrialisation drive through tailored financial solutions.

“This development marks a significant milestone in the Bank of Industry’s growth and long-term development agenda,” Olusi said.

“It positions the bank to further advance Nigeria’s sustainable and inclusive industrial development through tailored financial solutions for underserved and high-impact business segments.”

“Under this framework, BoI will be able to finance assets and raw materials for customers using approved non-interest banking products,” he added.

Mr Olusi noted that the approval underscores the CBN’s confidence in BoI’s governance and commitment to responsible financing.

He said the licence would allow the bank to scale its operations, introduce innovative financing solutions, deepen support for Micro, Small and Medium Enterprises (MSMEs), and reach a new category of borrowers who were previously unable to access BoI’s funding.

Reconstructed in 2001 from the former Nigerian Industrial Development Bank (NIDB) Limited, BoI was originally incorporated in 1959 to transform the country’s industrial sector by providing long-term, low-interest financing and advisory support to various enterprises.

The introduction of a non-interest banking window is expected to broaden BoI’s financing toolkit and attract new pools of ethical and faith-based capital.

Banking

Yemi Kale for Second Ecobank Customer Forum on Regional Integration

By Modupe Gbadeyanka

The Group Chief Economist and Managing Director for Research and Trade Intelligence at the African Export-Import Bank (Afreximbank), Mr Yemi Kale, has been pencilled down to deliver the keynote address at the second Ecobank Customer Forum.

The programme, themed Strengthening Regional Integration for Economic Transformation, will take place at the Ecobank Pan-African Centre (EPAC) in Lagos.

The forum, organised by the bank’s Fixed Income, Currencies and Commodities (FICC) Business (Treasury), is designed to examine critical issues shaping Nigeria’s and Africa’s economic outlook in 2026, with particular focus on trade, financial markets, foreign exchange liquidity and regional integration, especially as the African Continental Free Trade Area (AfCFTA) agreement enters a strategic phase of implementation.

The Regional Treasurer for Ecobank Nigeria Limited, Mr Olumide Adebayo, said the one-day programme reinforces the lender’s role as a trusted financial partner and customer-focused institution, with the intention to foster dialogue, support informed decision-making, and deeper regional economic integration across Africa.

According to him, the seminar will open with welcome remarks by the Managing Director/Regional Executive of Ecobank Nigeria, Mr Bolaji Lawal, who will underscore the bank’s commitment to supporting customers and driving inclusive growth through strategic dialogue, innovation and pan-African collaboration.

The keynote address, titled The Future of Trade in Africa: Harnessing the AfCFTA for Economic Transformation, will be delivered by Mr Kale and will provide insights into Africa’s trade prospects and the transformative potential of the AfCFTA.

The forum will feature two high-level panel discussions: Balancing the Risk between Interest Rate and Exchange Rate: Business Expectations and Outlook in 2026, and Export Proceeds, Oil Receipts and Remittances in 2026: Exploring Options that Best Support FX Liquidity and Flows in Nigeria.

The event would be moderated by Messrs. Aruoture Oddiri, Host and Producer of Global Business Report on Arise News and Barnabas Vajeh of Ecobank Nigeria Limited.

Banking

Sterling Holdco Interim FY25 Results Show Rise in Earnings, Profit

By Aduragbemi Omiyale

The 2025 full-year interim financial statements of Sterling Financial Holdings Company Plc released to the Nigerian Exchange (NGX) Limited revealed that pre-tax profit increased by 99 per cent to N90.7 billion.

The parent company of The Alternative Bank and Sterling Bank showcased an improvement in operational efficiency by cutting its cost-to-income ratio to 63 per cent from 72 per cent in 2024.

In the period under review, the gross earnings grew by 46 per cent to N476.5 billion, driven by healthy growth in both interest and non-interest income, with the former up by 43 per cent to N369.6 billion, fueled by an increase in loans and advances and improved yields on investment securities.

Also, the non-interest income expanded by 57.3 per cent, supported by higher trading income and growth in fees and commissions.

As for the balance sheet, it was robust as total assets surged by 11 per cent to nearly N4 trillion, a strong indicator of its expanded market footprint, with customer deposits rising by 18 per cent to N2.98 trillion, further reflecting the organisation’s successful efforts in enhancing customer engagement and product adoption across its platforms.

Sterling Holdco has also continued to strengthen its capital position, with shareholders’ funds increasing 39 per cent to N424.0 billion.

This bolstered capital base ensures the group’s banking subsidiaries are well-equipped to support its future growth initiatives, having met the recapitalisation requirements of the Central Bank of Nigeria (CBN) ahead of the March 2026 deadline.

This achievement was driven by a series of disciplined capital-raising initiatives, including a public offer of over N88 billion to bolster Sterling Bank’s position, and a prior capital injection that secured The Alternative Bank’s status as a national non-interest bank.

The results reflect a diversified earnings base, an emphasis on efficient capital deployment, and a strengthened operational foundation, all of which position Sterling Holdco for continued growth in the competitive financial services landscape.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn