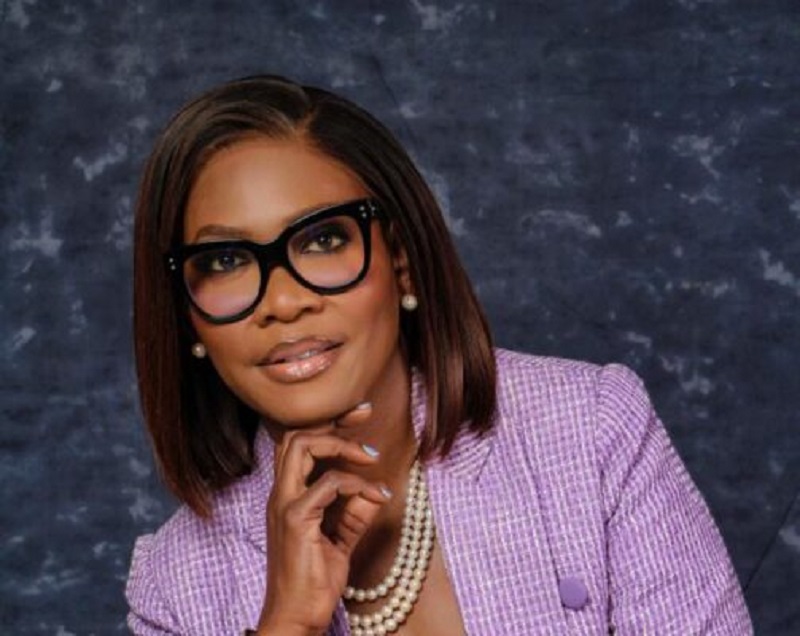

Jobs/Appointments

Olayinka Mubarak to Head Bank of Industry Investment Arm

By Adedapo Adesanya

The Bank of Industry (BOI) has appointed Ms Olayinka Mubarak as the Managing Director of BOI Investment and Trust Company Limited (BOI-ITC), its wholly owned subsidiary.

According to the bank in a statement on Thursday, Ms Mubarak brings over 25 years of experience in banking and financial services, spanning development finance, treasury management, public sector, commercial and retail banking, corporate and private banking, as well as investment banking.

The lender added that she has attended numerous local and international training programmes, equipping her with global perspectives and best practices in financial services, leadership, and governance.

Prior to her appointment, Ms Mubarak held various senior leadership roles at the Bank of Industry, where she was part of the team that drove significant impact across key sectors of the economy.

In 2017, she was appointed by the federal government to the Board of the Solid Minerals Development Fund, a role that further underscored her experience in governance and public sector oversight.

As BOI-ITC’s Managing Director, Ms Mubarak will provide strategic leadership for the firm, overseeing its core business areas of trusteeship, custodial services, financial planning, and advisory services.

The bank noted that her leadership will focus on strong governance, operational excellence, and sustainable value creation at the subsidiary.

BOI-ITC was incorporated on February 16, 1987, as a wholly owned subsidiary of the Nigerian Industrial Development Bank Limited (NIDB) now Bank of Industry Limited (BOI). The company is registered with the Securities and Exchange Commission (SEC) as a Capital Market Operator to function as Trustees.

Jobs/Appointments

Tony Elumelu Joins Seplat Board After 20% Shareholding Acquisition

By Aduragbemi Omiyale

Business mogul, Mr Tony Elumelu, has been appointed to the board of Seplat Energy Plc after acquiring 20.07 per cent equity stake in the energy firm.

Last month, the chairman of United Bank for Africa (UBA) Plc, acquired the shareholding of Etablissements Maurel et Prom SA (M&P) in Seplat through two of his companies, Heirs Holdings Limited and Heirs Energies Limited.

The acquisition made the Delta State-born retired banker as one of the major shareholders of Seplat Energy. This also qualified him to be a member of the organisation’s board.

In a statement to the Nigerian Exchange (NGX) Limited on Thursday, Seplat disclosed that Mr Elumelu has now joined the board as a non-executive director effective January 22, 2026 following the resignation of a nominee of M&P, Mr Olivier Cleret De Langavant, yesterday after being on the board since January 28, 2020.

The board expressed confidence that Mr Elumelu’s extensive experience and visionary leadership would significantly advance Seplat Energy’s strategic objectives and reinforce the company’s commitment to sustainable growth and long-term success.

“On behalf of the board and management, I wish to express our profound appreciation to Mr. Langavant for his outstanding contribution to Seplat Energy over the past six years. His expertise and commitment have been instrumental in driving our strategic initiatives.

“We warmly welcome Mr. Elumelu to the board and look forward to leveraging his wealth of experience and leadership as we continue to pursue sustainable growth and value creation for all stakeholders,” the chairman of Seplat Energy, Mr Udoma Udo Udoma, stated.

Seplat described Mr Elumelu as a distinguished African investor and philanthropist, globally recognized as one of the most prominent voices on Africa’s transformation agenda.

He is the founder and chairman of Heirs Holdings, a diversified investment company with interests across strategic sectors of the African economy, including energy, power, banking, insurance, technology, real estate, hospitality, and healthcare.

The businessman also serves as chairman of UBA, Heirs Energies, Transcorp Group, whose subsidiaries include Transcorp Power, and Transcorp Hotels Plc.

In 2010, he established The Tony Elumelu Foundation (TEF), the leading philanthropy dedicated to empowering African entrepreneurs across all 54 African countries.

His global influence has been widely acknowledged, including recognition as one of TIME Magazine’s 100 Most Influential People in the World (2020) and the conferment of the Commander of the Order of the Federal Republic (2022).

He also serves on several global boards, including UNICEF’s Generation Unlimited Global Leadership Council and the International Monetary Fund’s Advisory Council on Entrepreneurship and Growth.

Jobs/Appointments

Ayodeji Adelagun to Lead Standard Chartered Operations in Nigeria

By Adedapo Adesanya

Top financial institution, Standard Chartered, has announced the appointment of Mr Ayodeji Adelagun as the Acting chief executive of its operations in Nigeria.

According to a statement, the appointment of Mr Adelagun is is a testament to the lender’s established culture of promoting excellence and leadership continuity whilst reinforcing the confidence of its esteemed stakeholders in the Nigerian financial industry.

The seasoned banker has been with the company for over 19 years and has over 26 years experience in the financial services sector spanning financial markets, banking operations, securities trading, foreign exchange trading, asset & liability management, commercial banking, risk management and credit.

He takes over from Mr Dalu Ajene, who was recently appointed as Africa CEO and Head of Coverage at Standard Chartered Bank.

Speaking on his appointment, Mr Ajene said, “We are pleased to announce the appointment of Ayodeji ‘Deji’ Adelagun as the Acting Chief Executive Officer of Standard Chartered Bank Nigeria Limited. Deji brings a strong track record of leadership, deep market insight and a clear vision for growth. With an extensive background in banking and finance, he brings a wealth of experience and expertise to lead our operations in Nigeria.”

“Standard Chartered remains committed to driving economic growth and supporting our clients in Nigeria. We are confident that under his leadership, the Bank will further deepen its impact in Nigeria and continue delivering exceptional service and innovative solutions to our clients,” Mr Ajene added.

Until his appointment, the appointee was the bank’s Executive Director for Financial Markets, and was credited with driving enhanced trading liquidity and good risk management practices for the bank. He was also actively involved in the development of both local and regional markets.

Speaking on his appointment, Mr Adelagun said, “I am deeply honoured to assume the responsibility of leading the bank’s strategic agenda in Nigeria at this pivotal time. Nigeria remains a priority market for the bank, and our recent recapitalisation, together with a refreshed strategy, clearly underscores this commitment. We will continue to support the country by facilitating foreign portfolio flows to help strengthen the economy, we intend to sustain our leading position in unlocking flows into the country.

“As a bank, the voice of our customers has always been central to how we operate, and we remain firmly focused on consistently exceeding the expectations of our diverse client base. Our distinctive strengths in cross-border transactions, alongside our Wealth and Affluent focus, remains central to our strategy.

“These areas give us a clear competitive advantage, and we will continue to grow the business by delivering differentiated solutions that meet our clients’ evolving needs.”

Mr Adelagun joined Standard Chartered in August 2007 as Head, Rates & Credit Trading and was tasked with the responsibility of setting up the Rates & Credit desk.

His experience prior to joining Standard Chartered, includes the banking operations, commercial banking and treasury departments of Access Bank Plc. He had previously worked with First Securities Discount House Limited (FSDH) now FSDH Merchant bank in 2003 where he was the pioneer bond dealer and was responsible for setting up and running the bond trading desk.

Speaking of taking the mantle from his predecessor, the new Acting CEO Nigeria added, “I have had the privilege of working closely with Dalu Ajene, who recently transitioned from the role of CEO Nigeria to lead our strategic agenda across Africa as the CEO of the Africa Cluster. This ensures a seamless continuation of our business momentum in Nigeria. Our Board is both strong and uniquely diversified, and I will continue to rely on their invaluable guidance and support to deliver on our priorities.’’

The acting CEO is a graduate of Economics from University of Ilorin, Nigeria. He holds an MBA from the prestigious Lagos Business School (LBS) and is an Alumnus of IESE Business School, Executive Management Programme. He has also attended executive management training at INSEAD. He is a honorary senior member of the Chartered Institute of Bankers of Nigeria (CIBN) and ACI Financial Markets Association and has various executive management and leadership certifications, including the Executive Management Training at INSEAD.

Jobs/Appointments

Dele Alake Re-elected as Chairman of Africa Minerals Strategy Group

By Adedapo Adesanya

Nigeria’s Minister of Solid Minerals Development, Mr Dele Alake, has been re-elected as the Chairman of Africa Minerals Strategy Group (AMSG).

Mr Alake was first unanimously elected as the pioneer Chairman of AMSG in 2024 on the sidelines of Future Minerals Forum (FMF).

He was re-elected at the 2026 Annual General Meeting (AGM) of the group, held on the sidelines of the same conference in Riyadh, Saudi Arabia.

The continental ministerial forum of African ministers is responsible for minerals and mining, committed to coordinated action aimed at maximising value addition and beneficiation from Africa’s vast mineral resources.

A statement issued on Sunday in Abuja by the Special Assistant on Media to the Minister of Solid Minerals Development, Mr Segun Tomori, noted that the move is part of efforts to strengthen its institutional framework.

AMSG approved the creation of additional leadership positions, including Vice Chairman, Deputy Secretary-General, and Financial Secretary.

The forum further resolved that those positions be equitably distributed across Africa’s sub-regions to promote inclusion and regional balance.

While the positions of Chairman and Vice Chairman are elective and reserved for serving ministers, other positions are appointed by member states to which they are zoned.

Under the new leadership structure, Mr Alake continued as Chairman of the 24-member forum, representing West Africa.

The Minister of Mines of the Democratic Republic of Congo (DRC), Mr Louis Watum Kabamba, was elected Vice Chairman, representing Central Africa.

The position of Secretary-General remained with Uganda (East Africa), Mauritania was appointed Deputy Secretary-General (North Africa), while South Africa was assigned the position of Financial Secretary.

The AGM also ratified a two-year tenure for the newly elected executive committee and agreed that zoned positions belong to member countries, such that where a serving minister is replaced, the successor automatically assumes the role.

In his acceptance speech, Alake expressed gratitude to his colleagues for the renewed confidence reposed in him, stressing the urgent need for African nations to work collaboratively to unlock the continent’s economic potential through solid minerals development.

He called on member states to agree on minimum financial contributions and to refine the group’s budgeting framework to strengthen its operational effectiveness.

“Once member states contribute, accountability will naturally follow. This will enhance transparency and strengthen the credibility of the AMSG before the global community,” Mr Alake stated.

The AGM further resolved to hold quarterly ministerial meetings and ratified the establishment of standing committees, including those for Legal, Institutional Affairs and Human Resources; Sustainability and Responsible Mining; Finance, Budget and Resource Mobilisation, among others.

It was also agreed that steps be taken towards hosting a global minerals conference in Africa, similar to FMF.

Speaking earlier at a Leadership Roundtable, Mr Alake emphasised that mineral production alone could not deliver lasting economic transformation without reliable infrastructure, coordinated policies, and deliberate value-addition strategies.

Mr Alake cited the Lobito Corridor as a model of what was achievable when rail, ports, energy systems, and policy alignment worked in synergy. He stated that similar opportunities existed across the continent, including the Lagos–Abidjan Corridor linking Nigeria, Benin, Togo, Ghana, and Côte d’Ivoire; Walvis Bay Corridor connecting Southern Africa’s mining regions to global markets; Dar es Salaam and Central Corridors serving East and Central Africa, among others.

“The real question is not whether Africa has corridors, but whether these corridors are being financed, governed and structured to support industrial growth, regional integration and long-term stability.

“What matters is how financing is designed to reduce risk, attract private capital, and sustain commercial viability while advancing national and regional development objectives,” he said.

Mr Alake emphasised that unlocking capital required addressing issues, such as bankable and enforceable offtake arrangements; predictable and harmonised cross-border regulatory frameworks; alignment of rail, port, power, and industrial planning; and clear pathways for processing, smelting, logistics services, and industrial clusters along the corridors.

He added that the broader vision of AMSG was to ensure that Africa’s mineral infrastructure was strategically designed, responsibly financed, and efficiently managed in a rapidly evolving global environment, not to discourage investment, but to ensure it aligned with long-term stability, transparency, and shared economic prosperity.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn