Economy

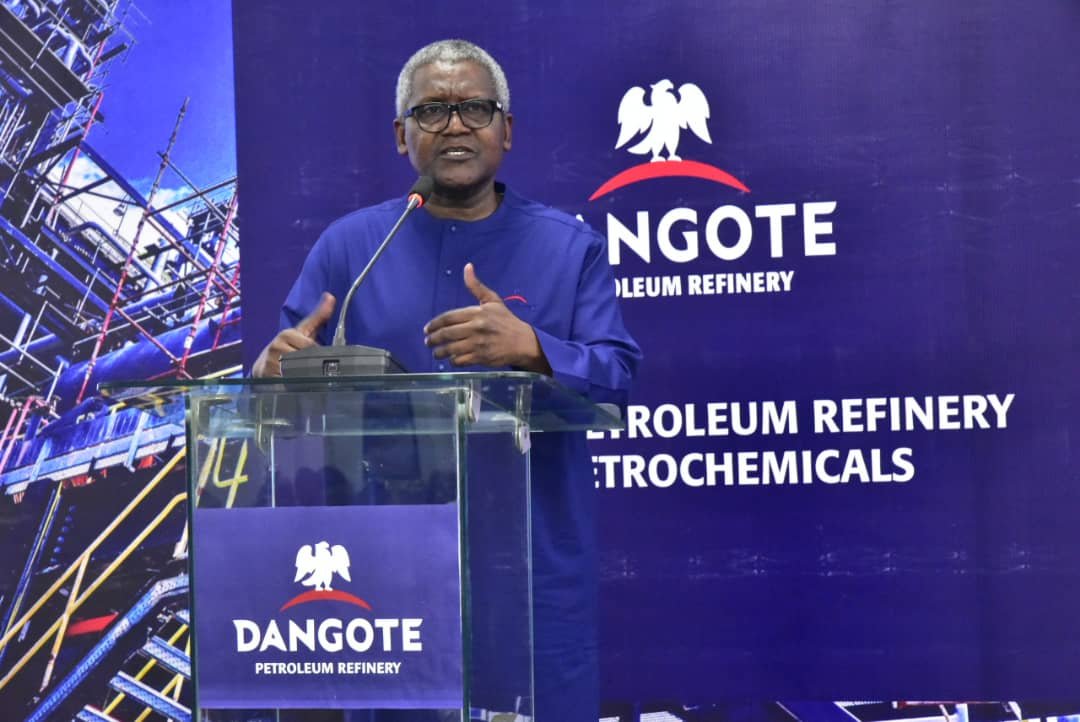

Fix Electricity, Economy Will Grow—Dangote Tells FG

By Modupe Gbadeyanka

Africa’s richest man and Nigerian billionaire businessman, Mr Aliko Dangote, has advised the Federal Government to concentrate on fixing the electricity problem in the country so as to spur economic growth.

Mr Dangote poor electricity supply in the country remains one of the problems hindering industrialisation in Nigeria.

The business mogul made this observation during the inauguration of the National Industrial Policy and Competitiveness Advisory Council in Abuja this week by the Acting President, Mr Yemi Osinbajo.

According to Mr Dangote, government should remove the constraints hindering industrialisation such as power, transportation, inconsistencies in policies, and challenges in land acquisition and communal violence.

He said the council was a welcome development which if well utilised could ensure diversification of the economy.

At the ceremony, Mr Dangote was announced as the Vice-Chairman, Private Sector team of the council chaired by the Acting President.

The Acting President charged members of council to create the chance for Nigeria to be competitive in international trade.

Mr Osinbajo said the council’s duty was not just patriotic but one to enable Nigerians to create livelihoods for themselves.

“It is not just a patriotic duty but I believe that it is what will rescue and save our country and give our country a real chance to be competitive in global business and commerce.

“And to give our people a fair chance of being able to create livelihood for themselves, jobs and all of those things that will make for a nation of people who are happy and satisfied,” he said.

The Acting President observed that the council members represented the crème de la crème of industry and business in Nigeria as a group and working with the public sector.

According to him, if the council cannot get it right then it is unlikely that the country can never get it right.

He said the council was important because generally speaking the public sector was not known to be good in business and could not deliver on any industrialisation effort.

Mr Osinbajo said that everywhere the government drove industrialisation, it always ended up in stagnation.

“Even the most successful experiments ended up in stagnation because government simply does not make the best business men or women.

“Government simply is not motivated enough,” he said.

He said it was the entrepreneurs’ drive for profit that saved the industry adding that such drives were initially personal.

He said that many of the council members had come to a point where it was not just enough to be wealthy of successful especially in a country with enormous potential.

Mr Osinbajo added that even to make more profits the environment needed to improve.

“I am really excited that that we are starting something today which I strongly believe that if we do it right we have a chance to turn things around permanently in the country,” the Acting President said.

He acknowledged that the key thing was implementation adding that while the private sector had the smartest people in the world, the public sector had the technocrats and urged for the collaboration of both sectors to solve many of the problems confronting the industrial sector, including creating good industrial hubs and solving power problems.

He also urged the council to hold the government accountable and make the government to act more effectively.

“I think that what we have tried to do by creating this council is to be able to put policy to test and policy to examination.

“So that there is a process by which the private sector is able to contribute to policy implementation but more importantly also to developing those policies,” he said.

On his part, the Minister of Industry, Trade and Investment, Mr Enelamah said the council represented what the government was working out in furtherance of the partnership between the public and private sector with respect to industrialisation.

He said he was confident that the council would provide the formula that would work and produce results.

Economy

Lagos Lists N230bn Series 4 10-Year Bond on Stock Exchange

By Aduragbemi Omiyale

The N230 billion 10-year bond issued to investors by the Lagos State government has been listed on the Nigerian Exchange (NGX) Limited.

It was the Series 4 of the state government’s N1 trillion Debt and Hybrid Instruments Issuance Programme, which was sold at a coupon rate of 16.25 per cent.

It was offered for sale to bondholders in November 2025, with Chapel Hill Denham Advisory Limited as the leading issuing house and bookrunner.

The joint issuing houses and bookrunners were Asset & Resources Management Limited, Capital Bancorp Plc, Cardinal Stone Partners Limited, Cedrus Capital Limited, Comercio Partners Capital Limited, Cordros Advisory Services Limited, Coronation Merchant Bank Limited, Dynamic Portfolio Limited, FCMB Capital Markets Limited, FCSL Asset Management Company Limited, FirstCap Limited, G.A. Capital Limited, LeadCapital Plc, Light House Capital Limited, Phoenix Global Capital Markets Limited, Quantum Zenith Capital and Investments Limited, Radix Capital Partners Limited, SFS Financial Services Limited, Stanbic IBTC Capital Limited, United Capital Plc, and, Vetiva Advisory Services Limited.

The debt instruments are callable at par after 60 months, on any coupon payment date, subject to the issuer having obtained prior regulatory approvals and upon issuance of the requisite notice to bondholders.

Business Post reports that the bond was sold at a unit price of N1,000, with the interest to be paid to investors on every May 20 and November 20 until maturity.

According to the Governor of Lagos State, Mr Babajide Sanwo-Olu, proceeds from the exercise would be used for critical infrastructure in transportation, housing, the environment, healthcare, education, urban renewal, and the provision of other sustainable infrastructure that would serve the future needs of the state.

The listing of the debt instrument on the stock exchange today, Monday, February 9, 2026, allows investors to trade the bond at the secondary market.

Economy

CBN to Begin 304th MPC Meeting February 23

By Adedapo Adesanya

The Central Bank of Nigeria (CBN) has announced plans to hold its 304th Monetary Policy Committee (MPC) meeting on Monday, February 23 and Tuesday, February 24, 2026.

This information was disclosed in a circular published on the apex bank’s official website on Monday. This will be the first meeting of 2026.

The gathering comes amid sustained efforts by the CBN to rein in inflation, stabilise the foreign exchange market, and strengthen macroeconomic conditions.

At its last MPC meeting in November 2025, the central bank retained the Monetary Policy Rate (MPR) at 27 per cent, maintaining its restrictive posture in a bid to curb inflationary pressures and stabilise the foreign exchange (FX) market.

The MPC is one of the bank’s highest policy-making bodies, responsible for formulating monetary and credit policies aimed at ensuring price stability.

Through key instruments such as the MPR, Cash Reserve Ratio (CRR), and Liquidity Ratio (LR), the committee guides interest rate conditions and overall monetary direction in the economy.

Comprising the CBN Governor, Deputy Governors, Board members, and appointed external members, the committee meets periodically to review critical economic indicators, including inflation, gross domestic product, and exchange rate developments, before taking policy decisions.

The apex bank outlined the timetable and venue in its official notice.

“The 304th meeting of the Monetary Policy Committee (MPC) is scheduled to hold as follows,” the CBN said.

“Day 1: Monday, February 23, 2026 – Time: 10.00 a.m.”

“Day 2: Tuesday, February 24, 2026 – Time: 8.00 a.m.”

According to the circular, the meeting will take place at the MPC Meeting Room on the 11th floor of the CBN Head Office in Abuja.

Economy

NGX Lifts Suspension on Fortis Global Insurance

By Aduragbemi Omiyale

The suspension placed on trading in the shares of Fortis Global Insurance Plc has been lifted by the Nigerian Exchange (NGX) Limited after six years.

The embargo arose from the company’s violation of Rule 3.1: Rules for Filing of Accounts and Treatment of Default Filing (Default Filing Rules).

The underwriting firm, formerly known as Standard Alliance Insurance Plc, was suspended by the exchange on July 2, 2019, after the board failed to file the necessary financial statements.

Rule 3.1 provides that if an issuer fails to file the relevant accounts by the expiration of the cure period, the exchange will: a) send to the issuer a second filing deficiency notification within two business days after the end of the cure period, b) suspend trading in the issuer’s securities, and c) notify the Securities and Exchange Commission (SEC) and the market within 24 hours of the suspension.

A notice from the bourse last week disclosed that the company has now filed all outstanding financial statements due to the NGX, and in view of this, the embargo has been lifted pursuant to Rule 3.3 of the Default Filing Rules.

This section states that, “The suspension of trading in the issuer’s securities shall be lifted upon submission of the relevant accounts, provided the exchange is satisfied that the accounts comply with all applicable rules of the exchange.

“The exchange shall thereafter also announce through the medium by which the public and the SEC were initially notified of the suspension, that the suspension has been lifted.”

The bourse informed trading license holders and the investing public “that the suspension placed on trading on the shares of Fortis Global Insurance was lifted on Wednesday, February 4, 2026.”

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn