Banking

Speakers Give Success Tips at Inaugural Stanbic IBTC Youth Leadership Series

By Modupe Gbadeyanka

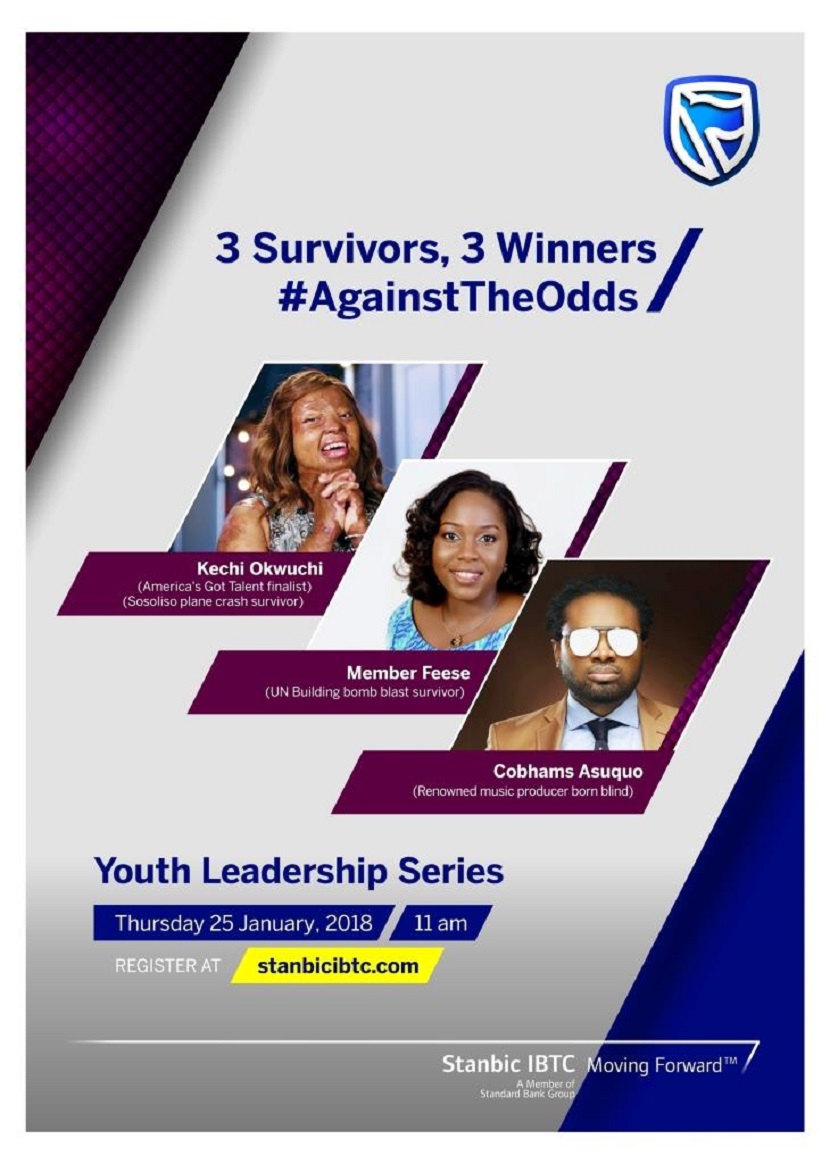

Living up to its theme, Against The Odds, the maiden edition of the Stanbic IBTC Youth Leadership Series provided a platform where three exceptional Nigerians spoke on the imperative of resilience, hardwork and perseverance to achieve individual, corporate and national goals.

The event, which held in Lagos on Thursday, January 25, 2018, attracted a huge audience of students and youth, bankers, investors, artists, captains of industry, and the business community.

Guest speakers, Kechi Okwuchi, a survivor of the ill-fated Sosoliso plane crash of December 2005; Member Feese, survivor of the United Nations Building bomb blast in Abuja; and Cobhams Asuquo, renowned music producer who was born blind, said if they could become role models by overcoming the grim challenges they faced, then nobody should give up the quest to succeed.

In his welcome address, Chief Executive of Stanbic IBTC Holdings Plc, Mr Yinka Sanni, said underlining the youth empowerment motivational series is a mission by the organization to inspire the youth, who are the leaders of today, not tomorrow, to strive to achieve their potential, regardless of the odds. The three lead speakers, he said, symbolized what is when people imbibe the evergreen cliché – “where there is a will, there is a way.”

The future of Nigeria and Africa is in the hands of the youth and there is no better time to arouse and deepen their knowledge and entrepreneurial skills than now. He said Stanbic IBTC is constantly exploring innovative ways of expanding the scope of its coverage and focus on the youth segment, otherwise known as the millennials, given the importance of the demography to national development, entrepreneurship drive and economic growth and development of the nation.

“The Youth Leadership Series is tailored after the annual Stanbic IBTC Business Leadership Series, an annual event that facilitates the sharing of knowledge and information among local and international participants who are drawn from key sectors of the economy.

“The overarching objective is to stimulate deeper engagements and outcomes for the sectors as well as unlock investment opportunities in the country,” Mr Sanni said.

He added that the Group decided it had become imperative for it to retool and re-strategize its efforts geared towards building the next generation of Nigerian leaders – the youths, in line with its commitment to growing that very important segment of the society.

“The popular saying that children are the leaders of tomorrow, as cliché as it may sound, for us at Stanbic IBTC, we believe that the youths are the leaders for today and because we understand just how easily one can get distracted or discouraged by the different challenges we face in our lives; our youths therefore need to be aptly and constantly guided, mentored, inspired and motivated, not just to attain their goals but in order for them to actualize their full potential,” Mr Sanni added.

Member Feese said the grace of God and prayers of Nigerians made her stronger and more determined to live and succeed, in the aftermath of the Abuja bomb blast, as the easier option would have been to live with the pain and trauma of the experience for the rest of her life. She pledged to continue with her advocacy work to support and encourage people in similar situations.

Kechi Okwuchi, who survived the Sosoliso crash, later went ahead to bag a First Class Degree from the University of Thomas Houston, Texas and emerged a finalist at America’s Got Talent. Her simple message to anyone faced with any affliction is: “don’t let your pains stunt you growth” and ‘don’t allow the scars to retard you.”

Cobahms Asuquo, the only blind child among seven siblings, said his condition gave him no choice than to live with it and find fulfilment. The first survival principle he learned early in life was to negotiate, which gave him the room to get what he lacked and to take control of his destiny. He urged people to always bring something to the table as “nobody owes you anything. You must work until nobody sees your disability. What they will see is your ability and contributions to society. Your disability simply disappears.”

“Through the travails, experiences and achievements of these exceptional young individuals, in spite of the hard-knock life and the odds, we hope to inspire, motivate and provoke the can-do spirit of our youth community and imbibe in them the strength of character, and tenacity to never give up but to constantly aspire to attain their full potential in life,” Mr Sanni concluded.

Stanbic IBTC Holdings PLC, a full service financial services group with a clear focus on three main business pillars – Corporate and Investment Banking, Personal and Business Banking and Wealth Management. Standard Bank Group, to which Stanbic IBTC Holdings belongs, is the largest African bank by assets and market capitalization. It is rooted in Africa with strategic representation in 20 countries on the African continent.

Standard Bank has been in operation for over 154 years and is focused on building first-class, on-the-ground financial services institutions in chosen countries in Africa; and connecting selected emerging markets to Africa by applying sector expertise, particularly in natural resources, power and infrastructure.

Banking

Senate Seeks CBN’s Full Disclosure on Unremitted N1.44trn Surplus

By Adedapo Adesanya

The Senate has demanded detailed explanation from the Central Bank of Nigeria (CBN) over the alleged non-remittance of N1.44 trillion in operating surplus.

The Senate Committee on Banking, Insurance and Other Financial Institutions, chaired by Mr Tokunbo Abiru, opened its statutory briefing with a firm call for transparency at the apex bank, noting that the Auditor-General’s query on the unremitted funds required a full, clear and documented response, insisting that public trust in monetary governance depended on strict accountability.

While acknowledging the CBN’s achievements in stabilising the foreign exchange market and reducing inflation, Mr Abiru underscored that such progress must be accompanied by institutional responsibility.

He stated the Senate expected the CBN to explain the circumstances surrounding the query, outline corrective steps taken and reveal safeguards against future lapses.

This came as the Governor of the central bank, Mr Yemi Cardoso, appeared before the senate committee and offered an extensive review of economic conditions, asserting that Nigeria was experiencing renewed macroeconomic stability across major indicators.

Mr Cardoso attributed the progress to bold monetary reforms, foreign-exchange liberalisation and disciplined liquidity management implemented since mid-2025.

According to him, headline inflation had declined for seven consecutive months, from 34.6 per cent in November 2024 to 16.05 per cent in October 2025, marking the steepest and longest disinflation trend in over a decade.

Food inflation accruing to him also slowed to 13.12 per cent, supported by improved supply conditions and exchange-rate predictability.

The CBN governor described the foreign-exchange market as fundamentally transformed, adding that speculative attacks and arbitrage opportunities had largely disappeared.

According to him, the premium between the official and parallel markets had fallen to below two per cent, compared to over 60 per cent a year earlier. As of November 26, the naira traded at N1,442.92 per dollar at the Nigerian Foreign Exchange Market, stronger than the N1,551 average recorded in the first half of 2025.

He also announced a sharp rise in external reserves to $46.7 billion, the highest in nearly seven years and sufficient to cover over ten months of imports.

Diaspora remittances, he noted, had tripled to about $600 million monthly, while foreign capital inflows reached $20.98 billion in the first ten months of 2025, 70 per cent higher than in 2024 and more than four times the 2023 figure.

Cardoso further confirmed that the CBN had fully cleared the $7 billion verified FX backlog, restoring investor confidence and strengthening Nigeria’s balance-of-payments position.

On banking-sector stability, he reported that recapitalisation efforts were progressing smoothly. Twenty-seven banks had already raised new capital, with sixteen meeting or surpassing the new regulatory thresholds ahead of the March 31, 2026 deadline, highlighting improvements in ATM cash availability, digital-payments oversight and cybersecurity compliance.

Despite the positive indicators, the Senate sought clarity on several policy decisions.

Mr Abiru pressed for explanations on the sustained 45 per cent Cash Reserve Ratio (CRR), the 75 per cent CRR applied to non-Treasury Single Account public-sector deposits, FX forward settlements, mutilated naira notes in circulation, excessive bank charges, failed electronic transactions and the compliance of CBN subsidiaries with parliamentary oversight.

He also requested an update on the activities of the Financial Services Regulatory Coordinating Committee, arguing that stronger inter-agency cooperation was necessary to maintain public confidence.

The session later moved into a closed-door meeting.

Banking

Toxic Bank Assets: AMCON Repays CBN N3.6trn, Still Owes N3trn

By Modupe Gbadeyanka

About N3.6 trillion has been repaid to the Central Bank of Nigeria (CBN) by the Asset Management Corporation of Nigeria (AMCON) since its inception in 2010.

This information was revealed by the chief executive of AMCON, Mr Gbenga Alade, during a media parley to update the press on the activities of the agency.

Mr Alade said at the moment, the organisation still owes the central bank about N3 trillion for toxic assets of banks in the country.

He praised the organisation for its asset recovery drive, stressing that when compared with others across the world, Nigeria has done well.

“It is important to stress that the corporation has done tremendously well, especially when compared to other notable government-owned Asset Management Corporations around the world.

“Based on the balance at purchase, AMCON outperformed other Asset Management Corporations all over the world by achieving over 87 per cent in recoveries despite the unique challenges associated with debt recovery in Nigeria.

“The Malaysian Danaharta, which is adjudged one of the best performing Asset Management Corporation’s, only achieved 58 per cent. The Chinese Asset Management Corporation, despite its stricter laws, achieved just 33 per cent.

“Only the Korean Asset Management Corporation (KAMCO), South Korea, has achieved more recoveries than AMCON, with about 100 per cent. This was due to their brute force with which they chased the obligors.

“Despite KAMCO’s recovery records, the agency is still operational to date with slight realignments in its mandate.

“Other noted Asset Management Corporations that have transitioned into a perpetual institution of the various governments include, China Asset Management Company, Federal Deposit Insurance Corporation (FDIC) USA, and KFW Germany.

“So, gentlemen, without sounding immodest, AMCON has done well, and we will not relent until all the outstanding debts are fully realized,” Mr Alade stated.

On the financial performance of AMCON, he said last year, the firm posted a revenue of N156.25 billion and operating expenses of N29.04 billion, while for the 2025 fiscal year should be a revenue of N215.15 billion and operating expenses of N29.06 billion.

Banking

The Alternative Bank Opens Effurun Branch in Delta

By Modupe Gbadeyanka

One of the non-interest banks in Nigeria, The Alternative Bank (AltBank), has opened a new branch in Effurun, Delta State.

The new office will serve the Edo-Delta region and provide purposeful banking and real financial empowerment for individuals, entrepreneurs, and businesses, a statement from the firm stated.

The lender disclosed that the Effurun branch is a bold move in its mission to reshape banking in Nigeria.

The launch was graced by key dignitaries, including the Ovie of Uvwie Kingdom, Emmanuel Ekemejewa Sideso Abe I; the Chairman of Uvwie Local Government, Anthony O. Ofoni, represented his vice, Andrew Agagbo; and the Special Adviser to the Governor of Delta State on Community Development, Mr Ernest Airoboyi; amongst others.

The Divisional Head for South at The Alternative Bank, Mr Chukwuemeka Agada, emphasised the institution’s commitment to Warri and its surrounding communities.

“By establishing a presence here, we are initiating a transformation in the way banking serves the people of Delta. Our purpose-driven approach ensures that customers’ financial goals are not just met but exceeded,” he stated.

“This branch represents our pledge to empower Warri’s dynamic businesses and families, providing them with the tools to grow without compromise,” Mr Agada added.

“We understand the heartbeat of this community, and we are excited to integrate our bank into the fabric of this dynamic region,” he stated further.

On his part, the representative of the Ovie, Mr Samuel Eshenake, challenged the bank to facilitate development and employment within the Effurun community.

The Regional Head for Edo/Delta at The Alternative Bank, Mr Akanni Owolabi, embraced this challenge, pledging that the bank will work sustainably to drive local commerce.

“At The Alternative Bank, we are committed to being an active partner in the development of Effurun. We see this branch as a catalyst for creating opportunities, driving employment, and supporting the growth of local businesses.

“Our mission is to empower this community, ensuring that every step forward is one of progress, prosperity, and shared success.”

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn