Jobs/Appointments

IMC Inducts Callistus Okoruwa, Lekan Ishola as Fellows

By Dipo Olowookere

Two prolific management and public relations consultants in Nigeria, Mr Callistus Okoruwa and Mr Lekan Ishola, have been inducted as Fellows of the Institute of Management Consultants (IMC).

Mr Okoruwa is the Chief Operating Officer of XLR8, while Mr Ishola is the Managing Director of PR Redline.

Both agencies manage the account of notable multinational companies operating in the country, providing consultancy and other media services to them.

Apart from being inducted by the institute, the duo have also bagged the Certified Management Consultant (CMC) certification of the Zurich-based International Council of Management Consulting Institutes ((ICMCI).

Both Mr Okoruwa and Mr Ishola were part of twenty-six practicing professionals in various areas of management consulting who bagged membership/fellowship status of IMC at the Lagos CMC Certification Workshop and Membership Induction which held at Lagos Airport Hotel, Ikeja, on Wednesday, January 31, 2018.

Other fellowship inductees at the event were Rear Admiral Joseph Oladeinde (Rtd), Professor Suraju Dada, Professor Chukwumah Obara, Engineer Obanor Victor Osagbouwa and Ifeoma Okoye.

Incorporated in 1983, the Institute of Management Consultants is the body of professional management consultants approved and registered by the Federal Government of Nigeria.

The Constitution and by-laws establishing the IMC empower it to promote and regulate the standards and practice of management consulting among its members throughout Nigeria.

Its membership is made up of individuals, consulting firms and organisations who share responsibility or are potential beneficiaries of improved standards in consulting practice.

The IMC Nigeria and the IMC South Africa are the only two professional bodies in Africa admitted into the International Council of Management Consulting Institutes (ICMCI).

The CMC Qualification is an annually renewable practicing licence for management consulting professionals and is reciprocally recognised in nearly 50 Member Countries of the ICMCI including USA, UK, Japan, Germany, India, China, Australia, South Africa, Nigeria and Netherlands, among others. It is only awarded or renewed upon a member attaining a minimum of 35 Credit Hours in selected range of practice activities under the Institute’s Continuing Professional Development Programme (CPDP) in line with the ICMCI global standards.

Jobs/Appointments

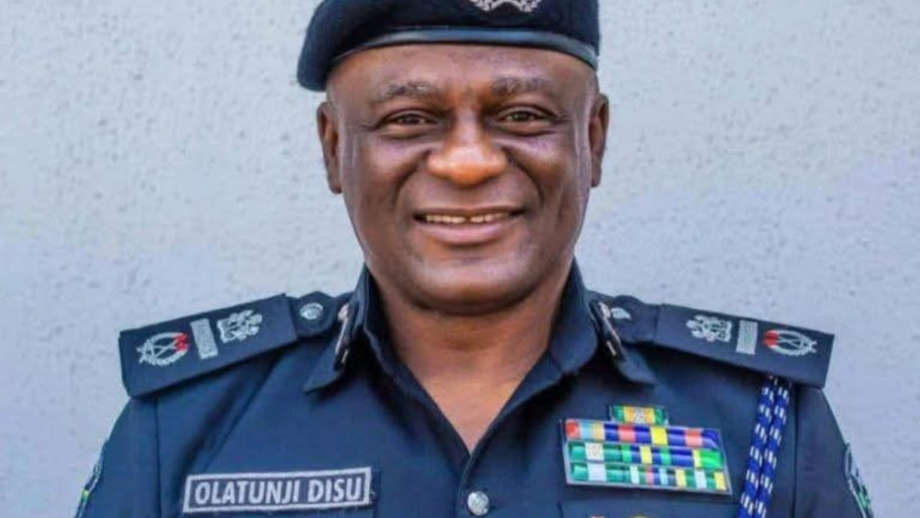

Tinubu to Swear in Tunji Disu as IGP Wednesday After Police Council’s Nod

By Modupe Gbadeyanka

The appointment of Mr Tunji Disu as the substantive Inspector-General of Police (IGP) has been ratified by the Nigeria Police Council (NPC).

The endorsement of the acting police chief was done on Monday at the council’s meeting held at the State House in Abuja, and chaired by President Bola Tinubu.

In attendance were Vice President Kashim Shettima, state governors and the Chairman of the Police Service Commission, Mr Hashimu Argungu.

Others in attendance were the Secretary to the Government of the Federation, Mr George Akume; the National Security Adviser, Mr Nuhu Ribadu; the Chief of Staff to the President, Mr Femi Gbajabiamila; the Minister of Police Affairs, Mr Ibrahim Gaidam; the FCT Minister, Mr Nyesom Wike; and the head of service, Mrs Esther Didi Walson-Jack.

Mr Disu was praised for his outstanding service to the nation through various means. He has held critical operational, investigative, and strategic command positions nationwide. His last position was as Assistant Inspector-General of Police (AIG) in charge of the Special Protection Unit and the Force CID Annex, Lagos.

The endorsement of his appointment on Monday paves the way for his swearing-in by Mr Tinubu on Wednesday. The ceremony will take place during the Federal Executive Council (FEC) meeting, scheduled for the same day.

The President appointed Mr Disu as the new police chief, following the resignation of the former occupier of the seat, Mr Kayode Egbetokun.

Mr Disu was born on April 13, 1966, in Lagos State and joined the Nigeria Police Force on May 18, 1992, as a Cadet Assistant Superintendent.

He rose through the ranks with multiple qualifications in public administration, forensic investigation, criminology, security, legal psychology, and entrepreneurship-credentials that reflect his commitment to knowledge-driven, modern policing.

His state governor, Mr Babajide Sanwo-Olu, lauded Mr Disu for his exemplary services as a policeman, especially when he served as the Commander of the Rapid Response Squad (RRS) in Lagos State between 2015 and 2021, where his tenure earned him and the RRS recognition for excellence in crime control.

Jobs/Appointments

Court Sanctions CHI Limited for Wrongful Employment Termination

By Modupe Gbadeyanka

The termination of the employment of one Mr Bodunrin Akinsuroju by CHI Limited has been declared as unlawful by the National Industrial Court of Nigeria.

Delivering judgment on the matter, Justice Sanda Yelwa of the Lagos Judicial Division of the court held that the sacking of Mr Akinsuroju did not comply strictly with the provisions of the contract of employment and the Employee Handbook.

Consequently, the company was directed to pay him the sum of N2 million as general damages for wrongful termination and N200,000 as costs of action, while Mr Akinsuroju was ordered to return the company’s properties in his possession or pay their assessed market value.

Justice Yelwa found that the contract agreement between both parties clearly required either party to give 30 days’ notice or payment in lieu of notice after confirmation of appointment, and there was no evidence that the employee was given the required notice or paid salary in lieu of notice.

The judge held that failure to comply with this fundamental term amounted to a breach of the contract of employment, thereby rendering the termination wrongful.

Mr Akinsuroju had claimed that the allegation of misconduct against him was unfounded and not established, maintaining that the disciplinary committee proceedings were prejudicial and that the termination of his employment was without justifiable cause and without compliance with the agreed terms of his employment.

In defence, CHI Limited contended that it had the right to terminate the employment of Mr Akinsuroju and that the termination was lawful and in accordance with the contract of employment and the Code of Conduct.

In opposition, counsel to Mr Akinsuroju submitted that the alleged breaches were not proved and that the termination letter took immediate effect without the requisite 30 days’ notice or payment in lieu of notice as stipulated in the letter of appointment and the Employee Handbook, urging the court to hold that the termination was wrongful and to grant the reliefs sought.

Jobs/Appointments

Tinubu Appoints Tunji Disu as Acting Inspector General of Police

By Modupe Gbadeyanka

President Bola Tinubu on Tuesday appointed Mr Tunji Disu as the acting Inspector General of Police (IGP), following the resignation of Mr Kayode Egbetokun.

Mr Disu, an Assistant Inspector General of Police (AIG), was recently moved to the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos.

A statement today by the Special Adviser to the President on Information and Strategy, Mr Bayo Onanuga, disclosed that the President would convene a meeting of the Nigeria Police Council shortly to formally consider the appointment of Mr Disu as substantive IGP, after which his name will be transmitted to the Senate for confirmation.

Mr Tinubu expressed confidence that Mr Disu’s experience, operational depth, and demonstrated leadership capacity would provide steady and focused direction for the Nigeria Police Force during this critical period.

He reiterated his administration’s unwavering commitment to enhancing national security, strengthening institutional capacity, and ensuring that the Nigeria Police Force remains professional, accountable, and fully equipped to discharge its constitutional responsibilities.

Mr Egbetokun was said to have resigned from the position due to pressing family considerations.

President Tinubu, who accepted the resignation letter, expressed his profound appreciation for Mr Egbetokun’s decades of distinguished service to the Nigeria Police Force and the nation. He acknowledged his dedication, professionalism, and steadfast commitment to strengthening internal security architecture during his tenure.

Appointed in June 2023, Mr Egbetokun was serving a four-year term scheduled to conclude in June 2027, in line with the amended provisions of the Police Act.

The statement disclosed that his replacement was in view of the current security challenges confronting the nation, and acting in accordance with extant laws and legal guidance.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn