Economy

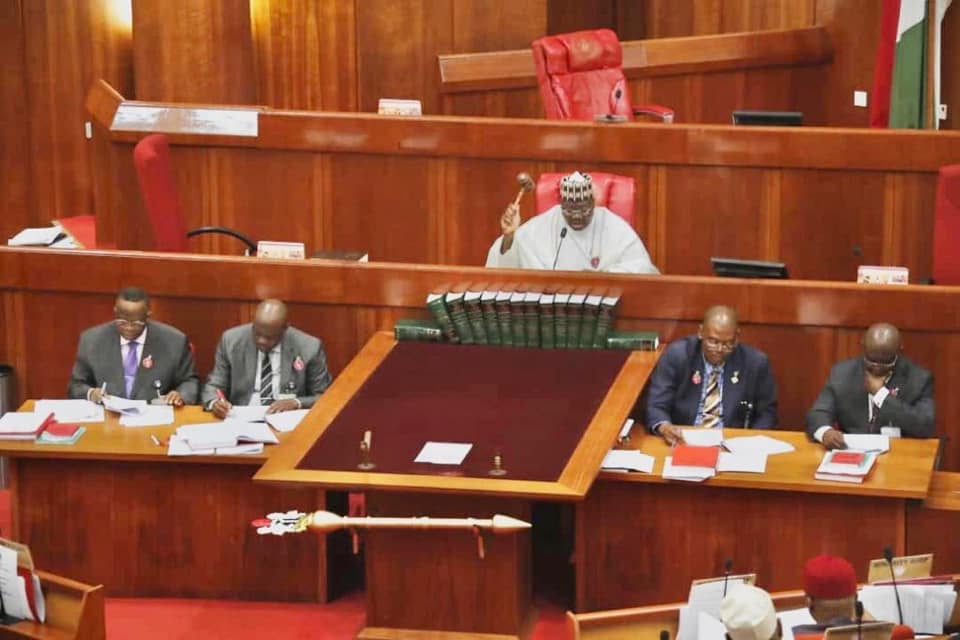

BREAKING: Finally, Senate Passes 2018 Budget of N9.12tr

By Modupe Gbadeyanka

The Nigerian Senate on Wednesday eventually passed the 2018 Appropriation Bill and would be forwarded to President Muhammadu Buhari for his assent.

The 2018 budget is estimated to be N9.12 trillion.

On Tuesday, report of the 2018 Appropriation Bill was laid before the Senate by Chairman of the Senate Committee on Appropriations, Mr Danjuma Goje.

Today, he briefed his colleagues on the components of the budget, saying it contains N3.5 trillion for recurrent (non-debt) expenditure, N2.9 trillion for development fund for capital expenditure, N2.2 trillion for debt servicing, N530.4 billion for statutory transfer and N190 billion for sinking fund for maturing loans.

While debating on the budget before it was passed, the lawmakers said it was unfortunate that Nigerians believed that the passage was delayed by the Senate when it was the executive that actually did.

They said Ministries, Departments and Agencies (MDAs) of Federal Government failed to defend their budget estimates until they were directed to do so in March this year.

President Muhammadu Buhari had presented the budget of N8.612 trillion to the parliament for passage in November 2017.

But the National Assembly raised the estimate to N9.12 trillion.

Details later.

Economy

Sell-Offs in Five Securities Weaken NASD Bourse by 0.30%

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange receded by 0.30 per cent on Tuesday, January 20 following sell-offs in five stocks on the unlisted stock trading platform.

The price losers were led by FrieslandCampina Wamco Nigeria Plc, which gave up N1.71 to sell at N72.00 per share compared with the N73.71 per share it traded a day earlier.

Further, Central Securities Clearing System (CSCS) Plc dropped 37 Kobo to close at N41.43 per unit versus Monday’s closing price of N41.80 per unit, Ge0-Fluids Plc lost 14 Kobo to trade at N7.00 per share compared with the previous day’s N7.14 per share, Afriland Properties Plc depreciated by 13 Kobo to trade at N14.60 per unit versus the N14.73 per unit it was exchanged a dy earlier, and UBN Property Plc declined by 11 Kobo to quote at N1.90 per share, in contrast to the preceding session’s N2.01 per share.

As a result, the market capitalisation went down by N6.5 billion to N2.187 trillion from N2.194 trillion, while the NASD Unlisted Security Index (NSI) depreciated by 10.86 points to 3,656.36 points from 3,667.22 points.

Business Post reports that yesterday, there was a price gainer, which was IPWA Plc. It gained 16 Kobo to end at N1.79 per unit versus N1.63 per unit.

During the trading day, the total value of transaction jumped by 137.5 per cent to N43.3 million from N18.2 million, while the volume of transactions decreased by 3.2 per cent to 2.6 million units from 2.7 million units, as the number of deals depreciated by 30.2 per cent to 30 deals from 43 deals.

At the close of trades, CSCS Plc was the most active stock by value on a year-to-date basis with 3.6 million units worth N145.6 million, trailed by MRS Oil Plc with 278.971 units valued at N55.7 million, and Geo-Fluids Plc with 7.6 million units sold for N51.9 million.

Geo-Fluids Plc maintained its position as the most active stock by volume on a year-to-date basis with 7.6 million units traded for N51.9 million, followed by CSCS Plc with 3.6 million units transacted for N145.6 million, and Industrial and General Insurance (IGI) Plc with 3.1 million units valued at N1.9 million.

Economy

Naira Appreciates 0.06% to N1,419/$1 at Official Market

By Adedapo Adesanya

The Naira rebounded on Tuesday, January 20 in the Nigerian Autonomous Foreign Exchange Market (NAFEM) as it appreciated against the US Dollar by 93 Kobo or 0.06 per cent to N1,419.35/$1 from Monday’s N1,420.28/$1.

However, it depreciated against the Pound Sterling in the official market by N2.43 to trade at N1,908.31/£1 versus the previous day’s N1,905.88/£1 and lost N13.53 against the Euro to finish at N1,666.31/€1 compared with the preceding session’s closing price of N1,652.78/€1.

The Nigerian currency also weakened against the Dollar at the GTBank forex counter yesterday by N5 to sell at N1,429/$1, in contrast to Monday’s exchange rate of N1,424/$1 and maintained stability at the parallel market at N1,485/$1.

Market analysts said they expect the current trading range of the Naira to remain firm in the near term supported by stronger foreign inflows driven by higher oil receipts, improved FPI participation, and consistent FX management by the Central Bank of Nigeria (CBN).

Boost from exporters’ and importers’ inflows in addition to non-bank corporate supply will also help enhance liquidity.

The Dollar also faced pressure in the international market in the midst of a dispute between the US and its European allies over Greenland, which President Donald Trump said “no going back” on his campaign thereby triggering selloffs to other safe haven assets.

As for the cryptocurrency market, Bitcoin (BTC) dropped below $90,000 on Tuesday amid a sharp shift in global risk sentiment, triggering more than $1 billion in forced liquidations of leveraged crypto positions.

The crypto sell-off coincided with broader market jitters tied to renewed tariff threats from President Donald Trump and a sell-off in Japanese government bonds that pushed global yields higher and pressured risk assets, with the BTC down by 1.6 per cent to $89,456.08.

Ethereum (ETH) lost 4.7 per cent to trade at $2,974.67, Binance Coin (BNB) slumped by 4.1 per cent to $878.27, Solana (SOL) depreciated by 2.8 per cent to $128.14, Cardano (ADA) crashed by 1.9 per cent to $0.3595, Ripple (XRP) slipped by 1.8 per cent to $1.91, Litecoin (LTC) declined by 1.7 per cent to $68.92, and Dogecoin (DOGE) shrank by 1.5 per cent to $0.1251.

On the flip side, the US Dollar Tether (USDT) appreciated by 0.01 per cent to trade at $1.00, and the US Dollar Coin (USDC) gained 0.03 per cent to settle at $1.00.

Economy

Stock Investors Recover N93bn after Previous Day’s Loss

By Dipo Olowookere

The Nigerian Exchange (NGX) Limited returned to green territory on Tuesday after it chalked up 0.09 per cent on the back of renewed buying pressure.

The market regained strength yesterday despite profit-taking in the banking space, which caused its index to close lower by 0.69 per cent.

Business Post reports that insurance counter was up by 2.80 per cent, the energy sector appreciated by 2.40 per cent, the commodity segment grew by 1.22 per cent, and the consumer goods industry improved by 0.03 per cent, while the industrial goods counter closed flat.

At the close of transactions, the All-Share Index (ASI) went up by 144.32 points to 166,256.82 points from 166,112.50 points and the market capitalisation gained N93 billion to finish at N106.436 trillion compared with the N106.343 trillion it settled on Monday.

During the session, investors transacted 795.5 million equities valued at N20.0 billion in 45,410 deals versus the 629.6 million equities worth N14.8 billion executed in 57,858 deals a day earlier, indicating a rise in the trading volume and value by 26.35 per cent and 35.14 per cent apiece and a decline in the number of deals by 21.52 per cent.

Tantalizers was the busiest stock yesterday with a turnover of 87.0 million units valued at N300.9 million, Secure Electronic Technology traded 74.2 million units worth N87.6 million, a new member of the NGX, Zichis Agro Allied Industries, transacted 69.6 million units for N138.5 million, Zenith Bank sold 49.1 million units valued at N3.5 billion, and GTCO exchanged 39.1 million units worth N3.8 billion.

On Tuesday, the market breadth index was positive after Customs Street ended with 39 appreciating shares and 25 depreciating shares, representing a bullish investor sentiment.

Deap Capital, NPF Microfinance Bank, and Red Star Express gained 10.00 per cent each to sell for N5.39, N4.73, and N15.95 apiece, as NCR Nigeria soared by 9.97 per cent to N155.50, and Morison Industries also increased by 9.97 per cent to N6.84.

Conversely, Aluminium Extrusion lost 9.95 per cent to settle at N17.20, Jaiz Bank declined by 9.88 per cent to N7.21, FTN Cocoa shrank by 8.44 per cent to N7.05, UPDC decreased by 8.06 per cent to N5.70, and Caverton slumped by 5.59 per cent to N7.60.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn