Economy

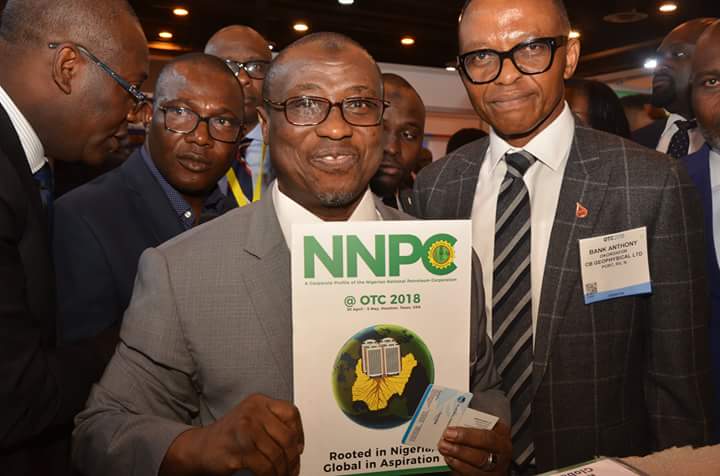

NNPC Restrategises for Better Efficiency

By Dipo Olowookere

In order to enhance its position as a fully integrated national energy company, ready to prosper despite the changing dynamics of the global oil and gas industry, the management of Nigerian National Petroleum Corporation (NNPC) says it is fine-tuning its strategies.

A release by Group General Manager, Group Public Affairs Division, Mr Ndu Ughamadu, said the Group Managing Director of the corporation, Dr Maikanti Baru, disclosed this at this year’s NNPC First Quarter 2018 Top Management Steering Committee (Steerco) Meeting held at the NNPC Towers in Abuja, weekend.

Dr Baru, who admitted the tremendous changes at play in the Petroleum Industry landscape globally, said it behooved oil companies to, as a long-time survival strategy, adapt to the changes for efficiency, growth and profitability.

“The changes we are seeing in the industry over the last few years call for some action on our part. This is because as a business concern, we don’t live in isolation in the Industry and therefore, we must act now,” Dr Baru affirmed.

According to the GMD, some of the strategies considered by the corporation included reviewing Key Performance Indicators (KPIs), setting realistic targets for immediate sign-off, as well as spending items capable of improving the organization’s bottom-line.

Other strategies, Dr Baru noted, are expediting action on the holistic rehabilitation of the refineries; strengthening internal control mechanisms and intensifying exploration efforts in the frontier Basins.

“Today, we are reviewing the mission and vision of the corporation and have also ventured into renewable energy and power sectors,” Dr Baru added.

Speaking at the meeting, Chief Operating Officer (COO), Downstream, Engr. Henry Ikem-Obih, said a lot of work had been done towards getting NNPC on the same pedestal with its peers, even as he commended the commitment and the resolve of the GMD at investing in NNPC’s downstream supply and distribution assets.

Obih stated that now, the corporation’s focus in the downstream sub-sector revolved around imbibing world-class culture, implementing best practices, focusing on cost reduction, improving efficiency, deploying cutting-edge technologies and having a clean balance sheet that reflects NNPC’s corporate business vision.

“Gradually, we are repositioning from an intervention engine for the nation to one that is ready to make profit, grow and create value for our teeming stakeholders,” Obih stated.

In his opening remarks at the occasion, the convener of the meeting and Group General Manager, Corporate Planning & Strategy Division, Mr Bala Wunti, said the essence of the Steerco meeting was to review performance, redefine expectations, identify areas of improvement and implement actionable items that would boost efficiency, and conversely, high profitability.

He said the meeting had brought to the fore areas yearning for further improvement which the CP&S Division would vigorously pursue to ensure that the NNPC continue to stand firm on the path of growth and profitability.

“It is important that we do what we need to do like any other NOC to move on the upward trajectory and be able to achieve our mandate of delivering value to our major shareholders, who are Nigerians,” Mr Wunti stated.

On her part, the Legal Adviser to the corporation, Mrs Hadiza Coomasie, said although, there were a lot of work to be done, positives from the Steerco Meeting would enable NNPC Management to know the current position of corporation and outlook.

The next Steerco meeting comes up in August this year.

Economy

Oil Exports to Drop as Shell Commences Maintenance on Bonga FPSO

By Adedapo Adesanya

Nigeria’s oil exports will drop in February following the shutdown of the Bonga Floating Production Storage and Offloading (FPSO) vessel scheduled for turnaround maintenance.

Shell Nigeria Exploration and Production Company (SNEPCo) Limited confirmed the development in a statement issued, adding that gas output will also decline during the maintenance period.

This comes as SNEPCo begun turnaround maintenance on the Bonga FPSO, the statement signed by its Communications Manager, Mrs Gladys Afam-Anadu, said, describing the exercise as a statutory integrity assurance programme designed to extend the facility’s operational lifespan.

SNEPCo Managing Director, Mr Ronald Adams, said the maintenance would ensure safe, efficient operations for another 15 years.

“The scheduled maintenance is designed to reduce unplanned deferments and strengthen the asset’s overall resilience.

“We expect to resume operations in March following completion of the turnaround,” he said.

Mr Adams said the scope included inspections, certification, regulatory checks, integrity upgrades, engineering modifications and subsea assurance activities.

“The FPSO, about 120 kilometres offshore in over 1,000 metres of water, can produce 225,000 barrels of oil daily.

“It also produces 150 million standard cubic feet of gas per day,” he said.

He said maintaining the facility was critical to Nigeria’s production stability, energy security and revenue objectives.

Mr Adams noted that the 2024 Final Investment Decision on Bonga North increased the importance of the FPSO’s reliability. He said the turnaround would prepare the facility for additional volumes from the Bonga North subsea tie-back project.

According to him, the last turnaround maintenance was conducted in October 2022.

“On February 1, 2023, the asset produced its one billionth barrel since operations began in 2005,” Mr Adams said.

SNEPCo operates the Bonga field in partnership with Esso Exploration and Production Nigeria (Deepwater) Limited and Nigerian Agip Exploration Limited, under a Production Sharing Contract with the Nigerian National Petroleum Company (NNPC) Limited.

The last turnaround maintenance activity on the FPSO took place in October 2022. On February 1, the following year, the asset delivered its 1 billionth barrel of oil since production commenced in 2005.

Economy

Nigeria Earns N1.17trn from Petroleum Sector in November 2025

By Adedapo Adesanya

Nigeria earned N1.17 trillion from the oil and gas industry in November 2025, lower than the N1.396 trillion generated in October 2025 by 16.2 per cent, according to data presented to the Federation Account Allocation Committee (FAAC) by the Central Bank of Nigeria (CBN).

The CBN, in the latest data available, noted that the N1.17 trillion earnings from the petroleum industry in November 2025 represented 96.4 per cent of the N1.214 trillion revenue budgeted for the sector for the month under review.

In comparison, revenue from the petroleum industry in October 2025 represented 94.71 per cent of the N1.474 trillion budgeted for the sector in the month.

In its breakdown of revenue from the oil and gas industry in November 2025, the central bank stated that the country earned N37.134 billion from crude oil sales, climbing by 395.58 per cent from N7.493 trillion recorded in the previous month; while revenue from gas sales appreciated by 25.22 per cent to N7.265 billion in November, compared with N5.802 billion recorded in October 2025.

Furthermore, the CBN noted that revenue from crude oil royalties dipped by 25.6 per cent, from N790.086 billion in October 2025 to N587.865 billion in November; while miscellaneous oil revenue more than doubled to N1.356 billion, from N447.279 million in October 2025.

Also, it stated that royalties from gas dipped by 38.1 per cent to N9.405 billion in November, from N15.195 billion in October, while the country earned N51.842 billion from gas flare penalties in November 2025, down from N61.898 billion recorded in the previous month.

The apex bank added that revenue from companies’ income tax (CIT) from upstream oil industry operations stood at N106.106 billion in the month under review, as against N73.025 billion in October 2025.

It also stated that revenue from Petroleum Profit Tax (PPT) stood at N301.471 billion; rentals – N775.162 million; while taxes stood at N67.242 billion in November 2025; as against N242.621 billion, N3.197 billion, and N196.277 billion in October 2025.

In addition, the apex bank reported that from the country’s oil earnings in November 2025, N18.163 billion was deducted for 13 per cent refund on subsidy, priority projects and Police Trust Fund from 1999 to 2021; while N2.872 billion was deducted by the Nigerian National Petroleum Company (NNPC) Limited in respect of its 13 per cent management fee and frontier exploration fund.

It added that N26.401 billion was deducted and collected by the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) in October 2025, being four per cent cost of collection; while N49.768 billion was transferred to the Midstream and Downstream Gas Infrastructure Fund from gas flare penalties in the same month.

Economy

NGX Weekly Trading Volume, Value Down as Investors Weigh Risks, Benefits

By Dipo Olowookere

The decision of investors weighing the risks and benefits of holding Nigerian stocks took a toll on the Nigerian Exchange (NGX) Limited last week.

The bourse suffered a marginal week-on-week 0.09 per cent loss, with the All-Share Index (ASI) down to 165,370.40 points. However, the market capitalisation gained 0.18 per cent in the five-day trading week to settle at N106.153 trillion.

Data from Customs Street indicated that all other indices finished higher apart from the NGX 30, NGX CG, premium, banking, pension, growth and pension broad indices, which respectively depreciated by 0.13 per cent, 0.63 per cent, 0.75 per cent, 0.63 per cent, 0.41 per cent, 1.13 per cent, and 0.22 per cent, respectively.

The level of activity also depleted in the week as the market recorded a turnover of 3.087 billion shares worth N81.505 billion in 222,185 deals compared with the 3.748 billion shares valued at N99.865 billion traded in 237,179 deals a week earlier.

The financial services industry was the most active with 1.495 billion shares valued at N33.923 billion traded in 83,939 deals, contributing 48.45 per cent and 41.62 per cent to the total trading volume and value apiece.

The services sector sold 443.222 million equities worth N4.936 billion in 17,615 deals, and the ICT space transacted 279.520 million stocks valued at N6.443 billion in 24,552 deals.

The three most active stocks for the week were Veritas Kapital Assurance, Cutix, and Secure Electronic Technology, accounting for 513.382 million units worth N1.139 billion in 4,895 deals, contributing 16.63 per cent and 1.40 per cent to the total trading volume and value, respectively.

Business Post reports that 44 stocks appreciated during the week versus 58 stocks a week earlier, 49 shares depreciated versus 40 shares in the previous week, and 55 equities closed flat versus 50 equities in the preceding week.

Zichis was the best-performing stock with a price appreciation of 59.92 per cent to sell for N4.19, Omatek expanded by 49.25 per cent to N3.00, Union Homes REIT grew by 32.94 per cent to N94.85, Morison Industries surged by 32.85 per cent to N9.99, and SCOA Nigeria grew by 32.77 per cent to N31.60.

Neimeth ended the week as worst-performing stock after it shed 26.04 per cent to trade at N9.80, Living Trust Mortgage Bank shrank by 21.36 per cent to N4.05, May and Baker lost 19.54 per cent to quote at N35.00, Livestock Feeds crashed by 13.70 per cent to N6.30, and Austin Laz dropped 13.14 per cent to finish at N3.90.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn