Economy

Stocks Shed N15bn Thursday as Year-to-Date Loss hits 13.93%

By Dipo Olowookere

Transactions on the floor of the Nigerian Stock Exchange (NSE) remained bearish on Thursday as investors continue to selloff their holdings due to some uncertainties.

This led to the reduction in the market value yesterday by N15 billion to settle at N13.183 trillion, while the All-Share Index (ASI) went down by 30.18 points to finish at 27,052.93 points.

Business Post reports that the market closed on Thursday with a total of 23 price losers as against the only nine price gainers, which left the market breadth negative.

Topping the risers chart was MTN Nigeria, which added N5.75k to its share price to close at N135 per share, with CCNN occupying the second position with N1.25k gain to end at N14.50k per unit.

Dangote Flour appreciated by 30 kobo to finish at N20.80k per share, Union Bank rose by 20 kobo to settle at N7 per unit, while Zenith Bank grew by 5 kobo to end at N16.25k per share.

At the other side, Stanbic IBTC dominated the price decliners’ table with a price depreciation of N3.80k to finish at N34.30k per share, while Unilever Nigeria shed N3.20k to close at N28.80k per unit.

Dangote Cement depreciated yesterday by N3 to end at N162 per share, Ecobank went down by 70 kobo to settle at N6.30k per share, while Custodian Investment declined by 60 kobo to close at N5.60k per unit.

During yesterday’s trading session, Business Post observed that the activity level was mixed with the volume of trades going down by 0.82 percent, while the value of the transactions went up by 10.48 percent.

The volume of shares exchanged by investors dropped to 233.2 million on Thursday from 235.1 million on Wednesday, while the value of the equities rose to N3.6 billion yesterday N3.3 billion.

Dominating the activity chart at the stock market yesterday was GTBank as investors traded 42.5 million units of the company’s shares worth N1.1 billion.

It was trailed by Transcorp, which sold 37.9 million valued at N33.1 million, Access Bank, which exchanged 22.1 million equities worth N130.1 million, Fidelity Bank, which transacted 19.4 million shares for N28.2 million, and Zenith Bank, which exchanged 18.3 million equities worth N298.6 million.

Economy

Naira Value Further Dips 0.13% to N1,355/$1

By Adedapo Adesanya

The Naira depreciated further against the United States Dollar by N1.76 or 0.13 per cent on Friday in the Nigerian Autonomous Foreign Exchange Market (NAFEX) to close at N1,33.42/$1, in contrast to the N1,353.66/$1 it was exchanged a day earlier.

However, the Naira appreciated against the Pound Sterling in the same market window yesterday by N5.05 to trade at N1,844.59 versus Thursday’s closing price of N1,849.64/£1, and against the Euro, it improved by 75 Kobo to quote at N1,60/€1 versus the previous day’s N1,608.68/€1.

At the GTBank FX desk, the domestic currency lost N6 on the US Dollar on Friday to settle at N1,365/$1 versus the preceding session’s N1,359/$1, and at the parallel market, it chalked up N10 to trade at N1,430/$1 versus the previous day’s N1,430/$1.

The weakening of the Nigerian currency in the official market happened as the Central Bank of Nigeria (CBN) refrained from intervening in the official window.

The FX supply side was eclipsed by growing demand for foreign payments. Exporters’ inflows, non-bank corporate supply, and other market participants’ contributions had enhanced the FX liquidity level.

Pressure came with the entry of all duly licensed Bureau De Change (BDCs) into the official foreign exchange, although there are indications that the move will help the Naira-US Dollar exchange value, as BDC operators have started approaching their banks to understand the operational modalities and framework for accessing Dollars.

As for the cryptocurrency market, benchmarked tokens improved as US interest rate futures on Friday raised odds of rate cuts by the Federal Reserve after a report that showed inflation rose less than expected in January.

Data showed the Consumer Price Index (CPI) rose 0.2 per cent last month after an unrevised 0.3 per cent gain in December, with Solana (SOL) up by 7.9 per cent to $85.17, and Ethereum (ETH) up by 6.5 per cent to trade at $2,059.78.

Further, Cardano (ADA) added 5.3 per cent to close at $0.2758, Ripple (XRP) jumped 5.1 per cent to $1.42, Bitcoin expanded by 4.8 per cent to $69,357.35, Litecoin (LTC) grew by 4.7 per cent to $55.27, Binance Coin (BNB) jumped 4.0 per cent to $621.88, and Dogecoin (DOGE) increased by 3.8 per cent to $0.0965, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) remained unchanged at $1.00 each.

Economy

Oil Prices up as US Inflation Data Outweighs OPEC Supply Concerns

By Adedapo Adesanya

Oil prices were marginally higher on Friday after data showed an overall slowdown in US inflation, helping offset supply concerns as the Organisation of the Petroleum Exporting Countries and allies (OPEC+) is leaning towards a resumption in production increases.

Brent crude futures grew by 23 cents or 0.3 per cent to $67.75 a barrel, while the US West Texas Intermediate (WTI) crude futures expanded by 5 cents or 0.08 per cent to $62.89 per barrel.

US consumer prices increased less than expected in January amid cheaper gasoline prices and a moderation in rental inflation.

The Consumer Price Index rose 0.2 per cent last month after an unrevised 0.3 per cent gain in December, the Labor Department’s Bureau of Labor Statistics said.

The report followed news this week of an acceleration in job growth in January and a drop in the unemployment rate to 4.3 per cent from 4.4 per cent in December.

Market analysts noted that since inflation is stabilising, it may lead to interest rates probably continuing to move a little bit lower.

OPEC is leaning towards a resumption in oil output increases from April, ahead of the upcoming peak summer fuel demand, and amid firmer crude prices owing to tensions over US-Iran relations.

There are indications that this will happen when eight OPEC+ producers – Saudi Arabia, Russia, the United Arab Emirates, Kazakhstan, Kuwait, Iraq, Algeria and Oman – meet on March 1.

The eight members raised production quotas by about 2.9 million barrels per day from April to the end of December 2025, equating to about 3 per cent of global demand, and froze further planned increases for January through March 2026 because of seasonally weaker consumption.

OPEC’s latest oil market forecasts show demand for OPEC+ crude in the second quarter falling by 400,000 barrels per day from the first three months of the year, but demand for the whole year is projected to be 600,000 barrels per day higher than in 2025.

Oil prices had strengthened earlier in the week on concerns that the US could attack Middle Eastern oil producer Iran over its nuclear programme. The US is sending an aircraft carrier from the Caribbean to the Middle East on Friday, a move that would put two carriers in the region as tensions soar between the two countries.

The US also eased sanctions on Venezuela’s energy sector on Friday, issuing two general licenses that allow global energy companies to operate oil and gas projects in the OPEC member and for other companies to negotiate contracts to bring in fresh investments.

On the US supply side, Baker Hughes said oil rigs fell by three to 409 this week.

Economy

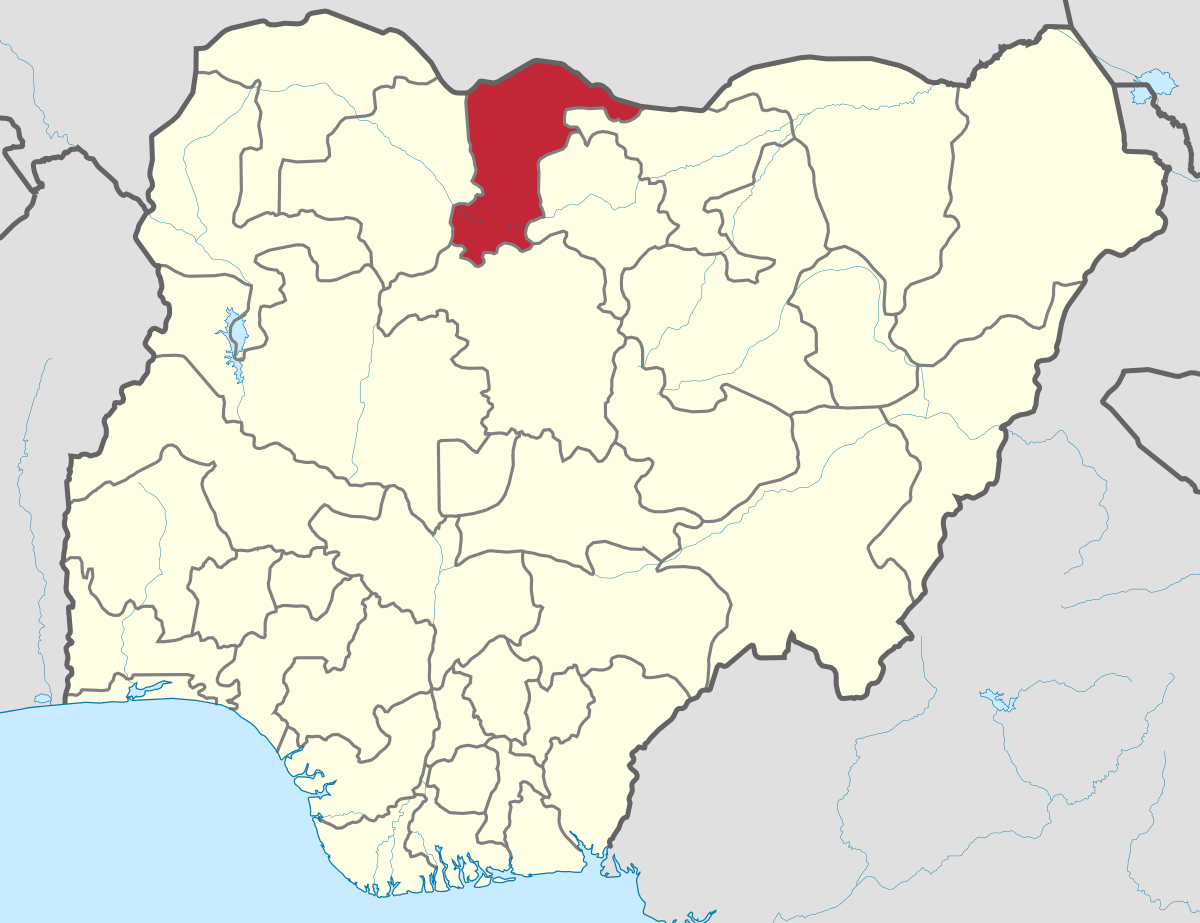

Katsina Provides Additional N500m for Women-owned Businesses

By Modupe Gbadeyanka

The Katsina State government has offered additional N500 million to support women-owned businesses in the state as part of efforts to boost economic activities.

Governor Dikko Umaru Radda announced this at the Women of Influence and Investment Summit hosted by the Katsina Inner Wheel Development Initiative (KIWDI), in partnership with Access Bank Plc.

The event brought together women entrepreneurs, investors, policymakers, and development partners to advance women’s economic empowerment in the state.

The summit, themed Where Influence Meets Investment, focused on positioning women as key drivers of enterprise, leadership, and inclusive growth. It also highlighted the growing collaboration between Access Bank and the Katsina State Government on financial inclusion and SME development.

Mr Radda noted that investing in women was critical to building a productive and sustainable economy.

In her welcome address, the founder of KIWDI, Ms Amina Zayyana, said the summit was designed to connect women to opportunities, training, finance, and markets, stressing that when women-led businesses grow, families and communities benefit.

On her part, the Group Head of Women Banking at Access Bank, Mrs Nene Kunle-Ogunlusi, said the lender was proud to partner with Katsina State and KIWDI in advancing women’s economic participation.

“At Access Bank, we are committed to moving women from potential to prosperity. Through our Women Banking proposition and the ‘W’ Initiative, we provide access to finance, capacity building, and market linkages that help women start, stabilise, and scale their businesses,” she said.

She noted that the W Initiative, launched in 2014, is Access Bank’s flagship women- focused platform, designed to meet the real needs of women entrepreneurs and professionals across Nigeria and Africa.

“Our partnership with Katsina State goes beyond banking. It is about supporting economic empowerment, SME growth, and financial inclusion, especially for women,” she added.

Mrs Kunle-Ogunlusi noted that Access Bank was proud to participate not just as a financial institution, but as a long-term partner in women’s economic advancement across Nigeria and Africa.

“At Access Bank, we made a deliberate decision to change that, not with charity, but with strategy. Not with sympathy, but with solutions. The W Initiative, which was launched in 2014, is Access Bank’s flagship women-focused proposition, created to respond to the real needs of women,” she said.

The banker disclosed that through the W Initiative, the bank has disbursed over N314 billion in loans to women, supporting over 3.6 million female loan beneficiaries, and helping women-owned businesses start, stabilise, and scale up.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn