Economy

Palm Oil Investor Gets N10m from Heritage Bank

By Aduragbemi Omiyale

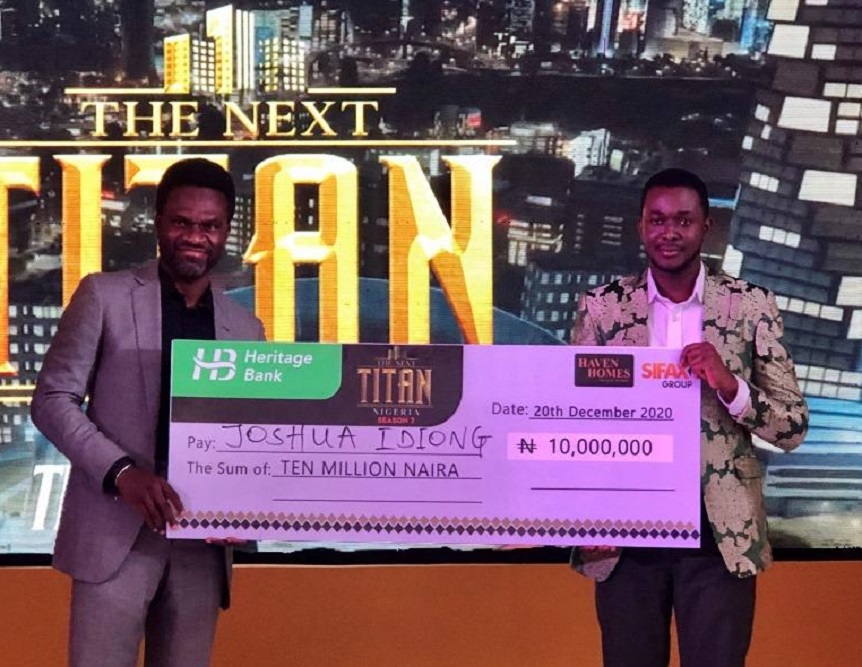

An investor in the palm oil industry, Mr Joshua Joseph Idiong, has received N10 million from Heritage Bank and the fund is expected to boost his business.

Mr Idiong is into the oil palm processing business. He is the chief executive of the Akwa Ibom State-based Josult Oil Processing Company.

He was one of the contestants of the prestigious The Next Titan Season 7. In fact, he won the edition of the programme themed The Unstoppable.

The Next Titan is an entrepreneurial reality show sponsored by Heritage Bank and aimed to support Micro, Small and Medium Enterprises (MSMEs).

Mr Idiong, who is a graduate of Federal University of Technology Owerri (FUTO) with Bachelor Degree in Environmental Science, emerged winner after competing with Ifeanyi Nkwonta, Chidinma Eriobu and Ifeoma Benjamin at the grand finale in Lagos.

Idiong’s entry on the show was amongst the 18,000 entries, followed by online auditions before the top 16 moved into the Titan House for 10 weeks to compete against top-notch young entrepreneurs in real-life entrepreneurial tasks.

They were grilled by a panel of judges who are technocrats with the perfect blend of entrepreneurial requisite skills comprising Kyari Bukar, co-founder/CEO of Trans-Sahara Investment; Lilian Olubi, CEO of Primera Africa Securities Ltd; Chris Parkes, Chairman/CEO of CPMS Africa and Tonye Cole, co-founder of Sahara Group.

The winner, who highly commended Heritage Bank for its continued supports to entrepreneurs and sponsorship of the Next Titan, said, “Heritage Bank is an amazing bank that has stood strong on this show. My love for Heritage Bank stems from the fact that this is my second time on this show but before I came in, I have learnt so much from the show.

“This means that Heritage Bank is truly affecting the lives and businesses of entrepreneurs positively, alongside the viewers. This is a bank that has differentiated itself from other banks in boosting the strength of SMES in Nigeria.”

Speaking at the grand finale, MD/CEO of Heritage Bank, Mr Ifie Sekibo, stated that the programme easily aligns with the primary focus of the management of Heritage Bank to promote every laudable entrepreneurial idea meant to broaden economic horizon of the country for the benefit of citizens and other residents of Nigeria.

Mr Sekibo who was represented by the Divisional Head, Corporate Communications, Mr Fela Ibidapo, further affirmed, “as a catalytic institution in the empowering of entrepreneurs in the MSME sector, Heritage Bank has continued to make relentless efforts in this space to empower entrepreneurs in Nigeria through championing several empowerment schemes like the HB Innovation Lab Accelerator programme (HB-LAB), Ynspyre Account, Youth Innovative Entrepreneurship Development Programme (YIEDP), Centre for Values in Leadership (CVL) on Young Entrepreneurship Business Training Programme (YEBTP), Young Entrepreneurs and Students (YES) Grant and Nigerian Youth Professional Forum (NYPF), Big Brother Nigeria, Lagos Comic Con, amongst others.”

The Executive Producer of The Next Titan, Mr Mide Kunle-Akinlaja, in his address explained that the project was created and designed as a deliberate attempt to provoke the spirit of entrepreneurship of young Nigerians, not only the contestants on the show but another multitude of aspiring entrepreneurs who can watch the show on TV.

He said that Season 7 was designed to search for business ideas that are immune to any pandemic, innovations that break boundaries and technologies that can survive any lockdown.

“It does not matter what your business idea is all about or its focus, but you must be able to prove that your business has what it takes in terms of ideas or technologies to survive any future pandemic or lockdown,” he said.

Economy

Six Price Gainers Rally OTC Securities Exchange by 2.09%

By Adedapo Adesanya

Six price gainers lifted the NASD Over-the-Counter (OTC) Securities Exchange by 2.09 per cent on Monday, February 9, amid a surge in activity level.

According to data, the volume of securities significantly increased by 3,499.1 per cent to 13.3 million units from the 384,784 units recorded in the preceding trading session, as the value of securities soared by 518.0 per cent to N99.3 million from N16.1 million, and the number of deals moved up by 95.8 per cent to 47 deals from the preceding session’s 24 deals.

Central Securities Clearing System (CSCS) Plc ended the day as the most active stock by value on a year-to-date basis with 16.9 million units exchanged for N699.9 million, followed by Geo-Fluids Plc with 23.2 million units valued at N123.6 million, and FrieslandCampina Wamco Nigeria Plc with 1.8 million units traded for N118.5 million.

However, Geo-Fluids Plc became the most traded stock by volume on a year-to-date basis, with 23.2 million units worth N123.6 million, as CSCS Plc was pushed down the pecking order as second with 16.9 million units transacted for N699.9 million, while Mass Telecom Innovation Plc sold 15.1 million units for N6.1 million.

The price gainers were led yesterday by Okitipupa Plc after it gained N17.00 to trade at N237.00 per share versus the previous price of N220.00 per share, FrieslandCampina Wamco Nigeria Plc added N6.00 to sell at N66.00 per unit versus N60.00 per unit, and CSCS Plc grew by N5.35 to N58.85 per share from N53.50 per share.

Further, IPWA Plc appreciated by 23 Kobo to N2.59 per unit from N2.36 per unit, UBN Property Plc increased its value by 19 Kobo to N2.19 per share from N2.00 per share, and Industrial and General Insurance (IGI) Plc advanced by 5 Kobo to 59 Kobo per unit from 54 Kobo per unit.

However, Nipco Plc lost N9.00 on Monday to close at N250.00 per share versus last Friday’s price of N259.00 per share, and Geo-Fluids Plc dipped by 22 Kobo to N4.08 per unit from N4.30 per unit.

At the close of business, the market capitalisation of the bourse was up by N46.2 billion to N2.253 trillion from N2.207 trillion, and the NASD Unlisted Security Index (NSI) jumped 77.22 points to 3,766.94 points from 3,689.72 points.

Economy

Naira Trades N1,354 Per Dollar at NAFEX

By Adedapo Adesanya

The first trading of the week at the Nigerian Autonomous Foreign Exchange Market (NAFEX) ended bullish for the Naira as it gained N11.93 or 0.87 per cent against the US Dollar on Monday, February 9, to trade at N1,354.26/$1 compared with the previous day’s N1,366.19/$1.

It also appreciated against the Pound Sterling in the official market during the session by N12.03 to settle at N1,845.72/£1 versus last Friday’s closing price of N1,857.75/£1, but depreciated against the Euro by 69 Kobo to quote at N1,613.19/€1, in contrast to the N1,612.52/€1 it was exchanged last Friday.

At the GTBank forex desk, the Nigerian Naira appreciated against the Dollar yesterday by N4 to close at N1,379/$1 versus the previous rate of N1,383/$1, and at the parallel market, it was flat at N1,450/$1.

The fortification of the Nigerian currency in the currency market on Monday was driven by forex liquidity, strong oil receipts, and flows from foreign investors attracted by the high yields on the country’s debt market.

Speaking at a forum on Monday, the Governor of the Central Bank of Nigeria (CBN), Mr Yemi Cardoso, declared that the bank’s reforms have established economic stability, evidenced by a significant reduction in inflation and growing external reserves, which he stated stood at $49 billion as of February 5, 2026.

He also highlighted the stability of the FX market, noting that the CBN is now accumulating foreign exchange from the market to enhance sustainability.

“By that, I mean that we now allow the market to generally find its level; many times, the Central Bank itself goes in to buy foreign exchange. The premium between the official and parallel market rates has collapsed to under 2 per cent,” Mr Cardoso stated.

The CBN chief said the reforms of the monetary authority—anchored on disinflation, FX market normalisation, and financial-system resilience—are already strengthening real-sector confidence.

As for the cryptocurrency market, it was in a recovery mode as investors took advantage of the drop in prices to add to their portfolios.

The pullback followed a turbulent few days in which Bitcoin (BTC) plunged to as low as $60,000 before rebounding. It rose 0.5 per cent on Monday to $70,415.57, as Ethereum (ETH) gained 0.9 per cent to trade at $2,116.42.

Further, Ripple (XRP) improved by 1.4 per cent to $1.44, Litecoin (LTC) expanded by 0.8 per cent to $54.66, Solana (SOL) grew by 0.5 per cent to $87.11, and Cardano (ADA) added 0.2 per cent to settle at $0.2704.

On the flip side, Binance Coin (BNB) slumped 0.6 per cent to $638.34, and Dogecoin (DOGE) weakened by 0.3 per cent to $0.0963, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) remained unchanged at $1.00 apiece.

Economy

Crude Oil Soars as US Cautions Vessels Near Iran

By Adedapo Adesanya

Crude oil gained more than 1 per cent on Monday after the United States issued an advisory to US-flagged vessels to stay as far as possible from Iranian territory while passing through the Strait of Hormuz and Gulf of Oman.

The price of Brent crude was up 99 cents or 1.5 per cent during the session to $69.04 a barrel, while the US West Texas Intermediate (WTI) crude rose 81 cents or 1.3 per cent to settle at $64.36 per barrel.

The US Department of Transportation (DOT) Maritime Administration yesterday noted that vessels going through the Strait of Hormuz and Gulf of Oman have historically faced the risk of being boarded by Iranian forces, including as recently as February 3.

The agency advised U.S.-flagged ships to stay close to Oman while eastbound in the Strait of Hormuz.

The move renewed concerns that tensions between the US and Iran could lead to oil supply disruptions. About a fifth of the oil consumed globally passes through the Strait of Hormuz between Oman and Iran.

US President Donald Trump has threatened to attack, citing possible executions of protesters, and saying “help is on its way.” He ordered the USS Abraham Lincoln aircraft carrier and a flotilla of accompanying ships to the region.

In June, the US attacked Iranian nuclear facilities at the end of a 12-day Israeli bombing campaign.

Iran’s foreign minister said on Saturday the country will strike US bases in the Middle East if attacked by American forces, which have built up their naval presence in the region.

Investors were also monitoring efforts by Western governments to curb Russia’s income from oil exports that support its war in Ukraine.

The European Commission has proposed a sweeping ban on any services that support Russia’s seaborne crude oil exports, in fresh efforts to reduce revenues that help Russia’s war against Ukraine.

Refiners in India, once the biggest buyer of Russian crude, are avoiding purchases for delivery in April. Market analysts noted that if India fully stopped purchasing this crude, it would boost oil prices.

Meanwhile, Tengiz oilfield in Kazakhstan has returned 60 per cent of its peak production and was pumping at a rate of 550,000 barrels per day as of Sunday, following a forced shutdown for half of January due to a fire.

Tengiz, which is operated by a consortium led by US supermajor Chevron, is expected to reach peak levels of oil output of about 950,000 barrels per day by February 23.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn