General

Experts to Discuss Tech, Digital Transformation at MSME Dialogue 3.0

By Modupe Gbadeyanka

On Saturday, April 24, 2021, experts in the Micro, Small and Medium Enterprises (MSMEs) sector will gather again for MSME Dialogue 3.0 at 10am.

The event, organised by MSME Africa, will give participants the opportunity to have robust insights on the theme Powering MSMEs with Technology and Digital Transformation, with registration required before the webinar via http://bit.ly/MSMEDIALOGUE3.

“Every business owner who is serious with their business would agree with me that technology and digital transformation are important factors for business growth and success.

“We all can’t all run or won tech startups but we can always drive our businesses and operations with technology and digital tools,” the convener and founder of MSME Africa, Mr Seye Olurotimi, stated.

He added that, “Tech-driven businesses are making waves and turning in almost unbelievable results against all odds.

“Businesses who have embraced technology, automation and digital transformation are enjoying unquantifiable advantages.

“It is because of this that I am calling on business owners and managers to join us at the 3rd Edition of MSME Dialogue, on Saturday as we bring in experts to provide insights on this theme.”

Business Post gathered the speakers confirmed for the programme include Akeem Lawal, Divisional CEO, Interswitch Group, Rex Mafiana: CEO, FPG Technologies, Fatma Nasujo, Global Head of Operational Excellence at Sokowatch, Kenya, David Lanre Messan, CEO, FirstFounders, Bisoye Coker, CEO/Co-founder, Kiakia FX. The session will be moderated by Solape Akinpelu: CEO/Founder, HerVest.

MSME Dialogue, which holds every quarter, seeks to address, burning and relevant issues about entrepreneurship and running a small business as well as proffering solutions to those issues.

The event aims to provide the right knowledge and know-how for MSMEs, entrepreneurs, and start-ups to enable them to grow and thrive and features subject matter experts, seasoned entrepreneurs, professionals, and players within the MSME ecosystem.

MSME Africa is a multi-faceted resource platform for MSMEs in Africa providing capacity development, news, opportunities, business articles and other resources for MSMEs, entrepreneurs, and start-ups.

General

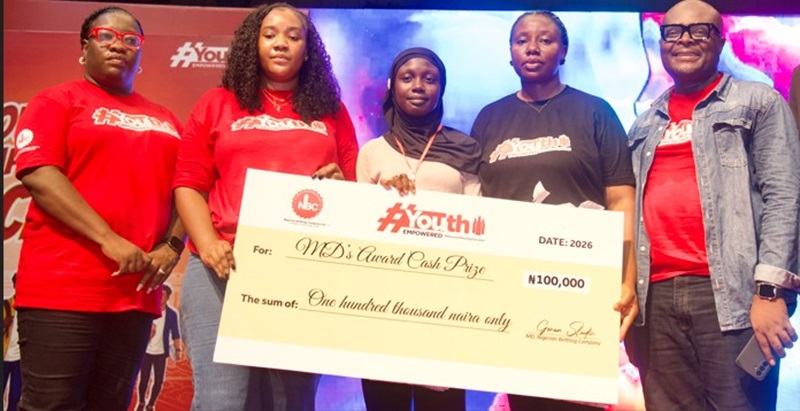

Nigerian Bottling Company Bridges Education, Employability Gap

By Modupe Gbadeyanka

The Nigerian Bottling Company (NBC) has reaffirmed its determination to bridge the gap between education and employability in the country by sustaining its flagship Youth Empowered (YE) programme.

This initiative provides hands-on learning, real-world insights, and access to career-shaping opportunities to young Nigerians.

The 2026 edition of the scheme commenced on February 2 at the University of Lagos (UNILAG), with participants mainly young people between the ages of 16 and 35.

A statement from the organisation said this year’s rollout will expand to more tertiary institutions, including the Federal University of Technology, Akure (FUTA). This follows a successful 2025 tour that reached seven cities across the country, including Makurdi, Jos, Benin, Kaduna, Asaba, Akure, and Port Harcourt.

Participants in the 2026 programme will receive training across key modules designed to support personal, professional, and business growth, including Business Life Skills, Adaptability and Resilience, Financial Literacy, Customer Service and Communication, Sales and Negotiation Skills, and Workplace Ethics.

The sessions will also feature breakout workshops on Business Planning, Project Management, and Time Management, alongside the Director’s Grant Pitch Competition, where participants can pitch their ideas for a chance to win business funding.

In addition to skills development, NBC’s People and Culture team will be present throughout the programme to identify outstanding talent for future opportunities within the organisation, further strengthening the connection between learning, employment, and long-term career growth.

One of the participants at the UNILAG training, Waliat Adedogun, who received a cash grant through the Director’s Grant Pitch Competition to support her small business, said: “Youth Empowered gave me more than training; it gave me clarity and confidence. Winning the grant means I can finally take my business idea from a dream into something real. I now feel prepared to build, grow, and create opportunities not just for myself, but for others too.”

Since its launch in 2017, the scheme has impacted more than 70,000 young Nigerians, equipping participants with practical skills, confidence, and exposure needed to succeed in today’s dynamic workplace and entrepreneurial landscape.

This year’s programme is being delivered in collaboration with Fate Foundation as the implementing partner, with funding support from The Coca-Cola HBC Foundation.

Last year, 10 beneficiaries were selected for six-month paid internships across NBC locations in Lagos, Ibadan, Asejire, and Challawa, gaining direct industry exposure.

Additionally, three outstanding participants received sponsorship for an all-expenses-paid intensive culinary training programme and were awarded N1 million each to support the launch of their businesses.

General

INEC Fixes February 20 for 2027 Presidential, NASS Elections

By Modupe Gbadeyanka

The 2027 presidential and National Assembly elections will take place on Saturday, February 20, the Independent National Electoral Commission (INEC) has revealed.

In a notice for the 2027 general polls issued on Friday, the electoral umpire also disclosed that the governorship and state assembly elections for next year would be on Saturday, March 6.

Speaking at a news briefing in Abuja today, the chairman of INEC, Mr Joash Amupitan, expressed the readiness of the commission to conduct the polls next year, which is 12 months away.

The timetable issued by the organisation for the polls comes when the federal parliament has yet to transmit the amended electoral bill to President Bola Tinubu for assent.

This week, the Senate passed the electoral bill, reducing the notice of elections from 360 days to 180 days, while the transmission of results was mandated with a proviso.

Recall that on February 4, INEC said it was ready to go ahead with preparations for the elections despite the delay in the passage of the amended electoral law of 2022.

General

NGIC Pipeline Network to Experience 4-Day Gas Supply Shortage

By Modupe Gbadeyanka

The pipeline network of the NNPC Gas Infrastructure Company Limited (NGIC) will witness a temporary reduction in gas supply for four days.

This information was revealed by the Chief Corporate Communications Officer of the Nigerian National Petroleum Company (NNPC) Limited, Mr Andy Odeh, in a statement on Thursday night.

A key supplier of gas into the NGIC pipeline network is Seplat Energy Plc, a joint venture partner of the state-owned oil agency.

It was disclosed that the facility would undergo routine maintenance from Thursday. February 12 to Sunday, February 15, 2026.

The NNPC stated that, “This planned activity forms part of standard industry safety and asset integrity protocols designed to ensure the continued reliability, efficiency, and safe operation of critical gas infrastructure.”

“Periodic maintenance of this nature is essential to sustain optimal system performance, strengthen operational resilience, and minimise the risk of unplanned outages,” it added.

“During the four-day maintenance period, there will be a temporary reduction in gas supply into the NGIC pipeline network. As a result, some power generation companies reliant on this supply may experience reduced gas availability, which could modestly impact electricity generation levels within the timeframe.

“NNPC Ltd and Seplat Energy are working closely to ensure that the maintenance is executed safely and completed as scheduled. In parallel, NNPC Gas Marketing Limited (NGML) is engaging alternative gas suppliers to mitigate anticipated supply gaps and maintain stability across the network,” the statement further said.

“Upon completion of the maintenance exercise, full gas supply into the NGIC system is expected to resume promptly, enabling affected power generation companies to return to normal operations,” it concluded.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn