Banking

Banks Involved in 70% of Economic Crimes in Nigeria—EFCC

By Aduragbemi Omiyale

Nearly 70 per cent of financial crimes in Nigeria have the involvement of banks, the Economic and Financial Crimes Commission (EFCC) has claimed.

“Broadly speaking, banking fraud in Nigeria is both inside and outside related.

“The inside related fraud comprises outright selling of customers’ deposits, authorising loan facilities, forgery and several other kinds of unhealthy and criminal practices,” the chairman of EFCC, Mr Ola Olukoyede, said while speaking at the Annual Retreat and General Meeting of the Association of Chief Audit Executives of Banks in Nigeria held in Abuja.

The EFCC boss, represented by the agency’s Director of Internal Audit, Mr Idowu Apejoye, feared that the banking sector was becoming notorious for fraudulent activities, noting that something must be urgently done to change this.

He said, “The outsider-related frauds in the sector include hacking, ATM fraud, and conspiracy, among others,” noting that more worrisome is the collaboration between “bankers and the outsiders.”

“That one is the one that is absurd because when you do that, that means you are selling out the system.

“It is estimated that about 70 per cent of financial crimes in Nigeria are traceable to the banking sector, this scenario is disturbing and unacceptable,” Mr Olukoyede stated.

He emphasised the importance of collaborative actions from relevant authorities and industry professionals, particularly audit executives, to proactively address and combat fraudulent activities within the sector.

Banking

EFCC Arraigns Two FSDH Merchant Bank Employees

By Modupe Gbadeyanka

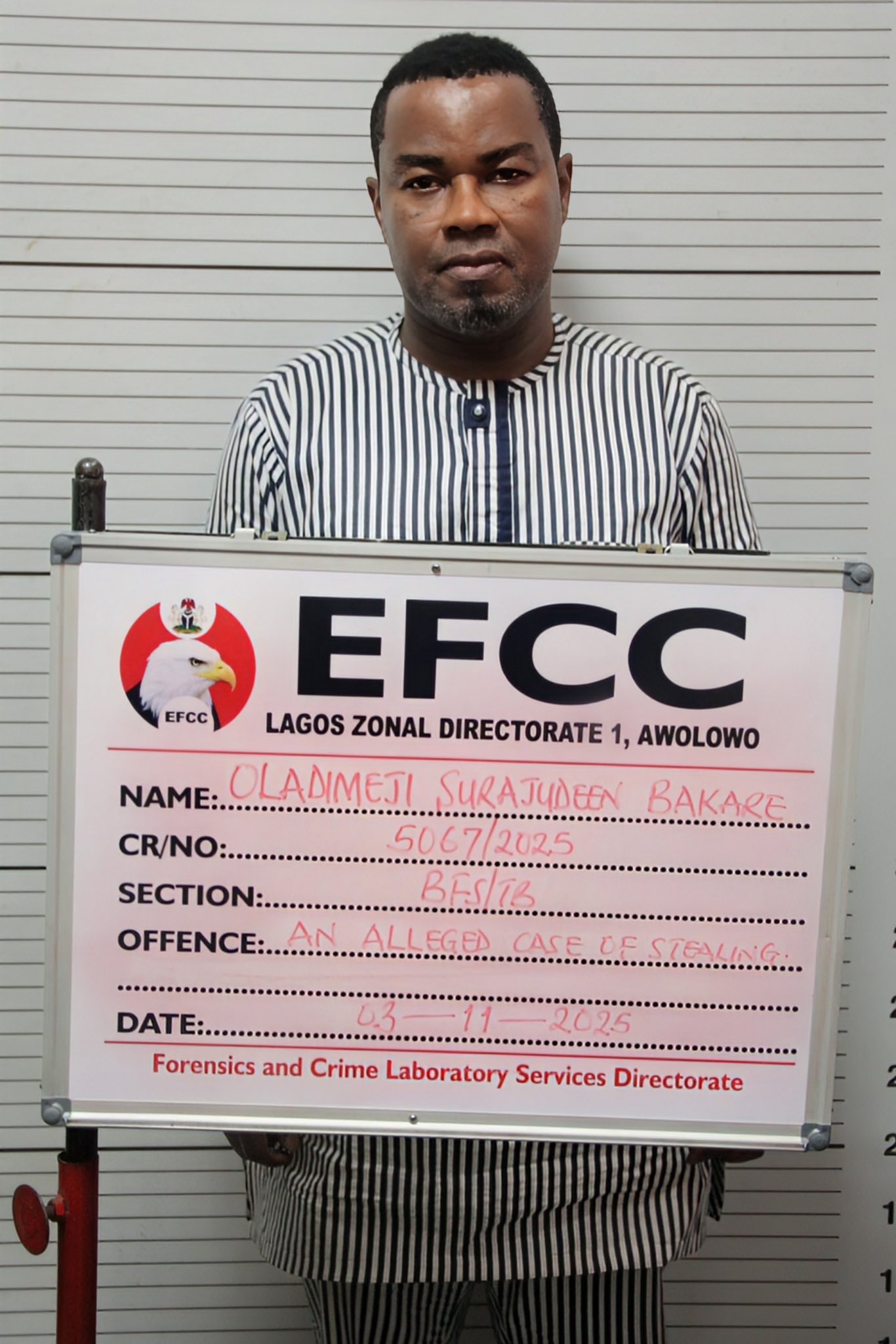

Two employees of FSDH Merchant Bank Limited, Mr Bakare Oladimeji Surajudeen and Mr James Olukayode Imokwede, have been arraigned by the Economic and Financial Crimes Commission (EFCC).

The suspects were brought before Justice Ismaila Ijelu of the Lagos State High Court sitting in Ikeja on Tuesday, March 3, 2026.

They were accused of stealing and retaining stolen property valued at about $306,667.81 and €50,250.

The EFCC, which received a petition from the lender, said its investigations showed that the suspects processed fraudulent transfers through the SWIFT platform to third parties.

The bank said an internal audit uncovered unauthorised debits totalling $306,667.81 and €50,250, equivalent to N527.4 million from its Letters of Credit (LC) payable accounts.

At the court yesterday, after the defendants pleaded “not guilty” to all 10-count charges preferred against them, the prosecution counsel, H. U. Kofarnaisa, asked for a trial date and also prayed that the defendants be remanded in a correctional facility pending trial.

Counsel to the first and second defendants, Oluwaseun Akintunde and Olajide S. Onasanya, informed the court that bail applications had been filed on behalf of the defendants and also urged the court to grant them bail on liberal terms.

They also prayed that the defendants be remanded in the EFCC custody pending the perfection of their bail conditions.

The prosecution counsel, however, opposed the prayers of the defence seeking the remand of the defendants in the EFCC custody, saying that “the EFCC detention facilities are overstretched.”

After listening to both parties, Justice Ijelu granted the defendants bail in the sum of N2 million each, with two sureties in like sum.

The court ordered that one of the sureties must be a relative who is gainfully employed. The sureties must provide evidence of tax payment in the last three years and must show proof of livelihood, with their residences verified.

The defendants were ordered to deposit their international passports with the court, and must not travel outside the country without the leave of the court.

The judge subsequently remanded the defendants in a correctional facility pending the perfection of their bail conditions, and adjourned the matter till March 25, 2026, for the commencement of trial.

Business Post reports that one of the counts said, “That you, Bakare Oladimeji Surajudeen and James Olukayode Imokwede, sometime in 2021 in Lagos within the jurisdiction of this court, dishonestly took the sum of N527,406,916.66, property of FSDH Merchant Bank Limited.”

Banking

Deriv Taps PawaPay to Expand Mobile Money Deposits Across Africa

By Adedapo Adesanya

Leading pan-African payments aggregator, PawaPay, has partnered with Deriv to support mobile money deposits across multiple African markets, with plans to expand further.

According to a statement on Tuesday, the integration gives Deriv users access to local payment methods through a single, compliant connection to major mobile operators.

The partnership, launched in 2025, currently supports mobile money deposits across eight African countries, with connectivity to major mobile money operators.

Deriv selected PawaPay to support its African expansion strategy in order to deliver mobile money without sacrificing localisation or reliability as volumes grow.

Since launching with PawaPay, Deriv has seen a measurable increase in mobile money deposits across the live markets. Coordinated launch and education campaigns accelerated adoption, while the underlying reliability of the integration meant fewer failed transactions and more predictable settlement, factors that directly affect whether a payment product succeeds in practice.

PawaPay connects businesses to local payment methods, including mobile money across 20 African markets, handling payment processing, settlement, FX, and reconciliation for global platforms operating at scale.

Through the partnership, Deriv users are able to fund their accounts using mobile money wallets they already use day to day. For platforms operating across African markets, mobile money is a primary way customers transact, and offering it reliably requires local operator connectivity, regulatory alignment, and the ability to manage payments consistently across markets.

PawaPay supports Deriv through a single integration that provides operator connectivity, compliance support, and settlement across the markets live today. This includes hands-on support during periods of network instability, so issues can be addressed before they impact users. The setup is designed to support high-volume payment flows as usage grows.

“Mobile money is already deeply embedded in how people transact across Africa,” said Mr Nikolai Barnwell, CEO at PawaPay. “The real challenge for companies expanding across multiple markets is running it reliably once volumes grow. Our role is to make sure payments remain predictable, so platforms like Deriv can focus on their customers rather than managing operational detail.”

On his part, Mr Derek Swift, Head of Client Funding Facilities at Deriv, said, “Our partnership with PawaPay is central to Deriv’s expansion across Africa. Their platform performs reliably in markets where payment infrastructure requires real local expertise, and their team operates with the kind of responsiveness that matters when you’re serving clients across multiple jurisdictions. This partnership has opened markets that simply weren’t accessible to us before.”

Banking

CIBN to Back ACAMB on Professional Development, Industry Advocacy

By Modupe Gbadeyanka

The Chartered Institute of Bankers of Nigeria (CIBN) has promised to support the ambitious plans of the Association of Corporate and Marketing Professionals in Banks (ACAMB).

At a meeting between the leaderships of the two organisations on Tuesday, the president of CIBN, Professor Pius Deji Olanrewaju, said it was impressed with the capability development and the undergraduate mentorship schemes of ACAMB under its leader, Mr Jide Sipe.

The CIBN chief commended the forward-thinking vision of the group, saying it had raised standards across Nigeria’s banking sector.

“ACAMB’s support has given CIBN and the banking sector brand equity,” he said, praising the association’s record in reputation management. recalling ACAMB’s role in addressing crises within the sector, describing the partnership as strategic and beneficial.

He further pledged support for ACAMB’s 30th anniversary in September 2026, its AGM, and other programmes, including fundraising initiatives.

“I want to assure you that everything you have presented today has been clearly noted and will be acted upon.

“We are fully committed to working closely with you so as to translate these discussions and vision into measurable progress. Our shared goal is to strengthen the sector, protect its reputation, and enhance its public image in a meaningful and lasting way.

“This meeting discussed various initiatives and reforms crucial for the future of our industry, including the need for continuous training and adaptation to new programs,” Mr Olanrewaju stated.

Speaking at the meeting, the president of ACAMB described the visit as a crucial first step in his tenure, aimed at contributing significantly to giving flight to his vision and that of ACAMB.

“When we assumed office, one of the first things we agreed on was the need to visit key stakeholders.

“However, before reaching out more broadly, we felt it was important to begin with our primary constituency and core stakeholders. We want them to understand the direction we are taking and to support the work we are doing, so that ACAMB can achieve greater success than it has in the past.

“We couldn’t have properly started our tenure without this very important meeting with the CIBN,” Mr Sipe stated

He introduced the newly constituted ACAMB Exco, which includes the 2nd Vice President, Morolake Phillip-Ladipo; General Secretary, Olugbenga Owootomo; Assistant General Secretary, Ademola Adeshola; Publicity Secretary, Abiodun Coker; and Executive Secretary, Fadekemi Ajakaiye.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn