Banking

Ecobank Retains ‘Best Retail Bank in Nigeria’ Award

By Aduragbemi Omiyale

For the second straight year, Ecobank Nigeria has won the Best Retail Bank in Nigeria award, beating other notable financial institutions in the country to reclaim the prize.

The award was issued by the Asian Banker at the Middle East and Africa Regional 2021 awards ceremony held recently in Johannesburg, South Africa.

The Asian Banker Excellence in Retail Financial Services and Technology Innovation Award is acclaimed as the most rigorous, prestigious and transparent country level award programme for consumer financial services and technology in Middle East & Africa.

The awards committee assesses banks and non-banks in Middle East & Africa on a product and business level through a comprehensive evaluation process based on criteria and scorecards on world-class standards of what the retail banking proposition and technology proposition should be.

The Managing Director, Regional Executive, Ecobank Nigeria, Mr Patrick Akinwuntan, while commenting on the award, stated that, “The fact that the bank is winning this award for the second time shows that we have come to stay in terms of delivering world-class and diverse financial services in Nigeria and to a greater number of Africans across the continent.

“We understand their needs, forecast opportunities in the market and making our digital platforms available to be leveraged to achieve the highest potentials.

“Ecobank’s platform is unique for all types of retail transactions, especially account opening, bills payment, airtime purchase and third party transfers.

“We have ATMs spread across the country while our agency network reaches every community in order to provide basic financial services and support for every Nigerian. We have built an ecosystem that brings affordable financial services – payments and collections to every African.”

Mr Akinwuntan reiterated that the award is worthy recognition of Ecobank’s digital transformation landmark initiatives whereby “we can make payments into more accounts and wallets than any other bank in Africa.”

He also commended the Asian Banker Awards’ Team for creating an opportunity to celebrate innovative ideas by members of the banking community, assuring that Ecobank will continue to deploy its robust digital platforms and enhance customer experience at every touchpoint.

On his part, the Chairman of The Asian Banker, Mr Emmanuel Daniel, congratulated Ecobank and other winners of the prestigious awards in the various categories, stating that the process for selection was rigorous, transparent and conducted with the highest level of integrity.

Ecobank Nigeria Limited is a subsidiary of the Ecobank Group, the leading pan-African banking group with operations in 33 African countries and an international presence in four locations (London, Paris, Beijing, and Dubai).

The lender is a full-service bank providing wholesale, retail, investment and transaction banking services and products to governments, financial institutions, multinationals, international organizations, medium, small, and micro businesses, and individuals.

Ecobank is a major player in the distribution of financial services in Nigeria, leveraging digital platforms including Ecobank Mobile App and USSD *326#, Ecobank Online, Ecobank OmniPlus, Ecobank Omnilite, EcobankPay, Ecobank RapidTransfer, ATMs, POSs and an extensive distribution network of over 250 branches and about 30,000 agency banking locations.

Banking

CIBN to Back ACAMB on Professional Development, Industry Advocacy

By Modupe Gbadeyanka

The Chartered Institute of Bankers of Nigeria (CIBN) has promised to support the ambitious plans of the Association of Corporate and Marketing Professionals in Banks (ACAMB).

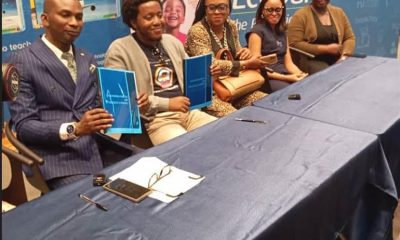

At a meeting between the leaderships of the two organisations on Tuesday, the president of CIBN, Professor Pius Deji Olanrewaju, said it was impressed with the capability development and the undergraduate mentorship schemes of ACAMB under its leader, Mr Jide Sipe.

The CIBN chief commended the forward-thinking vision of the group, saying it had raised standards across Nigeria’s banking sector.

“ACAMB’s support has given CIBN and the banking sector brand equity,” he said, praising the association’s record in reputation management. recalling ACAMB’s role in addressing crises within the sector, describing the partnership as strategic and beneficial.

He further pledged support for ACAMB’s 30th anniversary in September 2026, its AGM, and other programmes, including fundraising initiatives.

“I want to assure you that everything you have presented today has been clearly noted and will be acted upon.

“We are fully committed to working closely with you so as to translate these discussions and vision into measurable progress. Our shared goal is to strengthen the sector, protect its reputation, and enhance its public image in a meaningful and lasting way.

“This meeting discussed various initiatives and reforms crucial for the future of our industry, including the need for continuous training and adaptation to new programs,” Mr Olanrewaju stated.

Speaking at the meeting, the president of ACAMB described the visit as a crucial first step in his tenure, aimed at contributing significantly to giving flight to his vision and that of ACAMB.

“When we assumed office, one of the first things we agreed on was the need to visit key stakeholders.

“However, before reaching out more broadly, we felt it was important to begin with our primary constituency and core stakeholders. We want them to understand the direction we are taking and to support the work we are doing, so that ACAMB can achieve greater success than it has in the past.

“We couldn’t have properly started our tenure without this very important meeting with the CIBN,” Mr Sipe stated

He introduced the newly constituted ACAMB Exco, which includes the 2nd Vice President, Morolake Phillip-Ladipo; General Secretary, Olugbenga Owootomo; Assistant General Secretary, Ademola Adeshola; Publicity Secretary, Abiodun Coker; and Executive Secretary, Fadekemi Ajakaiye.

Banking

All Set for Second HerFidelity Apprenticeship Programme

By Modupe Gbadeyanka

Registration for the second HerFidelity Apprenticeship Programme (HAP 2.0) organised by Fidelity Bank Plc has commenced.

The Divisional Head of Product Development at Fidelity Bank, Mr Osita Ede, informed newsmen that the initiative was designed to empower women with sustainable entrepreneurship skills.

The lender created the flagship women-empowerment initiative to equip women with practical, income‑generating skills and structured pathways to entrepreneurship.

“HerFidelity Apprenticeship Programme 2.0 reflects our commitment to continuous improvement. Having evaluated feedback from the first edition, we have returned with stronger partnerships and deeper mentorship programmes to ensure that women acquire not just skills, but sustainable economic opportunities,” he said.

“At the heart of the programme is guided, real‑world learning. Participants will undergo intensive apprenticeship training under reputable institutions and industry experts across select fields such as hair styling, shoe making, auto mechatronics, and interior decoration,” Mr Ede added.

He noted that HerFidelity Apprenticeship Programme 2.0 goes beyond skills acquisition by offering participants a wide range of business advisory services. These include business and financial literacy training, mentorship support throughout the apprenticeship journey, access to Fidelity Bank’s women‑focused and SME financial solutions, as well as guidance on business formalisation and growth strategies.

Further emphasising the bank’s vision, Mr Ede said, “By integrating structured mentorship with entrepreneurial development, Fidelity Bank is positioning women not just as trainees, but as future employers, innovators, and economic contributors within their communities. This aligns with our mandate to help individuals grow, businesses thrive, and economies prosper.”

Banking

The Alternative Bank Opens New Branch in Ondo

By Modupe Gbadeyanka

A new branch of The Alternative Bank (AltBank) has been opened in Ondo State as part of the expansion drive of the financial institution.

A statement from the company disclosed that the new branch would support export-oriented agribusinesses through Letters of Credit and commodity-backed trade finance, ensuring that local producers can scale beyond state borders.

For SMEs, the bank is introducing robust payment rails, asset financing for equipment and inventory, and supply chain-backed facilities that strengthen working capital without trapping businesses in interest-based debt cycles.

The Governor of Ondo State, Mr Lucky Aiyedatiwa, represented by his Chief of

Staff, Mr Olusegun Omojuwa, at the commissioning of the branch, underscored the importance of financial institutions in economic development.

“The pivotal role of financial institutions to economic growth and development of any economy cannot be overemphasised. It provides access to capital, supporting small and medium-scale enterprises and encouraging savings.

“Therefore, I have no doubt in my mind that the presence of The Alternative Bank in Ondo State will deepen financial services, create employment opportunities and stimulate economic activities across various sectors,” he said.

In her remarks, the Executive Director for Commercial and Institutional Banking (Lagos and South West) at The Alternative Bank, Mrs Korede Demola-Adeniyi, commended the state government’s leadership and outlined the lender’s long-term vision for Ondo State.

“As Ondo State steps into its next fifty years, and into the future anchored on the sustainable development championed during the recent anniversary celebrations, The Alternative Bank is here to be the financial engine for that vision. We didn’t come to Akure to hang banners. We came to fund work, farms, shops, and factories.”

With Ondo State’s economy anchored largely on agriculture, particularly cocoa production, poultry farming, and other cash crops, alongside a growing SME and trade ecosystem, AltBank is deploying sector-specific financing solutions tailored to these strengths.

For cocoa aggregators, processors and poultry operators, the bank will provide production financing, facility expansion support, machinery lease structures, and structured trade facilities under its joint venture and cost-plus financing models, with transaction cycles of up to 180 days for commodity trades and longer-term structured asset financing for equipment and infrastructure.

The organisation is a notable national non-interest bank with a physical network now surpassing 170 locations, deploying capital to solve real-world challenges through initiatives such as the Mata Zalla project, which saw to the training of hundreds of women as electric tricycle drivers and mechanics.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn