Economy

Again, NGX All-Share Index Crosses 52,000 points as 40 Stocks Appreciate

By Dipo Olowookere

Investors are beginning to have confidence in the domestic stock market as the Nigerian Exchange (NGX) Limited appreciated by 0.95 per cent on Wednesday.

Business Post reports that 40 equities finished on the gainers’ chart during the trading session, while seven shares were on the losers’ table, indicating a positive market breadth and a bullish investor sentiment.

This helped push the All-Share Index (ASI) above 52,000 points after it increased by 491.13 points to 52,097.62 points from 51,606.49 points, as the market capitalisation grew by N267 billion to N28.367 trillion from N28.100 trillion.

Academy Press and Livestock Feeds gained 10.00 per cent each to finish at N1.43 and N1.10, respectively, as Total Energy grew by 9.96 per cent to N217.50, Cadbury Nigeria appreciated by 9.80 per cent to N11.20 and Honeywell Flour rose by 9.80 per cent to N2.80.

Conversely, Fidelity Bank lost 6.57 per cent to trade at N5.26, Fidson fell by 5.56 per cent to N8.50, Linkage Assurance depreciated by 4.35 per cent to 44 Kobo, AXA Mansard depleted by 3.28 per cent to N2.36, and Jaiz Bank went down by 3.26 per cent to 89 Kobo.

Transcorp topped the activity chart with the sale of 6.1 billion stocks valued at N15.6 billion, Aluminium Extrusion sold 112.5 million shares valued at N731.5 million, Access Holdings transacted 60.5 million equities worth N632.3 million, UBA traded 27.6 million shares valued at N218.0 million, and Fidelity Bank sold 22.3 million stocks for N123.6 million.

A total of 6.5 billion equities valued at N19.5 billion were transacted in 5,109 deals in the midweek session, in contrast to the 2.1 billion equities worth N8.9 billion transacted in 6,404 deals on Tuesday, implying a decline in the number of deals by 20.22 per cent, and a surge in the trading volume and value by 209.52 per cent and 119.10 per cent, respectively.

Analysis of the sectorial performance did not really reflect the outcome of the bourse yesterday as the consumer goods, energy, and banking sectors depreciated by 0.13 per cent, 0.12 per cent, and 0.08 per cent apiece, while the insurance and the industrial goods indices appreciated by 0.93 per cent and 0.16 per cent, respectively.

Economy

NNPC Targets 230% LPG Supply Surge to 5MTPA Under Gas Master Plan 2026

By Adedapo Adesanya

The Nigerian National Petroleum Company (NNPC) Limited has said the Gas Master Plan 2026 targets over 230 per cent scale-up of Liquefied Petroleum Gas (LPG) supply from 1.5 million tonnes per annum (MTPA) to 5 MTPA this year.

The Executive Vice President for Gas, Power and New Energy at NNPC, Mr Olalekan Ogunleye, unveiled the strategic direction of the NNPC Gas Master Plan 2026, outlining an aggressive expansion drive to position Nigeria as a regional and global gas powerhouse.

Mr Ogunleye delivered the keynote address at the 2026 Lagos Energy Week, organised by the Society of Petroleum Engineers (SPE), where he detailed plans to accelerate gas development, deepen infrastructure and significantly scale domestic supply.

According to him, the Gas Master Plan targets a scale-up of LPG or cooking gas supply from 1.5 MTPA to 5 MTPA, alongside expanded feedstock for Mini-LNG and Compressed Natural Gas (CNG) projects.

“The NNPC Gas Master Plan 2026 is a blueprint to unlock Nigeria’s vast gas potential and translate it into tangible economic value,” Mr Ogunleye said.

He added that the strategy would also drive exponential growth in Gas-Based Industries, GBIs, strengthening local manufacturing, fertiliser production and power generation.

“Our renewed focus is on turning abundant gas resources into inclusive economic growth and improved quality of life for Nigerians,” he stated.

Mr Ogunleye said the plan aligns with the Federal Government’s Decade of Gas initiative and the presidential production targets of achieving 10 billion cubic feet per day by 2027 and 12 BCF/D by 2030.

Industry leaders at the event, including executives from Chevron Corporation, Esso Exploration and Production Nigeria Limited, Midwestern Oil and Gas Company Limited, Abuja Gas Processing Company and Shell Nigeria Gas, commended the plan and praised Ogunleye’s leadership in driving implementation excellence.

The new blueprint signals NNPC’s determination to anchor Nigeria’s energy transition on gas, leveraging infrastructure expansion and domestic utilisation to consolidate the country’s status as Africa’s largest gas reserve holder.

Economy

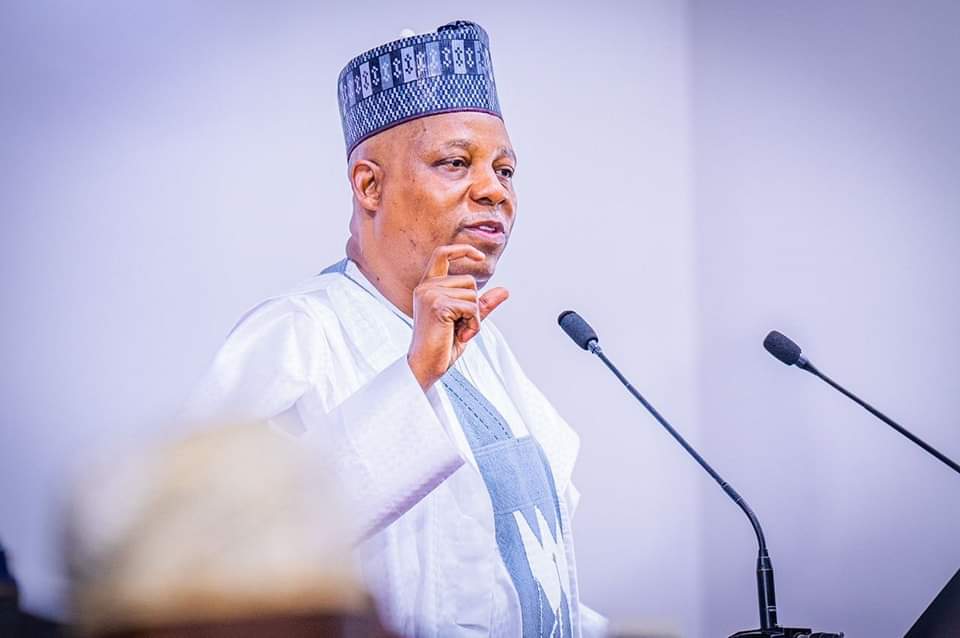

Shettima Blames CBN’s FX Intervention for Naira Depreciation

By Adedapo Adesanya

Vice President Kashim Shettima has attributed the Naira’s recent depreciation to the intervention of the Central Bank of Nigeria (CBN) in the foreign exchange (FX) market, stating that the currency could have strengthened to around N1,000 per Dollar within weeks if the apex bank had allowed market forces to prevail.

The local currency has dropped over N8.37 on the Dollar in the last week, as it closed at N1,355.37/$1 on Tuesday at the Nigerian Autonomous Foreign Exchange Market (NAFEM), after it went on a spree late last month and into the early weeks of February.

However, speaking on Tuesday at the Progressive Governors’ Forum (PGF), Renewed Hope Ambassadors Strategic Summit in Abuja, the Nigerian VP said the intervention was to ensure stability.

“In fact, if not for the interventions by the Central Bank of Nigeria yesterday, the 1,000 Naira to a Dollar we are going to attain in weeks, not in months. But for the purpose of market stability, the CBN generously intervened yesterday.

“So, for some of my friends, especially one of our party leaders who takes delight in stockpiling dollars, it is a wake-up call,” the vice president said.

He was alluding to CBN buying US Dollars from the market to slow down the rapid rise of the Naira.

Latest information showed that last week, the apex bank bought about $189.80 million to reduce excess Dollar supply and control how fast the Naira was gaining value.

The move was aimed at preventing foreign portfolio investors from exiting Nigeria’s fixed-income market, as large-scale sell-offs could heighten demand for US Dollars, intensify capital flight, and exert further pressure on the exchange rate.

Amid this, speaking after the 304th meeting of the monetary policy committee (MPC) of the CBN on Tuesday, Governor of the central bank, Mr Yemi Cardoso, said Nigeria’s gross external reserves have risen to $50.45 billion, the highest level in 13 years.

This strengthens the country’s foreign exchange buffers, enhances the apex bank’s capacity to defend the Naira when needed, and boosts investor confidence in the stability of the Nigerian FX market.

Economy

Dangote Refinery Exports 20 million Litres Surplus of PMS

By Aduragbemi Omiyale

Up to 20 million litres in surplus of Premium Motor Spirit (PMS), otherwise known as petrol, is being exported daily by the Dangote Petroleum Refinery and Petrochemicals after supplying about 65 million litres to the domestic market.

Nigeria’s average daily petrol consumption stands at between 50 and 60 million litres, indicating that the refinery’s output exceeds current domestic requirements, marking a decisive break from decades of fuel import dependence and recurrent scarcity.

The president of Dangote Group, Mr Aliko Dangote, speaking in Lagos, while confirming a structured offtake agreement with selected marketers to ensure nationwide distribution and eliminate supply instability, said the structured model was designed to eliminate supply bottlenecks and curb speculative practices that have historically triggered disruptions.

“We have agreed an offtake framework to supply up to 65 million litres daily for the domestic market. Any surplus, estimated at between 15 and 20 million litres, will be exported,” he said.

Under a revised distribution framework endorsed by the Nigerian Midstream and Downstream Petroleum Regulatory Authority, the refinery will channel nationwide supply through major marketing companies, including MRS Oil Nigeria Plc, Nigerian National Petroleum Company Limited Retail (NNPC), 11 plc (Mobil Producing Nigeria), TotalEnergies Marketing Nigeria Plc, Rainoil Limited, Northwest Petroleum & Gas Company Limited, Ardova Plc, Bovas & Company Limited, AA Rano Nigeria Limited, AYM Shafa Limited, Conoil and Masters Energy.

With local refining now exceeding national demand, the country stands to conserve billions of dollars annually in foreign exchange previously spent on petrol imports. Analysts say this would ease pressure on the naira, strengthen external reserves, and improve trade balance stability.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn