Economy

Asian Equities Rise as Commodity Prices Grow

By Investors Hub

Asian stocks ended broadly higher on Monday as commodity prices advanced, Chinese inflation data for September met expectations and finance ministers from around the world expressed their desire for lower interest rates at a weekend meeting of the International Monetary Fund.

US crude futures jumped to hover near a six-month high on concerns over potential renewed U.S. sanctions against Iran as well as conflict in Iraq. The dollar changed hands in the upper 111-yen zone, while gold prices eased on a firmer dollar.

Japanese shares hit a fresh 21-year high as the yen stayed flat against the dollar amid expectations that Shinzo Abe will win another majority in the House of Representatives election on October 22nd. The Nikkei 225 Index climbed 100.38 points or 0.5 percent to 21,255.56, the highest level since late 1996. The broader Topix Index closed 0.6 percent higher at 1,719.18.

Index heavyweight SoftBank Group rose 1.3 percent after reports it has reached a broad agreement to merge its U.S. unit Sprint with T-Mobile U.S.

Banks Mitsubishi UFJ Financial, Mizuho Financial Group and Sumitomo Mitsui Financial rose between 1.4 percent and 1.6 percent.

Australian shares rose notably, led by material stocks after base metals prices rallied broadly last week on the back of strong Chinese import data.

The benchmark S&P/ASX 200 Index advanced 32.60 points or 0.6 percent to a five-month high of 5,846.80, while the broader All Ordinaries Index ended 32.50 points or 0.6 percent higher at 5,917.20.

Mining heavyweights BHP Billiton and Rio Tinto rallied 2-3 percent, Mineral Resources jumped 4.2 percent and Galaxy Resources soared 7.3 percent.

Gold miner Evolution Mining advanced 1.8 percent after reporting increased production during the September quarter.

Energy stocks also saw widespread gains after crude oil futures rallied nearly 2 percent on Friday amid hopes for strong demand from the U.S. and China.

Meanwhile, Chinese shares ended slightly lower even as inflation figures matched forecasts and People’s Bank of China Governor Zhou Xiaochuan said the economy is set to achieve 7 percent growth in the second half of the year on rapid growth in household consumption.

The benchmark Shanghai Composite Index dropped 12.05 points or 0.4 percent to 3,378.47, dragged down by technology stocks. Hong Kong’s Hang Seng Index climbed 216.37 points or 0.8 percent to 28,692.80.

Economy

Naira Down Again at NAFEX, Trades N1,359/$1

By Adedapo Adesanya

The Naira further weakened against the Dollar in the Nigerian Autonomous Foreign Exchange Market (NAFEX) for the fourth straight session this week on Thursday, February 26.

At the official market yesterday, the Nigerian Naira lost N3.71 or 0.27 per cent to trade at N1,359.82/$1 compared with the previous session’s N1,356.11/$1.

In the same vein, the local currency depreciated against the Pound Sterling in the same market window on Thursday by N8.27 to close at N1,843.23/£1 versus Wednesday’s closing price of N1,834.96/£1, and against the Euro, it crashed by N8.30 to quote at N1,606.89/€1, in contrast to the midweek’s closing price of N1,598.59/€1.

But at the GTBank forex desk, the exchange rate of the Naira to the Dollar remained unchanged at N1,367/$1, and also at the parallel market, it maintained stability at N1,365/$1.

The continuation of the decline of the Nigerian currency is attributed to a surge in foreign payments that have outpaced the available Dollars in the FX market.

In a move to address the ongoing shortfall at the official window, the Central Bank of Nigeria (CBN) intervened by selling $100 million to banks and dealers on Tuesday.

However, the FX support failed to reverse the trend, though analysts see no cause for alarm, given that the authority recently mopped up foreign currency to achieve balance and it is still within the expected trading range of N1,350 and N1,450/$1.

As for the cryptocurrency market, major tokens posted losses over the last 24 hours as traders continued to de-risk alongside equities following Nvidia’s earnings-driven pullback, with Ripple (XRP) down by 2.7 per cent to $1.40, and Dogecoin (DOGE) down by 1.6 per cent to $0.0098.

Further, Litecoin (LTC) declined by 1.3 per cent to $55.87, Ethereum (ETH) slipped by 0.9 per cent to $2,036.89, Bitcoin (BTC) tumbled by 0.7 per cent to $67,708.21, Cardano (ADA) slumped by 0.6 per cent to $0.2924, and Solana (SOL) depreciated by 0.4 per cent to $87.22, while Binance Coin (BNB) gained 0.4 per cent to sell for $629.95, with the US Dollar Tether (USDT) and the US Dollar Coin (USDC) closing flat at $1.00 each.

Economy

Crude Oil Falls as Geopolitical Risk Around Iran Clouds Supply Outlook

By Adedapo Adesanya

Crude oil settled lower on Thursday as investors tracked developments in talks between the United States and Iran over the latter’s nuclear programme, weighing potential supply concerns if hostilities escalate.

Brent crude futures lost 10 cents or 0.14 per cent to close at $70.75 a barrel, while the US West Texas Intermediate (WTI) crude futures depreciated by 21 cents or 0.32 per cent to $65.21 a barrel.

The US and Iran held indirect talks in Geneva on Thursday over their long-running nuclear dispute to avert a conflict after US President Donald Trump ordered a military build-up in the region.

Prices had gained earlier in the session after media reports indicated the talks had stalled over US insistence on zero enrichment of uranium by Iran, as well as a demand for the delivery of all 60 per cent-enriched uranium to the US.

However, prices then retreated after the two countries extended talks into next week, reducing the immediate strike potential.

Iran’s Foreign Minister, who confirmed talks will continue next week, said Thursday’s talks were the most serious exchanges with the US yet, saying Iran clearly laid out its demand for lifting sanctions and the process for relief.

His counterpart from Oman, who is handling the talks, said significant progress was made in Thursday’s talks. The Omani minister’s upbeat assessment followed indirect talks between Iranian Foreign Minister and US envoys Steve Witkoff and Jared Kushner in Geneva, with one session in the morning and the second in the afternoon.

He will also hold talks with US Vice President JD Vance and other US officials in Washington on Friday.

The Trump administration has insisted that Iran’s ballistic missile program and its support for armed groups in the region must be part of the negotiations.

The American President said on February 19 that Iran must make a deal in 10 to 15 days, warning that “really bad things” would otherwise happen.

On Tuesday, he briefly laid out his case for a possible attack on Iran in his State of the Union speech, underlining that while he preferred a diplomatic solution, he would not allow Iran to obtain a nuclear weapon.

Meanwhile, the US continues to amass forces in the Middle Eastern region, with the military saying it is prepared to execute orders given by the US President.

Economy

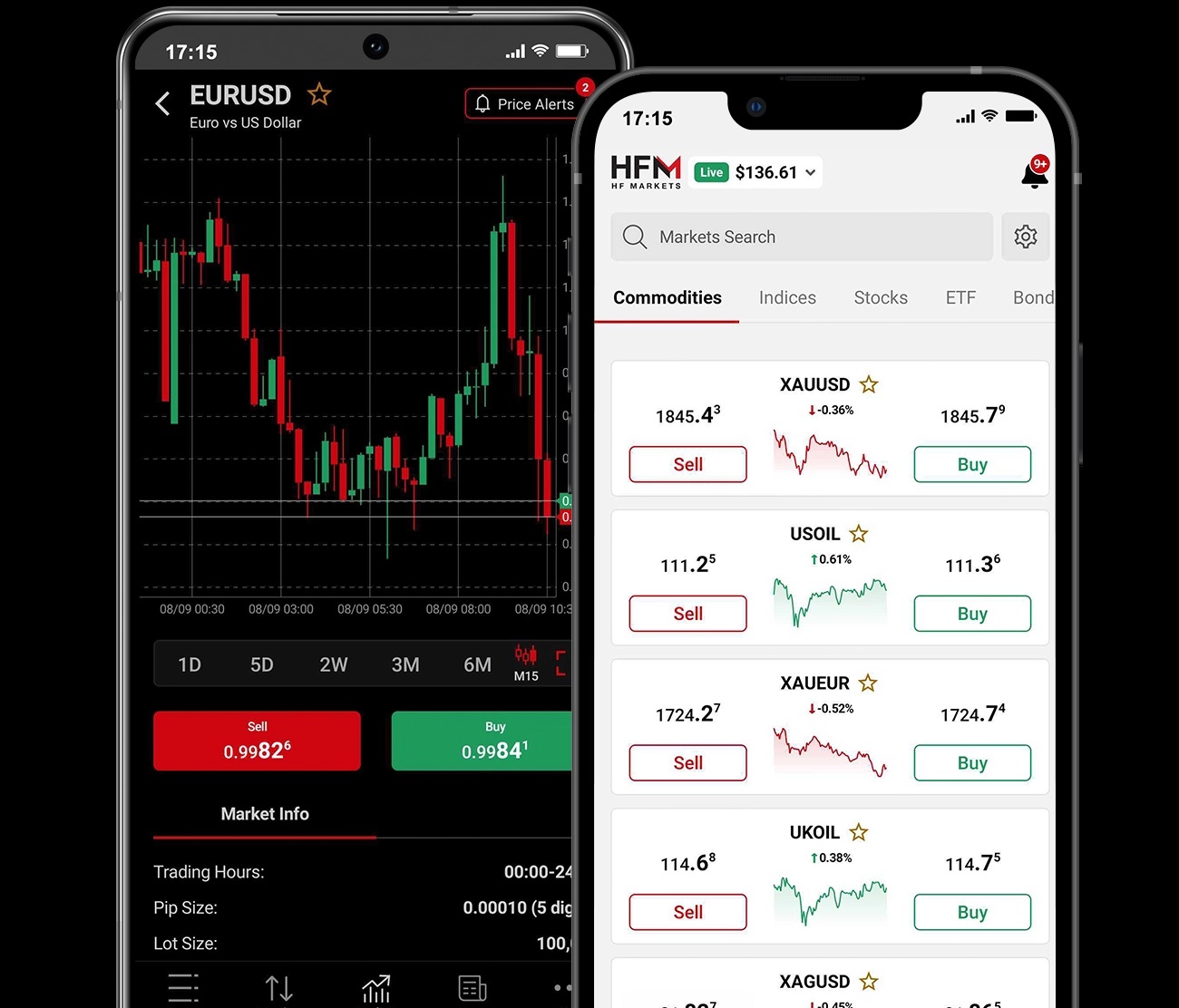

Why Transparency Matters in Your Choice of a Financial Broker

Choosing a Forex broker is essentially picking a partner to hold the wallet. In 2026, the market is flooded with flashy ads promising massive leverage and “zero fees,” but most of that is just noise. Real transparency is becoming a rare commodity. It isn’t just a corporate buzzword; it’s the only way a trader can be sure they aren’t playing against a stacked deck. If a broker’s operations are a black box, the trader is flying blind, which is a guaranteed way to blow an account.

The Scam of “Zero Commissions”

The first place transparency falls apart is in the pricing. Many brokers scream about “zero commissions” to get people through the door, but they aren’t running a charity. If they aren’t charging a flat fee, they are almost certainly hiding their profit in bloated spreads or “slippage.” A trader might hit buy at one price and get filled at a significantly worse one without any explanation. This acts as a silent tax on every trade. A transparent broker doesn’t hide the bill; they provide a live, auditable breakdown of costs so the trader can actually calculate their edge.

The Conflict of Market Making

It is vital to know who is on the other side of the screen. Many brokers act as “Market Makers,” which is a polite way of saying they win when the trader loses. This creates a massive conflict of interest. There is little incentive for a broker to provide fast execution if a client’s profit hurts their own bottom line. A broker with nothing to hide is open about using an ECN or STP model, simply passing orders to the big banks and taking a small, visible fee. If a broker refuses to disclose their execution model, they are likely betting against their own clients.

Regulation as a Safety Net

Transparency is worthless without an actual watchdog. A broker that values its reputation leads with its licenses from heavy-hitters like the FCA or ASIC. They don’t bury their regulatory status in the fine print or hide behind “offshore” jurisdictions with zero oversight. More importantly, they provide proof that client funds are kept in segregated accounts. This ensures that if the broker goes bust, the money doesn’t go to their creditors—it stays with the trader. Without this level of openness, capital is essentially unprotected.

The Withdrawal Litmus Test

The ultimate test of a broker’s transparency is how they handle the exit. There are countless horror stories of traders growing an account only to find that “technical errors” or vague “bonus terms” prevent them from withdrawing their money. A legitimate broker has clear, public rules for getting funds out and doesn’t hide behind a wall of unreturned emails. If a platform makes it difficult to see the exit strategy, it’s a sign that the front door should have stayed closed.

Conclusion

In 2026, honesty is the most valuable feature a broker can offer. It is the foundation that allows a trader to focus on the charts instead of worrying if their stops are being hunted. Finding a partner with clear pricing, honest execution, and real regulation is the first trade that has to be won. Flashy marketing is easy to find, but transparency is what actually keeps a trader in the game for the long haul.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn