Economy

That Aso Rock 2017 Budget That Deserves Your Attention

By Saatah Nubari

The first time this budget analysis series ran was for the 2016 budget; and it becomes visible each day that the 1810 page document was a horrid, hurriedly-put, corrupt-conduit-filled piece of executive cluelessness.

Well, since I’m more of a realist than any of the other-ists, I’ll just say that the fact that the world lost an entire tree to the making of the paper it was inked on is a tragedy.

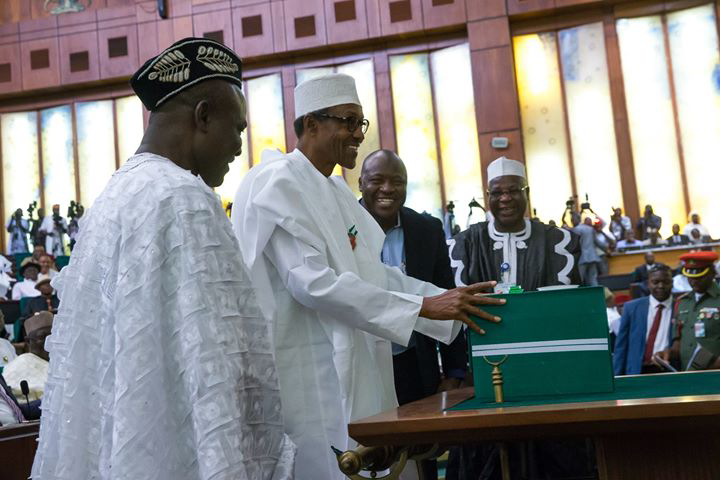

We have been given a sequel; the 2017 budget was presented to the National Assembly by the President in the presence of the ministers who drafted it—and even slept while the presentation was on—and it was called the “Budget of Recovery and Growth.”

If you noticed, it is quite a change from the previous budget of change just like the government’s change mantra.

Here are some quotes from the President’s speech on what when passed, will be arguably the most important document in the country—sorry, just checked and it is 63 paragraphs long so I will just skip to analysing the 2017 budget as we await the implementation report of the 2016 budget.

The 2017 budget is N7.298 trillion. According to the government, this comprises of

- Statutory transfers of N419.02 billion;

- Debt service of N1.66 trillion;

iii. Sinking fund of N177.46 billion to retire certain maturing bonds;

- Non-debt recurrent expenditure of N2.98 trillion; and

- Capital expenditure of N2.24 trillion (including capital in Statutory Transfers).

We will begin with the State House budget, which is N42,917,666,214. This almost doubles what the previous government budgeted for in 2015 which was N23,465,865,117. Out of this, N19,970,000,000 is the total capital budget while the total recurrent budget stands at N22,947,666,214. The total overhead is N10,171,082,268 and that for total personnel is N12,776,583,946.

This is the first piece in the #SaatahBudgetSeries2017, and I will be looking at the budget of the State House (which was referred to as Presidency in previous budgets).

STATE HOUSE

There are 16 agencies under the State House, and they are: State House Headquarters, The Office of the President, The Office of the Vice President, Office of the Chief of Staff to the President, Office of the Chief Security Officer to the President, State House Medical Centre, State House Lagos Liaison Office, Office of the Senior Special Assistant to the President on Sustainable Development Goals (SDGS), National Institute for Policy and Strategic Studies (NIPSS), Bureau of Public Enterprises, National Emergency Management Agency, Economic and Financial Crimes Commission, Bureau of Public Procurement, Nigeria Extractive Industries Transparency Initiative, Nigeria Atomic Energy Commission and its centres, and Office of the Chief Economic Adviser to the President which funny enough the President only appointed in August of this year.

The first piece of poo I was hit with, ironically, was the “Sewage Charges” budget of the State House Headquarters” It was put at N52,827,800; that means N144,733 every day. That’s a lot of poo as far as the eye can see. Compare this with the “Sewage Charge” budget for 2015 which was N4,957,143 and for 2016 which was N6,121,643.

This simply means the poo charge went up by 1050% compared with the 2015 budget, and 850% when compared with the 2016 budget. The N52,827,800 question I want to ask now is what exactly are they shittìng there?

The State House Headquarters budget for “Honorarium/Sitting Allowance” is N556,592,736. Let me remind you that the previous government budgeted N174,471,371 for same item in 2015, while in 2016, this administration jacked it up to N507,518, 861.

The State House Headquarters still continues to budget for “Residential Rent.” This is something I have failed to understand up till now and I wouldn’t mind someone explaining it to me. That aside, the amount budgeted for this “Residential Rent” in 2015 was N22,459,575, while in 2016 it was put at N27,735,643. I don’t know how or why, but in the 2017 budget of “Recovery and Growth,” this same “Residential Rent” went up to N77,545,700. Whoever the Landlord of that State House Headquarters is, in this economy, he must be a very lucky and fortunate chap.

There is an N8,539,200 budget for “Anti-Corruption” and I’m perplexed as to what exactly it is.

The last time there was a budget for “Motor Vehicles” or anything like that was in the 2014 budget by the last administration and it was a total of N132,200,000. This government came in in 2016 and somehow concluded that the State House Headquarters did not have enough “Motor Vehicles,” so they started by budgeting N877,015,000 which was something like a 650% increase from the 2014 budget for the same item.

The State House Headquarters still doesn’t think there are enough “Motor Vehicles,” so in 2017 they have budgeted a total of N197,000,000 for the purchase of “Motor Vehicles” and “Buses.” At this rate, by 2019, this government would’ve succeeded in buying enough “Motor Vehicles” to drive the entire country off the edge.

2016 will end up being one of the darkest years in this country in relation to power supply. So, I do not understand where the State House Headquarters got megawatts from in 2016 that they have now budgeted N319,625,753 for “Electricity Charge” in 2017. Just so you know, the “Electricity Charge” for 2016 was put at N45,332,433.

The 2016 State House Headquarters budget for the “Rehabilitation/Repairs of Residential Buildings” was N642,568,122, while in 2017, I don’t know, but it looks like an enormous asteroid managed to hit and destroy the residential building at the State House Headquarters because what is budgeted for “Rehabilitation/Repairs of Residential Buildings” happens to be N5,625,752,757.

As usual, knowing that we have travelling President, N739,487,784 has been budgeted for “International Travel & Transport.” Last year only the Vice President budgeted for books. This year neither the President nor his Vice budgeted for it. Apparently, they’re tired of reading.

Just like in last year’s budget, the entire capital budget for the National Emergency Management Agency is for the “Construction of Office Building,” all N374,473,456 of it.

The Economic and Financial Crimes Commission has budgeted N5,999,070,468 for the “Construction/Provision of Office Buildings.” In 2016 they spent N58,434,683 on that. If you do the math, that’s an increase of over 10,000% and qualifies as an economic and financial crime.

The Economic and Financial Crimes Commission also budgeted N230,536,000 for “Legal Services.” I don’t know if this is enough, but since they say it is; and as long as none of that amount goes to the case-bumbling, Twitter SAN, Festus Keyamo, no wahala.

In 2016 the EFCC budgeted N93,136,000 for “Motor Vehicles,” but since maybe the corruption they should be fighting has gotten faster, they have upped that to N455,000,000. So if you had a plan of running away from the EFCC, I am sorry, they will have almost half a billion Naira worth of cars to chase you with. It is a car race now you know.

There a line item in the EFCC budget that mentions the “Procurement and Upgrade of Microsoft Product Licences” which N142,237,198 was set aside for. This is as vague as something can get, and when it comes to corruptly enriching yourself, being vague is the best bet.

In 2016 N3,260,000 was budgeted by the EFCC for the “Purchase of Photocopiers” while in the 2017 budget N13,755,000 is the magic number.

N1,100,595,088 has been budgeted for the “Furnishing of the New Head Office” whose construction cost in the 2016 budget was put at N7,912,502,911. Now, guess what. There is a budget for the “Consultancy of the Head Office Project” and N244,727,624 is budgeted for it. I am sorry; you will have to guess what again. Let me not stress you, N4,583,616,838 is budgeted for the “Completion of Ongoing New Head Office Building Construction” which N7,912,502,911 was budgeted for in 2016, bringing the total to N12,496,119,749.

For those of you that numbers scare, that is over N12 billion for the construction of the EFCC new head office. If the budget for the “Furnishing” of same building is taken into consideration, it becomes almost N14 billion. That is the anti-corruption model; build a N14 billion edifice to scare corrupt individuals and firms.

The Bureau of Public Procurement has budgeted N52,957,485 for “Defence Software” and I find myself wondering when they became the Ministry of Defence. But things change, just like this government wants us to believe. I wish them a happy defence.

In the course of going through the 2107 budget, I noticed a significant change. There no longer existed a column to show the state of a project. Previous budgets had the “New” and “Ongoing” tags designated to line items, and it made it easier to understand or rather follow the money. We might not know, but that little omission, which I believe was on purpose, has the ability to make corrupt practices invisible.

The 2017 budget is beginning to look more like a poo-storm, but that shouldn’t be a problem because as you saw from the beginning, they started by budgeting generously for it.

We have come to the end of the first part of my budget analysis; hopefully the second part will have something better to offer us.

Saatah Nubari is on Twitter @Saatah

Economy

FG Targets Credit Access For 50% Workers By 2030

By Adedapo Adesanya

The Vice President, Mr Kashim Shettima, inaugurated the Board of the Nigerian Consumer Credit Corporation (CREDICORP) and gave a 50 per cent access target for workers, saying consumer credit was critical to Nigeria’s ambition of becoming a one-trillion-dollar economy by 2030.

According to him, President Bola Tinubu established the CREDICORP to build a trusted credit infrastructure, provide catalytic capital to lower borrowing costs, and help Nigerians overcome long-standing cultural resistance to credit.

Speaking on Thursday in Abuja when he inaugurated the board on behalf of the President, the Vice President, in a statement by his spokesman, Mr Stanley Nkwocha, said that the quality of life of Nigerians cannot improve without closing the gap between access to capital and human dignity.

“A civil servant who earns honestly does not have to chase sudden wealth just to buy a vehicle, or save for ten years to buy one. A young professional should not remain in darkness simply because solar power must be paid for all at once,” the Vice President said.

VP Shettima disclosed that in just one year of operations, CREDICORP has disbursed over ₦37 billion in consumer credit to more than 200,000 Nigerians, with over half of them accessing formal credit for the first time.

The Vice President said the organisation was specifically tasked with building credit infrastructure to bridge the trust gap between lenders and borrowers, providing wholesale capital and credit guarantees through its portfolio company.

“Ultimately, these critical jobs of CREDICORP will enable access to consumer credit to at least 50 per cent of working Nigerians by 2030,” he said.

The Vice President explained that the new board’s role was not ceremonial as they are custodians of the organisation’s mission, adding that the long-term strength of the institution would depend on their “vigilance, integrity, sacrifice, and commitment.”

He directed Board members to uphold Public Service Rules, the Board Charter, and all applicable governance frameworks, warning that accountability and stewardship of public resources were non-negotiable.

The Chairman of CREDICORP, Mr Aderemi Abdul, expressed appreciation to President Tinubu for his vision behind the formation of CREDICORP and for the confidence reposed in them, noting that the establishment of the corporation marked an important step towards strengthening the nation’s financial architecture.

He assured President Tinubu that the board understands its responsibility and will guide the institution to deliver meaningful benefits to Nigerians.

For his part, Mr Uzoma Nwagba, Managing Director/CEO of CREDICORP, recalled watching President Tinubu say 20 years ago that consumer credit is one of the major tools that will improve the lives of Nigerians.

He noted that over the past 18 months, the institution has benefited more than 200,000 Nigerians, including students.

He assured that the presidential vision behind CREDICORP would not be taken lightly, as the team considers their appointments a unique, once-in-a-lifetime opportunity.

Other members of the board inaugurated include Mrs Olanike Kolawole, Executive Director, Operations; Mrs Aisha Abdullahi, Executive Director, Credit and Portfolio Management; Mr Armstrong Ume-Takang (MD, MoFI), Representative of MoFI; Mrs Bisoye Coke-Odusote (DG, NIMC), Representative of NIMC; and Mr Mohammed Naziru Abbas, Representative of FMITI.

Others are Mr Marvin Nadah, Representative of FCCPC; Mrs Chinonyelum Ndidi, Representative of the Federal Ministry of Finance; Mr Mohammed Abbas Jega, Independent Director; and Mrs Toyin Adeniji, Independent Director.

Economy

NASD OTC Exchange Rallies 0.23% as Nipco Leads Six Advancers

By Adedapo Adesanya

Six price gainers helped the NASD Over-the-Counter (OTC) Securities Exchange retain its stay in green territory after a 0.23 per cent appreciation on Thursday, February 26.

The price gainers were led by Nipco Plc, which added N25.00 to close at N278.00 per share compared with the previous day’s N253.00 per share, NASD Plc rose by N5.13 to N56.41 per unit versus N51.28 per unit, FrieslandCampina Wamco Nigeria Plc expanded by N2.24 to N102.44 per share from N100.00 per share, Afriland Properties Plc grew by 88 Kobo to N18.88 per unit from N18.00 per unit, 11 Plc increased by 35 Kobo to N277.00 per share from N276.65 per share, and Lagos Building Investment Company (LBIC) Plc gained 27 Kobo to close at N3.75 per unit versus N3.48 per unit.

On the flip side, Central Securities Clearing System (CSCS) Plc lost N1.75 to sell at N68.25 per share versus N70.00 per share, and Geo-Fluids Plc depreciated by 2 Kobo to N3.25 per unit from N3.27 per unit.

The weight of the advancers fortified the NASD Unlisted Security Index (NSI) by 9.21 points to 4,034.46 points from 4,025.25 points, and the market capitalisation soared by N5.51 billion to N2.413 trillion from Wednesday’s N2.408 trillion.

Yesterday, the transaction value jumped by 18.8 per cent to N102.8 million from N80.7 million, and the number of deals surged by 18,8 per cent to 38 deals from 32 deals, while the transaction volume went down by 84.9 per cent to 1.3 million units from 8.7 million units.

At the close of business, CSCS Plc was the most traded stock by value (year-to-date) with 34.2 million units worth N2.04 billion, followed by Okitipupa Plc with 6.3 million units sold for N1.1 billion, and Geo-Fluids Plc with 122.1 million units valued at N478.2 million.

Resourcery Plc remained as the most traded stock by volume (year-to-date) with 1.05 billion units exchanged for N408.7 million, trailed by Geo-Fluids Plc with 122.1 million worth N478.2 million, and CSCS Plc with 34.2 million units traded for N2.04 billion.

Economy

Naira Down Again at NAFEX, Trades N1,359/$1

By Adedapo Adesanya

The Naira further weakened against the Dollar in the Nigerian Autonomous Foreign Exchange Market (NAFEX) for the fourth straight session this week on Thursday, February 26.

At the official market yesterday, the Nigerian Naira lost N3.71 or 0.27 per cent to trade at N1,359.82/$1 compared with the previous session’s N1,356.11/$1.

In the same vein, the local currency depreciated against the Pound Sterling in the same market window on Thursday by N8.27 to close at N1,843.23/£1 versus Wednesday’s closing price of N1,834.96/£1, and against the Euro, it crashed by N8.30 to quote at N1,606.89/€1, in contrast to the midweek’s closing price of N1,598.59/€1.

But at the GTBank forex desk, the exchange rate of the Naira to the Dollar remained unchanged at N1,367/$1, and also at the parallel market, it maintained stability at N1,365/$1.

The continuation of the decline of the Nigerian currency is attributed to a surge in foreign payments that have outpaced the available Dollars in the FX market.

In a move to address the ongoing shortfall at the official window, the Central Bank of Nigeria (CBN) intervened by selling $100 million to banks and dealers on Tuesday.

However, the FX support failed to reverse the trend, though analysts see no cause for alarm, given that the authority recently mopped up foreign currency to achieve balance and it is still within the expected trading range of N1,350 and N1,450/$1.

As for the cryptocurrency market, major tokens posted losses over the last 24 hours as traders continued to de-risk alongside equities following Nvidia’s earnings-driven pullback, with Ripple (XRP) down by 2.7 per cent to $1.40, and Dogecoin (DOGE) down by 1.6 per cent to $0.0098.

Further, Litecoin (LTC) declined by 1.3 per cent to $55.87, Ethereum (ETH) slipped by 0.9 per cent to $2,036.89, Bitcoin (BTC) tumbled by 0.7 per cent to $67,708.21, Cardano (ADA) slumped by 0.6 per cent to $0.2924, and Solana (SOL) depreciated by 0.4 per cent to $87.22, while Binance Coin (BNB) gained 0.4 per cent to sell for $629.95, with the US Dollar Tether (USDT) and the US Dollar Coin (USDC) closing flat at $1.00 each.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn