Economy

Chelsea And Ascott Celebrate Bringing The Famous CFC Fan Event To Singapore

Exhilarating weekend of activities at Chelsea’s flagship international fan engagement event, The Famous CFC, saw hundreds of passionate Chelsea fans and Ascott Star Rewards members interact with club legend Gianfranco Zola and celebrate the team’s continued run of impressive wins

LONDON, UK / SINGAPORE – Media OutReach Newswire – 3 December 2024 – Chelsea Football Club, in collaboration with presenting partner The Ascott Limited (Ascott), brought The Blues to Singapore this past weekend, hosting the club’s first edition of The Famous CFC in Southeast Asia.

Held over the weekend of 30 November and 1 December, the Singapore edition of The Famous CFC brought together hundreds of passionate Chelsea fans to celebrate the club’s legacy and passion. Anchored at lyf Funan Singapore, with additional activities at The Robertson House by The Crest Collection and Ascott Orchard Singapore, the two-day festivities featured football coaching clinics, a watch party for Chelsea’s match against Aston Villa, and exclusive meet-and-greet opportunities with Chelsea legend Gianfranco Zola. As Chelsea’s Official Global Hotels Partner and the presenting partner of The Famous CFC in Singapore, Ascott played a key role in bringing the event to life, showcasing its continued commitment to delivering exceptional experiences for Chelsea’s fans and Ascott Star Rewards members.

Gianfranco Zola said: “What a privilege it has been to be a part of The Famous CFC in Singapore! I thoroughly enjoyed my stay at The Robertson House by The Crest Collection, as well as my visits to lyf Funan Singapore and Ascott Orchard Singapore. It was a pleasure to meet so many of Chelsea’s passionate fans here. The enthusiasm and energy from them all has been amazing, and it is truly special to connect with so many supporters face-to-face. I am immensely grateful for the opportunity to share unforgettable moments with them.”

He added “The weekend was capped off with a dominant performance from Chelsea against Aston Villa. I recently spent time with Cole Palmer and saw first-hand what an unbelievable talent he is. His goal and performance against Aston Villa was top quality and there is no doubt in my mind he has the tools to be one of the best players in the world in the near future. What a signing he has proven to be for Chelsea!”

Casper Stylsvig, Chelsea’s Chief Revenue Officer, said: “The Singapore edition of The Famous CFC was a tremendous success, and we are delighted to have had the opportunity to reconnect with our passionate fanbase in Southeast Asia, thanks to our friends at Ascott. It was truly inspiring to see the unwavering dedication of our supporters. We are very proud of our partnership with Ascott, and the experience we have delivered for both our fans and Ascott Star Rewards members.”

Tan Bee Leng, Chief Commercial Officer, Ascott, said: “As Chelsea’s Official Global Hotels Partner, Ascott is proud to continue providing the club’s supporters and Ascott Star Rewards members with exclusive and immersive experiences that go beyond just the stay. From football clinics conducted by Chelsea coaches and an intimate fireside chat with club legend Gianfranco Zola, to curated pre-match F&B hospitality and watching the Blues in action alongside Zola himself; every detail throughout The Famous CFC in Singapore reflects Ascott’s dedication to seamlessly blend hospitality, entertainment and sports to deliver an unforgettable event, reinforcing our commitment to ensure guests ‘Stay Rewarded’ with exceptional experiences. Building on this momentum, Ascott is excited to already be working on bringing The Famous CFC to other cities in 2025, further strengthening our connection with Chelsea’s global fanbase. We look forward to creating more extraordinary experiences for fans and Ascott Star Rewards members worldwide, to live their unlimited passion for the club they love.”

“Ascott is also looking forward to the rebranding of the two stadium hotels, currently operating as Stamford Bridge Hotel London, to lyf by the second half of 2025. The lyf brand, with its experience-led, social living concept, aligns perfectly with the spirit of Chelsea and the dynamic energy of Stamford Bridge. Offering more than just a place to stay, lyf will deliver an immersive experience that reflects Chelsea’s strong sense of community, passion and excellence. Whether guests are visiting for a match or immersing themselves in the club’s legendary legacy, we are confident this new lyf property will provide a truly remarkable experience,” she added.

Highlights from The Famous CFC – Singapore Edition

The Singapore edition of The Famous CFC kicked off on Saturday, 30 November, with a series of football coaching clinics at The Ark futsal court in Funan, led by coaches from Chelsea FC. Reflecting The Famous CFC’s commitment to supporting local communities, the clinics hosted participants from SportCares, the philanthropic arm of Sport Singapore, and the Singapore Disability Sports Council. Chelsea legend Gianfranco Zola made a special appearance, engaging with the beneficiaries and sharing inspiring words with the young players.

Later in the day, Zola visited Ascott Orchard Singapore to film exclusive content for fans. He then hosted an intimate meet-and-greet with Ascott Star Rewards members at The Robertson House by The Crest Collection, where fans had the chance to interact with him and take photos with the 2016/17 Premier League trophy. Zola also stopped by Chandu, the hotel’s speakeasy cocktail bar, where he tried his hand at crafting the ‘Magic Box Dribble’, a cocktail specially created in his honour.

The activities continued on Sunday, 1 December, with more football coaching clinics. This was followed by a fireside chat at lyf Funan Singapore, where Zola shared personal stories, reflected on memorable moments from his football career and answered questions from attendees. In the evening, Zola joined Ascott Star Rewards members for a lively dinner party at lyf Funan Singapore. The event featured an immersive experiential zone for photo opportunities and a merchandise booth inspired by the iconic dressing room at Stamford Bridge. Three ‘one-of-a-kind’ shirts, two autographed by Zola and one by Chelsea award-winning player Cole Palmer respectively, were put up for a live charity auction during the dinner party. In line with Ascott’s and Chelsea’s efforts to promote disability inclusion, auction proceeds were donated to the Goh Chok Tong Enable Fund (GCTEF), which supports persons with disabilities through providing financial aid, supporting aspirations and conferring awards to recognise the achievements and potential of persons with disabilities. GCTEF is administered by SG Enable and supported by Mediacorp, with Singapore’s Emeritus Senior Minister Goh Chok Tong as its Patron.

The excitement culminated with the Chelsea vs. Aston Villa watch party at Funan, where around 250 supporters gathered at the shopping mall’s atrium to watch the thrilling match live from Stamford Bridge, with Zola celebrating alongside them. The atmosphere was electric as fans cheered on their favourite team. Special greetings from Kiernan Dewsbury-Hall, Robert Sanchez, Axel Disasi, Marcus Bettinelli and Nicholas Jackson, along with exclusive giveaways drawn by Marc Cucurella and Robert Sanchez, heightened the excitement throughout the evening. With surprises and memorable moments at every turn, the event marked the perfect conclusion to an extraordinary two-day Famous CFC festivities.

For the latest updates on exclusive offers from Ascott’s partnership with Chelsea, including the upcoming editions of The Famous CFC, please visit https://www.discoverasr.com/en/ascott-chelseafc.

Hashtag: #TheAscottLimited #AscottStarRewards #DiscoverASR #StayRewarded

![]() https://www.discoverasr.com/en

https://www.discoverasr.com/en![]() https://www.linkedin.com/company/the-ascott-limited/

https://www.linkedin.com/company/the-ascott-limited/

The issuer is solely responsible for the content of this announcement.

The Ascott Limited

Since pioneering Asia Pacific’s first international-class serviced residence with the opening of The Ascott Singapore in 1984, Ascott has grown to be a trusted hospitality company with over 960 properties globally. Headquartered in Singapore, Ascott’s presence extends across about 230 cities in over 40 countries in Asia Pacific, Central Asia, Europe, the Middle East, Africa, and the USA. Ascott’s diversified accommodation offerings span serviced residences, coliving properties, hotels and independent senior living apartments, as well as student accommodation and rental housing. Its award-winning hospitality brands include ![]() Ascott,

Ascott, ![]() Citadines,

Citadines, ![]() lyf,

lyf, ![]() Oakwood,

Oakwood, ![]() Somerset,

Somerset, ![]() The Crest Collection,

The Crest Collection, ![]() The Unlimited Collection,

The Unlimited Collection, ![]() Fox,

Fox, ![]() Harris,

Harris, ![]() POP!,

POP!, ![]() Preference,

Preference, ![]() Quest,

Quest, ![]() Vertu and

Vertu and ![]() Yello. Through Ascott Star Rewards (ASR), Ascott’s loyalty programme, members enjoy exclusive privileges and offers at participating properties.

Yello. Through Ascott Star Rewards (ASR), Ascott’s loyalty programme, members enjoy exclusive privileges and offers at participating properties.

A wholly owned business unit of CapitaLand Investment Limited, Ascott is a leading vertically-integrated lodging operator. Harnessing its extensive network of third-party owners and in-market expertise, Ascott grows fee-related earnings through its hospitality management and investment management capabilities. Ascott also expands its funds under management by growing its sponsored CapitaLand Ascott Trust and private funds.

This year, Ascott marks 40 years in hospitality service with the launch of Ascott Unlimited, a full year campaign that will offer Unlimited Opportunities, Unlimited Choices, Unlimited Freedom, and Unlimited Good. Navigating a future of unlimited possibilities against a backdrop of global change and evolving perspectives of travel, Ascott Unlimited marks Ascott’s ambitions to break new ground, and springboard to its next chapter of growth as a global hospitality company. Find out more about Ascott Unlimited at ![]() www.discoverasr.com/ascottunlimited.

www.discoverasr.com/ascottunlimited.

For more information on Ascott and its sustainability programme, please visit ![]() www.discoverasr.com/the-ascott-limited. Alternatively, connect with us on

www.discoverasr.com/the-ascott-limited. Alternatively, connect with us on ![]() Facebook,

Facebook, ![]() Instagram,

Instagram, ![]() TikTok and

TikTok and ![]() LinkedIn.

LinkedIn.

Chelsea Football Club

Chelsea Football Club is one of the top football clubs globally and its men’s team were the FIFA Club World Cup winners for 2021, with the final when the side beat Brazilian side Palmeiras in Abu Dhabi held in 2022 due to the pandemic. That success followed winning the UEFA Champions League for a second time in 2021 with victory over Manchester City in Porto.

Founded in 1905, Chelsea is London’s most central football club, based at the iconic 40,000-capacity Stamford Bridge stadium. Nicknamed ‘The Blues’, the club lifted the Champions League for the first time in 2012 and has also won the Premier League five times, the FA Cup eight times, the Football League Cup five times, the UEFA Europa League twice, the UEFA Cup Winners’ Cup twice, the UEFA Super Cup twice and the Football League Championship once, in 1955.

The 2021 Champions League and Super Cup triumphs ensured Chelsea became the first club to win four major UEFA club competitions twice, following its earlier successes in those two competitions as well as the Europa League and Cup Winners’ Cup.

The Chelsea Women’s team have enjoyed a huge amount of success and in 2024 won the FA Women’s Super League for a fifth consecutive year and the seventh time overall. The Women’s FA Cup has been won on five occasions. The side has also captured the FA Women’s League Cup twice as well as reaching the UEFA Women’s Champions League final in 2021.

In addition to possessing some of the world’s most recognisable players, Chelsea has also invested in its future with a state-of-the-art Academy and training centre in Cobham, Surrey. Since the Academy building’s opening in 2008, the club has won seven FA Youth Cups, back-to-back UEFA Youth League titles in 2015 and 2016, and the U23 and U18 Premier League national championships most recently in 2019/20 and 2017/18 respectively.

The Chelsea Foundation boasts one of the most extensive community initiatives in sport, helping to improve the lives of children and young people all over the world.

CapitaLand Investment Limited

Headquartered and listed in Singapore, CapitaLand Investment Limited (CLI) is a leading global real asset manager with a strong Asia foothold. As at 30 September 2024, CLI had S$134 billion of assets under management, as well as S$102 billion of funds under management held via six listed real estate investment trusts and business trusts and a suite of private real asset vehicles that invest in thematic and tactical strategies. Its diversified real estate asset classes include retail, office, lodging, industrial, logistics, business parks, wellness, self-storage, data centres, private credit and special opportunities.

CLI aims to scale its fund management, lodging management and commercial management businesses globally and maintain effective capital management. As the investment management arm of CapitaLand Group, CLI has access to the development capabilities of and pipeline investment opportunities from CapitaLand’s development arm.

As a responsible company, CLI places sustainability at the core of what it does and has committed to achieve Net Zero carbon emissions for Scope 1 and 2 by 2050. CLI contributes to the environmental and social well-being of the communities where it operates, as it delivers long-term economic value to its stakeholders.

![]()

Economy

Subscription for FGN Savings Bonds Opens for March 2026 at 13.9%

By Aduragbemi Omiyale

The Debt Management Office (DMO) has asked retail investors interested in investing in the FGN savings bonds to begin to talk to their financial advisers.

This is because subscription for the retail bonds for March 2026 has commenced and will close on Friday, March 6, according to a circular issued by the agency on Monday.

The debt office is selling two tenors of the debt instrument, with the shorter note maturing in two years’ time and the longer maturing a year later.

Details of the notice showed that the two-year paper is being offered at a coupon of 12.906 per cent, and the three-year paper at 13.906 per cent.

Both notes are sold at a unit price of N1,000, with a minimum subscription of N5,000 and in multiples of N1,000 thereafter, subject to a maximum subscription of N50 million. They can be purchased via approved stockbroking firms in Nigeria.

The FGN savings bond qualifies as a security in which trustees may invest under the Trustee Investment Act. It also serves as government securities within the meaning of the Company Income Tax Act (CITA) and the Personal Income Tax Act (PITA) for tax exemption for pension funds, amongst other investors.

It can be used as a liquid asset for liquidity ratio calculation for banks, and is listed on the Nigerian Exchange (NGX) Limited for trading at the secondary market.

The bond is backed by the full faith and credit of the Federal Government of Nigeria (FGN) and charged upon the general assets of the country.

Economy

Nigeria Splits OPL 245 into Four Blocks for Eni, Shell

By Adedapo Adesanya

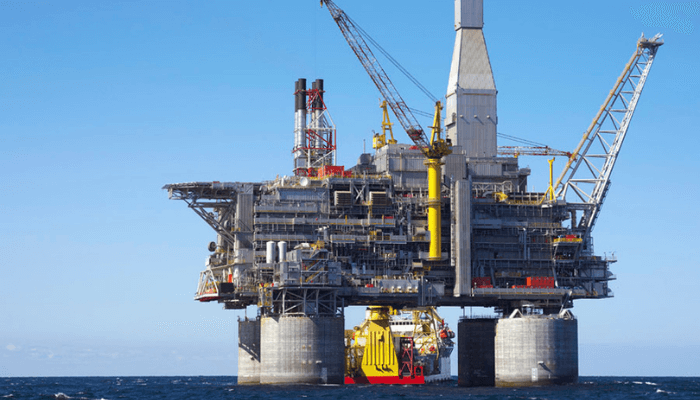

Nigeria has broken up the OPL 245 oil block into four new assets to be operated by Eni and Shell, potentially settling the future of the field at the centre of one of the oil industry’s biggest historic corruption trials.

According to Reuters, the agreement clears the way for the development of OPL 245, one of Nigeria’s biggest deepwater reserves that has remained untapped for almost three decades amid overlapping lawsuits in multiple countries.

The final contracts are expected to be signed starting Monday, the report said, citing a source familiar with the situation.

The Nigerian government had signalled for years that it was keen to find a solution that would bring the block into production. The source wished to remain anonymous as they are not authorised to comment on government policy before an official announcement.

Located in the Niger Delta’s deepwaters, the field has languished since its initial award in 1998 to Malabu Oil and Gas, a shadowy firm controlled by Mr Dan Etete, Nigeria’s oil minister at the time. The block is estimated to hold up to 9 billion barrels of oil equivalent in reserves—enough to rival Nigeria’s entire proven reserves if fully developed.

Mr Etete controversially awarded the lucrative licence to his own company for a nominal $20 million fee, sparking immediate controversy over conflicts of interest.

The saga escalated in 2011 when Malabu sold its rights to a Shell-Eni joint venture for $1.3 billion.

Italian and Nigerian prosecutors alleged that over $1 billion of that sum was siphoned off through bribes to politicians, middlemen, and Mr Etete himself, including hefty payments to then-President Goodluck Jonathan’s associates.

The two European energy giants and some of their former and current executives, including Eni CEO, Mr Claudio Descalzi, faced trial in Italy but all were acquitted in 2021, having denied all wrongdoing.

Shell and Eni have consistently denied wrongdoing, insisting the payments complied with due diligence.

The anti-graft agency, the Economic and Financial Crimes Commission (EFCC), has pursued parallel probes, recovering over $200 million in frozen funds, but progress stalled amid political shifts.

Operations at the Nigerian oil block have been halted for more than a decade by a series of trials and competing legal claims.

In 2023, the federal government withdrew civil claims totalling $1.1 billion against Eni, ending the long battle.

Economy

Dangote Refinery, NNPC Raise Petrol Pump Price by N100

By Modupe Gbadeyanka

The price of Premium Motor Spirit (PMS), otherwise known as petrol, has been increased by at least N100 per litre at the pump.

This followed the recent increase in the price of crude oil in the global market as a result of the bombardment of Iran by the United States and Israel over the weekend.

The air strikes killed the Supreme Leader of Iran, Mr Ayatollah Ali Khamenei, and several others.

Iran has responded by firing missiles at US facilities in some Gulf countries, including Saudi Arabia, Qatar, Kuwait, Bahrain, the UAE, and others.

Crude oil prices rose to about $80 per barrel on the market from about $70 per barrel before the Middle East crisis.

Oil marketers in Nigeria have responded to the tension and have raised the prices of petroleum products.

At most MRS Oil retail stations in Lagos, the new price notice showed an increase of about N100 per litre.

As of Monday, the price of PMS was N837 per litre, but on Tuesday morning, it had changed to N938 per litre, while at NNPC retail stations, it was N930 per litre instead of the previous N830 per litre.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn