Economy

Dangote to Build $450m Sugar Production Factory in Niger

By Modupe Gbadeyanka

A sugar production factory capable of creating over 15,000 jobs is to be situated on a 16,000-hectare of land at Lavun Local Government Area of Niger State.

On Wednesday, August 23, 2017, President of Dangote Group, Mr Aliko Dangote, signed a Memorandum of Understanding (MoU) with the state government for the $450million state-of–art and fully integrated sugar complex.

Mr Dangote noted that his decision to start the factory was part of his desire to achieve self-sufficiency in sugar production through the government’s backward integration policy.

At the signing today in Minna, Mr Dangote said when the project is completed, it would bring about a complete economic turn-around for the state.

Dangote Group is currently operating out-grower scheme in rice production in a number of states and also has Africa’s largest sugar refinery in Lagos and a sugar cane plantation in Numan, Adamawa State.

Mr Dangote said his investment was informed by his company’s firm belief in the potentials of the Nigerian economy, adding that the new outlay will add value and create jobs for Nigerians.

He commended the Niger State Governor, Mr Abubakar Sani Bello for his foresight and efforts to woo investors to the state, noting that “the Dangote’s Integrated Sugar Project in Niger State will also include the establishment of integrated sugar mills, generate power, produce molasses, ethanol fuel, biomass and produce animal feeds.”

In his remarks, Governor Bello said the deal will revolutionize agriculture in his state and Nigeria. Expressing joy that the MoU was signed during his own administration, he described Mr Dangote as the liberator of the Nigerian economy and a dependable partner.

The Governor then urged Dangote Group to explore other investment opportunities available in the state, just as he announced that the state was opened for multi-sectoral investments.

Representative of the Minister of Industry, Trade and Investment, Mr Aminu Bisala, described Mr Dangote as the biggest private sector supporter of the Nigerian economy, and Federal Government policies.

He said the Federal Government was comfortable with the numerous investments efforts of the Dangote Group.

Also speaking, Chairman of the Niger State Traditional Council Etsu Nupe, Mr Abubakar Yahyah said he was elated about the huge investment coming to the state, while praying God to bless the Dangote Group more.

Just last week, the conglomerate had sponsored an investment summit in the state, which was attended by former Presidents Abdulsalami Abubakar, Olusegun Obasanjo and the then Acting President, Yemi Osinbajo, who described the private sector as key to the country’s economic development.

Group Managing Director of Dangote Sugar Plc, Engr. Abdullahi Sule, stated that the MoU would be a game changer for Niger State economy and Nigeria as a whole.

He said the integrated sugar mills will have the capacity to produce 160,000MT of raw sugar, pointing out that has been in the fore front of support for government industrialization programmes through backward integration policy in agriculture.

According to him, the Dangote Sugar Refinery is developing a sugar backward integration plan through the production of 1.5MT/PA in ten years in: Nasarawa, Adamawa, Kogi, Kwara, Taraba and Niger states respectively.

The Group’s Executive Director Stakeholders’ Management and Corporate Communication, Mr Ahmed Mansur, had also announced that the Group was investing over $1billion in the agricultural sector in the country, specifically in rice, sugar, tomato and dairy productions.

Niger State Commissioner for Investment, Commerce and Industry, Rahmatu Muhammad Yar’Adua said that the deal with Dangote Group will help grow the agricultural sector and create direct and indirect jobs in the state.

It would be recalled that the Group’s foray into sugar business began in 1981. It has injected over $104million into the Savannah Sugar Company Limited it acquired from government in 2003. Savannah Sugar this year alone, produced 20,000MT of raw sugar from its plantation.

Economy

Dangote Cement Deepens Dominance, Export Activities With $1bn Sinoma Deal

By Aduragbemi Omiyale

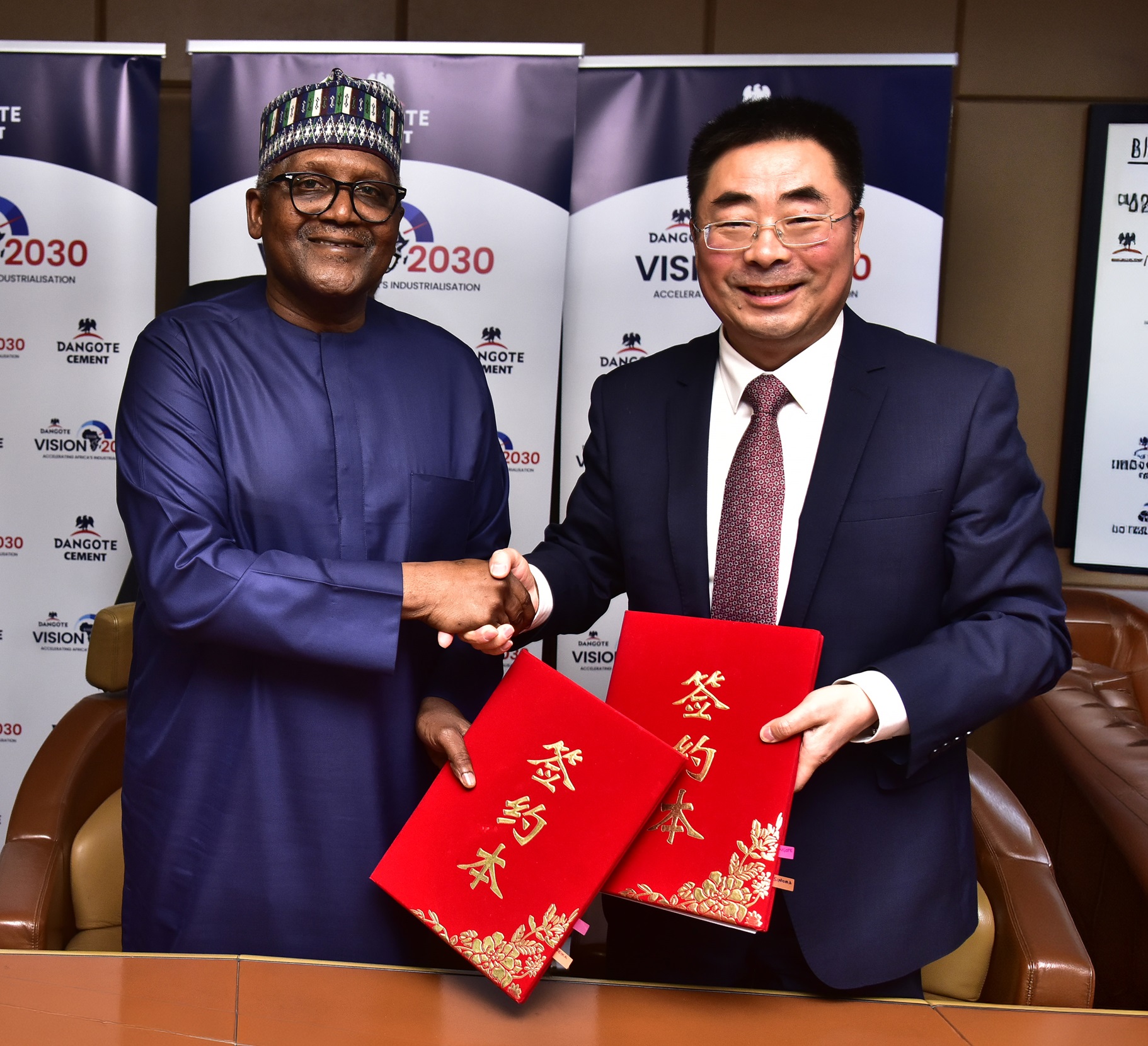

To strengthen its domestic market dominance, drive its export activities, optimise existing operational assets and enhance production efficiency and capacity expansion, Dangote Cement Plc has sealed $1 billion strategic agreements with Sinoma International Engineering for cement projects across Africa.

The president of Dangote Industries Limited, the parent firm of Dangote Cement, Mr Aliko Dangote, disclosed that the deal reinforces the company’s long-term growth strategy and aligns with the broader aspirations of the Dangote Group’s Vision 2030.

According to him, Sinoma will construct 12 new projects and expand others for the cement organisation across Africa, helping to achieve 80 million tonnes per annum (MTPA) production capacity by 2030, while supporting the group’s overarching target of generating $100 billion in revenue within the same period.

Under the Strategic Framework Agreement, Sinoma will collaborate with Dangote Cement on the delivery of new plants, brownfield expansions, and modernisation initiatives aimed at strengthening operational performance across key markets.

The new projects include a new integrated line in Northern Nigeria with a satellite grinding unit, a new line in Ethiopia and other projects in Zambia/Zimbabwe, Tanzania, Sierra Leone and Cameroon. In Nigeria, Sinoma will also handle different projects in Itori, Apapa, Lekki, Port Harcourt and Onne.

The projects signal Dangote Cement’s sustained commitment to consolidating its leadership position within the African cement industry, while enhancing its competitiveness on the global stage.

Chairman of the Dangote Cement board, Mr Emmanuel Ikazoboh, during the agreement signing event in Lagos, explained that the new projects would enable the company to play a critical role in actualising Dangote Group’s Vision 2030.

The new projects, when completed, will increase Dangote Cement’s capacity and dominant position in Africa’s cement industry.

On his part, the Managing Director of Dangote Cement, Mr Arvind Pathak, said the agreement reflects the company’s determination to grow its investments across African markets to close supply gaps and support the continent’s infrastructural ambitions.

According to him, Dangote Cement is committed to making Africa fully self‑sufficient in cement production, creating more value and linkages, leading to increased economic activities and a reduction in unemployment.

Economy

Lokpobiri Begs Lawmakers to Reschedule Oil Revenue Executive Order Probe

By Adedapo Adesanya

A joint National Assembly probe into President Bola Tinubu’s new oil revenue executive order was stalled on Thursday following a request for more time by the Minister of Petroleum Resources, Mr Heineken Lokpobiri.

The hearing was convened to scrutinise the executive order directing that royalty oil, tax oil, profit oil, profit gas and other revenues due to the Federation under various petroleum contracts be paid directly into the Federation Account.

Mr Lokpobiri told lawmakers that although he attended out of respect for parliament, he had been notified of the hearing only a day earlier and had not obtained all the relevant documents needed to defend the policy adequately.

He appealed for the session to be rescheduled.

Co-chairman of the joint committee and Chairman of the Senate Committee on Gas, Mr Agom Jarigbe, put the request to a voice vote, and lawmakers approved the adjournment.

A new date is expected to be communicated to the minister.

The executive order signed last week also scrapped the 30 per cent Frontier Exploration Fund created under the Petroleum Industry Act (PIA) and discontinued the 30 per cent management fee on profit oil and profit gas previously retained by the Nigerian National Petroleum Company (NNPC) Limited.

Anchored on Sections 5 and 44(3) of the Constitution, the presidency said the directive was aimed at safeguarding oil and gas revenues, curbing excessive deductions and restoring the constitutional entitlements of federal, state and local governments to the

However, the order has sparked criticism within the industry, one of which was from the Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN), whose president, Mr Festus Osifo, called for an immediate withdrawal of the order, warning that it could undermine the PIA and erode investor confidence.

Meanwhile, at another session, the Chairman of the Senate Committee on Finance, Senator Mohammed Sani Musa, disclosed that President Tinubu would soon transmit proposals to amend certain provisions of the PIA to align with current economic realities.

He noted that while many expect the executive order to boost revenue automatically, Nigeria has yet to achieve its desired income levels.

He did not specify which sections of the law would be targeted, but suggested that the drive to enhance revenue generation would necessitate legislative adjustments.

The PIA, signed into law in 2021 by the late ex-President Muhammadu Buhari, overhauled the governance, regulatory and fiscal framework of Nigeria’s oil and gas sector, commercialised the NNPC and restructured revenue-sharing arrangements.

Economy

NGX Group Declares N2 Final Dividend, 1-for-3 Bonus Issue for FY’25

By Aduragbemi Omiyale

Shareholders of Nigerian Exchange (NGX) Group Plc will receive one new share for every three held as of April 10, 2026, as a bonus, according to a proposal from the board.

This is in addition to a final dividend of N2.00 proposed by the board to shareholders for the 2025 fiscal year, which raised the total dividend for the year to N3.00, according to the financial statements of the company filed with NGX Limited.

Last year, NGX Group recorded a sterling performance, with its earnings growing by 36.0 per cent to N22.9 billion from N16.9 billion due to sustained growth across core business segments, improved customer penetration on the back of increased investor activity and rising investor confidence.

The operating profit in the year increased by 44.4 per cent to N11.8 billion, while pre-tax profit jumped to N15.6 billion from N13.6 billion in 2024, with the earnings per share (EPS) at N4.75.

As for its balance sheet, total assets increased to N71.0 billion from N68.0 billion, while shareholders’ equity strengthened to N55.2 billion

The improved debt-to-equity position reflects a conservative capital structure, enhanced solvency profile, and strong retained earnings growth.

“Our 2025 performance demonstrates the resilience of our business model and the effectiveness of disciplined strategic execution. Strong revenue growth, improved operating margins and a strengthened balance sheet reinforce our commitment to delivering sustainable long-term shareholder value.

“The increased dividend and bonus issue reflect the Board’s confidence in the sustainability of our earnings and the robustness of our capital position as we continue to deepen Nigeria’s capital markets.

“We are confident that the momentum that we have built in 2025 will be sustained, given investor confidence in the Nigerian capital market and a pipeline of exciting new listings that will broaden and deepen the market,” the chairman of NGX Group, Mr Umaru Kwairanga, said.

On his part, the chief executive of the organisation, Mr Temi Popoola, said, “We delivered strong top-line growth and enhanced profitability in 2025 despite macroeconomic headwinds.

“Our 36 per cent core revenue growth, improved operating efficiency and successful deleveraging have strengthened our capital base and financial flexibility, supporting the increased dividend and bonus issuance.

“As regulatory standards evolve, including the recent upward review of minimum capital requirements by the Securities and Exchange Commission (SEC), our robust balance sheet positions us to meet new thresholds seamlessly while continuing to invest in liquidity expansion, product innovation and market infrastructure to build a resilient, globally competitive exchange group.”

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn