Economy

FG Directs Agencies to Remit 50% of IGR, Publish Audited Financial Statements

By Modupe Gbadeyanka

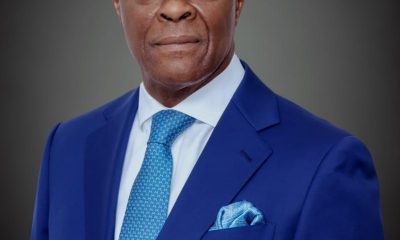

The Minister of Finance and Coordinating Minister of the Economy, Mr Wale Edun, has directed all partially-funded Federal Government Owned Enterprises (FGOEs) to remit 50 per cent of their internally generated revenues (IGRs) to the federal government, while the fully-funded Ministries, Departments, and Agencies (MDAs) are to remit all their revenues.

In a circular dated December 28, 2023, the Minister said, “This is to improve revenue generation, fiscal discipline, accountability, and transparency in the management of government financial resources and the prevention of waste and inefficiencies.”

This directive is expected to be implemented by the Accountant General of the Federation (OAGF) in compliance with a presidential directive aimed at plugging leakages and shoring up revenue.

“Further to Circulars Ref. Nos. FMFBNP/OTGHERS/lGR/CRF/12/2021 dated December 20, 2021, on Revenue, Expenditure, and IGR Remittances to the Consolidated Revenue Fund (CRF), the following guidelines are hereby issued for immediate compliance by all federal government agencies and parastatals for the collections, utilisation, and remittances of IGR:

“All Ministries, Departments, and Agencies (MDAs) that are fully funded through the Annual Federal Government Budget (receiving personnel, overhead, and capital allocation) and on the schedule of the Fiscal Responsibility Act, 2007 and any addition by the Federal Ministry of Finance (FMF) should remit one hundred per cent (100%) of their IGR to the Sub-Recurrent Account, which is a sub-component of the CRF,” the circular titled Re: Implementation of the Presidential Directives on 50% Automatic Deduction from Internally Generated Revenue of Federal Government Owned Enterprises (FGOEs), read.

The disclosure further mandated the OAGF to open new Treasury Single Account (TSA) sub-accounts for all federal government agencies and parastatals listed on the schedule of the Fiscal Responsibility Act of 2007 and any additions by the Federal Ministry of Finance, except where expressly exempted.

“The new account opened for agencies and parastatals shall be credited with inflows in the old revenue collection accounts based on the new policy implementation of 50 per cent auto deduction in line with the Finance Act, 2020, and the Finance Circular, 2021, 50 per cent cost to revenue ratio,” it noted.

It added that, “The revenue collection TSA Sub-Accounts currently operated and maintained by agencies and parastatals for receiving revenue from the public shall be blocked from access.

“The accounts shall be under the full control of the Minister of Finance and Coordinating Minister of the Economy and the Accountant-General of the Federation.”

The government stressed that the Revenue and Investment Department and the Treasury Single Account Department of the OAGF must supervise, monitor, and carry out a monthly review of both the old and new accounts of the agencies and parastatals to ensure that only funds approved by the Minister of Finance and Co-ordinating Minister of the Economy (HMFCME) and the Accountant-General of the Federation (AGF) are credited to the accounts.

“Each federal government self- or partially funded agency or parastatal shall not later than three months after the end of its financial year prepare and publish its audited financial statements and management account in accordance with the prescribed rules and forward copies to the OAGF for the review and computation of operating surplus in line with the approved template of the Fiscal Responsibility Commission/OAGF.

“The remittable portion of the adjusted operating surplus will be determined and paid to the TSA Sub-Recurrent Account after reconciliation.

“The final payment to be made to the TSA Sub-Recurrent Account for the year shall, however, be the higher of 80 per cent of the adjusted operating surplus and the deducted amount from the TSA Sub-Rec Accounts of the affected agencies and parastatals,” it said.

The circular noted that, “The Federal Ministry of Finance (FMF) and OAGF will recommend appropriate disciplinary actions and sanctions against defaulting accounting officers of agencies and parastatals found culpable of violating the contents of this Finance Circular and in accordance with the Fiscal Responsibility Act.”

Economy

NGX Lifts Suspension on Fortis Global Insurance

By Aduragbemi Omiyale

The suspension placed on trading in the shares of Fortis Global Insurance Plc has been lifted by the Nigerian Exchange (NGX) Limited after six years.

The embargo arose from the company’s violation of Rule 3.1: Rules for Filing of Accounts and Treatment of Default Filing (Default Filing Rules).

The underwriting firm, formerly known as Standard Alliance Insurance Plc, was suspended by the exchange on July 2, 2019, after the board failed to file the necessary financial statements.

Rule 3.1 provides that if an issuer fails to file the relevant accounts by the expiration of the cure period, the exchange will: a) send to the issuer a second filing deficiency notification within two business days after the end of the cure period, b) suspend trading in the issuer’s securities, and c) notify the Securities and Exchange Commission (SEC) and the market within 24 hours of the suspension.

A notice from the bourse last week disclosed that the company has now filed all outstanding financial statements due to the NGX, and in view of this, the embargo has been lifted pursuant to Rule 3.3 of the Default Filing Rules.

This section states that, “The suspension of trading in the issuer’s securities shall be lifted upon submission of the relevant accounts, provided the exchange is satisfied that the accounts comply with all applicable rules of the exchange.

“The exchange shall thereafter also announce through the medium by which the public and the SEC were initially notified of the suspension, that the suspension has been lifted.”

The bourse informed trading license holders and the investing public “that the suspension placed on trading on the shares of Fortis Global Insurance was lifted on Wednesday, February 4, 2026.”

Economy

Investors Transact 3.860 billion Stocks Worth N128.581bn in Five Days

By Dipo Olowookere

Last week, on the floor of the Nigerian Exchange (NGX) Limited, investors transacted 3.860 billion stocks worth N128.581 billion in 240,463 deals versus the 3.087 billion stocks valued at N81.505 billion traded in 222,185 deals in the preceding week.

In the five-day trading week, financial equities led the activity chart with 2.188 billion units valued at N50.459 billion in 94,005 deals, contributing 56.68 per cent and 39.24 per cent to the total trading volume and value, respectively.

Services stocks followed with 466.771 million units worth N4.495 billion in 18,526 deals, and ICT shares sold 377.800 million units for N9.049 billion in 25,653 deals.

Chams, Access Holdings, and Universal Insurance were the most active in the week with 664.942 million units valued at N6.801 billion in 15,161 deals, contributing 17.23 per cent and 5.29 per cent to the total trading volume and value apiece.

Business Post reports that 71 equities appreciated during the week versus 44 equities in the previous week, as 35 stocks depreciated compared with 49 stocks a week earlier, while 42 shares closed flat versus 55 shares in the preceding week.

RT Briscoe was the biggest price gainer with a price appreciation of 60.69 per cent to close at N12.63, Zichis gained 60.38 per cent to trade at N6.72, Abbey Mortgage Bank chalked up 59.04 per cent to settle at N14.95, Union Dicon expanded by 49.14 per cent to N13.05, and Austin Laz grew by 38.46 per cent to N5.40.

Conversely, Deap Capital was the biggest price loser after giving up 27.37 per cent to quote at N6.82, Union Homes REIT lost 26.99 per cent to finish at N69.25, Red Star Express declined by 17.55 per cent to N17.15, UPDC REIT shrank by 12.29 per cent to N7.85, and Cornerstone Insurance tumbled by 12.24 per cent to N5.45.

From the above data, the week was under buying pressure, which raised the All-Share Index (ASI) and the market capitalisation by 3.84 per cent to 171,727.49 points and N110.235 trillion, respectively.

Similarly, all other indices finished higher with the exception of the insurance index, which depreciated by 2.33 per cent due to sell-offs.

Economy

Dangote Cement Assures African Consumers Sufficient Supply With 90MT Yearly

By Aduragbemi Omiyale

Leading cement maker, Dangote Cement Plc, has reaffirmed its commitment to making Africa fully self‑sufficient in cement production by raising its output to 90 million metric tonnes per annum by 2030 from the current 52 million metric tonnes per annum.

The chief executive of the firm, Mr Arvind Pathak, during a strategic briefing on the company’s expansion drive, disclosed that efforts are being made to accelerate investments across African markets to close supply gaps and support the continent’s infrastructural ambitions.

According to him, the organisation is strengthening the continent’s industrial backbone and reducing reliance on imported construction materials, stressing that, “Our vision is clear — to ensure Africa produces enough cement to meet its own needs…Through continuous expansion, operational excellence, and a strong distribution network, we are positioning Dangote Cement to power growth across the continent. We are not just building a business; we are building Africa’s future.”

“Through our collective determination, we have eliminated Nigeria’s dependence on imported cement and transformed the country into a net exporter of cement to several neighbouring nations,” Mr Pathak added.

Dangote Cement currently operates in multiple African countries, with integrated plants, grinding facilities, and distribution hubs strategically located to serve diverse markets.

The company’s ongoing projects include plant upgrades, capacity expansions, and the introduction of advanced energy‑efficient technologies designed to reduce operational costs and carbon footprint.

Reinforcing the company’s long-term vision, its founder, Mr Aliko Dangote, described self-sufficiency as both an economic imperative and a continental responsibility.

“Africa has no reason to depend on cement imports. We have the raw materials, the talent, and the determination. Our goal at Dangote Cement is to unlock Africa’s potential by ensuring that every nation on this continent can access affordable, high‑quality cement produced within Africa. This is how we build prosperity, job opportunities, and sustainable development,” the businessman stated.

Mr Dangote added that the company’s investments reflect its passion for unlocking continental competitiveness and fostering industrialisation across Africa.

With major infrastructural projects rising across African cities — from highways and bridges to housing developments — the demand for cement continues to grow. Dangote Cement’s renewed push toward continental self‑sufficiency is expected to address supply challenges, stabilise prices, and enhance construction reliability in the years ahead.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn