Economy

Heritage Bank Backs Triton Group Reforestation Project in Oyo

By Dipo Olowookere

The second phase of afforestation programme of Globus Resources Limited, a subsidiary of Triton Group, in Oyo State has received the backing of Heritage Bank Plc, one of Nigeria’s most innovative banking services providers.

The bank as the first financier had earlier financed the first phase of the project and offered N2 billion long-term facility to enable Triton Aqua Africa Limited (TAAL) expand its aquaculture businesses- nursery/hatchery for the production of fingerlings and brood stock in Ikeja; and earthen ponds for catfish and tilapia in Asejire, Iwo and Gambari towns in Oyo.

Under the programme, Globus Resources is expected to plant about 350,000 seedlings of teak, Gmelina arborea and Cidrella trees yearly over a period nine years in a bid to reforest about nine thousand hectares of land in Gambari village in Oyo state which had been exploited by tree fellers for timbers among others.

Speaking at the event, Managing Director/CEO of Heritage Bank, Mr Ifie Sekibo, commended the state Governor, Mr Abiola Ajimobi and the Triton Group for the initiative between the state and Globus Resources to reforest the area again.

He remarked that if every governor could put a little of bit of backing into agriculture as a way of life, it would go a long way to better the lives of the people.

He added that, “we seemed to forget that our lives as Nigerians/Africans started with the land. If we don’t take care of the land, the land will take care of us, the land does not need us, and we need the land to take care of us. Afforestation is one of the ways to take care of the land and we need to talk about carbon credit because we need to find a way to make money.”

Mr Sekibo said “we consistently cut down trees to make boats, plywood and all kind of things for comfort and don’t think about replenishing them, remarking that they are actually exhaustive, they are not inelastic and there is need for deliberate steps to be taken to replenish them.”

Meanwhile, Mr Sekibo expressed satisfaction with the pace at which the project was going; as he assured the company’s team that Heritage Bank would continue to support the genuine cause by Triton Group to boost the agricultural base of the nation as long as the business relationship between the bank and Triton Aqua is mutually beneficial.

The bank boss thanked Triton Group for taking the initiative to replenish the trees, noting that although it will take a while for the trees to become usable, they will regenerate and as they nurture them to grow, in the next five to ten years, the whole place will be covered with trees.

Chairman/MD of Triton Group, Mr Ashvin Samtani, said the group has been operating in Nigeria for about 40 years, remarking that they are Nigerians, not expatriates, adding that beyond the tree planting initiative, the group intends to employ about 5,000 people.

The chairman of the occasion, Mr Akinwale Moradayo, Deputy Director of Forestry in the Ministry of Agriculture, Natural Resources and Rural Development, Oyo State who stood in for the Commissioner, Mr Oyewole Oyewumi also stressed the need to do something to protect the land, so that its inhabitants would not be consumed.

The Triton Group besides afforestation is also engaged in poultry and aquaculture among others.

Economy

Flour Mills Supports 2026 Paris International Agricultural Show

By Modupe Gbadeyanka

For the second time, Flour Mills of Nigeria Plc is sponsoring the Paris International Agricultural Show (PIAS) as part of its strategies to fortify its ties with France.

The 2026 PIAS kicked off on February 21 and will end on March 1, with about 607,503 visitors, nearly 4,000 animals, and over 1,000 exhibitors in attendance last year, and this year’s programme has already shown signs of being bigger and better.

The theme for this year’s event is Generations Solution. It is to foster knowledge transfer from younger generations and structure processes through which knowledge can be harnessed to drive technological advancement within the global agricultural sector.

In his address on the inaugural day of the Nigerian Pavilion on February 23, the Managing Director for FMN Agro and Director of Strategic Engagement/Stakeholder Relations, Mr Sadiq Usman, said, “At FMN, our mission is Feeding and Enriching Lives Every Day.

“This is a mandate we have fulfilled through decades of economic shifts, rooted in a culture of deep resilience and constant innovation. We support this pavilion because FMN recognises that the next frontier of global Agribusiness lies in high-level technical exchange.

“We thank the France-Nigeria Business Council (FNBC), the organisers of the PIAS, and our fellow members of the Nigerian Pavilion – Dangote, BUA, Zenith, Access, and our partners at Creativo El Matador and Soilless Farm Lab— we are exceedingly pleased to work to showcase the true face of Nigerian commerce.”

Speaking on the invaluable nature of the relationship between Nigeria and France, and the FMN’s commitment to process and product innovation, Mr John G. Coumantaros, stated, “The France – Nigeria relationship is a valuable partnership built on a shared value agenda that fosters remarkable Intercontinental trade growth.

“Also, as an organisation with over six decades of transformational footprint in Nigeria and progressively across the African Continent, FMN has been unwaveringly committed to product and process innovation.

“Therefore, our continuous partnership with France for the success of the Paris International Agricultural Show further buttresses the thriving relationship between both countries.”

PIAS is one of the most widely attended agricultural shows, with thousands of people from across the world in attendance.

Economy

NEITI Backs Tinubu’s Executive Order 9 on Oil Revenue Remittances

By Adedapo Adesanya

Despite reservations from some quarters, the Nigeria Extractive Industries Transparency Initiative (NEITI) has praised President Bola Tinubu’s Executive Order 9, which mandates direct remittances of all government revenues from tax oil, profit oil, profit gas, and royalty oil under Production Sharing Contracts, profit sharing, and risk service contracts straight to the Federation Account.

Issued on February 13, 2026, the order aims to safeguard oil and gas revenues, curb wasteful spending, and eliminate leakages by requiring operators to pay all entitlements directly into the federation account.

NEITI executive secretary, Musa Sarkin Adar, called it “a bold step in ongoing fiscal reforms to improve financial transparency, strengthen accountability, and mobilise resources for citizens’ development,” noting that the directive aligns with Section 162 of Nigeria’s Constitution.

He noted that for 20 years, NEITI has pushed for all government revenues to flow into the Federation Account transparently, calling the move a win.

For instance, in its 2017 report titled Unremitted Funds, Economic Recovery and Oil Sector Reform, NEITI revealed that over $20 billion in due remittances had not reached the government, fueling fiscal woes and prompting high-level reforms.

Mr Adar described the order as a key milestone in Nigeria’s EITI implementation and urged amendments to align it with these reforms.

He affirmed NEITI’s role in the Petroleum Industry Act (PIA) and pledged close collaboration with stakeholders, anti-corruption bodies, and partners to sustain transparent management of Nigeria’s mineral resources.

Meanwhile, others like the Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN) have kicked against the order, saying it poses a serious threat to the stability of the oil and gas industry, calling it a “direct attack” on the PIA.

Speaking at the union’s National Executive Council (NEC) meeting in Abuja on Tuesday, PENGASSAN President, Mr Festus Osifo, said provisions of the order, particularly the directive to remit 30 per cent of profit oil from Production Sharing Contracts (PSCs) directly to the Federation Account, could destabilise operations at the Nigerian National Petroleum Company (NNPC) Limited.

Mr Osifo firmly dispelled rumours of imminent protests by the union, despite widespread claims that the controversial executive order threatens the livelihoods of 10,000 senior staff workers at NNPC.

He noted, however, that the union had begun engagements with government officials, including the Presidential Implementation Committee, and expressed optimism that common ground would be reached.

Mr Osifo, who also serves as President of the Trade Union Congress (TUC), expressed concerns that diverting the 30 per cent profit oil allocation to the Federation Account Allocation Committee (FAAC), without clearly defining how the statutory management fee would be refunded to NNPC, could affect the salaries of hundreds of PENGASSAN members.

Economy

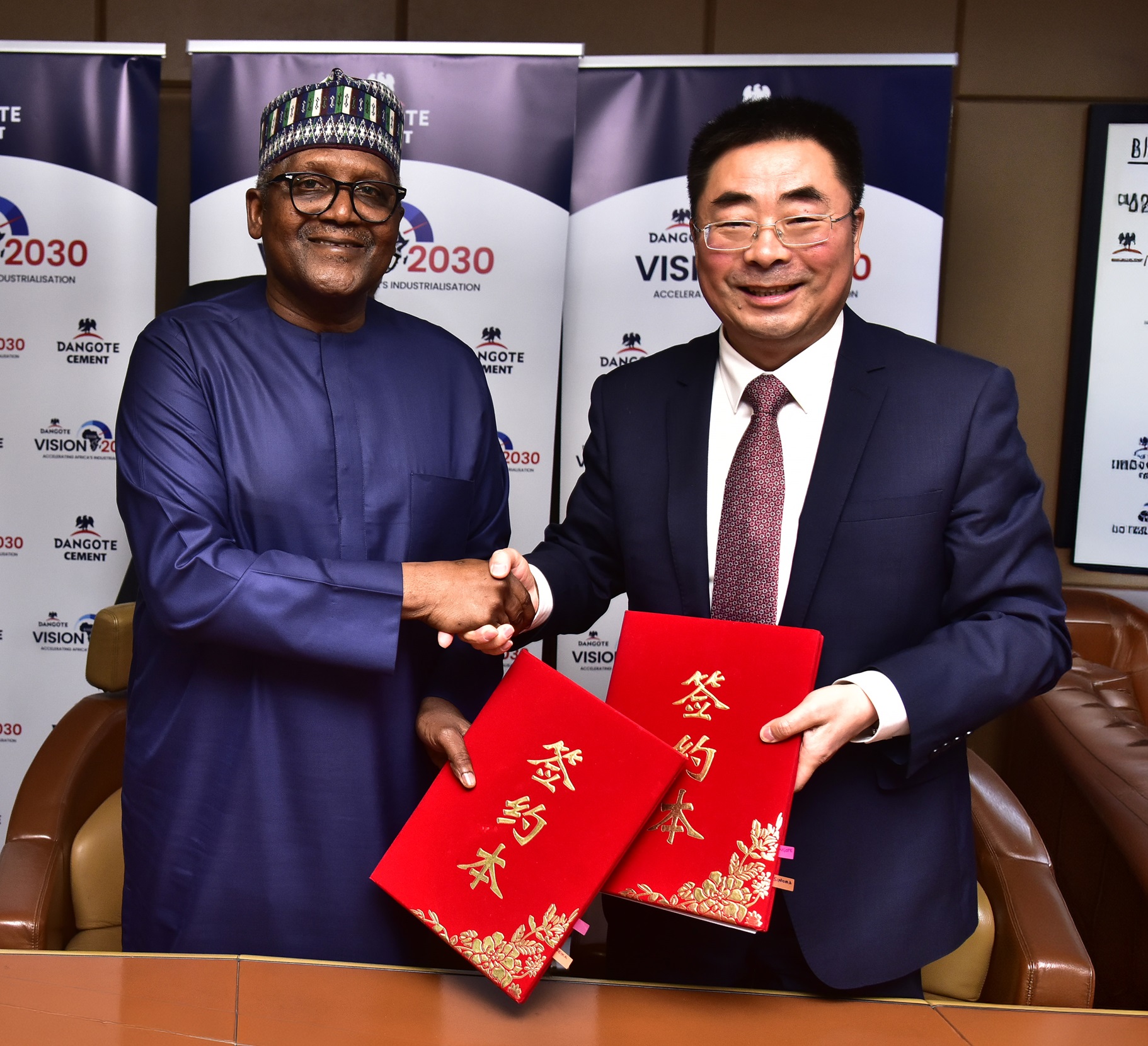

Dangote Cement Deepens Dominance, Export Activities With $1bn Sinoma Deal

By Aduragbemi Omiyale

To strengthen its domestic market dominance, drive its export activities, optimise existing operational assets and enhance production efficiency and capacity expansion, Dangote Cement Plc has sealed $1 billion strategic agreements with Sinoma International Engineering for cement projects across Africa.

The president of Dangote Industries Limited, the parent firm of Dangote Cement, Mr Aliko Dangote, disclosed that the deal reinforces the company’s long-term growth strategy and aligns with the broader aspirations of the Dangote Group’s Vision 2030.

According to him, Sinoma will construct 12 new projects and expand others for the cement organisation across Africa, helping to achieve 80 million tonnes per annum (MTPA) production capacity by 2030, while supporting the group’s overarching target of generating $100 billion in revenue within the same period.

Under the Strategic Framework Agreement, Sinoma will collaborate with Dangote Cement on the delivery of new plants, brownfield expansions, and modernisation initiatives aimed at strengthening operational performance across key markets.

The new projects include a new integrated line in Northern Nigeria with a satellite grinding unit, a new line in Ethiopia and other projects in Zambia/Zimbabwe, Tanzania, Sierra Leone and Cameroon. In Nigeria, Sinoma will also handle different projects in Itori, Apapa, Lekki, Port Harcourt and Onne.

The projects signal Dangote Cement’s sustained commitment to consolidating its leadership position within the African cement industry, while enhancing its competitiveness on the global stage.

Chairman of the Dangote Cement board, Mr Emmanuel Ikazoboh, during the agreement signing event in Lagos, explained that the new projects would enable the company to play a critical role in actualising Dangote Group’s Vision 2030.

The new projects, when completed, will increase Dangote Cement’s capacity and dominant position in Africa’s cement industry.

On his part, the Managing Director of Dangote Cement, Mr Arvind Pathak, said the agreement reflects the company’s determination to grow its investments across African markets to close supply gaps and support the continent’s infrastructural ambitions.

According to him, Dangote Cement is committed to making Africa fully self‑sufficient in cement production, creating more value and linkages, leading to increased economic activities and a reduction in unemployment.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn