Economy

Is Nigeria’s Economy Strong Enough for N33trn Debt?

By Adedapo Adesanya

Nigeria’s debt profile has been a source of worry to many and recently, with the current reality in the global economy as a result of the coronavirus pandemic, which coincided with President Muhammadu Buhari’s request for an additional $22.7 billion external loan, there have fresh reservations on the capability of the country to incur more debts.

Recently, the Debt Management Office (DMO) warned that the country could not hold its own especially with the impact that the virus is having on the country’s economy, making it impossible to service the debts on ground.

According to analysts, the country’s poor revenue generation and annual budget deficit were compounding the debts, as the country has to borrow to balance the shortage which as at September 2019 stood at $26 trillion.

With the Senate approval of the loan after much deliberations earlier this month, the total debt of the country could rise to N33 trillion and this has worried the same Senate, which expressed its displeasure as the loans intended to help the economy are on track to land the country in a crisis.

As such, the Deputy Chairman of Senate Committee on Local and Foreign Debts, Mr Muhammad Bima Enagi, pointed this out while speaking at the one-day public lecture organized by the National Institute for Legislative and Democratic Studies (NILDS), on Public Debt in Nigeria: Trend sustainability and management.

“With the recent approval of the 2016-2018 External Borrowing Plan, the total debt stock would be about N33 trillion and 21 percent Debt to GDP ratio.

“What do we have to show as a people for these huge debts accumulated over the last four decades or so?” he asked.

“Clearly, Nigeria needs to get its public finance in order to avoid the potential fiscal and financial crisis ahead of the nation.

“The current debt situation in Nigeria needs to be properly managed and every borrowed Naira or Dollar, carefully deployed, especially in the face of the continued dependence of the nation’s economy on exported crude oil, with its usual price volatility.

“Borrowings must be project-tied and not just to support budget deficit. Furthermore, the projects must be such to grow the economy and bequeath laudable infrastructure and not debt for future generations,” he had further said.

DMO’s Director-General, Ms Patience Oniha, has, however, called for calm, saying despite these worries, there was no cause for alarm.

She explained that in order to ensure that the public debt was sustainable, the Debt-to-GDP Ratio was set at 25 percent, lower than the 56 percent advised by the World Bank and IMF, adding that the total public debt-to-GDP had remained within the 25 percent limit, standing at 18.47 percent in September 2019.

“This is, however, only one measure of debt sustainability, the other equally important measure is the debt service-to-revenue ratio and this is where Nigeria needs significant improvement.

‘’Actual Debt Service to Revenue Ratio has been high at over 50 percent since 2015, although it dropped to 51 percent in 2018 from 57 percent in 2017.

“The relatively high Debt Service to Revenue Ratio is the result of lower revenues and higher debt service figures.”

But the pertinent question remains on the lips of many, considering the realities on ground with oil prices pointing south: can Nigeria sustain the debt?

Mrs Oniha noted: “Whilst Nigeria’s debt is sustainable, recent developments in the global environment induced by COVID-19, already suggest a less than favourable economic outlook with implications for Nigeria.”

This week, Minister of Finance, Budget and National Planning, Mrs Zainab Ahmed, announced the federal government has suspended its plans to do the $22.7 billion external borrowing. The House of Representatives is yet to approve the request, only the Senate has.

Economy

Dangote’s Impact Visible in Our Economy, Communities—Ogun Governor

By Aduragbemi Omiyale

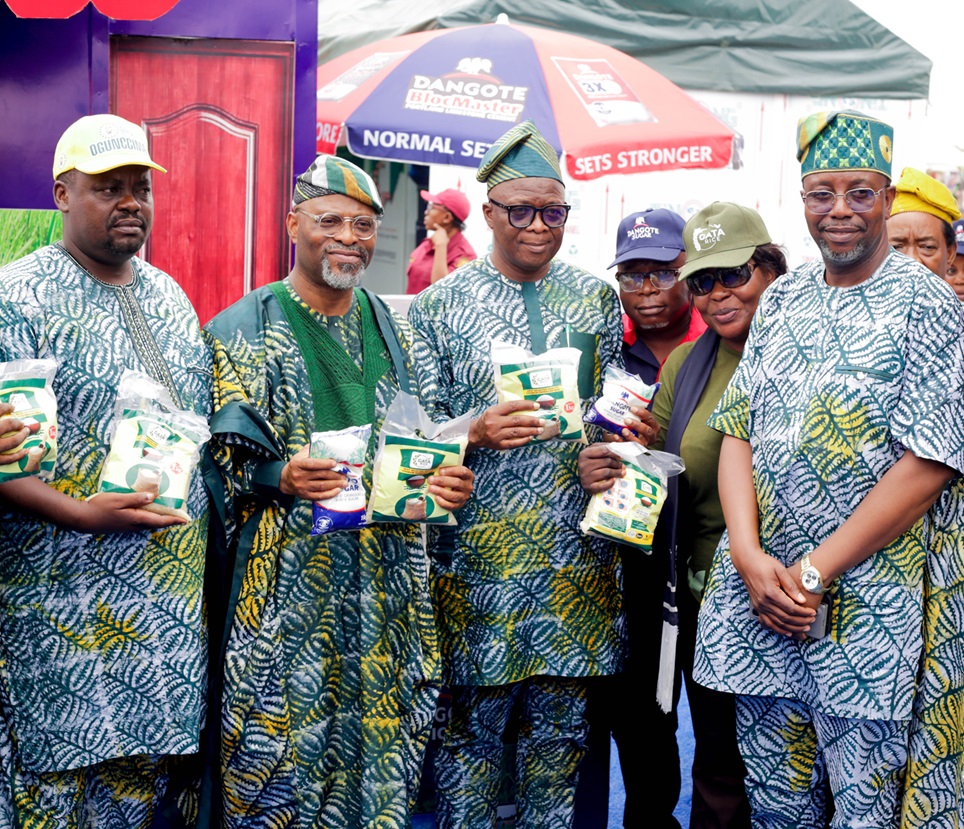

The Governor of Ogun State, Mr Dapo Abiodun, has praised Dangote Industries Limited for being an “exemplary strategic partner in our collective pursuit of industrial advancement and sustainable economic development.”

Speaking at the opening ceremony of the ongoing 15th Gateway International Trade Fair in Abeokuta, the Governor described the conglomerate as a strategic partner in the industrial and economic development of the state through investments.

Mr Abiodun, represented by the Commissioner for Trade, Industry and Investments, Mr Emmanuel Adebola Sofela, disclosed that, “Dangote’s legacy in Ogun State stands as a model of how meaningful collaboration between government and the private sector can deliver transformative results.”

According to him, the Dangote Group is no longer just an investor but a trusted ally—“one whose impact is visible in our economy, our communities, and the future we are building.”

He stated that over the years, the group’s unwavering commitment to excellence, innovation, and nation-building has not only strengthened Nigeria’s industrial backbone but has also contributed immensely to the prosperity and competitiveness of Ogun State.

“Through visionary investments, job creation, and consistent support for infrastructure and community growth, the Dangote Group has demonstrated what it means to be a responsible corporate citizen and a catalyst for broad-based development.

“Their partnership with Ogun State continues to open doors of opportunity for our people, energise local industries, and reinforce our reputation as a leading destination for productive enterprise,” he further noted.

Recall that Ibese, in the Yewa axis of Ogun State, is a host to the Dangote Cement Plc’s 12 million mtpa production capacity cement plant, while another 6 million mtpa cement plant is currently under construction at Itori, also in Ogun State.

Earlier, the president of Ogun State Chamber of Commerce, Industries, Mines and Agriculture (OGUNCCIMA), Mr Niyi Oshiyemi, in the same vein, commended the management of Dangote Group for always rising to be counted among the partners of the chamber in an effort to collaborate with the private sector for meaningful economic development.

“Today is not just the commencement of another trade fair but the celebration of collaborations, innovations, and shared prosperity.

“The trade fair in the last 15 years has served as a vital platform where ideas meet opportunity, where businesses connect with the market and where partnerships are formed to drive sustainable economic growth,” he said.

According to him, in an era defined by rapid technological advancement, global competitiveness and ever-evolving consumer needs, no business can thrive in isolation. The future belongs to those who build strong partnerships.

Mr Oshiyemi noted that OGUNCCIMA has been able to strengthen Ogun State’s position as a leading commercial and industrial hub in Nigeria and West Africa because it has been able to encourage investments, trade linkages and technology transfer by supporting policies and initiatives that enhance the ease of doing business in the state.

Economy

Presidential Directives Boost Efforts to Unlock Owowo Deepwater Resources—Baxi

By Adedapo Adesanya

The Managing Director and Lead Country Manager of ExxonMobil’s affiliates in Nigeria, Mr Jagir Baxi, has noted that recent presidential directives have been instrumental in strengthening the company’s efforts to unlock deepwater resources.

Mr Baxi was appointed to the position in July 2025 to oversee ExxonMobil’s business in Nigeria, including Esso Exploration and Production Nigeria Limited and Esso Exploration and Production Nigeria (Offshore East) Limited.

In an interview with The Energy Year, he said the directives issued by President Bola Tinubu in May 2025 were specifically designed to eliminate rent-seeking, slash project timelines, reduce contracting costs, and restore investor confidence in the Nigerian upstream sector.

According to him, Esso Nigeria is now focusing on advancing deepwater oil and gas developments as part of ExxonMobil’s portfolio after its divestment from the joint venture with Nigerian National Petroleum Company (NNPC) Limited.

“The presidential directives have been instrumental in strengthening Nigeria’s competitiveness in the oil and gas sector. For Esso Nigeria and our shareholder, ExxonMobil, they’ve provided a meaningful platform to reassess our discovered but undeveloped resources – most notably Owowo.

“These directives signal a commitment from the highest levels of government to address long‑standing barriers to deepwater investment, and that’s an important catalyst for industry confidence,” he said.

The ExxonMobil executive noted that the directives have enabled the oil major to take tangible steps forward while working closely with the state oil company and other agencies in the sector.

“We are co‑developing a contracting strategy tailored specifically to the scale and complexity of a world‑class deepwater project,” he noted, adding, “In parallel, we’ve collaborated with the Nigerian Content Development and Monitoring Board to shape a project‑specific National Content Strategy – one designed to both enable the project and deliver sustained, impactful benefits to Nigerian businesses and the workforce. That alignment is critical if we want to create value that extends far beyond the life of a single development.”

“That said, one essential element is still outstanding: codified implementation guidance. For investors, particularly those making multi‑billion‑dollar commitments over 20 to 30‑year horizons, clarity and predictability are non‑negotiable. Our concern stems from recent experience – instances where progress delivered through certain government actions was later eroded by others. It underscores why stability in fiscal and regulatory frameworks is so vital.

“If Nigeria can translate these directives into consistent, durable rules of engagement, the country will be positioned to unlock deepwater investment at a scale that delivers long‑term value for the nation, its citizens, and its partners. And we believe that is absolutely achievable,” he explained.

Economy

CAC Pushes for Harmonised National Register to Strengthen Anti-Crime Fight

By Adedapo Adesanya

The Corporate Affairs Commission (CAC) has called for the establishment of a single, harmonised national register for beneficial ownership to strengthen Nigeria’s anti-corruption framework and improve the fight against corporate and financial crimes.

The Registrar-General of CAC, Mr Hussaini Magaji, made the call during the commission’s 35th anniversary celebration, designated as Anti-Corruption Day on Tuesday in Abuja.

Mr Magaji said the current fragmented system of beneficial ownership disclosure, where some sectors maintained separate registers outside the CAC framework, created duplication, inconsistencies and regulatory loopholes that could be exploited for illicit activities.

According to him, CAC is legally and institutionally positioned to serve as the central repository for beneficial ownership information in Nigeria.

He said that access to accurate corporate records was critical to the successful investigation and prosecution of financial crimes.

He said that the CAC remained the custodian of information on company ownership, control and management.

“No successful prosecution of corporate and financial crimes can be achieved without the support of the Corporate Affairs Commission,” Mr Magaji said.

He reaffirmed the commission’s commitment to sustained collaboration with anti-corruption and law enforcement agencies.

“These include the Economic and Financial Crimes Commission (EFCC), Independent Corrupt Practices and Other Related Offences Commission (ICPC), Nigerian Financial Intelligence Unit (NFIU) and the National Drug Law Enforcement Agency (NDLEA),” he said.

Mr Magaji called for deeper information sharing, joint investigations and real-time verification processes to enhance enforcement outcomes.

The CAC boss also urged stakeholders to support the passage of the Persons with Significant Control (PSC) Rules into an Act of the National Assembly, saying a stronger legal framework was required to address sophisticated abuses of corporate structures.

He disclosed that companies that failed to disclose their beneficial owners were flagged as inactive in CAC records, adding that such entities should not enjoy the privileges of legality.

Mr Magaji, however, expressed concern that some financial institutions continued to transact with non-compliant companies, describing the practice as a major weakness in the national compliance chain.

On internal reforms, he said, CAC had demonstrated zero tolerance for corruption by surrendering three staff members to the ICPC over alleged misconduct and submitting details of 248 fake company registrations to the EFCC for investigation.

According to him, the fight against corruption requires coordinated efforts across institutions and sustained commitment to transparency and accountability.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn