Economy

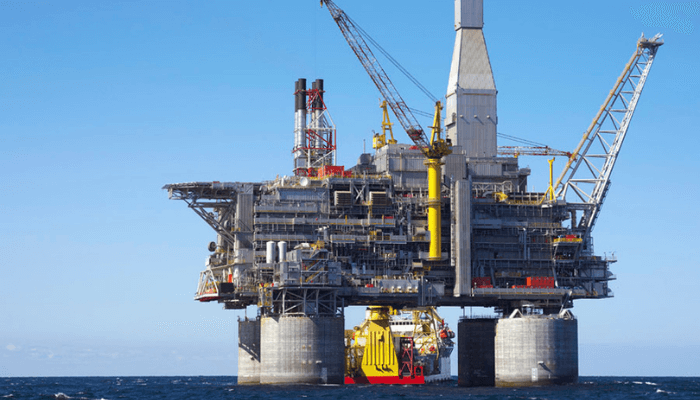

Lebanon Int’l Oil & Gas Summit Returns to Beirut

By Dipo Olowookere

Leading oil and gas industry executives and experts from across the East Mediterranean will gather in Beirut this May, to gain invaluable insight to the newly presented opportunities in Lebanon’s energy sector, the challenges and the road ahead for companies and investors in the field.

Organizers of the Lebanon International Oil & Gas (LIOG) Summit have confirmed that the event will return 9 -10 May 2017 for its third edition, at the prestigious Hilton Beirut Habtoor Grand Hotel, under the high patronage of Cesar Abi Khalil, Lebanon’s minister of energy and water, and in collaboration with the Lebanese Petroleum Administration (LPA).

The summit will highlight the recent progress by Lebanon’s new government to advance its vast oil and gas potential after developing highly advanced world-class regulatory and operational frameworks for this nascent industry.

Launched in 2012 to support Lebanon’s initial findings and to explore the potential of the country’s hydrocarbon resources, LIOG 2017 will build on the success of its previous editions which attracted hundreds of delegates and dozens of high-calibre speakers from over 30 countries representing over 150 local and international companies and organizations, including major international oil companies (IOCs).

Held under the theme ‘Lebanon – Moving Forward’, LIOG 2017 will cover key areas with over 30 Lebanese, regional and international expert speakers who will share their insight on Lebanon’s position as a key hydrocarbons player in the Mediterranean, highlighting recent achievements, showing the new potential of the country and providing delegates with an overview of the legal, financial and technical frameworks.

Also, they will share insight on current and expected market conditions and regional geopolitics, along with their impact on Lebanon. In-depth discussions will cover issues like providing return on investment even with low hydrocarbon prices and drawing on international experiences, particularly in terms of turning such challenges into opportunities for all stakeholders and the many benefits that Lebanon has to offer and how has the country restated itself as an attractive destination for oil and gas investments.

All the above subjects will be presented in a well-structured, rich programme, held over two consecutive days.

In addition to the prequalified companies for Lebanon’s first licensing round, participants will include a wide range of service providers including drilling and well servicing contractors; engineering, procurement and construction (EPC) contractors; banks and insurers; specialized law firms; HSE consultants and suppliers, and more.

Paul Gilbert, Managing Director organising company, Global Events Partners Ltd (GEP), said, “Following the recent approval by Lebanon’s council of ministers of the two crucial decrees and the official launch of the sector, everything is now in place for the Lebanese government to go ahead with the long-awaited first licensing round. We strongly believe that LIOG 2017 Summit has a pivotal role in this exercise, particularly in terms of promoting the country’s potentials and drawing investors.”

Dory Renno, Managing Director of the co-organising company, Planners and Partners S.A.L. added, “We believe in Lebanon and in its business climate, which makes it a great place for the conferences and exhibitions industry, We also strongly believe that successful conferences like LIOG reflect a positive image about Lebanon as an attractive investment arena, and highlight the many achievements by the government in terms of creating the right operational frameworks and promoting transparency in a sustainable manner.”

Renno added; “The Summit will also boast an international exhibition showcasing the latest products and services available by local, regional and international companies and organizations, and provide a unique branding opportunity for exhibitors.”

Lebanon, which is believed to have sizable hydrocarbon resources, has recently announced that five offshore blocks will be on offer in its first licensing round which is expected to take place during 2017.

Over 46 international companies were prequalified in 2013, and a new prequalification round is expected to take place in March 2017.

The 3rd LIOG-2017 Summit is organised by UK-based Global Events Partners Ltd (GEP) and Lebanese partner, Planners and Partners sal. Global Event Partners Ltd is affiliated to the dmg::events network.

Economy

Subscription for FGN Savings Bonds Opens for March 2026 at 13.9%

By Aduragbemi Omiyale

The Debt Management Office (DMO) has asked retail investors interested in investing in the FGN savings bonds to begin to talk to their financial advisers.

This is because subscription for the retail bonds for March 2026 has commenced and will close on Friday, March 6, according to a circular issued by the agency on Monday.

The debt office is selling two tenors of the debt instrument, with the shorter note maturing in two years’ time and the longer maturing a year later.

Details of the notice showed that the two-year paper is being offered at a coupon of 12.906 per cent, and the three-year paper at 13.906 per cent.

Both notes are sold at a unit price of N1,000, with a minimum subscription of N5,000 and in multiples of N1,000 thereafter, subject to a maximum subscription of N50 million. They can be purchased via approved stockbroking firms in Nigeria.

The FGN savings bond qualifies as a security in which trustees may invest under the Trustee Investment Act. It also serves as government securities within the meaning of the Company Income Tax Act (CITA) and the Personal Income Tax Act (PITA) for tax exemption for pension funds, amongst other investors.

It can be used as a liquid asset for liquidity ratio calculation for banks, and is listed on the Nigerian Exchange (NGX) Limited for trading at the secondary market.

The bond is backed by the full faith and credit of the Federal Government of Nigeria (FGN) and charged upon the general assets of the country.

Economy

Nigeria Splits OPL 245 into Four Blocks for Eni, Shell

By Adedapo Adesanya

Nigeria has broken up the OPL 245 oil block into four new assets to be operated by Eni and Shell, potentially settling the future of the field at the centre of one of the oil industry’s biggest historic corruption trials.

According to Reuters, the agreement clears the way for the development of OPL 245, one of Nigeria’s biggest deepwater reserves that has remained untapped for almost three decades amid overlapping lawsuits in multiple countries.

The final contracts are expected to be signed starting Monday, the report said, citing a source familiar with the situation.

The Nigerian government had signalled for years that it was keen to find a solution that would bring the block into production. The source wished to remain anonymous as they are not authorised to comment on government policy before an official announcement.

Located in the Niger Delta’s deepwaters, the field has languished since its initial award in 1998 to Malabu Oil and Gas, a shadowy firm controlled by Mr Dan Etete, Nigeria’s oil minister at the time. The block is estimated to hold up to 9 billion barrels of oil equivalent in reserves—enough to rival Nigeria’s entire proven reserves if fully developed.

Mr Etete controversially awarded the lucrative licence to his own company for a nominal $20 million fee, sparking immediate controversy over conflicts of interest.

The saga escalated in 2011 when Malabu sold its rights to a Shell-Eni joint venture for $1.3 billion.

Italian and Nigerian prosecutors alleged that over $1 billion of that sum was siphoned off through bribes to politicians, middlemen, and Mr Etete himself, including hefty payments to then-President Goodluck Jonathan’s associates.

The two European energy giants and some of their former and current executives, including Eni CEO, Mr Claudio Descalzi, faced trial in Italy but all were acquitted in 2021, having denied all wrongdoing.

Shell and Eni have consistently denied wrongdoing, insisting the payments complied with due diligence.

The anti-graft agency, the Economic and Financial Crimes Commission (EFCC), has pursued parallel probes, recovering over $200 million in frozen funds, but progress stalled amid political shifts.

Operations at the Nigerian oil block have been halted for more than a decade by a series of trials and competing legal claims.

In 2023, the federal government withdrew civil claims totalling $1.1 billion against Eni, ending the long battle.

Economy

Dangote Refinery, NNPC Raise Petrol Pump Price by N100

By Modupe Gbadeyanka

The price of Premium Motor Spirit (PMS), otherwise known as petrol, has been increased by at least N100 per litre at the pump.

This followed the recent increase in the price of crude oil in the global market as a result of the bombardment of Iran by the United States and Israel over the weekend.

The air strikes killed the Supreme Leader of Iran, Mr Ayatollah Ali Khamenei, and several others.

Iran has responded by firing missiles at US facilities in some Gulf countries, including Saudi Arabia, Qatar, Kuwait, Bahrain, the UAE, and others.

Crude oil prices rose to about $80 per barrel on the market from about $70 per barrel before the Middle East crisis.

Oil marketers in Nigeria have responded to the tension and have raised the prices of petroleum products.

At most MRS Oil retail stations in Lagos, the new price notice showed an increase of about N100 per litre.

As of Monday, the price of PMS was N837 per litre, but on Tuesday morning, it had changed to N938 per litre, while at NNPC retail stations, it was N930 per litre instead of the previous N830 per litre.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn