Economy

Nigeria Earns N1.011trn from Oil and Gas Sector in June 2025

By Adedapo Adesanya

About N1.011 trillion was earned by Nigeria from the oil and gas sector in June 2025, according to data released by the Office of the Accountant General of the Federation (OAGF).

The OAGF, in its July 2025 report to the Federation Account Allocation Committee (FAAC), disclosed that the amount was 3.75 per cent higher than the N974.602 billion recorded in May 2025,

It, however, disclosed that after various deductions, the net earnings from the industry shrank to N466.495 billion, lower than the N631.052 billion recorded in May 2025 by 26.08 per cent.

Giving a breakdown of the country’s earnings from the petroleum industry in June 2025, the OAGF stated that N526.949 billion was from crude oil royalties versus N505.864 billion in the previous month, as earnings from Petroleum Profit Tax (PPT) were N337.044 billion compared with N199.656 billion in the previous month.

The country also earned N67.644 billion from penalties for gas flaring versus N40.683 billion a month earlier, Companies Income Tax (CIT) collected from upstream companies stood at N54.905 billion compared with N143.809 billion, and royalties collected from gas companies stood at N16.729 billion versus N30.843 billion.

Also, royalties from gas sales collected by the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) fetched the country N4.758 billion compared with N314.377 million in May, while miscellaneous oil revenue and rent stood at N1.604 billion and N1.534 billion, respectively, in contrast to N2.928 billion and N1.519 billion, respectively in May.

The federation account did not receive any revenue from gas exports, crude oil exports, while no revenue was remitted to the federation account from gas in June 2025; in comparison, in May 2025, the federation account received N5.096 billion, N43.238 billion, and N652.129 million, respectively.

In terms of deductions associated with the petroleum industry in June 2025, the OAGF noted that N10.087 billion was paid out as 13 per cent derivation in respect of the Nigerian National Petroleum Company (NNPC) Limited management fee and frontier exploration fund for the year 2024, as against N9.511 billion in May.

Also N18.163 billion was deducted from the country’s gross oil earnings being 13 per cent refund on fuel subsidy, priority projects and Police Trust Fund (PTF) in June 2025, same as the amount recorded in the previous month; while N25 billion was spent by the National Executive Council (NEC) Ad-Hoc Committee on crude oil theft prevention and control, with no amount recorded on the item in the previous month.

NUPRC received N25.239 billion in June 2025, being amount for four per cent collection fee, compared with N24.605 billion in May 2025; transfer to the Midstream Gas Infrastructure Fund from gas flare penalty stood at N66.181 billion, compared with N41.273 billion in May 2025; while 13 per cent derivation refund on withdrawals from joint venture contract stood at N100 billion, as against the same amount in the previous month.

In addition, N300 billion was refunded to oil producing states from the month’s oil earnings from the 13 per cent Nigerian Liquefied Natural Gas refund, as against N150 billion recorded in May 2025.

Economy

Fidson, Jaiz Bank, Others Keep NGX in Green Territory

By Dipo Olowookere

A further 0.99 per cent was gained by the Nigerian Exchange (NGX) Limited on Friday after a positive market breadth index supported by 53 price gainers, which outweighed 23 price losers, representing bullish investor sentiment.

During the trading day, the trio of Jaiz Bank, Fidson, and NPF Microfinance Bank chalked up 10.00 per cent each to sell for N11.00, N86.90, and N6.27, respectively, while Deap Capital appreciated by 9.96 per cent to N7.62, and Mutual Benefits increased by 9.94 per cent to N5.42.

Conversely, Secure Electronic Technology shed 10.00 per cent to trade at N1.62, Sovereign Trust Insurance slipped by 9.73 per cent to N2.32, Ellah Lakes declined by 7.91 per cent to N12.80, International Energy Insurance retreated by 5.56 per cent to N3.40, and ABC Transport moderated by 5.26 per cent to N9.00.

Data from Customs Street revealed that the insurance counter was up by 2.52 per cent, the industrial goods sector grew by 2.28 per cent, the banking space expanded by 1.43 per cent, the consumer goods index gained 1.23 per cent, and the energy industry rose by 0.05 per cent.

As a result, the All-Share Index (ASI) went up by 1,916.20 points to 194,989.77 points from 193,073.57 points, and the market capitalisation moved up by N1.230 trillion to N125.164 trillion from Thursday’s N123.934 trillion.

Yesterday, investors traded 820.5 million stocks valued at N28.3 billion in 63,507 deals compared with the 898.5 million stocks worth N38.5 billion executed in 61,953 deals, showing a jump in the number of deals by 2.51 per cent, and a shortfall in the trading volume and value by 8.68 per cent and 26.49 per cent apiece.

Closing the session as the most active equity was Mutual Benefits with 79.0 million units worth N427.1 million, Zenith Bank traded 44.0 million units valued at N3.8 billion, Chams exchanged 43.9 million units for N182.0 million, AIICO Insurance transacted 42.4 million units valued at N179.8 million, and Veritas Kapital sold 36.0 million units worth N90.6 million.

Economy

Brent Climbs to $71 on Fears of US Military Action Against Iran

By Adedapo Adesanya

The price of Brent crude oil grade went up by 0.14 per cent or 10 cents to $71.76 per barrel on Friday as investors worried about US military action against Iran, as President Donald Trump presses the Islamic Republic to halt nuclear weapon development.

However, the US West Texas Intermediate (WTI) crude oil grade finished at $66.39 a barrel after going down by 4 cents or 0.06 per cent.

The market awaited developments in the struggle between Iran and the US after President Trump said, “We have to make a meaningful deal, otherwise bad things happen,” referring to Iran.

The main concern for the crude oil market is that military activity will lead to a supply disruption if Iran decides to block shipping in the Strait of Hormuz. About 20 per cent of the world’s oil consumption passes through that waterway. Conflict in the area could limit oil entering the global market and push up prices.

There is the fear that a potential US military campaign in Iran could disrupt shipping in the Middle East are also adding upward pressure on supertanker rates.

Traders and investors ramped up purchases of call options on Brent crude in recent days, betting on higher prices.

Also supporting oil were reports of falling crude stocks and limited exports in the world’s biggest oil-producing and exporting countries. US crude inventories dropped by 9 million barrels as refining utilisation and exports climbed, an Energy Information Administration (EIA) report showed on Thursday.

Markets were also considering the impact of ample supply, with talks of the Organisation of the Petroleum Exporting Countries and its allies (OPEC+) leaning towards a resumption in oil output increases from April.

Eight OPEC+ producers – Saudi Arabia, Russia, the United Arab Emirates, Kazakhstan, Kuwait, Iraq, Algeria and Oman will meet on March 1. The eight members raised production quotas by about 2.9 million barrels per day from April to the end of December 2025, equating to about 3 per cent of global demand, and froze further planned increases for January through March 2026 because of seasonally weaker consumption.

Meanwhile, the oil market shrugged off a US Supreme Court decision ruling unconstitutional President Trump’s use of a law to levy tariffs in national emergencies.

Economy

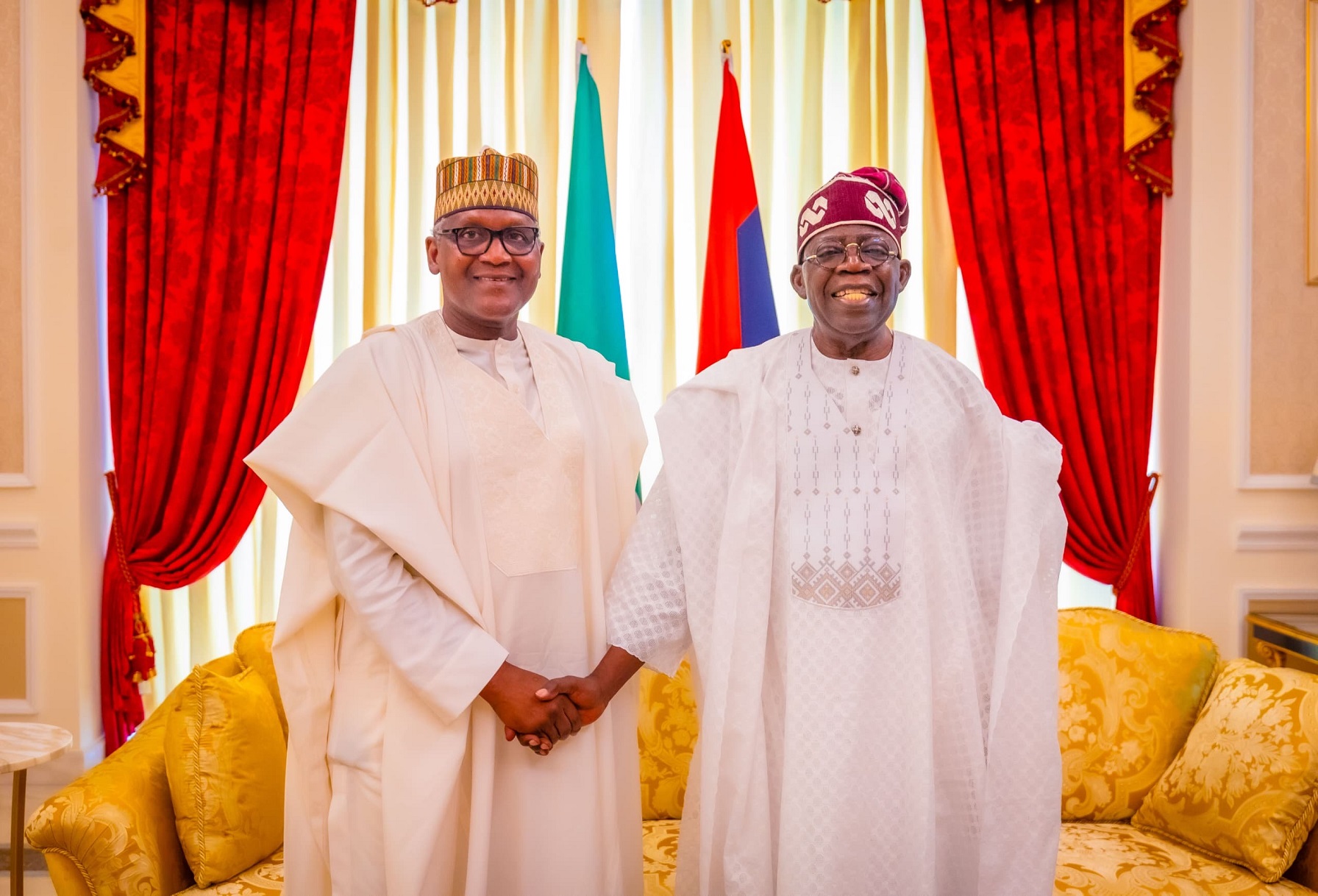

PENGASSAN Kicks Against Tinubu’s Executive Order on Oil, Gas Revenues

By Adedapo Adesanya

The Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN) has faulted the Executive Order signed by President Bola Tinubu on oil and gas revenues.

President Tinubu this week signed the Executive Order, titled The Upstream Petroleum Operations Cost Efficiency Incentives Order (2025), to safeguard and enhance oil and gas revenues for the Federation, curb wasteful spending, eliminate duplicative structures in the sector, and redirect resources for the benefit of the Nigerian people.

However, at a press conference in Abuja, PENGASSAN president, Mr Festus Osifo, argued that the tax incentives granted to oil companies by the President may not help in the reduction of cost if insecurity is not addressed.

“The Executive Order signed by the President yesterday is a direct attack on the provisions of the Petroleum Industry Act (PIA)—specifically Sections 8, 9, and 64,” Mr Osifo said.

“What the President has done is use an Executive Order to set aside a law of the Federal Republic of Nigeria. This is deeply troubling. What signal are we sending to investors and the international community?

“We are effectively telling them that the law of the land can be set aside by a simple executive decree. This is an aberration and should never have happened.”

According to a statement by the presidential spokesperson, Mr Bayo Onanuga, the President signed the EO in pursuance of Section 5 of the Constitution of the Federal Republic of Nigeria (as amended).

The Executive Order is anchored on Section 44(3) of the Constitution, which vests ownership, control, and derivative rights in all minerals, mineral oils, and natural gas in, under, and upon any land in Nigeria—including its territorial waters and Exclusive Economic Zone—in the Government of the Federation.

The directive seeks to restore the constitutional revenue entitlements of the federal, state, and local governments, which were removed in 2021 by the Petroleum Industry Act (PIA).

According to Mr Onanuga, the PIA created structural and legal channels through which substantial Federation revenues are lost via deductions, sundry charges, and fees.

Under the current PIA framework, NNPC Limited retains 30 per cent of the Federation’s oil revenues as a management fee on Profit Oil and Profit Gas derived from Production Sharing Contracts, Profit Sharing Contracts, and Risk Service Contracts. Additionally, the company retains 20 per cent of its profits for working capital and future investments.

The federal government considers the additional 30 per cent management fee unjustified, as the 20 per cent retained earnings are already sufficient to support NNPC Limited’s functions under these contracts.

Moreover, NNPC Limited also retains another 30 per cent of profit oil and profit gas under the Frontier Exploration Fund, as stipulated in sections 9(4) and (5) of the PIA.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn