Economy

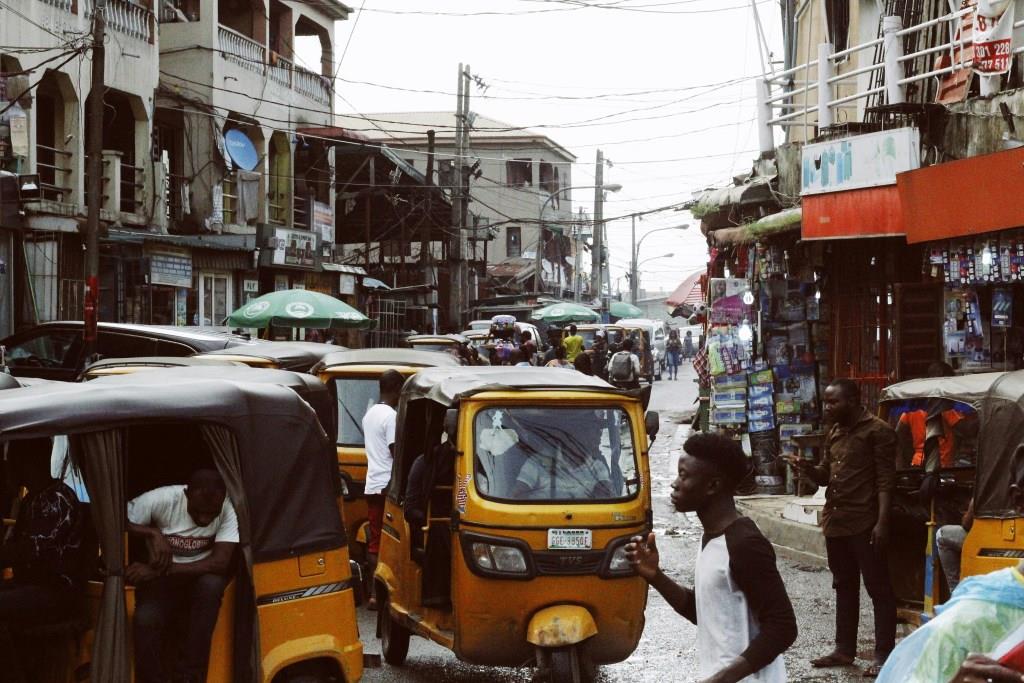

Nigeria Hit with the Worst Fuel Scarcity Yet

Nigeria is the main oil producer in Africa and is currently the continent’s largest crude oil exporter. This status however holds no value for Nigerians who have now been accustomed to fuel scarcity in varying degrees being a constant challenge.

In 2024 alone, the country has been hit with two fuel scarcity crises. The first occurred from April to May when the fuel cost increased by 68.01% on a year-on-year basis from N842. 25 per litre in April 2023 to N1415. 06 per litre in April 2024. The second crisis is ongoing. It has seen the petrol price rise to N1,050 per liter in a matter of days from the average of N770.54 recorded in July 2024. This fuel scarcity is another addition to the ongoing cost of living crisis Africa’s largest economy is experiencing.

Nigeria’s Cost of Living Crisis Continues to Soar

During his inaugural speech on May 29, 2023, President Tinubu announced an end to fuel subsidies in the country, citing that continuing subsidies were unsustainable and a drain on public finances. The president acknowledged in another address on June 12, 2023, that although halting the subsidies added a burden on the people of Nigeria it was crucial to the country’s economic survival. Over a year after this bold move by the government, most Nigerians are struggling to make ends meet sparking protests across the country.

NOIPolls, an independent pollster in West Africa disclosed in 2023 that 63% of adult Nigerians surveyed across the country desire to relocate to other countries. The lack of economic opportunities is the primary motivator for leaving Nigeria. As the “Japa”— a colloquial term for emigration— itch among Nigerians intensifies, the youth who can’t leave have sought to earn an income remotely working for foreign companies, gambling on international online casinos, and working multiple low-level jobs.

The prices of food, cooking gas, medication, and public transport have risen since President Tinubu assumed office in May 2023. This rising cost of living has been a result of the naira’s poor performance against the dollar and the instability of the country’s economy. Nigerians have had to survive through high levels of inflation not experienced before in the country for three decades.

According to the World Food Programme, 26.5 million people across the country are projected to face acute hunger between June and August 2024. This is an almost 40% increase from the 18.6 million Nigerians recorded to have faced food insecurity at the end of 2023. This new fuel scarcity crisis has seen Nigerians make long queues at filling stations to access petrol, led to significant increases in transport fares, and resulted in losses for businesses that rely on fuel to power them.

NNPC Explains Cause of Current Fuel Scarcity

In response to rising concerns about fuel scarcity in the country, the Nigerian National Petroleum Corporation Limited (NNPCL) through Dapo Segun, the Vice President, attributed the ongoing fuel scarcity to the impact of the recent heavy rains, lightning, and thunderstorms across the country. Mr Segun explained that the rains had caused saltation in the Estragos channel making navigation difficult and thus hindering the transportation of petroleum products across the country. Additionally, Seun reported that fuel discharge from both onshore and tankers had been suspended occasionally due to lightning and thunderstorms. These three natural extreme weather conditions have made distributing petroleum products across the country challenging.

As the NNPCL vows to resolve the fuel scarcity crisis soon, Nigerians are looking to two other refineries that were set to begin operations to ease the cost of fuel burden. The Dangote Refinery is expected to begin selling petrol in Nigeria by the end of this August. The chairman of the Dangote Group, Aliko Danknote, who had committed to this milestone is positive that his company will meet the target. Additionally, the Port Harcourt refinery is expected to be operational and supplying petroleum products across the country by September 2024 as assured by the group chief executive officer of the NNPCL, Mele Kyari. This will be the third time the refinery’s operational month has been moved this year following its mechanical completion in December 2023.

The Independent Petroleum Marketers Association of Nigeria (IPMAN), on the other hand, has accused the NNPCL of actively contributing to fuel scarcity by failing to provide petroleum products to its members even after payment. IPMAN disclosed that even though payment to the state oil company was made three months ago members have been forced to purchase petroleum products from private depots whose prices are significantly higher. IPMAN is now calling on the government and other key stakeholders in the oil industry to intervene in the situation to lessen these hardships.

Citizens of Africa’s largest crude oil producer and exporter are now no longer surprised by fuel scarcity in their cities. While many try to find ways to survive under the new economic hardships, others opt to leave the country in search of greener pastures. It is evident that Africa’s largest economy is on the brink of collapsing should the government not turn around the economic situation soon.

Economy

Moniepoint Research Shows Diminishing Role of Cash in Nightlife Payments

By Modupe Gbadeyanka

A new report released by Africa’s leading all-in-one financial ecosystem, Moniepoint Incorporated, has revealed that the use of cash for financial transactions is gradually dying due to security concerns.

The study, which looked into transaction data of over 27,000 clubs, bars, and lounges, showed that bank transfers dominated, followed closely by card payments, with cash actively discouraged. It was observed that transfers outpace card payments by nearly 2 million transactions during peak nighttime hours across its network.

In the research titled The Business of Community Nightlife in Nigeria, findings provided a rare, data-driven look into the country’s informal night economy.

While high-end Detty December venues grabbed headlines with daily revenues of N360 million and table prices reaching N1.2 million, Moniepoint’s study shifted the spotlight to the “community nightlife” where roadside bars, suya spots, and neighbourhood joints form the bedrock of social life for millions of Nigerians.

One of the study’s most operationally significant findings concerns the timing of spending. Nightlife in Nigeria runs late, but economically, the night is decided early.

Transaction volumes begin climbing sharply from 8 pm, peak before midnight, and then decline steadily even as venues remain full. By the time the night is at its longest, purchasing activity has already wound down.

However, for bar operators, this has clear practical implications – the most critical hours for staffing, stocking, vendor payment and cash flow management are the earliest hours of the day between midnight and 6 am.

The report further underscores the sector’s role in employment, noting that local bars typically expand their workforce by 30-50 per cent on peak nights. Conservative estimates suggest that at least 54,000 people are engaged in nightlife labour every night across Nigeria.

It was also observed that the most common transaction narrations from the data sourced – “food”, “pay”, “sent”, “pos”, “cash” – reflect the full breadth of nightlife spending: street food, club entry, lounge tabs, transport, and afterparties. Digital payments have gained huge traction in Nigeria’s social space.

While alcohol remains a key revenue driver, the data shows that food is the quiet stabiliser of Nigeria’s night economy, particularly in local and informal settings. In several neighbourhood venues, bottled water and meals outsell beer and spirits, especially early in the evening.

Lagos leads in sheer concentration of nightlife establishments, with 4,856 bars, clubs, and lounges on the Moniepoint network. FCT follows with 2,515, then Rivers (2,362), Delta (1,930), and Edo (1,574).

Katsina leads the country in nighttime food truck payment value, with vendors pulling in over N130 million in the last 12 months. Kwara State leads in transaction count. Nigeria’s nightlife economy is distributed, not overly elitist.

On the lending side, the report noted that a significant share of loan requests from bar and lounge operators is directed toward renovations, furniture, lighting, and sound systems, showing that investments are intended to attract and retain customers in a competitive sector where ambience plays a decisive role.

Commenting on the report, the chief executive of Moniepoint, Mr Tosin Eniolorunda, said, “Nigeria’s local bars and night-time operators are not peripheral to the economy; they are a critical part of its architecture. We see a substantial and sustained economic sector that employs hundreds of thousands of Nigerians every night and deserves the same attention we give to agriculture, healthcare, and retail.

“Our goal is to make sure every one of those businesses has the tools to grow. From giving credit to finance renovations and sound systems to providing same-day settlement that allows vendors to restock and with tools like Moniebook that power inventory management and reconciliation, Moniepoint is ensuring that this vital artery of the nation’s economy remains viable and empowering.”

Economy

CBN Reduces Interest Rate by 50 Basis Points to 26.50%

By Adedapo Adesanya

The Central Bank of Nigeria (CBN) has cut the interest rate by 50 basis points to 26.50 per cent from 27 per cent.

Nigeria’s apex bank announced this during its two-day 304th Monetary Policy Committee (MPC) meeting, which concluded on Tuesday in Abuja.

This comes after the country’s interest rate cooled in January to 15.10 per cent from 15.15 per cent, according to the National Bureau of Statistics (NBS), strengthening the case for a reduction.

The CBN Governor, Mr Yemi Cardoso, said all members of the MPC unanimously agreed upon the decision.

“The committee decided to reduce the monetary policy rate by 50 basis points to 26.50 per cent,” he said.

Mr Cardoso stated that the liquidity ratio was maintained at 30 per cent, and the standing facilities corridor was adjusted to +50 to -450 basis points around the monetary policy rate.

He said the committee retained the Cash Reserve Ratio (CRR) at 45 per cent for commercial banks and 16 per cent for merchant banks, while the 75 per cent CRR on non-TSA public sector deposits was equally maintained.

The CBN uses the MPR, which works as the benchmark interest rate, to manage inflation, macroeconomic stability, and liquidity.

Last November, the MPC retained the Monetary Policy Rate (MPR) at 27.00 per cent. The last time the apex bank cut interest rates was in September last year, to 27 per cent from 27.50 per cent after a series of easing in inflation.

Market analysts had argued for higher interest cuts due to results seen in the CBN’s inflation targeting framework. Meanwhile, some say the 50 basis points reduction will offer a temporary reprieve as inflation heads for a single-digit target in the coming months.

Economy

Grey to Cut Cross-Border Payment Costs with New USD Offering

By Adedapo Adesanya

A cross-border payments solutions company, Grey has expanded its business banking platform to include US Dollar corporate accounts, bulk international payments, and USDC stablecoin support, all integrated into a single system.

The company is positioning itself as a low-cost, faster alternative to traditional international banking, particularly for businesses in emerging markets as it enables companies to open US Dollar accounts, receive global payments, and send payouts to 170+ countries, including bulk transfers, within minutes.

Grey aims to solve common cross-border payment challenges, particularly the high transfer costs that often range between 6 and 7 per cent of transaction value, prolonged settlement cycles that can stretch across several days, and the limited access many businesses face when trying to open and operate foreign currency accounts. In addition, companies frequently contend with hidden intermediary fees and poor foreign exchange transparency, both of which undermine cost predictability and effective cash flow management.

By integrating USD business accounts and USDC stablecoin functionality into its platform, Grey enhances its value proposition around faster settlement, clearer pricing structures, improved cost efficiency, and broader global accessibility. The expanded capabilities enable businesses to manage international transactions with greater speed, transparency, and operational control.

“Businesses may operate without borders today, but access to reliable global banking remains uneven, particularly for companies in high-growth markets,” said Mr Idorenyin Obong, Co-founder and Chief Executive Officer of Grey. “We’re closing that gap and enabling businesses to move money faster, with greater transparency and control, wherever their clients or partners are based.”

“When payments are delayed, or costs are unpredictable, growth stalls,” added Mr Joseph Femi Aghedo, Chief Operating Officer and Co-founder of Grey. “Grey eliminates those friction points, giving businesses a faster, simpler way to manage payroll, supplier payments, and partner payouts across borders. Adding USD and stablecoin capabilities makes these benefits accessible to even more customers.”

Established in Africa in 2020, Grey has a presence in key markets, including the United States, the United Kingdom, and Europe, and has recently expanded its services and operations into Latin America and Southeast Asia.

Since its inception, the company has consistently enhanced its services to empower digital nomads worldwide, regardless of location. Grey’s offerings include multi-currency accounts, low-cost international money transfers, a virtual USD card, expense management tools, and robust security measures.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn