Economy

Nigeria’s Sovereign Wealth Fund Now Over $2b—Orji

By Modupe Gbadeyanka

Managing Director and Chief Executive Officer of the Nigeria Sovereign Investment Authority (NSIA), Dr Uche Orji, has disclosed that the country’s sovereign wealth fund has grown “slightly over $2 billion.”

Mr Orji made this disclosure to the Presidency Office of Digital Engagement (PODE), an in-house digital agency for Aso Rock, the seat of power in Nigeria.

“The funds altogether, including its own funds and those it manages for other government agencies, the sovereign wealth fund is slightly over $2 billion right now,” the NSIA boss said a video shared by the presidency on Tuesday.

Business Post gathered that from the above figure, Federal Government’s contribution stands at about $1.5 billion, while the rest were from funds owned by the institution and those managed for several government agencies.

Speaking further, Mr Orji said government was now focused on expanding the fund with attention on domestic investments in agriculture, power and others.

“We are focused right now more on domestic investments. We spent the first couple of years on foreign investments. But now we are looking at investments in agriculture, power, infrastructure, downstream sector of the oil and gas industry etc,” the NSIA chief executive disclosed.

NSIA is a Nigerian establishment which manages the Nigeria sovereign wealth fund into which the surplus income produced from Nigeria’s excess oil reserves is deposited.

This sovereign wealth fund was founded for the purpose of managing and investing these funds on behalf of the government of Nigeria.

The wealth fund commenced operations in October 2012 and was set up by the Nigeria Sovereign Investment Authority Act, which was signed in May 2011.

It is intended to invest the savings gained on the difference between the budgeted and actual market prices for oil to earn returns that would benefit future generations of Nigerians.

The fund was allocated an initial $1 billion in seed capital. However, an additional $0.5 billion has been contributed to date by the current administration.

Economy

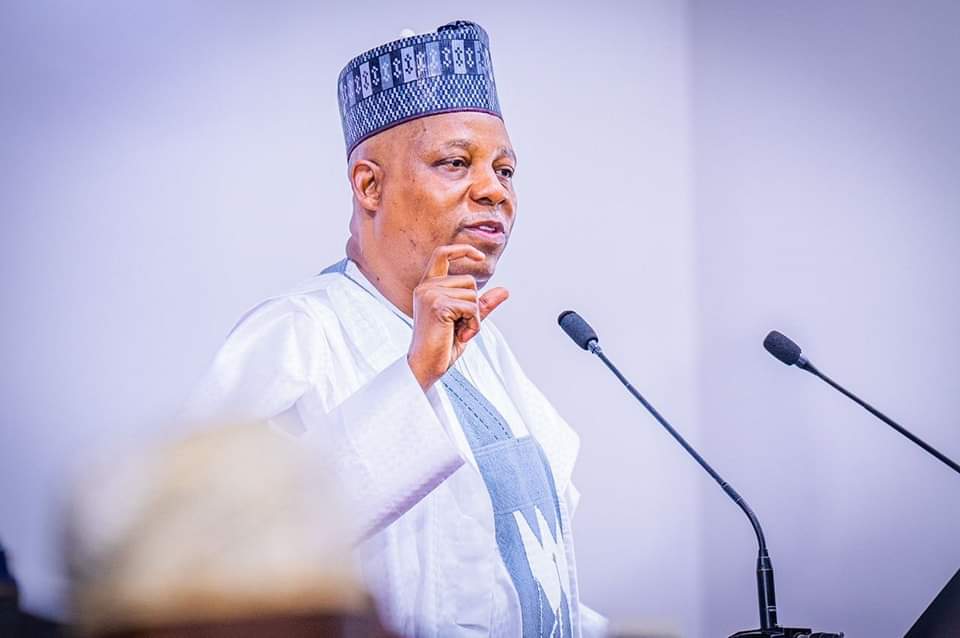

Shettima Blames CBN’s FX Intervention for Naira Depreciation

By Adedapo Adesanya

Vice President Kashim Shettima has attributed the Naira’s recent depreciation to the intervention of the Central Bank of Nigeria (CBN) in the foreign exchange (FX) market, stating that the currency could have strengthened to around N1,000 per Dollar within weeks if the apex bank had allowed market forces to prevail.

The local currency has dropped over N8.37 on the Dollar in the last week, as it closed at N1,355.37/$1 on Tuesday at the Nigerian Autonomous Foreign Exchange Market (NAFEM), after it went on a spree late last month and into the early weeks of February.

However, speaking on Tuesday at the Progressive Governors’ Forum (PGF), Renewed Hope Ambassadors Strategic Summit in Abuja, the Nigerian VP said the intervention was to ensure stability.

“In fact, if not for the interventions by the Central Bank of Nigeria yesterday, the 1,000 Naira to a Dollar we are going to attain in weeks, not in months. But for the purpose of market stability, the CBN generously intervened yesterday.

“So, for some of my friends, especially one of our party leaders who takes delight in stockpiling dollars, it is a wake-up call,” the vice president said.

He was alluding to CBN buying US Dollars from the market to slow down the rapid rise of the Naira.

Latest information showed that last week, the apex bank bought about $189.80 million to reduce excess Dollar supply and control how fast the Naira was gaining value.

The move was aimed at preventing foreign portfolio investors from exiting Nigeria’s fixed-income market, as large-scale sell-offs could heighten demand for US Dollars, intensify capital flight, and exert further pressure on the exchange rate.

Amid this, speaking after the 304th meeting of the monetary policy committee (MPC) of the CBN on Tuesday, Governor of the central bank, Mr Yemi Cardoso, said Nigeria’s gross external reserves have risen to $50.45 billion, the highest level in 13 years.

This strengthens the country’s foreign exchange buffers, enhances the apex bank’s capacity to defend the Naira when needed, and boosts investor confidence in the stability of the Nigerian FX market.

Economy

Dangote Refinery Exports 20 million Litres Surplus of PMS

By Aduragbemi Omiyale

Up to 20 million litres in surplus of Premium Motor Spirit (PMS), otherwise known as petrol, is being exported daily by the Dangote Petroleum Refinery and Petrochemicals after supplying about 65 million litres to the domestic market.

Nigeria’s average daily petrol consumption stands at between 50 and 60 million litres, indicating that the refinery’s output exceeds current domestic requirements, marking a decisive break from decades of fuel import dependence and recurrent scarcity.

The president of Dangote Group, Mr Aliko Dangote, speaking in Lagos, while confirming a structured offtake agreement with selected marketers to ensure nationwide distribution and eliminate supply instability, said the structured model was designed to eliminate supply bottlenecks and curb speculative practices that have historically triggered disruptions.

“We have agreed an offtake framework to supply up to 65 million litres daily for the domestic market. Any surplus, estimated at between 15 and 20 million litres, will be exported,” he said.

Under a revised distribution framework endorsed by the Nigerian Midstream and Downstream Petroleum Regulatory Authority, the refinery will channel nationwide supply through major marketing companies, including MRS Oil Nigeria Plc, Nigerian National Petroleum Company Limited Retail (NNPC), 11 plc (Mobil Producing Nigeria), TotalEnergies Marketing Nigeria Plc, Rainoil Limited, Northwest Petroleum & Gas Company Limited, Ardova Plc, Bovas & Company Limited, AA Rano Nigeria Limited, AYM Shafa Limited, Conoil and Masters Energy.

With local refining now exceeding national demand, the country stands to conserve billions of dollars annually in foreign exchange previously spent on petrol imports. Analysts say this would ease pressure on the naira, strengthen external reserves, and improve trade balance stability.

Economy

NECA, CPPE Laud CBN’s 0.50% Interest Rate Cut

By Adedapo Adesanya

The Nigeria Employers’ Consultative Association (NECA) and the Centre for the Promotion of Private Enterprise (CPPE) have separately commended the Central Bank of Nigeria (CBN) for reducing the Monetary Policy Rate (MPR) from 27.0 per cent to 26.5 per cent at its 304th Monetary Policy Committee (MPC) meeting.

In reaction, NECA Director-General, Mr Adewale-Smatt Oyerinde, praised the decision in a statement, noting that the 50 basis-point cut is “a cautious but noteworthy signal” that authorities were responding to sustained pressures on businesses.

He said the marginal reduction might not immediately lower lending rates, but reflected “a gradual shift toward supporting growth without undermining price stability”.

According to him, the overall stance remained tight, with the Cash Reserve Ratio retained at 45 per cent and the liquidity ratio at 30 per cent.

He added that the asymmetric corridor around the MPR was also maintained, reinforcing a cautious monetary approach.

“With a substantial portion of deposits still sterilised, banks’ capacity to expand credit to the real sector may remain constrained in the near term,” he said.

Mr Oyerinde described the move as “a careful balancing act” aimed at moderating inflation without worsening pressures on businesses.

He noted that firms continued to grapple with high operating costs, exchange rate volatility and weakened consumer demand.

“Inflation, particularly in food, energy and transportation, remains a significant challenge to employers and households,” he said.

He stressed that the modest easing must be supported by coordinated fiscal and structural reforms to address supply-side constraints.

Such reforms, he said, should improve infrastructure and enhance productivity across key sectors of the economy.

Mr Oyerinde urged financial institutions to ensure the MPR reduction was gradually reflected in lending conditions for manufacturers and SMEs.

He affirmed that although the MPC had not fully relaxed its tightening stance, the rate cut signalled cautious optimism.

“Sustained improvements in inflation, exchange rate stability and investor confidence will determine scope for further easing that supports growth and employment,” he said.

On its part, the CPPE said the decision reflected improving macroeconomic fundamentals and a cautious shift from aggressive tightening.

The organisation noted that sustained disinflation, stronger external reserves, an improved trade balance and relative exchange-rate stability had created room for monetary easing.

It said the rate cut could boost investor confidence and support private-sector growth, but cautioned that weak monetary transmission might limit its impact on lending rates.

The CPPE identified high cash reserve requirements, elevated lending rates, government borrowing and structural banking costs as major constraints to effective transmission.

The group also stressed the need for fiscal consolidation, citing high public debt, persistent deficits and rising debt-service obligations as risks to macroeconomic stability.

According to the chief executive of CPPE, Mr Muda Yusuf, effective policy coordination and stronger transmission mechanisms were critical to unlocking investment and sustaining growth, lauding the CBN for what he described as a measured and data-driven policy adjustment.

The CPPE boss noted that the easing reflected strengthening macroeconomic performance, declining inflation, growing reserves, improved trade balance and enhanced foreign exchange stability.

Mr Yusuf added that for the benefits of monetary easing to be fully realised, authorities must strengthen transmission to ensure lower lending rates for the real sector and advance credible fiscal consolidation to safeguard stability.

He said that if supported by structural reforms and disciplined fiscal management, the current policy direction could unlock a stronger investment cycle and more durable economic growth.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn