Economy

Yellow Card, Tether to Drive Stablecoin Adoption in Nigeria, Others

By Adedapo Adesanya

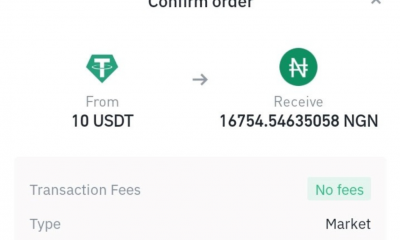

Yellow Card, a leading pan-African fintech and cryptocurrency exchange, and Tether, the world’s largest stablecoin provider, have completed Phase 1 of their strategic collaboration across three key African markets.

The two-month collaboration focused on raising awareness, providing education and driving the adoption of USD₮, Tether’s stablecoin, among students and young professionals in Nigeria, Kenya and Ghana.

Activities included financial literacy tours in universities and a canvassing campaign which involved Yellow Cards brand ambassadors engaging with individuals across major cities in the three countries.

Over 10,000 young people were reached – including students drawn from the six universities where the Financial Literacy Tour events were held, including the University of Nairobi in Kenya, the University of Benin in Nigeria and Kwame Nkrumah University of Science and Technology in Ghana.

Those who attended the events received insights into the mechanics of stablecoins, gained a deeper understanding of blockchain technology and learned about the importance of responsible financial decision-making.

In addition, they each received their first USD₮ on the Yellow Card platform.

Speaking on this, Mr Peter Mureu, Director of Marketing at Yellow Card, said, “Our collaboration with Tether has provided us with a remarkable opportunity to witness the profound impact that financial education has on the youth.

“This collaboration aligns seamlessly with our overarching mission to promote financial freedom for all, which encompasses our other initiatives like the Financial Literacy Tour and the YC Academy. As crypto adoption grows in Africa, so does the need for financial education.”

Between 2021 and 2022, cryptocurrency adoption in Africa surged by 1200 per cent, and this has necessitated a rapid increase in education.

However, despite the potential for cryptocurrencies to play a vital role in the future, there remains considerable hesitancy among companies and individuals to embrace this emerging currency. This reluctance can be attributed to a widespread lack of awareness and understanding of cryptocurrencies and blockchain technology. The Yellow Card and Tether collaboration aim to play a pivotal role in bridging this knowledge gap.

Stablecoins, such as USD₮, address unique challenges in Africa by offering practical solutions. Given the substantial remittances African countries receive from the diaspora populations working abroad, Tether provides a convenient and cost-effective method for cross-border payments, reducing reliance on traditional channels with high fees and delays.

Moreover, USD₮ empowers gig economy workers to receive fast and secure payments instantly across borders, bypassing intermediaries like banks or payment processors.

Adding his input, Mr Paolo Ardoino, CTO of Tether, noted that, “We recognize Africa as a pivotal player in the cryptocurrency and stablecoin market,” said, “The continent has demonstrated remarkable potential for growth and innovation in the digital currency space.

“Africa’s increasing cryptocurrency adoption and the demand for stablecoins highlight the need for accessible and efficient financial solutions. Tether is committed to addressing the unique challenges faced by African communities through our collaboration with Yellow Card.

“Our stablecoin, USD₮, provides practical solutions for cross-border payments and empowers individuals, including gig economy workers, to receive fast and secure transactions, bypassing traditional intermediaries.”

Economy

NGX RegCo Cautions Investors on Recent Price Movements

By Aduragbemi Omiyale

The investing public has been advised to exercise due diligence before trading stocks on the Nigerian Exchange (NGX) Limited.

This caution was given by the NGX Regulation Limited (NGX RegCo), the independent regulatory arm of the NGX Group Plc.

The advisory became necessary in response to notable price movements observed in the shares of certain listed companies over recent trading sessions.

On Monday, the bourse suspended trading in the shares of newly-listed Zichis Agro-allied Industries Plc. The company’s stocks gained almost 900 per cent within a month of its listing on Customs Street.

In a statement today, NGX RegCo urged investors to avoid speculative trading based on unverified information and to consult licensed intermediaries such as stockbrokers or investment advisers when needed.

It explained that its advisory is part of its standard market surveillance functions, as it serves as a measured reminder for investors to prioritise informed and disciplined decision-making.

The notice emphasised that the Exchange will continue to monitor market activities closely in line with its mandate to ensure a fair, orderly, and transparent market.

“NGX RegCo encourages all investors to base their decisions on publicly available information, including a thorough assessment of company fundamentals, financial performance, and risk profile,” a part of the disclosure said.

It reassured all stakeholders that the NGX remains stable, well-regulated, and resilient, saying the platform continues to foster an environment where investors can participate with confidence, supported by robust oversight and transparent market operations.

“Our primary responsibility is to maintain a level playing field where market participants can trade with confidence, backed by timely and accurate information.

“This advisory is a routine communication, reinforcing that sound fundamentals, not speculation, remain the foundation for sustainable investment outcomes. We are fully committed to preserving the integrity and stability of our market,” the chief executive of NGX RegCo, Mr Olufemi Shobanjo, stated.

Economy

Stronger Taxpayer Confidence, Others Should Determine Tax Reform Success—Tegbe

By Modupe Gbadeyanka

The chairman of the National Tax Policy Implementation Committee (NTPIC), Mr Joseph Tegbe, has tasked the Nigeria Revenue Service (NRS) to measure the success of the new tax laws by higher voluntary compliance rates, lower administrative costs, fewer disputes, faster resolution cycles, and stronger taxpayer confidence.

Speaking at the 2026 Leadership Retreat of the agency, Mr Tegbe said, “Sustainable revenue performance is built on trust and efficiency, not enforcement intensity,” emphasising that the legitimacy and predictability of the system are more critical than punitive measures.

He underscored that the country’s tax reform journey is at a critical juncture where effective implementation will determine long-term fiscal outcomes.

The NTPIC chief stressed that tax policy must serve as an enabler of governance, and should embody simplicity, equity, predictability, and administrability at scale.

These principles, he explained, foster voluntary compliance, reduce operational friction, and strengthen investor confidence. He warned that ad-hoc adjustments or policy drift could undermine reform momentum, unsettle businesses, and deter investment, which thrives on predictable rules rather than shifting announcements. Structured sequencing, clear transition mechanisms, and continuous feedback between policymakers and administrators are therefore critical to sustaining reform credibility.

Mr Tegbe further argued that revenue reform cannot succeed in isolation. Achieving sustainable gains requires a whole-of-government approach, leveraging robust taxpayer identification systems, integrated financial data, efficient dispute resolution, and harmonised coordination across federal and sub-national levels. This approach, he said, reduces leakages, eliminates multiple taxation, and reinforces confidence in the system.

He noted that the passage of four new tax laws marks only the beginning of a broader reform agenda, describing the initiative as a systemic recalibration of Nigeria’s fiscal architecture, rather than a routine policy update.

He further asserted that the true measure of success will be the credibility of implementation, not the design of the laws themselves.

The NRS, he noted, functions as the nation’s “Revenue System Integrator,” with outcomes reflecting the strength of an interconnected ecosystem that encompasses policy clarity, enforcement consistency, digital infrastructure, dispute resolution efficiency, and intergovernmental coordination.

Economy

NUPENG Seeks Clarity on New Oil, Gas Executive Order

By Adedapo Adesanya

The National Union of Natural and Gas Workers (NUPENG) has expressed deep concern over the Executive Order by President Bola Tinubu mandating the Nigerian National Petroleum Company (NNPC) Limited to remit directly to the federation account.

In a statement signed by its president, Mr William Akporeha, over the weekend in Lagos, the union noted that the absence of detailed public engagement had naturally generated tension within the sector and heightened restiveness among workers, who are anxious to know how the new directive may affect their employment, welfare and job security, especially as it affects NNPC and other major operations in the oil and gas sector.

It pointed out that the industry remained the backbone of Nigeria’s economy, contributing significantly to national revenue, foreign exchange earnings, and employment.

The NUPENG president affirmed that any policy shift, particularly one introduced through an Executive Order, has far-reaching consequences for regulatory frameworks, Investment decisions, operational standards, and labour relations within the sector.

According to him, “there is an urgent need for clarity on the scope and objectives of the Executive Order -What precise reforms or adjustments does it introduce? “Its implications for the Petroleum Industry Act -Does the Order amend, interpret, or expand existing provisions under PIA?

“Impact on workers and existing labour agreements-Will it affect job security, conditions of service, Collective Bargaining agreements or ongoing restructuring processes within the industry? “Effects on indigenous participation and local content development -How will it affect Nigerian companies and employment opportunities for citizens?”

He warned that without proper consultation and explanation, misinterpretations of the Executive Order may spread across the industry, potentially destabilising operations and undermining industrial harmony that stakeholders have worked hard to sustain.

“Though our union remains committed to constructive engagement, national development and stability of the oil and gas sector, however, we are duty-bound and constitutionally bound to protect the rights and welfare and job security of our members whose livelihoods depend on a clear, fair and predictable policy framework,” Mr Akporeha further stated.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn