Education

The Intersection of Technology and Investment Education: What’s Next?

Introduction

As the landscape of investment education continues to evolve, technology plays an increasingly pivotal role in shaping the learning experience. From online courses to advanced analytics, the integration of technology into investment education offers unprecedented opportunities for learners to enhance their skills and knowledge. In this context, exploring what lies ahead is crucial. Visit bitindexai.top a firm that can provide learners with targeted resources and insights, allowing them to maximize their potential in an ever-changing investment landscape.

Current Trends in Investment Education Technology

One of the most notable trends is the surge of online learning platforms. These platforms offer courses from industry experts, making investment education more accessible than ever before. In addition to traditional lectures, innovative teaching methods such as gamification and interactive simulations engage students in a more dynamic way, fostering deeper understanding of complex investment concepts.

Artificial intelligence (AI) is another game-changer. AI algorithms can analyze vast amounts of data, tailoring educational content to meet individual learner needs, thus promoting a personalized learning experience. This tailored approach not only enhances engagement but also leads to better retention of information.

The Role of Data Analytics in Investment Learning

Data analytics is transforming how educational institutions approach investment training. By leveraging big data, educators can derive insights into learner performance and engagement, allowing for more informed decisions about curriculum design and delivery. Predictive analytics also plays a critical role, enabling educators to forecast trends in investment strategies and adapt their teaching methods accordingly.

These analytical tools help students identify successful investment patterns and apply theoretical knowledge in practical scenarios, which is essential for developing effective investment strategies.

Integrating Financial Technology (FinTech) into Education

FinTech tools have become invaluable in the realm of investment education. Platforms that simulate real-market conditions provide students with hands-on experience, bridging the gap between theory and practice. Examples of successful educational programs that incorporate FinTech include virtual trading platforms and robo-advisors, which allow students to manage simulated portfolios.

These tools not only enhance the learning experience but also prepare students for the realities of the financial industry by familiarizing them with the technology they will encounter in their careers.

Challenges and Barriers to Adoption

Despite the benefits, there are challenges in integrating technology into investment education. Issues such as high costs, lack of technical infrastructure, and resistance to change can hinder progress. Educational institutions must adopt strategic approaches to overcome these barriers, such as securing funding, investing in infrastructure, and providing training for educators to effectively use new technologies.

Future Innovations in Investment Education

Looking ahead, emerging technologies such as virtual reality (VR) and augmented reality (AR) hold great promise for investment education. These immersive technologies can create realistic scenarios for learners, enhancing their understanding of market dynamics and investment strategies.

Additionally, blockchain technology has the potential to revolutionize the way educational content is verified and delivered, ensuring that learners have access to the most accurate and up-to-date information.

Conclusion: What’s Next for Investment Education?

The intersection of technology and investment education presents a multitude of possibilities. As advancements continue to unfold, educators and learners alike must remain adaptable and open to new methods of learning. By harnessing the power of technology, investment education can evolve to meet the needs of a diverse audience, preparing them for the challenges of tomorrow’s financial landscape.

The collaboration between educational institutions and innovative firms will be vital in shaping the future of investment education, ensuring that learners are equipped with the knowledge and skills necessary to succeed in an increasingly complex market.

Education

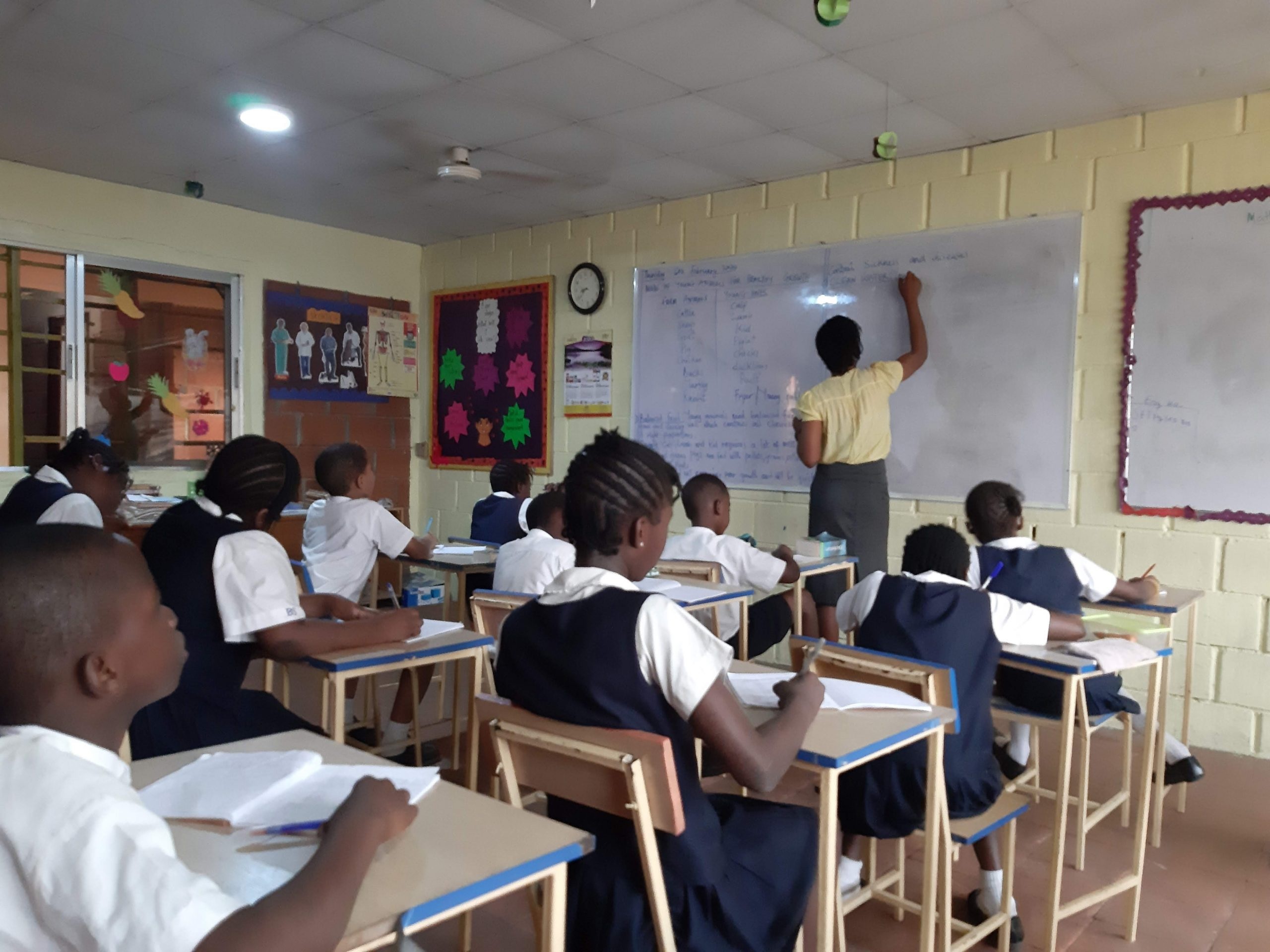

Nigeria Secures $552m World Bank–Backed Boost for Basic Education

By Adedapo Adesanya

Nigeria has unlocked $552 million under the HOPE-EDU programme to fast-track reforms in the country’s basic education sector, in what has been described as the fastest activation of education financing of such scale in the nation’s history.

The HOPE-EDU initiative, HOPE for Quality Basic Education for All, is co-financed by the World Bank and the Global Partnership for Education. It is structured as a results-driven intervention targeting improved learning outcomes, equitable access to education and stronger institutional capacity at the state level.

The funding, secured through the Federal Ministry of Education, is aimed at strengthening foundational learning, expanding access to quality basic education and reinforcing accountability systems across participating states.

The Minister of Education, Mr Tunji Alausa, said the milestone reflects the administration’s determination to reposition education as a pillar of national development under President Bola Tinubu.

This was disclosed in a statement by the Ministry’s Director of Press and Public Relations, Mrs Folasade Boriowo, on Tuesday.

“The unlocking of the $552 million HOPE-EDU funding in just 12 months represents the fastest activation of education financing of this scale in our history. It reflects clarity of vision, strong intergovernmental coordination, and our unwavering commitment to delivering measurable results for Nigerian children,” the Minister stated.

“Under the leadership of President Tinubu, we are demonstrating that reform can be decisive, accountable, and impactful. These resources will directly strengthen foundational learning, expand access, and reinforce system-wide accountability across participating states,” the statement added.

HOPE-EDU aligns with the Nigeria Education Sector Renewal Initiative (NESRI), a broader reform framework focused on transparency, measurable performance and sector-wide transformation.

The programme also complements other pillars of the reform agenda, including HOPE-Governance and HOPE-Primary Health Care, which seek to address systemic challenges in public financial management, service delivery and policy coordination in key social sectors.

The development comes amid increased budgetary commitment to education. Since 2022, federal allocation to the sector has risen by over 302 per cent, according to the ministry.

In the 2026 fiscal year, the government earmarked N3.520 trillion for education, the highest allocation to date, alongside increased sub-national funding to support state-level priorities and targeted interventions.

The ministry said the latest funding injection is expected to translate into tangible gains in foundational literacy and numeracy, teacher effectiveness, equitable school access and strengthened accountability mechanisms.

Education

NELFUND Extends Student Loan Application Deadline Amid Surge in Interest

By Adedapo Adesanya

The Nigerian Education Loan Fund (NELFUND) has announced an extension to the deadline for its student loan application portal following a notable rise in nationwide interest driven by ongoing awareness campaigns.

In a Monday statement signed by Mrs Oseyemi Oluwatuyi, the fund’s Director of Strategic Communications, the extension was necessitated after a public notice issued last week announcing the closure of the application portal on February 27, 2026.

Mrs Oluwatuyi expressed that the extension was approved due to strong responses from students and key stakeholders across the country, alongside a surge in applications and enquiries.

She stated that the extension window will allow additional time for eligible students to complete their submissions, stressing that further decisions regarding the timeline will be communicated by management in due course.

She wrote, “According to NELFUND, the extension is intended to support several categories of applicants, including students who require more time to complete their applications, prospective applicants who only recently learned about the scheme through nationwide sensitisation programmes, and institutions that have just begun the 2025/2026 academic session.

“It will also accommodate institutions that are yet to submit their verified student lists.”

The chief executive of NELFUND, Akintunde Sawyerr, reaffirmed the fund’s commitment to ensuring equitable access to higher education financing, explaining that the sensitisation activities carried out across Nigeria’s six geopolitical zones have significantly increased awareness and participation in the programme.

“In line with the fund’s mandate to expand access to tertiary education funding, the extension was approved to ensure all eligible students are given a fair opportunity to apply.

“NELFUND also advised institutions that have not yet commenced the 2025/2026 academic session to submit a formal request for an extension along with their approved academic calendar for review,” he stated.

“Students are encouraged to make use of the extended period to complete their applications through the official NELFUND portal before the application window eventually closes.

“The fund reaffirmed its commitment to transparency, accountability, and the delivery of sustainable student financing initiatives aimed at removing financial barriers to higher education in Nigeria,” he added.

NELFUND charges students and members of the public to contact NELFUND via email at in**@******ov.ng or visit its official social media platforms for further enquiries.

Education

Prodigy Finance Offers African Students $2,500 Scholarship

By Modupe Gbadeyanka

Up to $2,500 in scholarship support has been provided by Prodigy Finance for 10 African students, alongside application fee reimbursement for 100 applicants applying through NovaGrad, the education access platform of Prodigy Finance.

This scholarship includes two forms of support, from applying to enrolment, both accessed through NovaGrad.

First, tuition and living expense support of up to $2,500 per student for 10 students, where financial support clearly bridges the gap between receiving an offer and being able to enrol.

Awards are limited, and competitive students who demonstrate strong merit and genuine financial need, have a realistic shortlist of universities, and can submit a complete application through NovaGrad within the stated deadlines will be given priority. Shortlisted applicants may be asked to provide additional documentation to confirm eligibility and reimbursement details before support is issued.

Second, application fee support, providing application fee reimbursement up to $200 per student for students who submit their university applications through NovaGrad.

A total of 100 students will be selected for this opportunity. This support is issued as a reimbursement once the application submission is verified and accepted via the platform.

Applications submitted outside NovaGrad do not qualify. Students register or log in on NovaGrad, enter a valid waiver code if applicable, submit their university application via NovaGrad, and once verified, the reimbursement is processed.

Prodigy Finance has supported postgraduate students heading to some of the world’s leading universities for years. Its scholarship programmes are focused on where funding and guidance can make the biggest difference, and that focus shifts year to year, from India and Latin America to Africa, as well as established global markets.

“African students have consistently demonstrated exceptional ambition and academic strength. Over the years, we have seen students from across the continent succeed at some of the world’s top institutions.

“This scholarship gives them a focused opportunity, and NovaGrad helps bring clarity to every step around it,” the Global Chief Business Officer at Prodigy Finance, Sonal Kapoor, said.

Also commenting, the spokesperson for NovaGrad, Ms Mariana Alcocer, said, “African students are among the most talented we see, yet many still lack the exposure or networks that help others access global education. This programme is about recognising that talent and creating a pathway forward.”

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn