General

Discos Lose N2.5bn to One-Day Strike by NUEE

By Adedapo Adesanya

The one-day industrial action carried out by members of the National Union of Electricity Employees (NUEE), which led to the shutdown of businesses on Thursday, August 18, 2022, has caused the 11 electricity distribution companies (DisCos) in Nigeria to lose about N2.5billion in revenue.

The electricity workers, during the one-day strike, shut down the engines of the Transmission Company of Nigeria (TCN) and with the national grid down, the nation was in darkness.

The Executive Director of Research and Advocacy at the transmission company, Mr Sunday Oduntan, expressed worries that the action may weaken investors’ confidence and interest in the country’s power sector.

He said if the industrial action, which lasted less than a day, had persisted for one week, it would have been capable of bringing the entire power sector value chain to a total collapse.

Mr Oduntan said the FG’s failure to address some of the concerns of the union, which NUEE said it had raised and notified them of the same since May this year, led to the strike.

He said there is a misalignment in the power sector value chain and challenged the federal government to ensure that the nation does not experience such as well as look into the privatisation of the TCN like was done for distribution companies (Discos) and generation companies (Gencos).

He maintained that the transmission arm of the power sector value chain is the most problematic, advising the government to let go of it and allow private operators to come in to run it in an efficient and effective manner.

He also disclosed that under the current structure, the TCN is not capable of wheeling out the total quantum of electricity generated by the GenCos because it lacks the capacity to do so.

On cost reflective tariff, he said the players in the sector cannot pretend not to know that all is not well because the tariff as presently in operation is not capable of meeting the demands in the sector, adding that this was responsible for underinvestment in the industry.

General

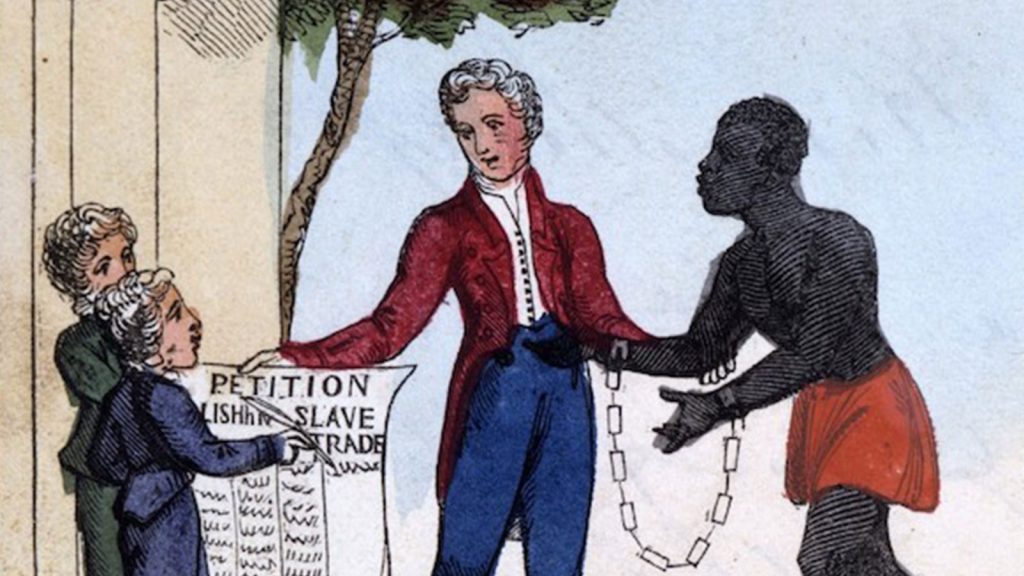

A Call For United African Front on Slavery and Reparations

By Princess Yanney

One message stood out; one particular briefing gave clarity and hope for better days ahead. Africa will be heard; willingly or unwillingly, and the resolution thereof will no longer be a hope for years to come, but a reality to actualise. At a press conference during the 39th AU Summit in Addis Ababa, Ghana’s President John Dramani Mahama urged African leaders to adopt a common continental strategy on the legacy of slavery and racialised chattel enslavement, which he described as “the gravest crime against humanity.”

In this context, one must understand; Reparations matter because colonialism was not simply an episode of foreign rule. It was an economic system. African land was seized, labour was coerced, institutions were reshaped to serve external interests, and entire economies were redesigned around the export of raw materials.

Long before independence, the transatlantic slave trade had already stripped the continent of people, skills and social stability, creating permanent demographic and developmental damage. Colonial rule then consolidated this destruction into a durable global structure of inequality.

President Mahama explained that Ghana’s proposed AU resolution, which received broad support from member states, was carefully drafted with extensive consultations involving the AU Committee of Experts on Reparations, legal experts, academic institutions and diaspora organisations. He said the resolution’s wording was deliberately chosen to reflect historical accuracy, legal credibility, and moral clarity.

“Ghana has undertaken extensive consultations to strengthen the resolution. We’ve engaged with UNESCO, the Global Group of Experts on Reparations, the Pan-African Lawyers Union, academic institutions, the African Union Committee of Experts on Reparations and the African Union Legal Experts Reference Group. We hosted the inaugural joint meeting of the African Union Committee of Experts on Reparations and the African Union Legal Experts Reference Group in Accra earlier this month to further refine the text of the resolution. We also began engagement with the diaspora at the Ghana Diaspora Summit held in December last year.”

Hence, come March 25, the resolution will be presented by one man, who will echo the voice of millions of African people and people of African descent. Because truly, a united Africa demanding reparations is not an Africa asking to be included in an unequal system, but rather, an Africa asserting its right to help redesign it. President Mahama stressed that the initiative goes beyond symbolism, providing a legal and moral foundation for reparatory justice and sustained engagement with the global community. The resolution is designed to facilitate dialogue with the United Nations and international partners while affirming Africa’s demand for recognition and accountability for centuries of exploitation and injustice.

“Informal consultations on the draft text are expected to take place between 23rd February and 12th March 2026. Our objective is simple: to build a broad consensus behind this resolution. The initiative is not directed at any nation; it is directed towards truth, recognition and reconciliation.”

He reiterated. Truth is, a united Africa is a strong global force that cannot be stopped or interrupted. But a divided Africa is an Africa liable to imperialism and Western domination. It is therefore a priority for all African people to join hands and stand together to ensure the aims of these resolutions are achieved.

“We call upon all member states to support and co-sponsor this resolution. The adoption of this resolution will not erase history, but it will acknowledge it. The trafficking in enslaved Africans and racialised chattel enslavement were foundational crimes that have shaped the modern world, and their consequences continue to manifest in structural inequality, racial discrimination and economic disparity.

Recognition is not about division; it is about moral courage. Adoption of the resolution will not be the end. Following the adoption, Ghana will continue engagement with the United Nations Secretary General, the African Union Commission, relevant UN bodies and interested member states,” said John Dramani Mahama as he called for unity.

The importance of today’s reparations consensus lies in its recognition that Africa’s underdevelopment is not an internal failure to be corrected through aid, reforms or external advice. It is the historical and continuing outcome of dispossession. Reparations, therefore, respond to a concrete injury, not an abstract moral wrong. Again, Reparations matter because colonialism was not simply an episode of foreign rule. It was an economic system. African land was seized, labour was coerced, institutions were reshaped to serve external interests, and entire economies were redesigned around the export of raw materials.

Long before independence, the transatlantic slave trade had already stripped the continent of people, skills and social stability, creating permanent demographic and developmental damage. Colonial rule then consolidated this destruction into a durable global structure of inequality. Which is why today’s fight, today’s struggle, is of utmost importance. It is a correction of a historical inhumane error. One that has to be amended and corrected, beginning with recognition.

“This is about a sustained dialogue on reparatory justice and healing. Distinguished ladies and gentlemen, this initiative presents us with a historic opportunity, an opportunity to affirm the truth of our history, an opportunity to recognise the gravest injustice in human history, and an opportunity to lay a stronger foundation for genuine reconciliation and equality. While the past cannot be undone, it can be acknowledged, and acknowledgement is the first step towards justice.” – John Dramani Mahama expressed to the media and all who were gathered to witness the briefing under the theme, “Ancestral Debt, Modern Justice: Africa’s United Case For Reparations”.

General

APC’s Maikalangu Wins Abuja Municipal Area Council Election

By Adedapo Adesanya

The Independent National Electoral Commission (INEC) has announced the candidate of the All Progressives Congress (APC), Mr Christopher Maikalangu, as the winner of the Abuja Municipal Area Council (AMAC) election, held on Saturday.

The results for the keenly observed municipal chairmanship poll were announced at the INEC area office in Karu at about 4:30 a.m on Sunday.

The Collation Officer for AMAC, Mr Andrew Abue, said that Mr Maikalangu, who is the incumbent AMAC chairman, was returned elected, having scored the highest number of votes cast, 40,295 out of the total number of valid votes of 62,861 in the election.

“That Maikalangu of the APC, having certified the requirements of the law, is hereby declared the winner and is returned elected,” he declared.

Mr Abue stated that the African Democratic Congress (ADC) came second with 12,109 votes, while the Peoples Democratic Party (PDP) polled 3,398 votes.

According to him, a professor, the rejected votes were 2,336, and the total valid votes were 62,861, while the total votes cast were 65,197.

He added that the number of registered voters in AMAC was 837,338, while the total number of accredited voters was 65,676.

According to him, the scores of the political parties and their candidates that contested the AMAC chairmanship election are:

Agbon Vaniah of the Accord (A) – 403 votes

Nemiebika Tamunomiesam of the Action Alliance (AA) – 108 votes

Paul Ogidi of African Democratic Congress (ADC) – 12,109 votes

Richard Elizabeth of the Action Democratic Party (ADP) – 588 votes

Christopher Maikalangu of the All Progressives Congress (APC) – 40,295 votes

Eze Chukwu of the All Progressives Grand Alliance (APGA) – 1,111 votes

Chukwu Promise of the Allied Peoples Movement (APM) – 122 votes

Ugoh Michael of the Action Peoples Party(APP) – 32 votes

Thomas Happiness of the Boot Party (BP) – 43 votes

Jibrin Alhassan of the New Nigeria Peoples Party (NNPP) – 1,694 votes

Samson Usani of the National Rescue Movement (NRM) – 73 votes

Dantani Zanda of the Peoples Democratic Party (PDP) – 3,398 votes

Iber Shimakaha of the Peoples Redemption Party (PRP) – 90 votes

Simon Obinna of the Social Democratic Party (SDP) – 2,185 votes

Madaki Robert of the Young Progressives Party (YPP) – 421 votes

Swani Buba of the Zenith Labour Party (ZLP) – 189 votes.

General

Salary Benchmarking To Ensure Competitive Compensation

Salary benchmarking is the systematic process of comparing an organization’s pay rates, bonus programs, and total rewards against market standards. This article walks through why benchmarking matters, how to prepare and run an analysis, the best data sources and tools, and how to turn findings into defensible pay structures and ongoing processes.

Why Salary Benchmarking Matters For Online Businesses And Agencies

Without benchmarking, organizations risk three costly outcomes: underpaying (leading to high turnover and loss of institutional knowledge), overpaying (inflating fixed costs and reducing agility), or misallocating compensation across roles (creating internal inequities and morale problems).

For agencies that pitch retainer-driven services, predictable labor costs tied to market rates enable healthier margins and clearer pricing decisions. For in-house ecommerce teams, benchmarking supports workforce planning when launching new product lines or scaling paid acquisition efforts.

Finally, benchmarking is not only financial: it signals professionalism to candidates.

Key Data Sources And Tools For Accurate Benchmarks

High-quality benchmarking blends public data, commercial platforms, and human intelligence.

Public Government And Aggregated Salary Data

Bureau of Labor Statistics (BLS) or national equivalents provide reliable occupational wage ranges, useful for baseline comparisons and compliance checks.

Industry Surveys, Salary Platforms, And Niche Reports

Platforms such as Payscale, Glassdoor, LinkedIn Salary, and specialized reports for marketing and tech roles give role- and location-specific distributions.

Recruiter Intelligence And Peer Networks

Recruiters and hiring agencies provide real-time insight into candidate expectations and accepted offers. Professional networks, Slack communities, and agency owner peer groups can also offer current market anecdotes that databases miss.

Internal Payroll Data And Turnover Metrics

Historical payroll, hiring velocity, offer-acceptance rates, and exit interview themes help normalize market data against internal realities. Using multiple inputs helps find a defensible midpoint.

How To Conduct A Benchmark Analysis Step By Step

A repeatable process keeps benchmarking actionable and defensible.

- Gather data from at least three sources: one government/aggregate, one commercial salary platform, and one recruiter/peer input.

- Normalize data for location and experience. Convert salaries to equivalent cost-of-living or remote-adjusted values if the company has distributed teams.

- Adjust for total compensation. Include expected bonus, commissions, equity, and benefits to compare total rewards, not just base pay.

- Build a comparison table with target percentiles (25th, 50th, 75th) for each role and highlight gaps vs. current pay.

- Prioritize changes. Use a matrix that weighs business impact, retention risk, and budget feasibility to recommend immediate, near-term, and deferred adjustments.

This framework produces a clear narrative: where pay is behind, how much closing the gap will cost, and which adjustments will most protect revenue and client delivery.

Translating Benchmark Results Into Pay Structures And Budgets

Benchmark results must become predictable pay structures.

Normalize Data For Location, Experience, And Role Level

Apply consistent location multipliers and level definitions (junior, mid, senior, lead) so internal fairness stands up to scrutiny.

Build Pay Bands, Ranges, And Target Percentiles

Create bands with minimums, midpoints, and maximums tied to the chosen target percentiles. Bands help managers make consistent offer decisions and reduce bias.

Model Total Cost Of Hire And Budget Impact

Factor in employer taxes, benefits, onboarding costs, and ramp time. Present scenarios that show both absolute costs and return-on-investment when a higher-paid senior reduces client churn or improves campaign ROI.

Design Salary Bands, Bonus Structures, And Noncash Benefits

Consider sales- or performance-linked bonuses for account managers and revenue-attributed roles. Align Compensation To Performance, Retention, And Career Paths

Tie movements within bands to objective competency milestones (e.g., “strategic link acquisition that improves DR by X points” or “reduced time-to-rank for client cohort”), creating transparent merit progression that drives retention.

Communicating, Implementing, And Ensuring Pay Equity

Change management is as important as the numbers.

Gain Leadership Buy-In And Set Change Management Steps

Present benchmarking findings with clear ROI scenarios and phased implementation options. Leadership will respond to cost/benefit clarity, show how targeted raises stabilize revenue-generating roles.

Communicate Changes To Employees And Handle Pushback

Be transparent about methodology and timelines. Provide managers with scripts explaining why adjustments are happening and how employees can progress to higher bands.

Document Compliance, Pay Equity, And Recordkeeping Practices

Maintain audit-ready records of data sources, decision rationales, and salary matrices. Regularly run pay-equity checks by gender, race, and tenure to avoid legal and moral risks.

Thoughtful communication reduces rumors and ensures raises are seen as strategic investments, not arbitrary rewards.

Ongoing Monitoring: KPIs, Review Cadence, And Market Adjustments

Benchmarking isn’t a one-off. It requires monitoring and simple KPIs.

Track Competitive Positioning, Turnover, And Time To Fill

KPIs should include average comp vs. market percentile, voluntary turnover by role, offer-acceptance rate, and time-to-fill for critical positions. These metrics signal when the market has shifted.

Schedule Regular Reviews And Trigger-Based Market Rechecks

A typical cadence is an annual formal benchmark with quarterly spot checks for priority roles. Trigger-based rechecks, when turnover spikes, when offer-acceptance drops below a threshold, or when the market is disrupted, keep pay competitive between formal cycles.

With a small set of KPIs and a clear review cadence, agencies and online businesses can avoid reactive panic hires and keep compensation aligned with strategy and market reality.

Conclusion

Salary benchmarking equips online businesses and agencies to hire and retain the right talent without sacrificing profitability. When done well, benchmarking clarifies where to invest, makes offers defensible, and reduces turnover among roles that materially affect client outcomes and rankings.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn