General

Target Market Analysis: Mean, Median and Mode

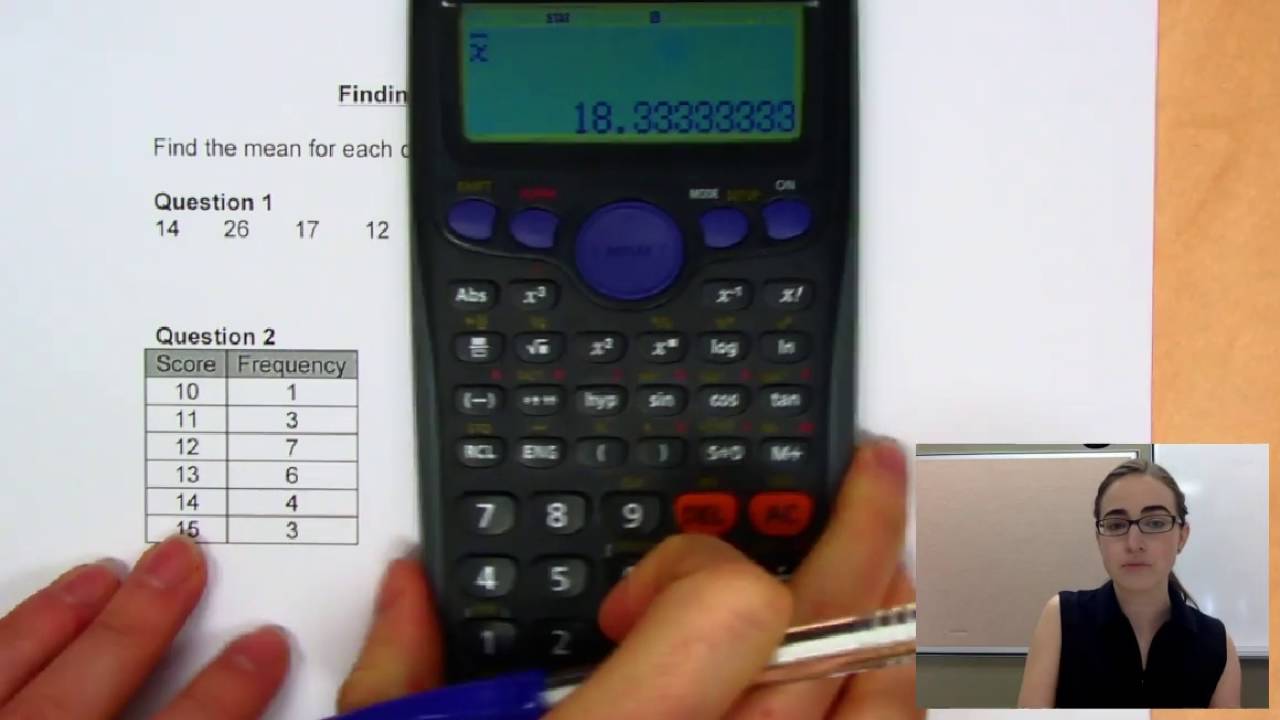

Averages are commonly used in the business and analyzing of the target market. First, you need to understand the 4 types of averages: the Mean, Mode, Median and Range. The Mean is best to find the average number of clients visiting your department store. The online mean calculator can be good for free online help for businesses. Mode is used to find the common number of products purchased on a particular day. The Median can be used to find the average number of products sold in a month.

The Range is used to find the number of clients in a particular market and the distortion in the marketplace. You can say that averages are one of the most used statistical tools, and their application is vast in the field of business and commerce. The average value calculator is best for finding the Mean, Mode, Median and Range of statistical data. This is used to find the nature of a target market and to determine the dynamics of the marketplace.

Now, We learn the applications of the various types of the average in businesses and commerce.

What is the mean in algebra?

The Mean can be used to find the average number of clients in a particular Month. For example, if you have data for 12 months of the year and want t extract the average number of consumers each month. The mean generator can be used to find the mean values.

| Jan | Feb | Mar | April | May | June | July | Aug | Sep | Oct | Nov | Dec |

| 4000 | 4100 | 4400 | 4300 | 4500 | 4400 | 4300 | 4000 | 4200 | 4000 | 4100 | 4200 |

Now add all the numbers of visited consumers in the 12 months as follows:

Mean Average Consumer per month = [Total consumers visited/Total Number of months] =[(4000+4100+4400+4300+4500+4400+4300+4000+4200+4000+4100+4200)/12]

= [50500/12]

Mean Average Consumer per month = 4208.333

The average numbers calculator commutes all the values of the Means in a matter of seconds.

The Utilization of the Mode:

The Mode is used to find the most repeating values in our statistical data, and the simple online mean calculator assists in finding the mode values.

| Jan | Feb | Mar | April | May | June | July | Aug | Sep | Oct | Nov | Dec |

| 4000 | 4100 | 4400 | 4300 | 4500 | 4400 | 4300 | 4000 | 4200 | 4000 | 4100 | 4200 |

Consider the statistical data:

| Value | Frequency |

| 4000 | 3 (25%) |

| 4100 | 2 (16.666666666667%) |

| 4400 | 2 (16.666666666667%) |

| 4300 | 2 (16.666666666667%) |

| 4500 | 1 (8.3333333333333%) |

| 4200 | 2 (16.666666666667%) |

The online mean calculator indicates that 4000 appears 3 times in the data, and it is the mode or the most repeating value of our dataset. You can find the Mode to find the most repeating value in the marketplace; this can be quite useful in scanning the marketplace.The analysis of the target market is essential to make our planning up to mark and enable us to beat our competitors.

The Utilization of the Median:

The Median value finds pinpoint segregation of the data; the online mean calculator would be used to find the Median of our dataset values.

| Jan | Feb | Mar | April | May | June | July | Aug | Sep | Oct | Nov | Dec |

| 4000 | 4100 | 4400 | 4300 | 4500 | 4400 | 4300 | 4000 | 4200 | 4000 | 4100 | 4200 |

Median = 4000, 4000, 4000, 4100, 4100, 4200, 4200, 4300, 4300, 4400, 4400, 4500

Median = 4200

The Median values of the current dataset is the 4200

What is the Range?

The range of the dataset values is the dispersion of the data and the size of the target market. The online mean calculator displays the following Range of the dataset values:

| Jan | Feb | Mar | April | May | June | July | Aug | Sep | Oct | Nov | Dec |

| 4000 | 4100 | 4400 | 4300 | 4500 | 4400 | 4300 | 4000 | 4200 | 4000 | 4100 | 4200 |

Range of the Consumer= (Biggest – Smallest)

Range of the Consumer=(4500-4000)=500

Conclusion:

The average values of the Mean, Median, Mode and Range are great estimations to find the nature of the Target Market. The analysis of the Target Market is essential to formulate the decision-making. You can determine the various alternatives to decision-making if you have extracted the result from the average calculator. This result would clear the picture and the scenario of the target market and competitors analysis. You can determine the SWOT(Strengths, Weaknesses, Opportunities, and Threats) of the marketplace.

General

FG Begins February 2026 Salary Payments After Brief System Glitch

By Adedapo Adesanya

The Office of the Accountant-General of the Federation (OAGF) has commenced payment of February 2026 salaries to federal government workers paid through the treasury.

The office said payments began on Monday, March 2, 2026, following a brief delay caused by a technical issue in the payment system.

The office’s Director of Press and Public Relations in the OAGF, Mr Bawa Mokwa, explained that the problem responsible for the delay had been resolved and measures had been put in place to prevent a recurrence.

“The delay in the payment of the February 2026 salaries was due to a technical hitch, and it has been tackled, and necessary measures have been put in place to prevent a recurrence,” Mr Mokwa said.

The development means that thousands of federal civil servants across ministries, departments and agencies will begin receiving their February salaries.

The OAGF also disclosed that it has completed the payment process for one month of the outstanding wage award arrears owed to federal workers.

According to the office, the payment was made after the necessary approval was received to begin clearing the arrears.

The statement explained that the payment represents one month out of the three months of wage award arrears still outstanding.

The wage award was introduced by the federal government under President Bola Tinubu as a temporary measure to ease financial pressure on workers following economic reforms that increased the cost of living.

In August 2025, the government began paying the second tranche of the N35,000 wage award arrears to civil servants as part of efforts to fulfil its commitments to workers.

The N35,000 monthly wage award was introduced after the removal of petrol subsidies and other economic reforms that affected household expenses across the country.

The measure was agreed during negotiations between the Federal Government and organised labour as temporary support for workers while discussions on a new minimum wage structure continued.

However, concerns had recently emerged in some quarters that the government might have abandoned the wage award payments.

The Accountant-General’s office dismissed the claims, insisting that the government remains committed to settling the outstanding arrears.

“The Federal Government has not reneged on its obligation. The wage award arrears will continue to be paid in instalments of N35,000 per month until the outstanding balance is completely settled,” the statement said.

The OAGF noted that the phased payment approach would enable the government to meet its obligations to workers while managing its financial commitments.

The issue of wages and workers’ welfare has remained a major topic in discussions between the government and labour unions amid rising living costs driven by inflation and ongoing economic adjustments.

General

IIF Takes Step to Operationalise Gender-Smart Investing

By Aduragbemi Omiyale

A decisive step aimed at operationalising its Gender Equity and Social Inclusion (GESI) roadmap has been taken by the Impact Investors Foundation (IIF).

Last week, the organisation organised a high-level workshop in Lagos to equip institutions with the tools, standards, and data necessary to integrate GESI into capital allocation decisions.

In attendance for this programme were investors, policymakers, development partners, and private sector leaders.

The Nigeria Gender-Smart and Inclusive Capital workshop served as a critical component of the broader implementation strategy initiated after the launch of Nigeria’s Gender/GESI Roadmap at the 2025 Gender Impact Investment Summit.

“Following the landmark launch of Nigeria’s Gender/GESI Roadmap in 2025, this workshop represents the essential next strategic step in our journey towards a truly inclusive financial ecosystem,” the chief executive of IIF, Ms Etemore Glover, told participants.

“It is not enough to have a roadmap; we must now begin to operationalise it through institutional transformation that goes beyond mere policy alignment.

“This phase is critical because it moves us past advocacy and into the rigorous work of implementation, ensuring that organisations begin to intentionally deploy strategies to bridge the gaps that have historically sidelined women and marginalised groups,” she added.

Ms Glover submitted that, “With growing evidence that diverse and inclusive enterprises outperform their peers in risk management, innovation, and long-term value creation, Nigeria’s push to operationalise gender-smart investing reflects both a moral imperative and a significant market opportunity.”

A central highlight was a technical deep dive into the Gender/GESI Roadmap, presented by a Partner from PwC. The roadmap provides a structured approach to embedding gender-smart principles across the entire investment lifecycle: deal sourcing, by identifying women-led or gender-diverse enterprises; due diligence, through assessing GESI-related risks and opportunities; portfolio management, by strengthening inclusive governance; and exit strategies, which focus on ensuring long-term impact sustainability.

Investment and sustainability professionals from Verod Capital at the event shared practical strategies for embedding GESI metrics into governance systems. Additionally, a case study from Alitheia Capital illustrated how gender-lens investing drives both financial performance and measurable social impact.

Further, experts from 2X Global and Moremi Capital delivered sessions on the Foundations of Gender-Smart Investing, contextualising global standards such as the 2X Criteria for the Nigerian investment landscape.

These discussions demonstrated how investors can intentionally benefit women-led businesses, women in leadership, and women as value chain participants.

Organisations were charged with embedding gender-smart principles into their core operations to unlock Nigeria’s full economic potential, effectively turning the roadmap into the standard for investment in the nation’s future.

General

Why News Matters More Than Ever

For many people, the relationship with news begins with resistance. As children, news channels felt slow, serious, and far removed from the world we know. They interrupt cartoons and movies, filling the screen with long conversations about politics, crises, and distant places. It is perceived as heavy, formal, and intended only for adults, not for young minds seeking entertainment or fun.

Over time, the value of news becomes clear. Most people want to stay informed, understand context, and gain insight into the events that shape society. News moves beyond reports and statistics to provide essential information for making sense of the world.

News Today Fits Into Life, Not the Other Way Around

Modern audiences no longer consume news the way previous generations did. Attention spans are shorter, schedules are busier, and habits are more flexible. People want updates without commitment and access without pressure. News now adapts to everyday life; it can be a quick headline in the morning, a background update while working, or a detailed story in the evening. It meets audiences where they are, not the other way around.

This is where GOtv excels. GOtv offers a wide range of local and international news channels that allow viewers to stay informed in the way that suits them best. Whether it’s a casual check-in, following major developments throughout the day, or deep-diving into global affairs at night.

Local Stories: Global Perspective

The news landscape on GOtv reflects the world audiences live in, fast-moving, interconnected, and diverse. National channels such as Channels Television and ARISE News cover stories that directly impact Nigeria and Africa, from politics and economy to social trends and culture. Meanwhile, international networks like CNN and Al Jazeera provide a broader lens, connecting viewers to global events and discussions that influence nations and societies. Together, these channels give viewers a comprehensive understanding of the world, offering multiple perspectives rather than a single narrative.

When News Finally Makes Sense

There comes a point where news stops feeling like background noise and starts feeling relevant. It matters when decisions need to be made, when conversations require context, and when understanding the world becomes part of everyday life. It becomes clear why adults value it so much because being informed equips people to engage, respond, and make sense of the complex world around them.

GOtv understands that news consumption evolves. It meets audiences at different stages, from casual viewers who want a simple update to engaged viewers seeking deeper analysis and informed discussion. Growing up isn’t about suddenly loving news channels; it’s about realising that staying informed is no longer optional. It’s a conscious choice, a way to connect with the world, and a tool to navigate life’s complexities.

With GOtv, news is no longer something you’re forced to watch. It becomes a choice, a way to stay connected to both local and global stories that matter.

For easy access, viewers can tune in to Channels Television on Channel 27, ARISE News on Channel 24, CNN on Channel 72, and Al Jazeera on Channel 71.

To subscribe, upgrade, or reconnect, download the MyGOtv App or dial *288#. You can also stream anytime with the GOtv Stream App.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn