General

Technology Can Help Rebuild Trust in Accounting Profession—Expert

By Dipo Olowookere

Following a series of high-profile scandals across the world, many accountants and accounting firms have come under heavy scrutiny by regulating bodies.

In this regard, one issue of immediate concern to practitioners is the need to regain public trust and an expert in the accounting business, Mr Michael Armstrong, has submitted that if properly utilised, technology can be used as a vital tool to help rebuild trust in the profession.

Speaking at the recently held 48th Annual Accountants’ Conference themed Securing Our Shared Future: A Collective Responsibility, Mr Armstrong said the accounting profession was set to witness exciting times ahead, in a changing world.

The accounting expert, who is the Regional Director of the Institute of Chartered Accountants in England and Wales (ICAEW) in the Middle East, Africa and South Asia, stated that, “Our profession is currently under a great deal of scrutiny with the media reporting corporate failures, criticism of accountants and auditors, and sanctions being imposed on what can sometimes feel like a daily basis. All Chartered Accountants are under scrutiny.”

Mr Armstrong, during his presentation titled Accounting Firms of the Future: Challenges and Opportunities at the event in Abuja, noted that, “As defined by our Royal Charter, the fundamental function of bodies like ICAEW and ICAN are the protection of public interest.

“Due to the loss of public confidence, the key challenge facing the profession and our most immediate concern is the need to rebuild trust.”

Mr Armstrong noted that the accountancy profession needed to recover its original purpose of assuring investors and the public of the truth, rebuilding trust and ensuring the sustainability of the profession.

The ICAEW director called on accounting professionals to act immediately. “In fact, our (ICAEW) CEO, Michael Izza, describes this as a “watershed moment” – a wake-up call for business leaders, regulators and auditors. As a profession, we have to be prepared to think and act differently in the future. If we don’t address this now, one wonders if we will still have a profession in 20 years’ time”, he said.

For Mr Armstrong, who was also a partner at KPMG, one way to improve the credibility of financial reporting is to boost audit quality. He noted that changes, driven by a range of factors, but most significantly technology, will transform all aspects of business and society in the coming years, and reshape the accountancy profession across Africa, Europe, the Middle East and the rest of the world.

“Over the years, our profession has moved from the use of spread-sheets, to computers and other more advanced technological devices.

“While the scale of the change today may appear more dramatic, this is not new territory for the profession which has a long history of adapting to changing regulatory and technological environments. It may seem more pressing and transformational now, but is the arrival of Artificial Intelligence (AI) or Big Data more significant than the arrival of computers into finance departments or the appearance of the spread sheet? Our profession has always been very adaptable in the past so there’s no reason to think it can’t adapt this time,” he added.

Mr Armstrong also emphasised the need for collaboration amongst Chartered Accountants more than ever before; and looks forward to working and collaborating with ICAN following the MoU signed earlier in the year.

In his presentation, Mr Armstrong noted that technology is the driving force behind change in the accountancy profession, as it presents countless opportunities for the profession to deliver more value to businesses through new and enhanced services. He also explained that accountants can save time – for themselves and their clients – from lower value tasks to focus on more complex and advisory work.

Other workshops held at the four-day conference were: ‘SMPS & SMES: Revving The Economy To Action’; ‘Securing Our Shared Future; Cyber Security Challenges’ and ‘Contemporary Issues in Digital Economy’.

The conference ended with a Gala Night and was attended by Chartered Accountants from across Nigeria.

General

Nigeria Signs Defence Joint Venture with Terra Industries

By Adedapo Adesanya

Nigeria has signed a joint venture with defence technology company, Terra Industries Limited, as part of efforts to boost the country’s defence industrial capacity and advance indigenous high-technology development.

The Defence Industries Corporation of Nigeria (DICON) and Terra signed a Memorandum of Understanding (MoU) for the establishment of the Joint Venture Company (JVC), both parties announced on Monday.

The partnership provides a robust framework for the local production, assembly, research and development (R&D), and training in high-technology systems, including drones, cybersecurity solutions, robotics, and other ancillary software and hardware platforms.

The MoU, executed pursuant to the DICON Act 2023, underscores DICON’s statutory mandate to collaborate with indigenous and foreign defence-related industries through Public-Private Partnerships. Under the agreement, the Joint Venture Company will operate as a subsidiary of DICON, jointly promoted and owned by DICON and Terra Industries, and duly incorporated in Nigeria.

This marks the latest move by Terra, which recently became a $100 million company, following recent raises from investors including Flutterwave CEO, Mr Gbenga Agboola, American actor Jared Leto as well as 8VC founded by the co-founder of Palantir Technologies Inc., Mr Joe Lonsdale. Other investors included Valor Equity Partners, Lux Capital, SV Angel, Leblon Capital GmbH, Silent Ventures LLC, Nova Global.

Terrahaptix, founded by Mr Nathan Nwachukwu and Mr Maxwell Maduka, are using the new funding to expand Terra’s manufacturing capacity as it expands into cross-border security and counter-terrorism.

The latest agreement with DICON is designed to establish advanced production and assembly lines for high-tech equipment within Nigeria, while promoting meaningful technology transfer, skills development, and specialised training for Nigerian personnel.

It also aims to strengthen local sourcing of raw materials, reduce dependence on imports, and enhance domestic industrial capacity and strategic autonomy. Additionally, the partnership will support the supply of security equipment to the wider Nigerian security agencies, other security agencies, positioning Nigeria as a competitive player in the global defence manufacturing sector.

Under the agreement, Terra Industries will provide technical expertise, professional services, and training, and will attract both local and foreign investment to strengthen the defence industrial ecosystem.

The company will also facilitate the procurement of production equipment, coordinate local and international training programmes, and provide access to manufacturing know-how, tooling, spare parts, and established defence sector supply chains.

Speaking on this, Mr Nathaniel Nwachukwu, CEO of Terra Industries, noted that the partnership “Demonstrates confidence in indigenous Nigerian engineering capability and creates a platform for sustainable defence technology development, innovation, and export competitiveness.”

On his part, Major General BI Alaya, the Director General of DICON, described the agreement as “A transformational step toward strengthening Nigeria’s defence manufacturing base, reducing import dependence, and positioning Nigeria as a regional hub for advanced innovation.”

The need for security has risen in recent years, as groups such as Islamic State and al-Qaeda are gaining ground in Africa, converging along a swathe of territory that stretches from Mali to Nigeria.

General

Deep Blue Project: Mobereola Seeks Air Force Support

By Adedapo Adesanya

The Director General of the Nigerian Maritime Administration and Safety Agency (NIMASA), Mr Dayo Mobereola, is seeking enhanced cooperation between the agency and the Nigerian Air Force (NAF) with the aim of strengthening tactical air support within the Deep Blue project.

During a courtesy visit last week, Mr Mobereola told the Chief of Air Staff, Air Marshall S. K. Aneke at the NAF Headquarters in Abuja, that the Air Force was a strategic partner in enhancing maritime security in Nigeria and sustaining the momentum of the Deep Blue Project’s success.

According to the DG, “We are here to seek the Air Force’s support, given the importance of tactical air surveillance to the Deep Blue Project. Nigeria is the only African country with a record of zero piracy within the last 4 years. The Deep Blue Project platforms have been used to achieve zero piracy and sea robberies in the Gulf of Guinea, and we need your collaboration to sustain this momentum”.

He further emphasised that international trade depends on security, which is why vessels prefer to go to or transit through countries where they are secured. “With the traffic we have now, we need to show more security might through collaboration to strengthen our trade viability because of the risks attached to our route. We need these collaborations to sustain what we have achieved so far with the Deep Blue Project”.

The NIMASA DG expressed hope that the collaboration with the Nigeria Air Force will reduce response time.

On his part, the Chief of Air Staff, Air Marshall S.K. Aneke, noted that the Air Force desires to be “a very supportive and collaborative partner with NIMASA and is ready to match the Agency step by step and side by side to achieve the desired results.”

He noted that “collaboration between NIMASA and the Nigerian Air Force under the Deep Blue Project can be strengthened through a joint strategic framework, integrated command structures, and a standing steering committee to ensure shared objectives and accountability.

“Establishing a joint maritime domain awareness fusion cell will enable real-time intelligence sharing, synchronised surveillance, and faster response to maritime threats and ensure sustained operational effectiveness across Nigeria’s territorial waters and exclusive economic zone,” he said, according to a statement.

The Air Force Chief added that the Air Force can also support NIMASA outside the Deep Blue Project operations by providing its own ISR platforms, tactical air support, and rapid airborne deployment for interdictions and search and rescue missions.

While thanking the NIMASA DG for the basic trainings the Agency has provided the aircraft pilots under the Deep Blue Project, Air Marshall Aneke also highlighted areas of operational challenges needing NIMASA’s attention to include bridging the communication gap between NAF operators and NIMASA, higher level and in-depth maintenance trainings, readily available fueling of aircrafts to avoid delays on missions, and provision of flying kits among others.

He therefore pledged the Air Force’s collaboration and assured that the request by NIMASA has been noted and that things will begin to move at thrice its speed going forward.

General

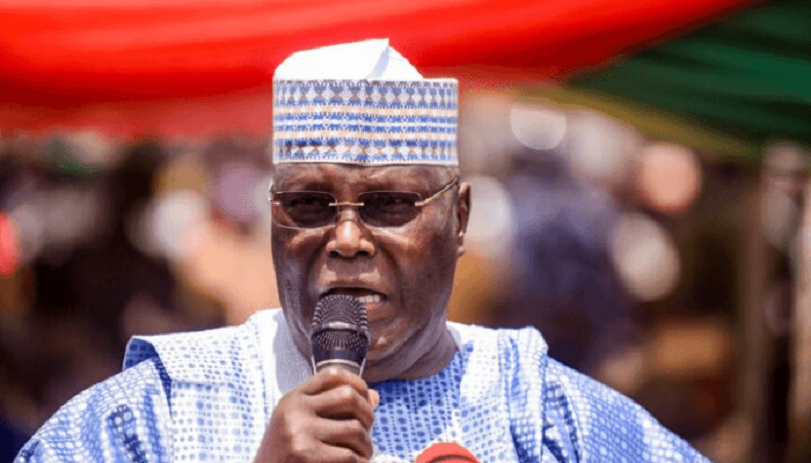

Nigeria’s Democracy Suffocating Under Tinubu—Atiku

By Modupe Gbadeyanka

Former Vice President, Mr Atiku Abubakar, has lambasted the administration of President Bola Tinubu for the turnout at the FCT Area Council elections held last Saturday.

In a statement signed by his Media Office, the Adamawa-born politician claimed that the health of Nigeria’s democracy under the current administration was under threat.

According to him, “When citizens lose faith that their votes matter, democracy begins to die. What we are witnessing is not mere voter apathy. It is a direct consequence of an administration that governs with a chokehold on pluralism. Democracy in Nigeria is being suffocated slowly, steadily, and dangerously.”

He warned that the steady erosion of participatory governance, if left unchecked, could inflict irreversible damage on the democratic fabric painstakingly built over decades.

“A democracy without vibrant opposition, without free political competition, and without public confidence is democracy in name only. If this chokehold is not released, history will record this era as the period when our hard-won freedoms were traded for fear and conformity,” he stressed.

Mr Atiku said the turnout for the poll was below 20 per cent, with the Abuja Municipal Area Council (AMAC) recording 7.8 per cent.

He noted that such civic participation in the nation’s capital, the symbolic heartbeat of the federation, is not accidental, as it is the predictable outcome of a political environment poisoned by intolerance, intimidation, and the systematic weakening of opposition voices.

The presidential candidate of the People’s Democratic Party (PDP) in the 2023 general elections stated that the ruling All Progressives Congress (APC) under Mr Tinubu has pursued a deliberate policy of shrinking democratic space, harassing dissenters, coercing defectors, and fostering a climate where alternative political viewpoints are treated as threats rather than contributions to national development.

He called on opposition parties and democratic forces across the country to urgently close ranks and forge a united front, declaring, “This is no longer about party lines; it is about preserving the Republic. The time to stand together to rescue and rebuild Nigeria is now.”

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn