Jobs/Appointments

14,000 May Lose Job on Exit of Oriental Hotel Owners from Nigeria

By Modupe Gbadeyanka

There are strong indications that the number of job loss in Nigeria under the present administration of President Muhammadu Buhari may further increase anytime soon.

This is because owners of the popular Oriental Hotel in Lagos, Western Metal Products Company Limited (WEMPCO) Group, are planning to leave the country after over four decades doing business in the Africa’s largest economy.

Few days ago, there were reports that WEMPCO was offering to sell its flagship hospitality business, Oriental Hotel for $250 million (about N90 billion).

In a report posted a moment ago, Business Day said WEMPCO wants to sell the company because of some issues, including unfavourable business environment, corporate governance, debts and others.

It was reported that the group has fallen on hard times and is considering an exit from Nigeria along with its steel plant, which has 700,000 tonnes-capacity and employs about 14,000 people, mostly Nigerians.

“When deep, long-term guys like these are exiting, then it is a very worrying sign. People like these are not supposed to exit,” an economic analyst, who asked not to be quoted, said.

Founded by Lewis Tung and his brother Robert Tung, WEMPCO Group has been in Nigeria for over 40 years with established manufacturing companies that produce roofing sheets, galvanised pipes, wire nails, plywood, ceramic tiles and sanitary ware. It is also actively involved in agricultural and hospitality sectors through which it currently employs over 13,000 workers across its 11 subsidiaries.

The Tungs were among the four Chinese families that came to Nigeria in the 60s.

“If they leave there will be only one left,” an industry expert said on the condition of anonymity.

Chaired by Lewis Tung, a Chinese-born, US-trained entrepreneur, WEMPCO has made some of the biggest foreign direct investments in Nigeria in recent years.

Top directors in the steel and hospitality sectors who are familiar with the situation, however, told BusinessDay that the reasons for the group’s ordeal are poor corporate governance, over-dependence on government policy, inability to consider Nigerian realities before making key decisions, and harsh business environment.

They say there is poor corporate governance at the Luxury Oriental Hotel as directors’ children interfere in the financial operations of the business.

More so, the group relied so much on government policy and Olusegun Aganga, the then minister of industry, trade and investment, for its survival. This has turned out to be part of its Achilles Heel.

In 2015, BusinessDay exclusively reported that the then outgoing government of Goodluck Jonathan, under the supervision of Aganga, classified WEMPCO, Midland and Kam Wire as upstream manufacturers of cold-rolled steel. They were to produce for the downstream segment which would use the cold-rolled steel for further production.

These companies were granted import waivers that would allow them to import any shortfall (the demand gap) to complement what they would produce locally to meet the demands of the downstream segment.

Downstream manufacturers wishing to import the cold rolled steel coils were mandated to pay 20 percent import duty.

At some point, WEMPCO and co raised prices of cold-rolled steel, forcing some of the manufacturers in the downstream segment to set up cold-rolled plants.

“WEMPCO had invested heavily in this segment. So when the manufacturers who were supposed to buy from them set up cold-rolled lines, it became a problem for the likes of WEMPCO. As this was happening, a new government of Muhammadu Buhari came and cancelled the waivers,” a reliable source in the steel sector said.

Sources added that WEMPCO calibrated a production line in its N236 billion rolling mill in Lagos to produce a thick cold-rolled of 0.2mm, which is more expensive than the 0.8mm or 0.4 mm seen in the West African market.

“It became difficult for them to be competitive in a market where low-quality products are rife,” another industry source said.

However, some analysts say the company’s problem shows Nigeria’s weak business environment.

Babatunde Paul Ruwase, president, Lagos Chamber of Commerce and Industry (LCCI), recently said businesses are generally burdened with the challenges of infrastructural deficiencies and macroeconomic blows, as most investors are saddled with huge cost of providing electricity, poor access to good roads, insecurity and other industry-specific issues amid poor access to affordable credit, high exchange rates and multiple taxation.

Ken Udoh, a Lagos-based public affairs analyst, said the sale of the hotel by its owners could be as a result of a tough operating environment and the increase in the cost of doing business in the country.

“This further confirms our fears about the economy and the decrepit infrastructure in the country,” Udoh said.

Ademola Feranmi, an economist, said the service industry is really struggling currently. The shrinking consumer wallet has reduced the patronage and the profitability of these companies while the cost of operation keeps rising.

“Most hotels now have large halls to host social events on weekends and corporates to boost their revenue,” he said.

The Manufacturers CEOs Confidence Index (MCCI) report released on Tuesday by the Manufacturers Association of Nigeria (MAN) shows that confidence of business owners in Nigeria’s manufacturing sector stands at 51.3 percent in the first quarter of 2019 as 200 CEOs interviewed said access to dollars, credit, electricity and fair taxes were major drawbacks.

The sale of Oriental Hotel is coming after Four Points by Sheraton was acquired in 2018 by Actis, an investment firm, and Westmont Hospitality Group. The 231-room hotel is targeted towards business travellers and small conventions. It was owned by Starwood Hotels & Resorts, which is a subsidiary of Marriott International.

An imminent exit of WEMPCO Steel, commissioned in 2013 by President Jonathan, could mean loss of 14,000 jobs after Procter&Gamble shut down its $300 million diaper plant, with Kimberly Clark also exiting.

The CBN in 2015, as part of its initiative to resuscitate local industries and improve employment generation, released a list of items not eligible for foreign exchange in the government-created Importers & Exporters window. Among the 41 items on the list are cold-rolled steel sheets, galvanised steel sheets, and roofing sheets.

Business Post reports that some Nigerians had before linked ownership of Oriental Hotel to the national leader of the ruling All Progressives Congress (APC), Mr Ahmed Tinubu.

Jobs/Appointments

Court Sanctions CHI Limited for Wrongful Employment Termination

By Modupe Gbadeyanka

The termination of the employment of one Mr Bodunrin Akinsuroju by CHI Limited has been declared as unlawful by the National Industrial Court of Nigeria.

Delivering judgment on the matter, Justice Sanda Yelwa of the Lagos Judicial Division of the court held that the sacking of Mr Akinsuroju did not comply strictly with the provisions of the contract of employment and the Employee Handbook.

Consequently, the company was directed to pay him the sum of N2 million as general damages for wrongful termination and N200,000 as costs of action, while Mr Akinsuroju was ordered to return the company’s properties in his possession or pay their assessed market value.

Justice Yelwa found that the contract agreement between both parties clearly required either party to give 30 days’ notice or payment in lieu of notice after confirmation of appointment, and there was no evidence that the employee was given the required notice or paid salary in lieu of notice.

The judge held that failure to comply with this fundamental term amounted to a breach of the contract of employment, thereby rendering the termination wrongful.

Mr Akinsuroju had claimed that the allegation of misconduct against him was unfounded and not established, maintaining that the disciplinary committee proceedings were prejudicial and that the termination of his employment was without justifiable cause and without compliance with the agreed terms of his employment.

In defence, CHI Limited contended that it had the right to terminate the employment of Mr Akinsuroju and that the termination was lawful and in accordance with the contract of employment and the Code of Conduct.

In opposition, counsel to Mr Akinsuroju submitted that the alleged breaches were not proved and that the termination letter took immediate effect without the requisite 30 days’ notice or payment in lieu of notice as stipulated in the letter of appointment and the Employee Handbook, urging the court to hold that the termination was wrongful and to grant the reliefs sought.

Jobs/Appointments

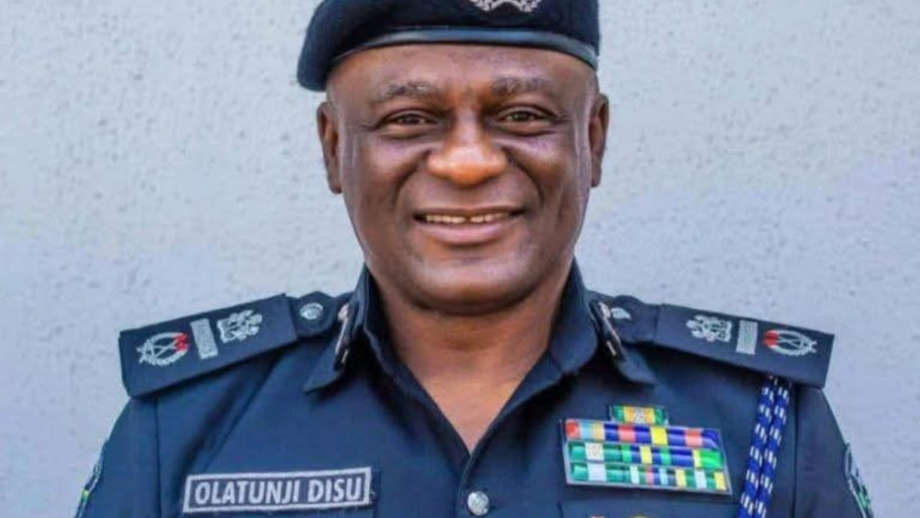

Tinubu Appoints Tunji Disu as Acting Inspector General of Police

By Modupe Gbadeyanka

President Bola Tinubu on Tuesday appointed Mr Tunji Disu as the acting Inspector General of Police (IGP), following the resignation of Mr Kayode Egbetokun.

Mr Disu, an Assistant Inspector General of Police (AIG), was recently moved to the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos.

A statement today by the Special Adviser to the President on Information and Strategy, Mr Bayo Onanuga, disclosed that the President would convene a meeting of the Nigeria Police Council shortly to formally consider the appointment of Mr Disu as substantive IGP, after which his name will be transmitted to the Senate for confirmation.

Mr Tinubu expressed confidence that Mr Disu’s experience, operational depth, and demonstrated leadership capacity would provide steady and focused direction for the Nigeria Police Force during this critical period.

He reiterated his administration’s unwavering commitment to enhancing national security, strengthening institutional capacity, and ensuring that the Nigeria Police Force remains professional, accountable, and fully equipped to discharge its constitutional responsibilities.

Mr Egbetokun was said to have resigned from the position due to pressing family considerations.

President Tinubu, who accepted the resignation letter, expressed his profound appreciation for Mr Egbetokun’s decades of distinguished service to the Nigeria Police Force and the nation. He acknowledged his dedication, professionalism, and steadfast commitment to strengthening internal security architecture during his tenure.

Appointed in June 2023, Mr Egbetokun was serving a four-year term scheduled to conclude in June 2027, in line with the amended provisions of the Police Act.

The statement disclosed that his replacement was in view of the current security challenges confronting the nation, and acting in accordance with extant laws and legal guidance.

Jobs/Appointments

Tunji Disu to Become New IGP as Egbetokun Quits

By Adedapo Adesanya

Mr Tunji Disu, an Assistant Inspector General of Police (AIG), has reportedly replaced Mr Kayode Egbetokun as the new Inspector General of Police (IGP).

Mr Egbetokun resigned from the position on Tuesday after he was said to have held a meeting with President Bola Tinubu on Monday night at the Presidential Villa in Abuja.

President Tinubu appointed Mr Egebtokun as the 22nd IGP on June 19, 2023, with his appointment confirmed by the Nigeria Police Council on October 31, 2023.

Appointed as IGP at the age of 58, Mr Egbetokun was due for retirement on September 4, 2024, upon reaching the mandatory age of 60, but his tenure was extended by the President, creating controversies, which trailed him until his exit from the force today.

Although the police authorities are yet to comment on the matter or issue an official statement about his resignation, the move came amid reports suggesting that Mr Egbetokun has left the position.

Mr Egbetokun’s tenure was marred by a series of controversies; he recently initiated multiple charges against activist Mr Omoyele Sowore and his publication, SaharaReporters, after Mr Sowore publicly described him as an “illegal IGP.”

The dispute escalated into protracted legal battles, with the Federal High Court issuing injunctions restricting further publications relating to the former police chief and members of his family. Critics interpreted these court actions as attempts to stifle dissent and weaken press freedom.

His replacement, Mr Disu, was posted to oversee the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos, some days ago.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn