Jobs/Appointments

Critics Question Aisha Ahmad’s Qualification for New CBN Job

By Dipo Olowookere

Since Thursday, October 5, 2017, when President Muhammadu Buhari announced Mrs Aishah Ahmad, as the new Deputy Governor of the Central Bank of Nigeria (CBN), there have been controversies trailing the young woman.

Mrs Ahmad was appointed to replace Mrs Serah Alade, who retired in March 2017 as the Deputy Governor of the CBN in charge of Economic Policy.

She is expected to assume duty as CBN deputy governor immediately after her confirmation by the Senate.

A report by Premium Times has said Mrs Ahmad was ‘controversially’ promoted to the position of an Executive Director of Diamond Bank Plc few hours to her announcement for the new CBN job.

But the lender, when contacted by the newspaper, gave a dodgy response to this issue.

Rather than make a categorical comment on when Mrs Ahmad was raised from her position as deputy general manager to executive director, Mr Mike Omeife, Head of Media Relations at the bank, merely said she had been executive director at the bank “for a while”.

He maintained that based on her wealth of experience, she is qualified to be appointed to the new position.

Until her appointment, Mrs Ahmad, a holder of Master of Science, M.Sc degree in Finance & Management from the Cranfield School of Management, United Kingdom (2006-2007) and a Master of Business Administration, MBA in Finance, University of Lagos (1999-2001), was the executive director (Retail Banking) at Diamond Bank Plc.

She is the chairperson, executive council of Women in Management, Business and Public Service, WIMBIZ, a Nigerian non-profit organization focused on issues affecting the interest of women professionals in business, particularly those promoting leadership development and capacity building to engender growth.

Since her appointment, there had been controversies, especially on social media, over her qualification for the CBN job.

SCANTY DETAILS

But in a chat with PREMIUM TIMES on Tuesday, Mr Omeife said the new CBN deputy governor had been an executive director at Diamond Bank “for a while”.

When asked of the specific date, he explained that he might not immediately have the details but he was confident she had been appointed executive director “for a while”.

Our sources maintained Mr Omeife “was economical with the truth”.

Checks by PREMIUM TIMES revealed that details of the bank’s annual report showed that as at December 2016, Mrs Ahmad held the position of Head, Consumer and Privilege Banking. The two executive directors listed in the report are Chizoma Okoli, Executive Director Business Development, and Chiugo Ndubisi, Executive Director/Chief Financial Officer.

Similarly, in its quarterly reports for March and June 2017, the names of the two aforementioned officials remained as executive directors.

Meanwhile, checks on the disclosure platform of the Nigerian Stock Exchange, NSE, for possible announcement of Mrs Ahmad’s elevation also yielded no result as no such disclosure was made throughout 2017.

When contacted on the telephone on Monday, the media officer of the NSE, Joseph Kadiri, could not immediately give response to the request.

He, however, told PREMIUM TIMES to forward the request to him via email and promised to send to appropriate quarters for reply. More than 24 hours after the request was sent with reminders, PREMIUM TIMES has not gotten any response.

But Mr Omeife, Tuesday, suggested that disclosure of Mrs Ahmad’s appointment as ED may not necessarily be made to the Nigerian bourse.

“From the financial services perspective, the CBN handles issues involving people from ED (position) up (wards),” he said.

When asked about the alleged double promotion the new CBN official reportedly enjoyed on the day she was appointed by President Muhammadu Buhari, Mr Omeife said he knew nothing about such development.

“I don’t know about that; all I am meant to understand is that the president appointed her as CBN deputy governor and sent her name to the Senate for approval. I don’t know about that (issue of double promotion).

“But I know she is eminently qualified to be the CBN deputy governor and I am expecting young Nigerians to applaud her,” he said, in reference to Mrs Ahmad’s academic and professional antecedents.

He, however, said further enquiries should be directed to the CBN.

But PREMIUM TIMES’ efforts to reach the CBN were futile. Isaac Okorafor, the apex bank’s spokesperson, did not answer or return calls to his known number. He also did not reply to a text message sent to him.

PRIVILEGE BANKING VS ECONOMIC POLICY

Many commentators alleged that her promotion to the position of executive director at Diamond Bank Plc was ‘fast-tracked’, a few hours to the announcement of her name by the Nigerian government.

Insiders at the bank told PREMIUM TIMES she was promoted executive director hours to the announcement of her appointment to the CBN position. There was a company-wide announcement to that effect, our sources said.

However, the CBN Act does not require that an appointee to that position must be an executive director of a bank, and it is not clear why she had to be controversially upgraded.

Section 8 sub-section 1 of the CBN Act 2007 states, among others, that: “The Governor and Deputy Governors “shall be persons of recognised financial experience and shall be appointed by the President subject to the confirmation of the Senate.”

Some commentators argue that Mrs Ahmad’s expertise may not be the kind of skills needed at the CBN. She is better known for overseeing privilege banking, securing accounts from high net-worth individuals, and providing private client services to wealthy customers. Her understanding of economic policies remained unclear.

Abdul Mahmud, an Abuja-based attorney, said of the appointment, “That she replaces Sarah Alade as Deputy Governor of CBN in charge of economic policy- monetary policy, financial market, etc, before her retirement, makes her catapult curious.

“With a background in accounting and professional training in consumer banking, you would ask: what was her appointor thinking? She is not a monetarist, there is nothing in her CV that shows that she is nuanced in monetary economics.

“Well, with another misfit, Emefiele, at the helm of CBN, who has been accused of doing wash wash -printing more naira notes- an Emefiele-esque Quantitative Easing (QE) -to address liquidity problem and creating the more serious problem of inflationary pressure- a process of policy catalyzation really- you will understand why the oracle has consistently argued that the government projection of the Economic and Recovery Growth Plan (ERGP) to reduce the inflation rate from 19% to 0% by 2020 is a pipe dream.

“Brace up for harder, perilous, and more difficult economic times.”

Source: Premium Times

Jobs/Appointments

Court Sanctions CHI Limited for Wrongful Employment Termination

By Modupe Gbadeyanka

The termination of the employment of one Mr Bodunrin Akinsuroju by CHI Limited has been declared as unlawful by the National Industrial Court of Nigeria.

Delivering judgment on the matter, Justice Sanda Yelwa of the Lagos Judicial Division of the court held that the sacking of Mr Akinsuroju did not comply strictly with the provisions of the contract of employment and the Employee Handbook.

Consequently, the company was directed to pay him the sum of N2 million as general damages for wrongful termination and N200,000 as costs of action, while Mr Akinsuroju was ordered to return the company’s properties in his possession or pay their assessed market value.

Justice Yelwa found that the contract agreement between both parties clearly required either party to give 30 days’ notice or payment in lieu of notice after confirmation of appointment, and there was no evidence that the employee was given the required notice or paid salary in lieu of notice.

The judge held that failure to comply with this fundamental term amounted to a breach of the contract of employment, thereby rendering the termination wrongful.

Mr Akinsuroju had claimed that the allegation of misconduct against him was unfounded and not established, maintaining that the disciplinary committee proceedings were prejudicial and that the termination of his employment was without justifiable cause and without compliance with the agreed terms of his employment.

In defence, CHI Limited contended that it had the right to terminate the employment of Mr Akinsuroju and that the termination was lawful and in accordance with the contract of employment and the Code of Conduct.

In opposition, counsel to Mr Akinsuroju submitted that the alleged breaches were not proved and that the termination letter took immediate effect without the requisite 30 days’ notice or payment in lieu of notice as stipulated in the letter of appointment and the Employee Handbook, urging the court to hold that the termination was wrongful and to grant the reliefs sought.

Jobs/Appointments

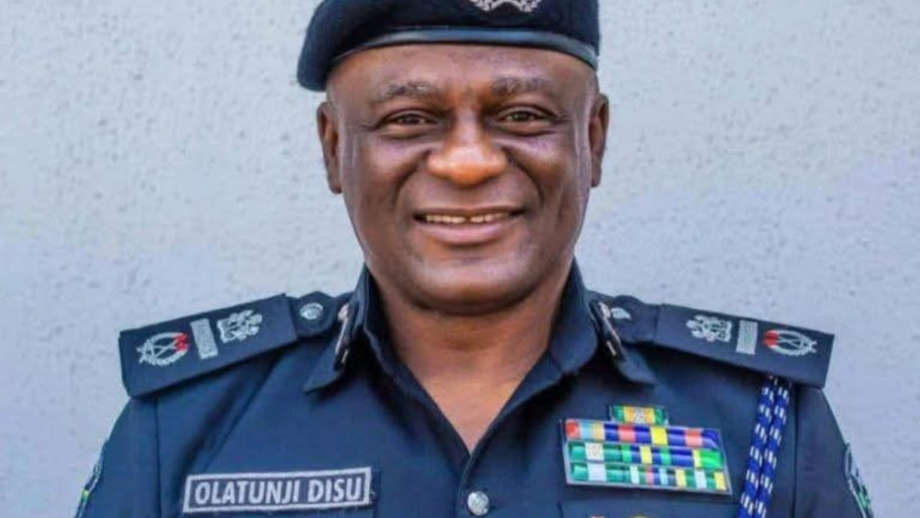

Tinubu Appoints Tunji Disu as Acting Inspector General of Police

By Modupe Gbadeyanka

President Bola Tinubu on Tuesday appointed Mr Tunji Disu as the acting Inspector General of Police (IGP), following the resignation of Mr Kayode Egbetokun.

Mr Disu, an Assistant Inspector General of Police (AIG), was recently moved to the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos.

A statement today by the Special Adviser to the President on Information and Strategy, Mr Bayo Onanuga, disclosed that the President would convene a meeting of the Nigeria Police Council shortly to formally consider the appointment of Mr Disu as substantive IGP, after which his name will be transmitted to the Senate for confirmation.

Mr Tinubu expressed confidence that Mr Disu’s experience, operational depth, and demonstrated leadership capacity would provide steady and focused direction for the Nigeria Police Force during this critical period.

He reiterated his administration’s unwavering commitment to enhancing national security, strengthening institutional capacity, and ensuring that the Nigeria Police Force remains professional, accountable, and fully equipped to discharge its constitutional responsibilities.

Mr Egbetokun was said to have resigned from the position due to pressing family considerations.

President Tinubu, who accepted the resignation letter, expressed his profound appreciation for Mr Egbetokun’s decades of distinguished service to the Nigeria Police Force and the nation. He acknowledged his dedication, professionalism, and steadfast commitment to strengthening internal security architecture during his tenure.

Appointed in June 2023, Mr Egbetokun was serving a four-year term scheduled to conclude in June 2027, in line with the amended provisions of the Police Act.

The statement disclosed that his replacement was in view of the current security challenges confronting the nation, and acting in accordance with extant laws and legal guidance.

Jobs/Appointments

Tunji Disu to Become New IGP as Egbetokun Quits

By Adedapo Adesanya

Mr Tunji Disu, an Assistant Inspector General of Police (AIG), has reportedly replaced Mr Kayode Egbetokun as the new Inspector General of Police (IGP).

Mr Egbetokun resigned from the position on Tuesday after he was said to have held a meeting with President Bola Tinubu on Monday night at the Presidential Villa in Abuja.

President Tinubu appointed Mr Egebtokun as the 22nd IGP on June 19, 2023, with his appointment confirmed by the Nigeria Police Council on October 31, 2023.

Appointed as IGP at the age of 58, Mr Egbetokun was due for retirement on September 4, 2024, upon reaching the mandatory age of 60, but his tenure was extended by the President, creating controversies, which trailed him until his exit from the force today.

Although the police authorities are yet to comment on the matter or issue an official statement about his resignation, the move came amid reports suggesting that Mr Egbetokun has left the position.

Mr Egbetokun’s tenure was marred by a series of controversies; he recently initiated multiple charges against activist Mr Omoyele Sowore and his publication, SaharaReporters, after Mr Sowore publicly described him as an “illegal IGP.”

The dispute escalated into protracted legal battles, with the Federal High Court issuing injunctions restricting further publications relating to the former police chief and members of his family. Critics interpreted these court actions as attempts to stifle dissent and weaken press freedom.

His replacement, Mr Disu, was posted to oversee the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos, some days ago.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn