Jobs/Appointments

FG Eyes 40,000 Jobs from $17bn NLNG Train 7 Project

By Modupe Gbadeyanka

No fewer than 40,000 direct and indirect jobs are expected to be created from the execution of the Nigeria Liquefied Natural Gas (NLNG) Train 7 project worth $17 billion.

Executive Secretary of the Nigerian Content Development and Monitoring Board (NCDMB), Mr Simbi Wabote, who made this disclosure, said this development will go a long way to boost the nation’s economy.

The NCDMB boss said further that, “The NLNG Train-7 will deliver 100 percent engineering of all non-cryogenic areas in-country. The total in-country engineering man-hours is set at 55 percent which exceeds the minimum level stipulated in the NOGICD Act, in line with our resolve to push beyond the boundary of limitations.”

During an event held on Wednesday in Abuja for the signing of the Letter of Intent (LoI) for the Train-7 Engineering, Procurement and Construction (EPC) Contract between NLNG and the preferred consortium- SCD, which is constituted by three entities – Saipem, Chiyoda and Daewoo, Mr Wabote the schedule of the NOGICD Act set the minimum engineering man-hours for FEED and Detailed Engineering on LNG Facility at 50 percent.

He stated further that the benefits of the Train 7 project will extend to site civil works on roads, piling, and jetties, 100 percent local procurement of all LV and HV cables, non-cryogenic valves, protective paints and coatings, sacrificial anodes and many other direct procurements from our local manufacturing plants.

The target, according to the Executive Secretary, is to assemble over 70 percent of all non-cryogenic pumps and control valves in-country, while other spin-off opportunities include logistics, equipment leasing, insurance, hotels, office supplies, aviation, haulage and many more.

He confirmed that the Minister of State for Petroleum Resources, Mr Timipre Sylva, has charged stakeholders connected with the NLNG Train-7 project to fast track actions related to it.

According to him, “the Minister has this project as one of his focus areas to put an end to the drought of FID’s in the oil and gas industry in the last few years”.

Apart from the job opportunities and the accruable revenues from this multi-billion-dollar Train-7 project, the Minister also sees the additional tonnage of LPG to be produced from Train-7 as a key benefit to reduce importation of LPG into the country, he added.

“He is also excited that Train-7 project attracts other upstream gas supply projects required to keep the LNG train busy. The project opens up other development opportunities for some gas fields in the shallow and deep offshore acreages such as HI, HA, HK, and Opoukunou-Tuomo fields,” the local content boss stated.

Mr Wabote charged the SCD consortium to fully implement the agreed Nigerian Content levels as contained in the approved Nigerian Content Plan for Train-7 project, covering engineering, fabrication, civil works, local procurement, project services, logistics, equipment leasing, insurance, hotels, office supplies, aviation, haulage, human capacity development and jobs.

At the event, Managing Director of NLNG, Mr Tony Attah, said “that Train-7 will move from Front End Engineering Design (FEED) to detailed design, construction, commission and delivery and this phase will attract almost $7 billion with an addition of the upstream scope of $10 billion which will boost the foreign direct investment profile of Nigeria.”

He pledged the company’s commitment to achieve the project within four to five-year period and hoped that it would sign the Final Investment Decision (FID) by the end of October 2019.

Mr Attah commended NCDMB for completing its review of the commercial evaluation report of Train 7 in 48 hours, noting that it took the natural gas company about three months to produce the commercial evaluation summary.

While confirming that NCDMB had kept to its commitment of reducing its approval cycle on projects, the NLNG boss also thanked the federal government for the support they provide for the project.

He lauded the three entities that constituted the SCD consortium – Saipem of Italy, Japan’s Chiyoda and Daewoo of South Korea for delivering the FEED and participating in the EPC tendering.

He confirmed that the issuance of the LoI moved the NLNG even closer to the Final Investment Decision (FID) as the ceremony is the declaration of intent and commitment to the contractors who will go forward with the project. Train 7 will move the company from 22-million-tons capacity from its six trains currently to 30 million tons, essentially about 35 percent increase in capacity.

Jobs/Appointments

Court Sanctions CHI Limited for Wrongful Employment Termination

By Modupe Gbadeyanka

The termination of the employment of one Mr Bodunrin Akinsuroju by CHI Limited has been declared as unlawful by the National Industrial Court of Nigeria.

Delivering judgment on the matter, Justice Sanda Yelwa of the Lagos Judicial Division of the court held that the sacking of Mr Akinsuroju did not comply strictly with the provisions of the contract of employment and the Employee Handbook.

Consequently, the company was directed to pay him the sum of N2 million as general damages for wrongful termination and N200,000 as costs of action, while Mr Akinsuroju was ordered to return the company’s properties in his possession or pay their assessed market value.

Justice Yelwa found that the contract agreement between both parties clearly required either party to give 30 days’ notice or payment in lieu of notice after confirmation of appointment, and there was no evidence that the employee was given the required notice or paid salary in lieu of notice.

The judge held that failure to comply with this fundamental term amounted to a breach of the contract of employment, thereby rendering the termination wrongful.

Mr Akinsuroju had claimed that the allegation of misconduct against him was unfounded and not established, maintaining that the disciplinary committee proceedings were prejudicial and that the termination of his employment was without justifiable cause and without compliance with the agreed terms of his employment.

In defence, CHI Limited contended that it had the right to terminate the employment of Mr Akinsuroju and that the termination was lawful and in accordance with the contract of employment and the Code of Conduct.

In opposition, counsel to Mr Akinsuroju submitted that the alleged breaches were not proved and that the termination letter took immediate effect without the requisite 30 days’ notice or payment in lieu of notice as stipulated in the letter of appointment and the Employee Handbook, urging the court to hold that the termination was wrongful and to grant the reliefs sought.

Jobs/Appointments

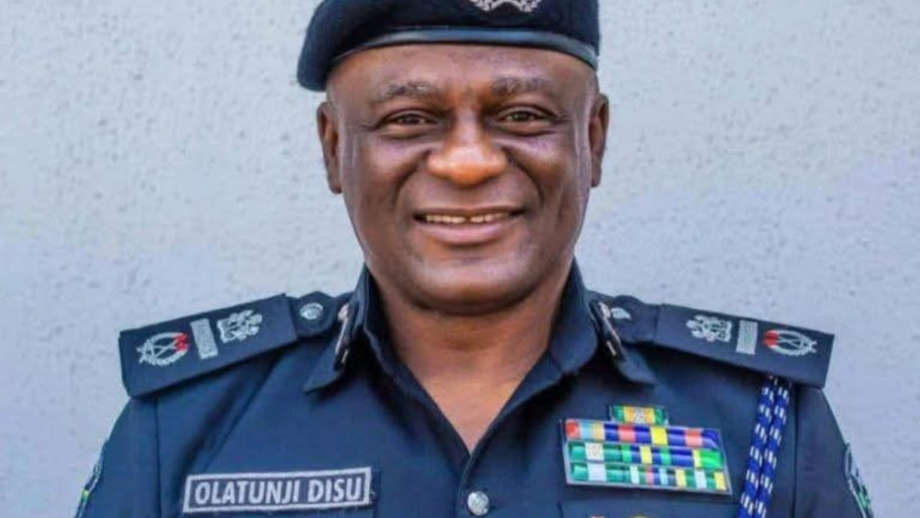

Tinubu Appoints Tunji Disu as Acting Inspector General of Police

By Modupe Gbadeyanka

President Bola Tinubu on Tuesday appointed Mr Tunji Disu as the acting Inspector General of Police (IGP), following the resignation of Mr Kayode Egbetokun.

Mr Disu, an Assistant Inspector General of Police (AIG), was recently moved to the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos.

A statement today by the Special Adviser to the President on Information and Strategy, Mr Bayo Onanuga, disclosed that the President would convene a meeting of the Nigeria Police Council shortly to formally consider the appointment of Mr Disu as substantive IGP, after which his name will be transmitted to the Senate for confirmation.

Mr Tinubu expressed confidence that Mr Disu’s experience, operational depth, and demonstrated leadership capacity would provide steady and focused direction for the Nigeria Police Force during this critical period.

He reiterated his administration’s unwavering commitment to enhancing national security, strengthening institutional capacity, and ensuring that the Nigeria Police Force remains professional, accountable, and fully equipped to discharge its constitutional responsibilities.

Mr Egbetokun was said to have resigned from the position due to pressing family considerations.

President Tinubu, who accepted the resignation letter, expressed his profound appreciation for Mr Egbetokun’s decades of distinguished service to the Nigeria Police Force and the nation. He acknowledged his dedication, professionalism, and steadfast commitment to strengthening internal security architecture during his tenure.

Appointed in June 2023, Mr Egbetokun was serving a four-year term scheduled to conclude in June 2027, in line with the amended provisions of the Police Act.

The statement disclosed that his replacement was in view of the current security challenges confronting the nation, and acting in accordance with extant laws and legal guidance.

Jobs/Appointments

Tunji Disu to Become New IGP as Egbetokun Quits

By Adedapo Adesanya

Mr Tunji Disu, an Assistant Inspector General of Police (AIG), has reportedly replaced Mr Kayode Egbetokun as the new Inspector General of Police (IGP).

Mr Egbetokun resigned from the position on Tuesday after he was said to have held a meeting with President Bola Tinubu on Monday night at the Presidential Villa in Abuja.

President Tinubu appointed Mr Egebtokun as the 22nd IGP on June 19, 2023, with his appointment confirmed by the Nigeria Police Council on October 31, 2023.

Appointed as IGP at the age of 58, Mr Egbetokun was due for retirement on September 4, 2024, upon reaching the mandatory age of 60, but his tenure was extended by the President, creating controversies, which trailed him until his exit from the force today.

Although the police authorities are yet to comment on the matter or issue an official statement about his resignation, the move came amid reports suggesting that Mr Egbetokun has left the position.

Mr Egbetokun’s tenure was marred by a series of controversies; he recently initiated multiple charges against activist Mr Omoyele Sowore and his publication, SaharaReporters, after Mr Sowore publicly described him as an “illegal IGP.”

The dispute escalated into protracted legal battles, with the Federal High Court issuing injunctions restricting further publications relating to the former police chief and members of his family. Critics interpreted these court actions as attempts to stifle dissent and weaken press freedom.

His replacement, Mr Disu, was posted to oversee the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos, some days ago.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn