Jobs/Appointments

SEC Okays CEOs of Nigerian Exchange Group, Others

By Dipo Olowookere

The appointments of the chief executive officers (CEOs) of the demutualised Nigerian Stock Exchange (NSE) have been approved by the Securities Exchange Commission (SEC).

Recently, the SEC, which is the highest regulatory body for the capital market in Nigeria, authorised the unbundling of the exchange after meeting all the requirements, including registering with the Corporate Affairs Commission (CAC).

This transformed the NSE into a non-operating holding company known as the Nigerian Exchange Group (NGX Group) and three operating subsidiaries Nigerian Exchange Limited (NGX), the operating exchange; NGX Regulation Limited (NGX REGCO), the independent regulatory company; and NGX Real Estate Limited (NGX RELCO), the real estate company.

Mr Oscar Onyema, who had been the CEO of the NSE, was appointed as the Group CEO of the NGX Group, while Mr Temi Popoola was made the CEO of NGX and Ms Tinuade Awe chosen as the CEO of NGX RELCO.

In his remarks, the Chairman of the NGX Group, Mr Abimbola Ogunbanjo, stated that, “The confirmation of these appointments are an important step in the process of building a leading and resilient African exchange group following the completion of our demutualisation programme.

“I am delighted to continue working with Oscar Onyema, who has played a significant role in the reshaping of the exchange.

“As a proven business leader and strategic thinker, I am confident that he will elevate the NGX Group and its subsidiaries successfully into a new era of development.”

On his part, the Chairman of the NGX, Mr A.B Mahmoud, said: “The confirmation of the appointment of Temi Popoola as the first CEO of the Nigerian Exchange Limited comes at a pivotal moment for Nigerian capital markets as the Exchange enters a new phase of its history as a demutualised company, bringing to the exchange his track record of achievement local and global capital markets.

“He will focus on ensuring the exchange delivers an even higher level of service for all its participants and stakeholders, including investors, listed companies and brokers.

“I look forward to working with him and his team in the new dispensation as we move forward on implementing the group’s growth strategy.”

On the part of the Chairperson of NGX REGCO, Ms Catherine Echeozo, “The clear separation of the regulatory and business functions is an essential part of the group’s operations following demutualisation and the board was determined to ensure the selection of an experienced regulator for this task.

“I believe all the exchange’s stakeholders will welcome the announcement of Tinuade Awe as the first CEO NGX Regulation, given her prodigious experience and track record in capital markets regulation.

“Our stakeholders can continue to look forward to a robust and transparent regulatory regime under her leadership.”

Who they are

Oscar Onyema

Mr Oscar Onyema until his new appointment served as the CEO and member of the National Council of the exchange from 2011 – 2021.

In this role, he was responsible for supervising the general work of the exchange. He serves as the Chairman, Central Securities Clearing System Plc (CSCS), the clearing, settlement and depository for the Nigerian capital markets; and Chairman, NG Clearing, which is in the process of developing a Central Counterparty Clearing House (CCP).

In addition, Mr Onyema is a board member of the National Pension Commission of Nigeria (PENCOM) and sits on several advisory boards including the London Stock Exchange Group (LSEG) Africa Advisory Group (LAAG).

Prior to relocating to Nigeria, he served as Senior Vice President and Chief Administrative Officer at American Stock Exchange (Amex). He also ran the NYSE Amex equity business following the merger of NYSE Euronext and Amex in 2008.

His remarkable achievements have earned him awards such as the Special Recognition Award for transformational leadership in the Nigerian Capital Markets at Business Day Top 25 CEOs Award 2018.

In 2015 Forbes Magazine named him among the Top 10 Most Powerful Men in Africa. In the preceding year, he received the national honour of Officer of the Order of the Niger (OON) from the Federal Government of Nigeria.

Mr Onyema is an alumnus of Harvard Business School, The Wharton School, University of Pennsylvania and INSEAD International Directors Programme. He got his MBA from Baruch College, New York; and BSc degree from Obafemi Awolowo University, Ile-Ife. He is a Fellow of the Institute of Directors (IoD) Nigeria, Fellow of the Chartered Institute of Stockbrokers (CIS), Associate of the Chartered Institute for Securities & Investment (CISI) in the UK, and holds FINRA Series 7, 24, 63 qualifications in the United States.

Temi Popoola

Mr Temi Popoola is a successful C-suite leader whose unique blend of business acumen, financial expertise, global market growth and operational insight has earned him a reputation built on verifiable career achievements.

A Wall Street trained investment banker, Mr Popoola joins NGX Ltd from Renaissance Capital (Rencap) where he was Managing Director and CEO for West Africa.

He supported the continuous growth, profitability and success of the organisation by providing strategic market insight and leadership. He led the transformation of Rencap in West Africa by diversifying the company’s revenue streams into fixed income, derivatives, structured products, debt financing and wealth management.

In addition to influencing change across the organisation, he was responsible for overseeing a global workforce, expanding foreign investor capital opportunities into West Africa and introducing enduring business processes and strategic initiatives.

Since his return to Nigeria in 2009, Mr Popoola has also worked with United Bank of Africa (UBA) as Head of Structured Products for Global markets and with CSL Stockbrokers Ltd as Head of Sales and Trading. In both of these positions, he guided growth and advancement for investors across global markets, including South Africa, the UK, the Middle East and the US.

Mr Popoola began his career in London as a portfolio manager focused on African energy markets and worked for several years as a senior equity derivatives trader with Bank of America Securities in New York where he drove firm profitability by providing derivative solutions to US corporations and family offices.

He graduated with a First-Class degree in Chemical Engineering from the University of Lagos and holds a Master’s degree from the Massachusetts Institute of Technology (MIT). He is a Chartered financial analyst (CFA) and a Chartered stockbroker (CIS). He holds Series 7 and 63 licensures.

Tinuade Awe

Ms Tinuade Awe, prior to attaining her new position, was an Executive Director, Regulation at the exchange. She also served as the General Counsel and Head of the Legal and Regulation Division as well as Council Secretary before becoming an Executive Director.

Before joining the exchange, Ms Awe worked with the United Nations in The Hague and Geneva as well as the New York offices of the global law firm, Simpson Thacher & Barlett and Banwo & Ighodalo in Lagos, Nigeria.

As Executive Director, Regulation, she had responsibility for the regulation of the two primary stakeholder groups of the exchange, i.e., the dealing members that trade on the exchange and issuers that have securities listed on the bourse.

Her team was responsible for rulemaking and interpretation, monitoring, inspections, market surveillance, investigations, regulatory technology, and enforcement.

She is a non-executive director of the Central Securities Clearing System Plc (CSCS) and also a member of the board of the Financial Reporting Council of Nigeria (FRC).

She chairs the FRC’s Board Corporate Governance Committee, which has board-level responsibility to monitor the implementation of the National Code of Corporate Governance (NCCG).

Among other professional pursuits, Ms Awe was a member of the Nigerian Senate’s Technical Advisory Committee to review the Bill for an Act to Amend the Companies and Allied Matters Act and the Bill for an Act to review the Investment and Securities Act.

Ms Awe has an LL.B Degree from the Obafemi Awolowo University, graduating as the Best Female Student in the Faculty of Law. She finished at the Nigerian Law School with First Class Honours, graduating as Best Overall Student. She also holds LL.M Degrees from Harvard Law School, where she was a Landon H. Gammon Fellow, as well as The London School of Economics and Political Science (LSE), where she graduated with a Merit. At the LSE, she was a British Council Scholar. She is admitted to both the Nigerian and New York Bars.

Ms Awe is a member of the Nigerian Bar Association (NBA) and the International Bar Association. She is an Associate Member of the Institute of Chartered Secretaries and Administrators of Nigeria (ICSAN) and the Institute of Capital Market Registrars (ICMR). She is a Life Member of the Institute of Directors. She is the recipient of The African Legal Awards 2018, General Counsel of the Year; Law Digest Africa Awards, General Counsel of the Year 2018, and Esq. Nigeria Legal Awards, General Counsel of the Year 2017.

Jobs/Appointments

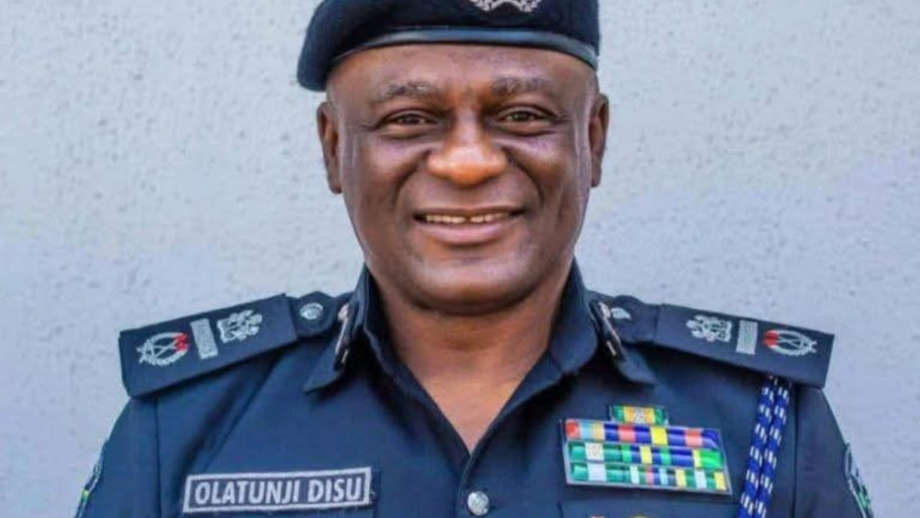

Tinubu to Swear in Tunji Disu as IGP Wednesday After Police Council’s Nod

By Modupe Gbadeyanka

The appointment of Mr Tunji Disu as the substantive Inspector-General of Police (IGP) has been ratified by the Nigeria Police Council (NPC).

The endorsement of the acting police chief was done on Monday at the council’s meeting held at the State House in Abuja, and chaired by President Bola Tinubu.

In attendance were Vice President Kashim Shettima, state governors and the Chairman of the Police Service Commission, Mr Hashimu Argungu.

Others in attendance were the Secretary to the Government of the Federation, Mr George Akume; the National Security Adviser, Mr Nuhu Ribadu; the Chief of Staff to the President, Mr Femi Gbajabiamila; the Minister of Police Affairs, Mr Ibrahim Gaidam; the FCT Minister, Mr Nyesom Wike; and the head of service, Mrs Esther Didi Walson-Jack.

Mr Disu was praised for his outstanding service to the nation through various means. He has held critical operational, investigative, and strategic command positions nationwide. His last position was as Assistant Inspector-General of Police (AIG) in charge of the Special Protection Unit and the Force CID Annex, Lagos.

The endorsement of his appointment on Monday paves the way for his swearing-in by Mr Tinubu on Wednesday. The ceremony will take place during the Federal Executive Council (FEC) meeting, scheduled for the same day.

The President appointed Mr Disu as the new police chief, following the resignation of the former occupier of the seat, Mr Kayode Egbetokun.

Mr Disu was born on April 13, 1966, in Lagos State and joined the Nigeria Police Force on May 18, 1992, as a Cadet Assistant Superintendent.

He rose through the ranks with multiple qualifications in public administration, forensic investigation, criminology, security, legal psychology, and entrepreneurship-credentials that reflect his commitment to knowledge-driven, modern policing.

His state governor, Mr Babajide Sanwo-Olu, lauded Mr Disu for his exemplary services as a policeman, especially when he served as the Commander of the Rapid Response Squad (RRS) in Lagos State between 2015 and 2021, where his tenure earned him and the RRS recognition for excellence in crime control.

Jobs/Appointments

Court Sanctions CHI Limited for Wrongful Employment Termination

By Modupe Gbadeyanka

The termination of the employment of one Mr Bodunrin Akinsuroju by CHI Limited has been declared as unlawful by the National Industrial Court of Nigeria.

Delivering judgment on the matter, Justice Sanda Yelwa of the Lagos Judicial Division of the court held that the sacking of Mr Akinsuroju did not comply strictly with the provisions of the contract of employment and the Employee Handbook.

Consequently, the company was directed to pay him the sum of N2 million as general damages for wrongful termination and N200,000 as costs of action, while Mr Akinsuroju was ordered to return the company’s properties in his possession or pay their assessed market value.

Justice Yelwa found that the contract agreement between both parties clearly required either party to give 30 days’ notice or payment in lieu of notice after confirmation of appointment, and there was no evidence that the employee was given the required notice or paid salary in lieu of notice.

The judge held that failure to comply with this fundamental term amounted to a breach of the contract of employment, thereby rendering the termination wrongful.

Mr Akinsuroju had claimed that the allegation of misconduct against him was unfounded and not established, maintaining that the disciplinary committee proceedings were prejudicial and that the termination of his employment was without justifiable cause and without compliance with the agreed terms of his employment.

In defence, CHI Limited contended that it had the right to terminate the employment of Mr Akinsuroju and that the termination was lawful and in accordance with the contract of employment and the Code of Conduct.

In opposition, counsel to Mr Akinsuroju submitted that the alleged breaches were not proved and that the termination letter took immediate effect without the requisite 30 days’ notice or payment in lieu of notice as stipulated in the letter of appointment and the Employee Handbook, urging the court to hold that the termination was wrongful and to grant the reliefs sought.

Jobs/Appointments

Tinubu Appoints Tunji Disu as Acting Inspector General of Police

By Modupe Gbadeyanka

President Bola Tinubu on Tuesday appointed Mr Tunji Disu as the acting Inspector General of Police (IGP), following the resignation of Mr Kayode Egbetokun.

Mr Disu, an Assistant Inspector General of Police (AIG), was recently moved to the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos.

A statement today by the Special Adviser to the President on Information and Strategy, Mr Bayo Onanuga, disclosed that the President would convene a meeting of the Nigeria Police Council shortly to formally consider the appointment of Mr Disu as substantive IGP, after which his name will be transmitted to the Senate for confirmation.

Mr Tinubu expressed confidence that Mr Disu’s experience, operational depth, and demonstrated leadership capacity would provide steady and focused direction for the Nigeria Police Force during this critical period.

He reiterated his administration’s unwavering commitment to enhancing national security, strengthening institutional capacity, and ensuring that the Nigeria Police Force remains professional, accountable, and fully equipped to discharge its constitutional responsibilities.

Mr Egbetokun was said to have resigned from the position due to pressing family considerations.

President Tinubu, who accepted the resignation letter, expressed his profound appreciation for Mr Egbetokun’s decades of distinguished service to the Nigeria Police Force and the nation. He acknowledged his dedication, professionalism, and steadfast commitment to strengthening internal security architecture during his tenure.

Appointed in June 2023, Mr Egbetokun was serving a four-year term scheduled to conclude in June 2027, in line with the amended provisions of the Police Act.

The statement disclosed that his replacement was in view of the current security challenges confronting the nation, and acting in accordance with extant laws and legal guidance.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn