Media OutReach

175 years of Heidelberger Druckmaschinen: Company starts anniversary year with growth strategy

- Growth strategy: medium-term sales potential of more than € 300 million

- Growth drivers in the core business: packaging, digital printing Software and lifecycle business

- Industrial business: focus on further expansion

- 175 years: the company has been shaping the printing industry for decades with technological innovations, quality and reliability

- Numerous anniversary activities throughout the year

HEIDELBERG, GERMANY – Newsaktuell – 8 January 2025 – Heidelberger Druckmaschinen AG (HEIDELBERG) is entering its anniversary year 2025 with a growth strategy: March 11, 2025, marks the 175th anniversary of the company’s founding. What began over a century and a half ago as a bell foundry in Frankenthal in the Palatinate region of Germany, has since developed into a leading global technology company and total solutions provider for print shops and packaging applications. HEIDELBERG is tackling the challenges of the future with a clear growth strategy.

“To expand our market position, we are increasingly tapping into growth potential in our core business in packaging and digital printing as well as in the software and lifecycle business,” says Jürgen Otto, CEO of HEIDELBERG. “We will also continue to expand our offering in the growing green technologies market. This includes key areas such as high-precision mechanical engineering, the automotive industry, charging infrastructure and software, and new hydrogen technologies.” In total, HEIDELBERG sees growth potential of more than € 300 million in sales for all strategic initiatives by the 2028/2029 financial year, while at the same time consolidating performance and increasing efficiency.

- Packaging market has seen significant growth since 2014

HEIDELBERG is benefiting from the constantly growing global demand for packaging. The end customer market for packaging has grown by more than 6o percent worldwide over the past ten years. In cooperation with Solenis, HEIDELBERG is responding to the global trend away from plastic and foil towards paper-based packaging and will in future offer solutions for printing recyclable packaging, particularly for the food industry. The company already generates more than 50 percent of its turnover in the packaging segment. And the trend is clearly upward.

- HEIDELBERG seizes opportunities in growing industrial digital printing

According to market estimates, the global digital printing market accessible to HEIDELBERG, including service and consumables, will grow from around EUR 5 billion today to EUR 7.5 billion by 2029. HEIDELBERG has significantly expanded its offering, including through its cooperation with Canon. This will significantly increase sales of digital printing solutions. Incoming orders already confirm this from the next financial year.

- International business with high potential

HEIDELBERG sees a lever for more sales growth in its strong international presence in around 170 countries worldwide, with one of the largest global sales and service networks. The company will continue to expand this internationalization, particularly in growth markets such as Asia, the USA and emerging markets. HEIDELBERG has the best prerequisites for this, particularly in China, thanks to its local production and partnership with MK Masterwork. More than 85 percent of the company’s business is already conducted outside Germany.

- Focus on expanding industrial business in the Technology segment

Another focus is on HEIDELBERG’s industrial business to open up new product areas, markets, and industries. To this end, the company has extensive skills, expertise and resources that are currently already being used outside the printing industry, particularly in the fields of high-precision mechanical engineering, the automotive industry, electromobility and hydrogen. The company is also increasingly offering its expertise and installed capacities to other companies in order to efficiently industrialize or manufacture their products.

175 years: the company has been shaping the printing industry for decades with technological innovations, quality and reliability

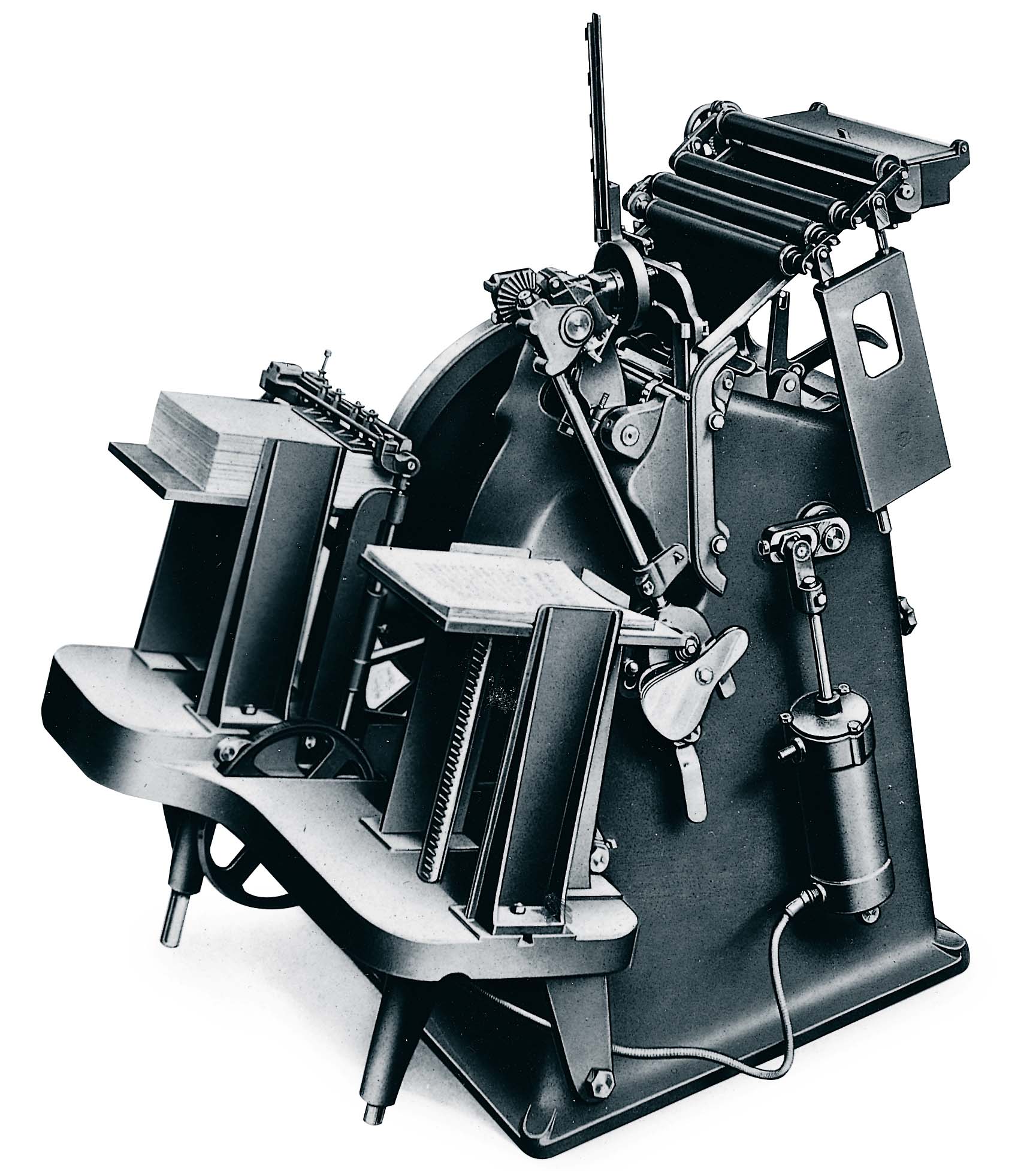

HEIDELBERG has been shaping the printing industry for 175 years with innovations, top quality and maximum reliability. Throughout its history, the company has repeatedly set new standards with pioneering developments such as the “Original Heidelberger Tiegel” and the “Speedmaster” model series for sheetfed offset printing. “175 years of Heidelberger Druckmaschinen are a strong testimony to consistency, as well as innovative strength and thus future viability,” says Jürgen Otto. “Thanks to its impressive achievements over the past 175 years, the company is looking forward to further growth in the coming years with its current market position, the expertise of its employees and global customer relationships.”

Numerous anniversary activities throughout the year

Together with customers, employees and partners, HEIDELBERG is celebrating its anniversary year with numerous events and activities. In the summer, for example, there will be a week of celebrations at the Wiesloch-Walldorf headquarters in the newly designed demonstration center – the Home of Print – including an anniversary ceremony with guests from all over the world, i.e. customers, suppliers, partners and representatives from politics and society. Family days are planned for employees at individual locations. In addition, there will be an anniversary magazine in which the history of the company will be presented, and the future will be directed.

With around 9,500 employees worldwide, production facilities in several countries and regions, including China and the USA, as well as the densest sales and service network in the industry, HEIDELBERG is now a true global player and world market leader from Germany. “Our history impressively demonstrates how entrepreneurship, technical expertise and the genuine creative power of our employees can have a lasting impact on a company over such a long period of time and, far beyond that, on an entire industry to this day,” Otto continues.

Images and further information about the company are available on the Heidelberger Druckmaschinen AG press portal at www.heidelberg.com.

Important note:

This press release contains forward-looking statements based on assumptions and estimates made by the management of Heidelberger Druckmaschinen Aktiengesellschaft. Even if the company management is of the opinion that these assumptions and estimates are accurate, actual future developments and future actual results may deviate considerably from these assumptions and estimates due to a variety of factors. These factors may include, for example, changes in the overall economic situation, exchange rates and interest rates as well as changes within the graphic arts industry. Heidelberger Druckmaschinen Aktiengesellschaft provides no guarantee and assumes no liability that future developments and the actual results achieved in the future will correspond to the assumptions and estimates made in this press release.

Hashtag: #HEIDELBERG

The issuer is solely responsible for the content of this announcement.

Media OutReach

Compax MVNE continues to support Airalo’s eSIM platform

Airalo and Compax have extended their partnership for another five years, ensuring Airalo continues to run on the powerful Compax backend platform. This technology allows Airalo to quickly launch and manage data plans across more than 200 destinations. By using the Compax real-time charging system, Airalo can accurately track data usage and set custom pricing independently, without having to rely on the technical systems of local phone carriers. This total control ensures that Airalo can offer its 20 million users the most flexible and competitive travel eSIM rates on the market.

Compax is proud to support Airalo as it continues to launch new products and services, ensuring its 20M+ customers can stay connected seamlessly across more than 200 destinations, regardless of their travel plans.

“At Airalo, our goal is to provide our customers with reliable connectivity and a seamless experience. Extending our partnership with Compax MVNE for another five years ensures we have the technical foundation to keep that promise,” explained Peter Nussbaumer, VP of Networks at Airalo. “Compax MVNE’s platform gives us the independence to launch new products and manage complex global data plans in real-time, allowing us to stay agile and focus on what matters most: keeping our 20 million users connected, no matter where their journey takes them.”

“The Airalo team set out to transform the way travelers enjoy connectivity abroad forever and they are not falling short on their goal. It’s an absolute pleasure for us to be a part of their journey and assist them on their mission. Connectivity is at the heart of everything we do in our modern ways of life and the Airalo offering is perfectly tuned to that beat.” said Werner Kohl, CEO of Compax.

Hashtag: #CompaxMVNE

The issuer is solely responsible for the content of this announcement.

About Compax

Compax is a leading BSS/OSS software provider for the telecommunications industry. Its business software suite covers the full spectrum required to cover areas such as DSL, FTTH, MVNO and related industries: Apps and portals for customer orders and selfcare, convergent product catalog, CPQ, order management, CRM, contact center, billing, accounting, payments, online charging, and retail management. Compax enables operators to bring new services, offers, and brands to market with a quick turnaround and covering B2B, B2C, and B2B2X scenarios. Relying on proven agile methodology, Compax successfully serves top brands around the globe.

About Airalo

Airalo, founded in 2019, is the world’s largest travel eSIM platform. Trusted by over 20 million travelers, Airalo offers eSIM packages in 200+ destinations, empowering users to connect to mobile networks worldwide instantly. With a remote team of over 300 people, spanning more than 50 countries, Airalo is committed to making mobile connectivity on the move easier, more affordable, and accessible to all.

Media OutReach

Many happy returns as Kai Tak Sports Park celebrates first anniversary

Over 120 event days in first year of operation

HONG KONG SAR – Media OutReach Newswire – 2 March 2026 – Hong Kong’s Kai Tak Sports Park (KTSP) celebrated its milestone first anniversary on Sunday (1 March), successfully hosting nearly 50 major events and delivering over 120 international and local sports and entertainment days since its grand opening.

KTSP has established a unique identity as the city’s new “Home Venue” for major sports and entertainment events. Highlights have included the Hong Kong Sevens (rugby), the Hong Kong Football Festival featuring top teams such as Liverpool, AC Milan, Arsenal and Tottenham Hotspur, as well as concerts by British rock band Coldplay, Mandopop rock band Mayday, singer Jay Chou and global pop icons BLACKPINK.

Sports activities at the Park have welcomed more than 840,000 participants so far. In terms of sports activities, the three major facilities—Kai Tak Stadium, Kai Tak Arena and Kai Tak Youth Sports Ground—together with the bowling centre, outdoor sports facilities and open spaces in the precinct, are expected to surpass 200 event days from the Park’s opening through to the end of March 2026.

In the past year, the utilisation rates of the Kai Tak Stadium and Kai Tak Arena have reached close to 90%. Kai Tak Stadium has already attracted over 1.8 million attendees, rapidly becoming a powerful new driving force in advancing Hong Kong’s sports industry, events economy, and tourism development.

“Our first anniversary is not only a major milestone for Kai Tak Sports Park, but also a moment of pride for Hong Kong. Over the past year, we witnessed athletes’ determination, outstanding performances from artists, and the unforgettable energy of cheering audiences. Each event has touched and inspired us.

“As Hong Kong’s largest integrated sports, leisure and entertainment landmark, we are committed to bringing the community together while strengthening Hong Kong’s connection with the Greater Bay Area and the international stage,” said a spokesperson for KTSP.

The centerpiece 50,000-seat Kai Tak Stadium was ranked third in the world and top in Asia for total ticket sales in 2025 just nine months after its debut, according to Pollstar’s 2025 year-end stadium charts (published mid-December 2025). Pollstar also ranked Kai Tak Stadium No.5 worldwide and No.1 in Asia for total gross revenue (1.25 million passes worth US$191.34 million). Meanwhile, the 10,000-seat Kai Tak Arena, was ranked Asia’s No. 8 in terms of total gross revenue.

“Seeing the Park evolve over the past year into a major sports destination for Hong Kong has been incredibly inspiring,” said Hong Kong, China karatedo team former representative, Lee Chun Ho. “Every time I walk in, I can feel the energy. The professional facilities not only support large-scale events but also make it easier for the public to access different sports, whether they’re beginners or experienced enthusiasts.”

With an expanding line‑up of exciting events, enhanced visitor experiences and an increasingly compelling programme of global attractions, KTSP will further advance the integration of culture, sports and tourism, ushering in an even brighter and more vibrant chapter for Hong Kong.

Hashtag: #HongKong #BrandHongKong #KTSP #Sports #Entertainment #Landmark #MegaEvents

![]() https://www.brandhk.gov.hk/

https://www.brandhk.gov.hk/![]() https://www.linkedin.com/company/brand-hong-kong/

https://www.linkedin.com/company/brand-hong-kong/![]() https://x.com/Brand_HK/

https://x.com/Brand_HK/![]() https://www.facebook.com/brandhk.isd

https://www.facebook.com/brandhk.isd![]() https://www.instagram.com/brandhongkong

https://www.instagram.com/brandhongkong

The issuer is solely responsible for the content of this announcement.

Media OutReach

Green SM Named “Best EV Carpooling App” In the Asia-Pacific Region

Award recipients are evaluated entirely based on independent performance data, including key indicators such as downloads, monthly active users (MAU), growth rates, in-app purchase revenue, and user engagement. These metrics reflect sustained operational effectiveness and performance over time. Green SM’s recognition not only marks a breakthrough for the brand but also demonstrates consistent growth and sufficient operational stability to be recognized at a regional level.

According to the published results, Green SM achieved 114.4% year-on-year MAU growth in 2025 and ranked No. 1 in downloads among EV-focused carpooling platforms in the region. This performance reflects steady expansion across the company’s operating markets, including Vietnam, Laos, Indonesia, and the Philippines.

Behind these growth figures lies a systematically built operational foundation. Green SM maintains that growth is only sustainable when accompanied by the ability to deliver consistent service quality across all operating markets. Scaling its electric fleet while ensuring a uniform and reliable user experience has remained a central priority throughout the company’s development.

This operational stability benefits both sides of the platform. Passengers experience transparent, dependable services, while the Green Driver community operates within a clearly structured, long-term-oriented work environment. For Green SM, growth and quality control are pursued in parallel as two core pillars of sustainable development.

Mr. Nguyen Van Thanh – Global CEO of Green SM stated: “Recognition through an independent data evaluation system affirms that the fully electric mobility model we are pursuing is on the right track. More important than growth speed is the trust we earn from users in every market where we operate. That trust motivates us to continuously refine our fully electric mobility model, ensuring stable operations, structured technology deployment, and sustainable long-term development.”

In the context of an increasingly competitive mobile application landscape, recognition grounded in independent performance data demonstrates that Green SM’s growth is built on a structured, scalable operational platform. The ability of an electric mobility model to achieve strong regional growth while maintaining consistent service quality confirms that this is no longer an experimental alternative, but a practical direction for modern urban transportation.

Previously, Green SM was also honored at the VnExpress Tech Awards 2025 with the titles “Outstanding Ride-Hailing App” and “Vietnamese Tech Brand of the Year,” and received the “CXP Best Customer Experience Award,” which recognized its implementation capabilities and consistent operational standards across the system.

Hashtag: #GreenSM

The issuer is solely responsible for the content of this announcement.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn