Media OutReach

A Diamond is Forever And Lane Crawford Launch “The Forever Gifts: A Natural Diamond Series”

“The Forever Gifts: A Natural Diamond Series” the ultimate destination for bespoke natural diamond master creations in Hong Kong, launched with a line-up of activities at Lane Crawford’s flagship retail space in IFC mall. Renowned actress Charmaine Sheh, fashion trendsetter Hilary Tsui, VIPs, media members and influencers from Hong Kong and China were invited to explore exquisite natural diamond collections, thoughtfully curated by Lane Crawford.

This special series starts with a selection of contemporary fine jewellery brands, each offering a unique design story and a commitment to creativity and excellence. They include State Property, YEPREM, Mio Harutaka, KORLOFF and Claudia Ma Fine Jewellery. “This collaboration marks an important moment for Lane Crawford. Together with De Beers, we’re creating a destination that celebrates the beauty of natural diamonds through exceptional craftsmanship and global creativity. This exclusive space reimagines how clients engage with fine jewellery – bringing artistry, innovation, and the opportunity to design something truly personal.” Emily Wong, Senior Vice President of Merchandising at Lane Crawford.

The exclusive event brought a series of interactive workshops led by experts Jodine Bolden and Samantha Sibley from the De Beers Institute of Diamonds alongside London-based multi-disciplinary artist Annette Fernando.

At the natural diamond workshop, participants gained hands-on experience on rough diamond sorting, polished diamond grading, and differentiation of natural diamonds versus synthetics. Participants also had the unique opportunity of viewing a nearby 297-carat rough diamond and kimberlite carrying a 22-carat rough diamond. Also on display was a gem called “Beating Heart”, a 0.329-carat rough diamond that features a smaller diamond moving freely inside its larger counterpart, a rarity that showcases the extraordinary conditions under which diamonds can form. This exquisite piece, recovered by De Beers Group and analyzed at the facilities of De Beers Institute of Diamonds, is recorded on the Tracr platform, giving insight into its history and heritage. Upon completion of the workshop, each participant received a natural diamond masterclass certificate from the De Beers Institute of Diamonds.

“We are pleased to partner with Lane Crawford for this special series of events to proudly recognize the enduring value of natural diamonds, and to honour the artists who continue to bring life to these creations.” says Loletta Lai, Vice President, Natural Diamonds APAC De Beers Group.

Complementing the technical insight offered by the De Beers Institute of Diamonds, artist Annette Fernando shared her art creations inspired by natural diamonds, named The Multi-Faceted Self. Through a reflective coloring workshop, Annette invited participants to explore the transformative journey of natural diamonds as a metaphor for personal growth and resilience.

The partnership between A Diamond is Forever and Lane Crawford spotlights crafted natural diamond pieces sourced and styled from around the globe, the most treasured gifts ever! These iconic legacy brands and exciting new talent alike, all centered around the timeless beauty of natural diamonds, come together at Lane Crawford, the ultimate destination for discovery, craftsmanship, and contemporary luxury.

Featured Brands

Claudia Ma Fine Jewellery

Claudia Ma, driven by a passion for modern high jewelry and an unwavering dedication to quality, founded her eponymous brand, Claudia Ma, in 2000. With a distinctive design sensibility and an eye for artistic aesthetics, she masterfully reinterprets classic themes through innovative modern expressions. Her creations have earned widespread acclaim for their signature style and exceptional craftsmanship. Over the years, Claudia has collaborated with renowned names such as Shanghai Tang, Lane Crawford, and De Beers Group Forevermark, solidifying her brand’s standing in Hong Kong’s fine jewelry landscape.

Her latest work draws inspiration from the barbell as a symbol of balance, focus, and strength. Crafted in 18k gold and accented with natural diamonds, these versatile pieces embody resilience while seamlessly elevating everyday style.

According to Claudia, “Natural diamonds and craftsmanship go hand in hand. Craftsmanship brings out the diamond’s inner brilliance, while my design presents this timeless classic in a modern way for generations to enjoy. Without this artistry, even the finest diamond remains just a hidden treasure.”

State Property

An award-winning contemporary fine jewellery label from Singapore, State Property fuses modern design with traditional craftsmanship. Founded in 2015 by a jeweller and an industrial designer, the brand draws inspiration from culture, literature, and history—bringing to life structured silhouettes in precious metals that embrace the softness of the human form.

“There’s an emotional gravity with natural diamonds that’s hard to replicate, State Property shares. “Their rarity, beauty, and resilience make them extraordinary. Each one a fragment of the earth’s story, time in a crystallised form. We’re drawn to materials that carry meaning, and diamonds embody permanence, memory, and the quiet luxury of time. At State Property, we strive to have those same qualities reflected in our own work — creating jewellery with intention, designed to endure and be cherished across generations.”

YEPREM

Known for its avant-garde creations, House of YEPREM is a family-run brand that continues to push the boundaries of contemporary diamond jewellery. With a legacy rooted in timeless craftsmanship and visionary design, YEPREM’s striking pieces are now celebrated across America, Europe, the Middle East, and Asia.

“Natural diamonds are the ultimate expression of authenticity and endurance, virtues that mirror YEPREM’s journey and craftsmanship. Born from time, pressure, and perseverance, each diamond holds the essence of transformation and strength. Their inherent brilliance and purity transcend trends, embodying emotion and individuality. In YEPREM’s world, a natural diamond is not merely a material, it is the foundation upon which stories of resilience and radiance are told.”

Mio Harutaka

Crafted in Japan by local artisans, MIO HARUTAKA channels the beauty of Mother Nature into every design. The brand, founded in 2011, is committed to achieving diamond traceability and sustainability while maintaining exceptional artisanal craftsmanship. Harutaka shares: “Craftsmanship is essential—it accounts for almost everything. All of these details depend entirely on the skills of the craftsmen. Craftsmanship is what allows me to welcome close, hands-on appreciation, knowing that each piece will meet that level of scrutiny with confidence and beauty.”

KORLOFF

Since 1978, KORLOFF has been a symbol of true femininity—magnetic, adventurous, and bold. Renowned for crafting exquisite bespoke jewelry, each piece reflects daring designs and the unmatched artistry of French craftsmanship, showcasing the Maison’s boundless creativity and passion. “Our story began with a diamond, the Black Korloff, the largest brilliant-cut natural black diamond in the world. Its uniqueness, shaped over millions of years, continues to inspire us every day as a symbol of mystery, transformation, and the magic of nature. Natural diamonds possess an authenticity and depth that no other material can replicate. They remind us that beauty is born from time, pressure, and light, forces that mirror the creative journey behind each Korloff jewel.”

Meet the De Beers Institute of Diamonds Experts:

Jodine Bolden, Director of Education De Beers Institute of Diamonds

Jodine has previously developed her career as an operations line manager within large FMCG companies, and European HR Management roles within the luxury Health & Beauty industry where she first developed her passion for creating exceptional consumer experiences. After moving to De Beers, she worked as HR Manager for 5 years and discovered her fascination for diamonds as she supported various global functions across the De Beers estate, she then involved creating the Institute of Diamonds Education Service and developing each course that they now offer to their clients.

Since 2018 the De Beers Institute of Diamonds Education Service has provided education on a range of diamond subjects including, Rough Diamond Sorting, Polished Diamond Grading and Laboratory-Grown Detection.

Samantha Sibley, Technical Liaison Manager De Beers Group, UK

With over 30 years’ experience in De Beers’ research, development and commercial teams, Samantha brings a wealth of knowledge regarding the characteristics of both natural and laboratory-grown diamonds. She has been involved in the development of De Beers Group’s current and previous suites of verification instruments and currently also facilitates training and educational courses around the world on the use of these instruments for accurate screening results. Other projects involve research into irradiation and HPHT colour treatments and the utilisation of this information to develop screening processes within the De Beers grading laboratories.

Sam has a BTEC Higher National Certificate in Physics, is a diamond fellow of the Gemmological Association of Great Britain (DGA) and holds a team leader qualification from Leadership Management UK and the Chartered Management Institute. She has presented on diamond topics globally and has had first-hand experience of the diamond industry over many years through visits to mines, cutting centres, polishing factories, gemmological laboratories and tradeshows.

Annette Fernando, Commissioned Artist, “The Multi-Faceted Self” at The Forever Gifts: A Natural Diamond Series

Annette Fernando (b. 1991, London) is a multi-disciplinary artist and curator. She holds a BA in Fine Art from Central Saint Martins and is currently pursuing an MA in Contemporary Art at Sotheby’s Institute of Art, where she was awarded the prestigious Cultural Leaders Scholarship.

Fernando’s artistic repertoire spans drawing, printmaking, painting, and film. Fernando’s current work is driven to immortalise natures scenes, capturing the beauty of moments often overlooked through various mediums. Fernando’s work has garnered significant recognition, including winning the Jerwood Drawing Prize in 2014 and selections for the Royal Academy Summer Exhibition in 2021 and 2023. Her pieces are held in public and private collections across the USA, France, Hong Kong, and the UK.

Hashtag: #adiamondisforeverhk #lanecrawford #adiamondisforever #theforevergifts #naturaldiamonds #diamonds

![]() https://www.debeersgroup.com/

https://www.debeersgroup.com/![]() https://www.linkedin.com/company/debeersgroup/posts/?feedView=all

https://www.linkedin.com/company/debeersgroup/posts/?feedView=all![]() https://www.facebook.com/DeBeersGroupOfCompanies

https://www.facebook.com/DeBeersGroupOfCompanies![]() https://www.instagram.com/debeersgroup/

https://www.instagram.com/debeersgroup/

The issuer is solely responsible for the content of this announcement.

About De Beers Group

Established in 1888, De Beers Group is the world’s leading diamond company with expertise in the exploration, mining, marketing and retailing of diamonds. Together with its joint venture partners, De Beers Group employs more than 20,000 people across the diamond pipeline and is the world’s largest diamond producer by value, with diamond mining operations in Botswana, Canada, Namibia and South Africa. Innovation sits at the heart of De Beers Group’s strategy as it develops a portfolio of offers that span the diamond value chain, including its jewellery houses, De Beers Jewellers and Forevermark, and other pioneering solutions such as diamond sourcing and traceability initiatives Tracr and GemFair. De Beers Group also provides leading services and technology to the diamond industry in the form of education and laboratory services via De Beers Institute of Diamonds and a wide range of diamond sorting, detection and classification technology systems via De Beers Group Ignite. De Beers Group is committed to ‘Building Forever,’ a holistic and integrated approach for creating a better future – where safety, human rights and ethical integrity continue to be paramount; where communities thrive and the environment is protected; and where there are equal

opportunities for all. De Beers Group is a member of the Anglo American PLC group. For further information, visit www.debeersgroup.com.

About Lane Crawford

Founded in 1850, Lane Crawford is an iconic luxury department store, with a mission to search the world for the most exciting talent and product, to create the ultimate luxury edit of fashion and lifestyle for its customers across Greater China. Featuring the largest own-bought designer portfolio across Womenswear, Menswear, Beauty & Wellbeing,

Home and Lifestyle, and Fine Jewellery in the region, Lane Crawford constantly evolves its product, experience, and services offer to embrace the most innovative and relevant designers and exceptional craftsmanship of the season, and to reflect the dynamic pace of its market and customers.

With four stores in Hong Kong; and three stores across Shanghai, Beijing and Chengdu, supported by a global digital flagship, and a purpose-built ecommerce site for China and WeChat store, Lane Crawford is Greater China’s first and only omni-channel luxury fashion retailer. Each store is personalised to its location and designed to provide sensory experience, fusing fashion, design, art and music, while offering exceptional service.

Lane Crawford is a part of The Lane Crawford Joyce Group, Asia’s premier fashion retail, brand management and distribution group, which also includes cutting-edge fashion boutique Joyce; and fashion, beauty, and lifestyle brand management and distribution business ImagineX Group.

Media OutReach

Southco Introduces New Folding T-Handle Compression Latch

The N5 Compression Latch is designed for ergonomic operation, even under harsh conditions. The folding t-handle is easy to grip and actuate, even with a gloved hand, so operators can prioritize their safety and still work efficiently. When not in use, the handle folds neatly into the latch housing for a low-profile look that eliminates catch points.

The folding T-handle is not the only low-profile aspect of the N5 Compression Latch. The entire device is designed to take up minimal space on a panel and protrude as little as possible into an enclosure. With these design choices, engineers can maximize their internal and surface space while still leveraging the ergonomic and sealing benefits of a t-handle compression latch.

Despite its compact design, the N5 is NEMA4/IP65 sealing compliant, and provides strong compressive force to protect valuable interior components. When paired with the right gasket, its compressive force forms a seal around a panel that guards against harmful outside elements like dust and water. Even without a gasket, compression also prevents the panel from rattling against its frame as interior components work, keeping your device quiet.

Finally, the N5 Lift-and-Turn Compression Latch has a variety of locking options and a non-locking variant to accommodate all security needs. These include key-locking cores and tool-operated options such as No. 2 Phillips recess, slotted recess, and hex recess. The N5 adapts to meet the security needs of each user without additional customization.

For more information about the N5 Lift-and-Turn Compression Latch, visit southco.com or email the 24/7 customer service department at in**@*****co.com

Hashtag: #Southco #N5COMPRESSIONLATCH

The issuer is solely responsible for the content of this announcement.

About Southco

Southco, Inc. is the leading global designer and manufacturer of engineered access solutions. From quality and performance to aesthetics and ergonomics, we understand that first impressions are lasting impressions in product design. For over 75 years, Southco has helped the world’s most recognized brands create value for their customers with innovative access solutions designed to enhance the touch points of their products in transportation and industrial applications, medical equipment, data centers and more. With unrivalled engineering resources, innovative products and a dedicated global team, Southco delivers the broadest portfolio of premium access solutions available to equipment designers throughout the world.

Media OutReach

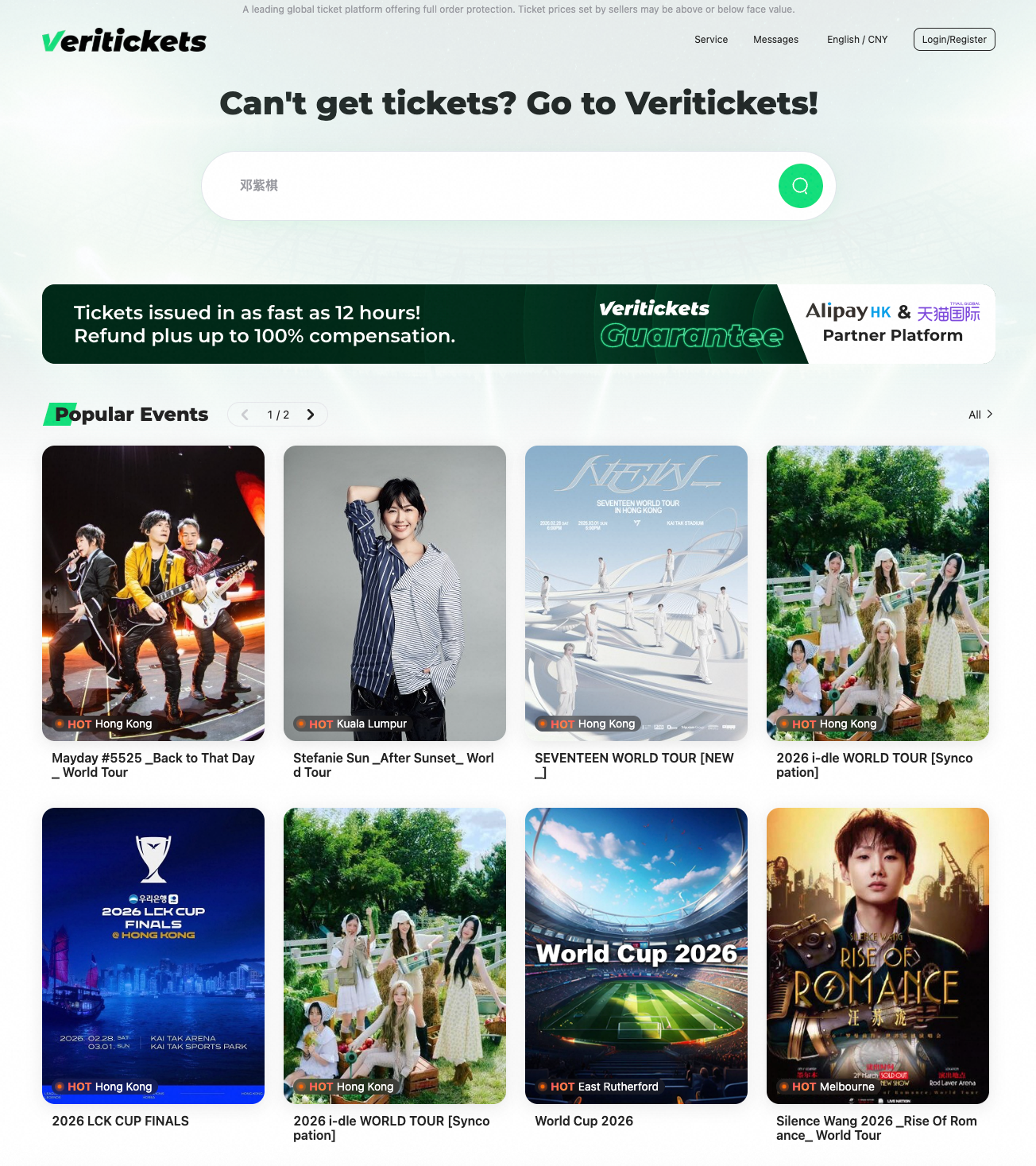

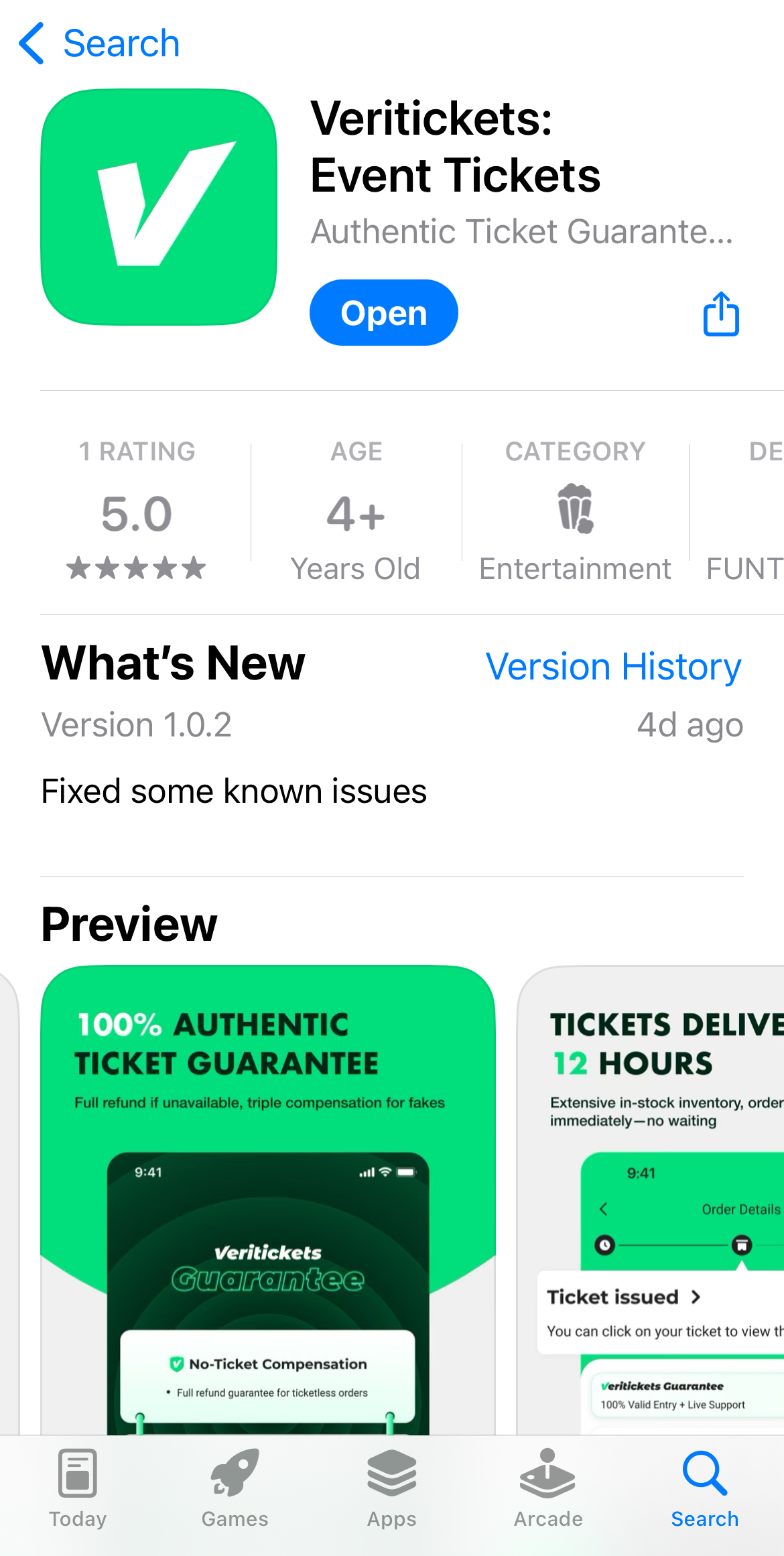

Global Ticketing Platform Veritickets Goes Live on Web and Mobile, Promising 100% Verified, Authentic Tickets with Delivery in 12 Hours

- Veritickets offers a ticket issuance promise as fast as 12 hours and guarantees that every ticket is verified and valid for entry.

- The platform is an officially certified partner of Alipay, China’s leading payments and digital services platform, and of the cross-border e-commerce platform Tmall Global.

- It provides multilingual interfaces and multi‑currency payment options.

SINGAPORE – Media OutReach Newswire – 26 February 2026 – Veritickets, a next‑gen global ticketing platform, recently launched its website and mobile app. The platform pledges to issue confirmed, in‑stock tickets in as fast as 12 hours and offers multilingual interfaces and multi‑currency payment options to address major pain points for cross‑border buyers and streamline the purchase experience.

The platform also guarantees “100% verified tickets,” supported by a consumer‑protection policy that offers a full refund plus additional compensation of up to the ticket price if a ticket is not delivered. Users can access the service via the Veritickets website or by downloading the mobile app from various app stores.

Designed specifically for international buyers, Veritickets accepts major credit cards including Visa, Mastercard and JCB. It is also an officially certified partner of China’s leading payments and digital services open platform Alipay and of the cross-border e-commerce platform Tmall Global.

The platform has already listed multiple high‑demand events, including the BTS 2026-2027 World Tour, the World Cup 2026 and Stefanie Sun _After Sunset_ World Tour.

With an initial focus on Hong Kong, Macau and Southeast Asia, Veritickets is positioning itself as a global ticketing platform, aiming to deepen its presence across the Asia‑Pacific region while expanding into additional markets in phases.

To reduce search friction and enhance transparency, Veritickets aggregates official, vetted inventory into a single interface, enabling users to compare options efficiently. The platform provides real‑time availability and pricing, supported by an all‑in pricing model intended to minimize unexpected fees and last‑minute adjustments.

Its smart recommendation engine curates event suggestions based on user preferences. The platform also offers round‑the‑clock customer support and real‑time transaction verification as part of its agent supervision standards.

Veritickets is currently recruiting internationally qualified ticketing agents, requiring valid operating licenses, strong credit records and proven professional service capabilities. All agents must comply with stringent requirements, including real‑time ticket updates, instant transaction validation and round-the-clock customer support, ensuring a consistent and reliable experience for buyers worldwide.

Hashtag: #Veritickets

The issuer is solely responsible for the content of this announcement.

Media OutReach

Hong Kong 2026-27 Budget: Driving High-quality, Inclusive Growth with Innovation and Finance

The theme of the 2026-27 Budget, the fourth Budget of the current-term Government, is “Driving High-quality, Inclusive Growth with Innovation and Finance”.

“Over the past year, as a result of the booming economy and capital market, our tax revenue has increased. Coupled with the reinforced fiscal consolidation programme gradually bearing fruit, our public finances have improved sooner than expected,” Mr Chan said.

The Financial Secretary revealed that Hong Kong’s Consolidated Account was expected to register a surplus of $2.9 billion in the current fiscal year, instead of a deficit of about $67 billion as originally estimated. The Operating Account for 2025-26, which was originally estimated to record a deficit of about $3 billion, will register a surplus of $51.3 billion, he said.

It was also confirmed that Hong Kong’s economy expanded by 3.5% in 2025, with growth forecast to be between 2.5% and 3.5% for 2026.

Mr Chan noted that this year marks the beginning of the National 15th Five-Year Plan, and he stressed the need for Hong Kong to actively align with the Plan.

“Our country’s sustained high-standard two-way opening-up, coupled with scientific and technological innovation, have presented us with new opportunities,” he said. “We must embrace the 15th Five-Year Plan with an innovative mindset, fostering new quality productive forces in accordance with local conditions.”

Mr Chan set out a series of measures to drive I&T development, including establishing the Committee on AI+ and Industry Development Strategy; taking forward the Sandy Ridge data facility cluster project; promoting AI training; and accelerating digital intelligence transformation of the Government.

“We are pressing ahead with the industrialisation of AI and deepening its integration across various industries, while encouraging wider AI application, thereby achieving the target of adoption and utilisation by all,” he said.

The International Clinical Trial Academy will, he said, also be established to help enable the Chinese Mainland’s biomedicine technology to go global, attract foreign investment, and help develop Hong Kong into an international health and medical innovation hub.

To facilitate the development of new industrialisation, the Budget has earmarked resources for establishing in Hong Kong the first national manufacturing innovation centre outside the Mainland, and the New Industrialisation Elite Enterprises Nurturing Scheme will be launched.

The Government will promote the full integration of technological innovation and industrial innovation through key infrastructure, including the Hong Kong Park of the Hetao Shenzhen-Hong Kong Science and Technology Innovation Co-operation Zone, and the San Tin Technopole in the Northern Metropolis.

To support financial services, Hong Kong will proactively align with national development strategies, advance the internationalisation of the Renminbi, and continuously reform the securities market.

The Government will legislate this year to enhance tax regimes for family offices and funds, as well as establish licensing regimes for digital asset dealing and custodian service providers.

“Despite the complex and ever-changing external environment, Hong Kong’s financial market has performed strongly and our financial system remains robust,” Mr Chan said. “We will continue to consolidate our existing strengths, tap into emerging fields, strengthen market systems and risk control and deepen financial co-operation in the GBA (Guangdong-Hong Kong-Macao Greater Bay Area).”

Noting that Hong Kong saw a year-on-year 12 per cent increase in visitor arrivals last year, which had created business and job opportunities for related sectors, the Budget will allocate $1.66 billion (US$212 million) to the Hong Kong Tourism Board (HKTB).

“The HKTB will scale up its flagship events and promotion, introducing new elements and extending event duration, and organise more signature festive events to highlight Hong Kong’s East-meets-West uniqueness,” Mr Chan said.

The Budget also earmarks an additional funding of $1 billion (US$128 million) for the Built Heritage Conservation Fund to enrich city culture. Elsewhere, the Government will launch the Northern Metropolis Urban-rural Integration Fund as a pilot scheme to support rural tourism projects.

To further promote sports development in Hong Kong, the Financial Secretary will inject $1.2 billion (US$154 million) to the sports portion of the Arts and Sports Development Fund.

Mr Chan said that the global environment has remained volatile over the past year, and Hong Kong has continued to undergo economic transformation.

“Technological innovation, in particular the development of AI, has brought us a mix of opportunities and challenges. Yet, Hong Kong has always thrived amid changes and progressed through innovation. We must make full use of our strengths and leverage the resolute support of our country to speed up and scale up our economic development sustainably for creating better development opportunities for the people and enhancing their quality of life,” Mr Chan said.

For more details on the 2026-27 Budget, click here.

Hashtag: #hongkong #brandhongkong #Budget #Inclusive #Growth #Innovation #Finance

![]() https://www.brandhk.gov.hk/

https://www.brandhk.gov.hk/![]() https://www.linkedin.com/company/brand-hong-kong/

https://www.linkedin.com/company/brand-hong-kong/![]() https://x.com/Brand_HK/

https://x.com/Brand_HK/![]() https://www.facebook.com/brandhk.isd

https://www.facebook.com/brandhk.isd![]() https://www.instagram.com/brandhongkong

https://www.instagram.com/brandhongkong

The issuer is solely responsible for the content of this announcement.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn