Media OutReach

BBSB International Limited Proposes Listing on GEM of HKEx to raise a maximum of approximately HK$87 million by way of Share Offer

- An established civil engineering contractor in Malaysia specialised in providing bridge engineering services as a subcontractor for large scale transportation infrastructure, with over 16 years of experience.

- Provides 2 main types of services: (i) bridge engineering works and (ii) flood mitigation works.

- Holds the highest grade of contractor licence under the CIDB – Grade G7 qualification in Category CE (Civil Engineering Construction), Category B (Building Construction) and Category ME (Mechanical and Electrical) in Malaysia, which allows the Group to undertake civil and structural works of unlimited tender/contract value.

- The Group mainly provides services in projects owned or initiated by the government or government-linked companies in Malaysia, and has participated in a number of notable projects, such as Eastern Dispersal Link, Duta-Ulu Kelang Expressway, Damansara-Shah Alam Elevated Expressway and the SUKE Highway.

Financial Highlights

| (RM’000) | FY2023 | FY2024 | 6M2024(unaudited) | 6M2025 |

| Revenue | 76,757 | 133,002 | 69,786 | 73,986 |

| Bridge engineering works | 74,594 | 123,208 | 64,263 | 73,148 |

| Flood mitigation works | 2,163 | 9,794 | 5,523 | 838 |

| Gross Profit | 10,990 | 25,664 | 10,594 | 15,806 |

| Gross Profit Margin (%) | 14.3 | 19.3 | 15.2 | 21.4 |

| (Loss)/profit and total comprehensive income for the year/period attributable to owners of the Company | (14,460) | 26,189 | 12,112 | 3,201 |

HONG KONG SAR – Media OutReach Newswire – 31 December 2025 – BBSB International Limited (“BBSB” or the “Company”, together with its subsidiaries, the “Group”, stock code: 8610.HK), announces the details of its plan to list on the GEM of The Stock Exchange of Hong Kong Limited (“SEHK”) today.

A total of 125,000,000 shares, subject to the Offer Size Adjustment Option, will be offered under the Share Offer, of which 90%, or 112,500,000 shares will be offered by way of Placing; while the remaining 10%, or 12,500,000 Shares (subject to reallocation) will be offered under the Public Offer. The Offer Price per Offer Share is expected to be not less than HK$0.6 and not more than HK$0.7. The shares will be traded in board lots of 4,000 shares each. The Public Offer will commence at 9:00 a.m. on 31 December 2025 (Wednesday) and close at 12:00 noon on 8 January 2026 (Thursday). The final offer price and allotment results are expected to be announced on 12 January 2026 (Monday). Dealings in shares of BBSB on the GEM of the SEHK are expected to commence on 13 January 2026 (Tuesday).

Assuming an Offer Price of HK$0.65 per Offer Share (being the mid-point of the indicative price range of the Offer Price), the aggregated net proceeds from the Share Offer, after deducting related expenses and assuming the Offer Size Adjustment Option is not exercised, will be approximately HK$56.0 million (equivalent to approximately RM30.2 million). The Group intends to use these net proceeds for the following purposes: 1) approximately 65.2% to strengthen its financial position to pay for the upfront costs of its potential projects; 2) approximately 19.8% for expansion of workforce to support growth across all regions; 3) approximately 5.0% to upgrade and digitise the Group’s information systems and internal processes; and 4) approximately 10.0% for general working capital.

Lego Corporate Finance Limited is the Sole Sponsor. Lego Securities Limited is the Sole Overall Coordinator. Lego Securities Limited and Fortune Origin Securities Limited are the Joint Bookrunners and Joint Lead Managers.

Cornerstone Investors

The Group has entered into cornerstone investment agreements with 2 cornerstone investors, namely Mr. Choy Joo Seong and Mr. Tan Nam Joo, pursuant to which each of the cornerstone investors have agreed to, subject to certain conditions, subscribe for such number of Shares at the Offer Price, which may be purchased with an amount of HK$7.0 million.

Business Overview

The Group is an established civil engineering contractor in Malaysia with over 16 years of experience, specialising in providing bridge engineering services as a subcontractor for large-scale transportation infrastructure engineering projects owned or initiated by the government or government-linked companies in Malaysia. The Group’s business provides 2 categories of services:

- Bridge engineering works which primarily involve (i) the design and construction of girder bridges; and (ii) construction of the connecting highways, roads and facilities ancillary to the girder bridge, such as drainage, sewerage, lightings and signages; and

- Floor mitigation works, focusing on the design and construction of flood mitigation structural solutions to reduce flooding risks.

During the Track Record Period, the Group has completed 2 transportation infrastructure engineering projects. Project JB25, which involved step-in works to assist in the completion of certain outstanding work along the SUKE Highway, had a total contract value of approximately RM33.1 million. Project JB30, involving the construction of earth work and drainage works along Raub Bypass, had a total contract value of RM25.0 million. As at the Latest Practicable Date, the Group has 5 ongoing projects with a total contract value of approximately RM723.5 million.

Competitive Strengths

1. Proven track record in the transportation infrastructure engineering market in Malaysia

The Group has established a strong foothold in the transportation infrastructure engineering market in Malaysia since 2008. Attributed to its experiences in undertaking large-scale transportation infrastructure engineering projects in Malaysia, the Group is registered with the highest contractor licence under the CIDB that allows it to undertake civil and structural works of unlimited tender/contract value. The Group has participated in various major transportation infrastructure engineering projects in Malaysia. This demonstrates not only the Group’s technical capability and service quality, but also its potential to capture future opportunities in the transportation infrastructure engineering market in Malaysia.

2. Provide holistic value engineering solutions to customers

The Group is able to provide holistic value engineering to customers, which take into account construction cost, timelines and environmental impacts. Value engineering is a systematic methodology that applies established tools and techniques to identify, analyse and optimise the functions of a project. Through detailed analysis of project requirements and close collaboration with its customers, the Group ensures that the final design is both efficient and cost-effective.

3. Management team with in-depth industry experience and knowledge

The Group’s management team has extensive industry experience and expertise in the transportation infrastructure engineering industry, especially in the provision of bridge engineering services for large-scale transportation infrastructure engineering projects in Malaysia. Datuk Tan, the chairman of the Board and an executive Director, is a professional engineer in Malaysia and a chartered professional engineer in Australia with over 36 years of experience in the transportation infrastructure engineering industry across both public and private sector projects in Malaysia.

4. Committed to upholding safety and eco-friendliness

The Group places emphasis on safety standard, stringent quality control and environmental protection in the execution of its projects. Its management systems for provision of construction and completion of its projects were certified to be in compliance with the standard required under ISO 9001.

5. Established stable business relationships with major customers, suppliers and subcontractors

The Group’s extensive experience and technical knowledge, coupled with its steadfast commitment to safety, quality and environmental responsibility, have earned the confidence of its customers. The Group has been able to maintain long-term business relationships with reputable and large-scale construction and engineering contractors. As at the Latest Practicable Date, its 5 largest customers in each of FY2023 and FY2024 and 4 largest customers in 6M2025 had maintained a business relationship with the Group for up to eight years.

BUSINESS STRATEGIES

1. Competing for more upcoming large-scale transportation infrastructure engineering projects and flood mitigation projects in both Peninsular Malaysia and East Malaysia

Under the policy framework of the Twelfth Malaysia Plan between 2021 to 2025, the Malaysian government has prioritised infrastructure improvement and inter-regional connectivity. To advance these objectives, RM86.0 billion was allocated to key sectors such as transportation and municipal infrastructure in 2025. The Group’s established track record coupled with its successful application of civil engineering expertise to flood mitigation projects position the Group favourably to bid for future large-scale projects in both Peninsular Malaysia and East Malaysia.

2. Further strengthening manpower and enhancing project management capability

Bridge engineering works within transportation infrastructure projects typically span 1 to 5 years. The Group is required to deploy a full project management team for each project. To ensure the effective execution of any newly awarded projects without compromising the progress, quality, or safety standards of ongoing works, additional recruitment would be necessary to strengthen the Group’s project supervision and site management capabilities.

3. Expansion of workforce to support growth across all regions

The Group plans to expand its headquarters workforce in Peninsular Malaysia to strengthen its central operational capabilities. The expansion in workforce at headquarters will create a robust foundation that not only supports the Group’s current project commitments but also positions it to capitalise on future growth opportunities.

4. Upgrade and digitise the Group’s information systems and internal processes

At present, the Group does not have an integrated IT system in place and instead relies on individual software tools for specific functions such as budgeting, scheduling, and documentation. The Group intends to acquire a range of software, IT infrastructure upgrades, and process enhancements to establish a streamlined and integrated procurement management system.

Hashtag: #BBSB #IPO

The issuer is solely responsible for the content of this announcement.

BBSB International Limited

BBSB International Limited is a civil engineering contractor in Malaysia with over 16 years of experience, specialising in providing bridge engineering services for large-scale transportation infrastructure engineering projects owned or initiated by the government or government-linked companies in Malaysia. The Group has strategically expanded its civil engineering works to include flood mitigation works. The Group has participated in a number of notable transportation infrastructure engineering projects in Malaysia, such as Eastern Dispersal Link, Duta-Ulu Kelang Expressway, Damansara-Shah Alam Elevated Expressway and the SUKE Highway. The Group currently holds a CIDB Grade G7 qualification in Category CE (Civil Engineering Construction), Category B (Building Construction) and Category ME (Mechanical and Electrical) in Malaysia, which is the highest grade of contractor licence under the Construction Industry Development Board of Malaysia, allowing it to undertake civil and structural works of unlimited tender/contract value.

Media OutReach

Southco Introduces New Folding T-Handle Compression Latch

The N5 Compression Latch is designed for ergonomic operation, even under harsh conditions. The folding t-handle is easy to grip and actuate, even with a gloved hand, so operators can prioritize their safety and still work efficiently. When not in use, the handle folds neatly into the latch housing for a low-profile look that eliminates catch points.

The folding T-handle is not the only low-profile aspect of the N5 Compression Latch. The entire device is designed to take up minimal space on a panel and protrude as little as possible into an enclosure. With these design choices, engineers can maximize their internal and surface space while still leveraging the ergonomic and sealing benefits of a t-handle compression latch.

Despite its compact design, the N5 is NEMA4/IP65 sealing compliant, and provides strong compressive force to protect valuable interior components. When paired with the right gasket, its compressive force forms a seal around a panel that guards against harmful outside elements like dust and water. Even without a gasket, compression also prevents the panel from rattling against its frame as interior components work, keeping your device quiet.

Finally, the N5 Lift-and-Turn Compression Latch has a variety of locking options and a non-locking variant to accommodate all security needs. These include key-locking cores and tool-operated options such as No. 2 Phillips recess, slotted recess, and hex recess. The N5 adapts to meet the security needs of each user without additional customization.

For more information about the N5 Lift-and-Turn Compression Latch, visit southco.com or email the 24/7 customer service department at in**@*****co.com

Hashtag: #Southco #N5COMPRESSIONLATCH

The issuer is solely responsible for the content of this announcement.

About Southco

Southco, Inc. is the leading global designer and manufacturer of engineered access solutions. From quality and performance to aesthetics and ergonomics, we understand that first impressions are lasting impressions in product design. For over 75 years, Southco has helped the world’s most recognized brands create value for their customers with innovative access solutions designed to enhance the touch points of their products in transportation and industrial applications, medical equipment, data centers and more. With unrivalled engineering resources, innovative products and a dedicated global team, Southco delivers the broadest portfolio of premium access solutions available to equipment designers throughout the world.

Media OutReach

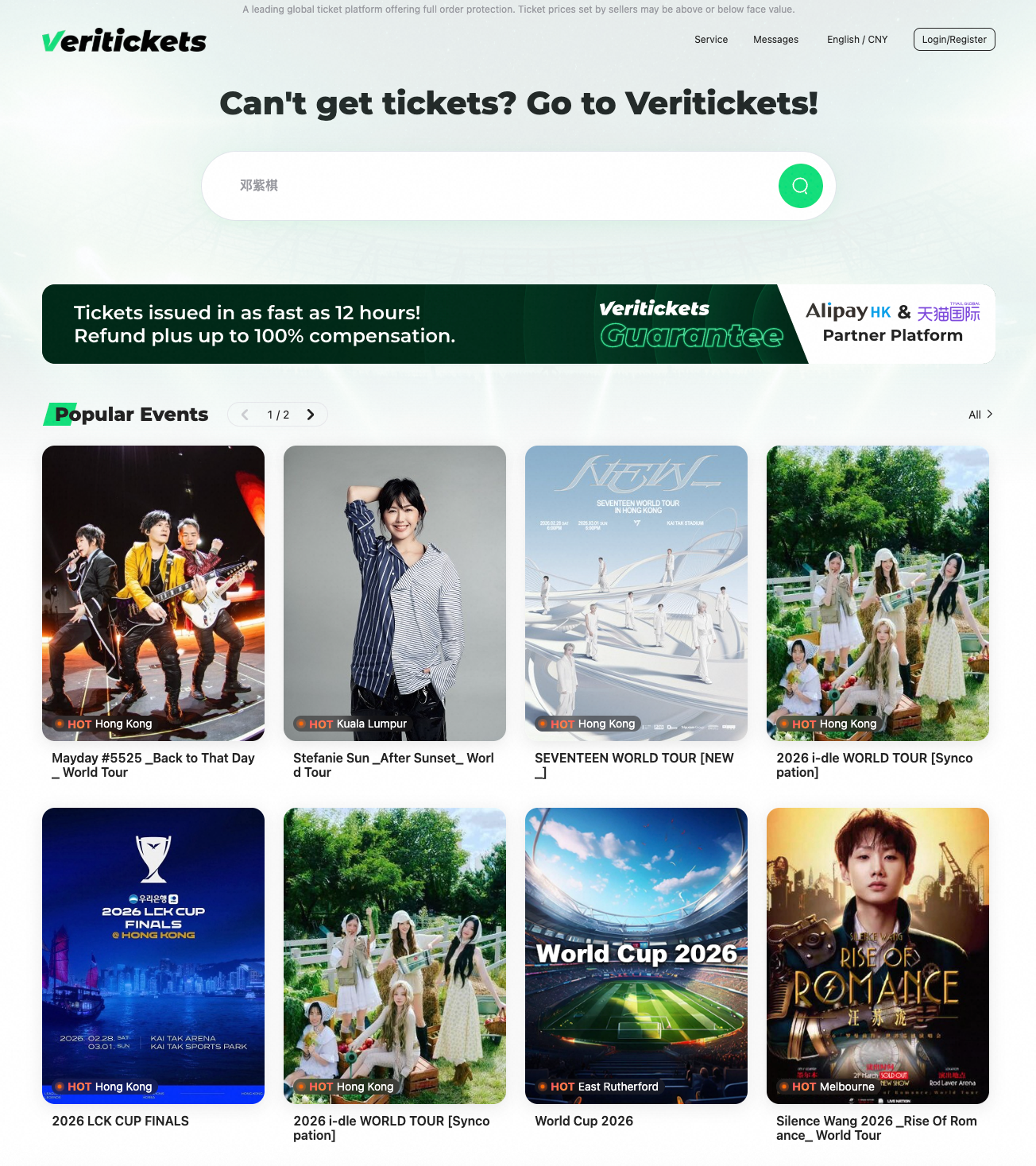

Global Ticketing Platform Veritickets Goes Live on Web and Mobile, Promising 100% Verified, Authentic Tickets with Delivery in 12 Hours

- Veritickets offers a ticket issuance promise as fast as 12 hours and guarantees that every ticket is verified and valid for entry.

- The platform is an officially certified partner of Alipay, China’s leading payments and digital services platform, and of the cross-border e-commerce platform Tmall Global.

- It provides multilingual interfaces and multi‑currency payment options.

SINGAPORE – Media OutReach Newswire – 26 February 2026 – Veritickets, a next‑gen global ticketing platform, recently launched its website and mobile app. The platform pledges to issue confirmed, in‑stock tickets in as fast as 12 hours and offers multilingual interfaces and multi‑currency payment options to address major pain points for cross‑border buyers and streamline the purchase experience.

The platform also guarantees “100% verified tickets,” supported by a consumer‑protection policy that offers a full refund plus additional compensation of up to the ticket price if a ticket is not delivered. Users can access the service via the Veritickets website or by downloading the mobile app from various app stores.

Designed specifically for international buyers, Veritickets accepts major credit cards including Visa, Mastercard and JCB. It is also an officially certified partner of China’s leading payments and digital services open platform Alipay and of the cross-border e-commerce platform Tmall Global.

The platform has already listed multiple high‑demand events, including the BTS 2026-2027 World Tour, the World Cup 2026 and Stefanie Sun _After Sunset_ World Tour.

With an initial focus on Hong Kong, Macau and Southeast Asia, Veritickets is positioning itself as a global ticketing platform, aiming to deepen its presence across the Asia‑Pacific region while expanding into additional markets in phases.

To reduce search friction and enhance transparency, Veritickets aggregates official, vetted inventory into a single interface, enabling users to compare options efficiently. The platform provides real‑time availability and pricing, supported by an all‑in pricing model intended to minimize unexpected fees and last‑minute adjustments.

Its smart recommendation engine curates event suggestions based on user preferences. The platform also offers round‑the‑clock customer support and real‑time transaction verification as part of its agent supervision standards.

Veritickets is currently recruiting internationally qualified ticketing agents, requiring valid operating licenses, strong credit records and proven professional service capabilities. All agents must comply with stringent requirements, including real‑time ticket updates, instant transaction validation and round-the-clock customer support, ensuring a consistent and reliable experience for buyers worldwide.

Hashtag: #Veritickets

The issuer is solely responsible for the content of this announcement.

Media OutReach

Hong Kong 2026-27 Budget: Driving High-quality, Inclusive Growth with Innovation and Finance

The theme of the 2026-27 Budget, the fourth Budget of the current-term Government, is “Driving High-quality, Inclusive Growth with Innovation and Finance”.

“Over the past year, as a result of the booming economy and capital market, our tax revenue has increased. Coupled with the reinforced fiscal consolidation programme gradually bearing fruit, our public finances have improved sooner than expected,” Mr Chan said.

The Financial Secretary revealed that Hong Kong’s Consolidated Account was expected to register a surplus of $2.9 billion in the current fiscal year, instead of a deficit of about $67 billion as originally estimated. The Operating Account for 2025-26, which was originally estimated to record a deficit of about $3 billion, will register a surplus of $51.3 billion, he said.

It was also confirmed that Hong Kong’s economy expanded by 3.5% in 2025, with growth forecast to be between 2.5% and 3.5% for 2026.

Mr Chan noted that this year marks the beginning of the National 15th Five-Year Plan, and he stressed the need for Hong Kong to actively align with the Plan.

“Our country’s sustained high-standard two-way opening-up, coupled with scientific and technological innovation, have presented us with new opportunities,” he said. “We must embrace the 15th Five-Year Plan with an innovative mindset, fostering new quality productive forces in accordance with local conditions.”

Mr Chan set out a series of measures to drive I&T development, including establishing the Committee on AI+ and Industry Development Strategy; taking forward the Sandy Ridge data facility cluster project; promoting AI training; and accelerating digital intelligence transformation of the Government.

“We are pressing ahead with the industrialisation of AI and deepening its integration across various industries, while encouraging wider AI application, thereby achieving the target of adoption and utilisation by all,” he said.

The International Clinical Trial Academy will, he said, also be established to help enable the Chinese Mainland’s biomedicine technology to go global, attract foreign investment, and help develop Hong Kong into an international health and medical innovation hub.

To facilitate the development of new industrialisation, the Budget has earmarked resources for establishing in Hong Kong the first national manufacturing innovation centre outside the Mainland, and the New Industrialisation Elite Enterprises Nurturing Scheme will be launched.

The Government will promote the full integration of technological innovation and industrial innovation through key infrastructure, including the Hong Kong Park of the Hetao Shenzhen-Hong Kong Science and Technology Innovation Co-operation Zone, and the San Tin Technopole in the Northern Metropolis.

To support financial services, Hong Kong will proactively align with national development strategies, advance the internationalisation of the Renminbi, and continuously reform the securities market.

The Government will legislate this year to enhance tax regimes for family offices and funds, as well as establish licensing regimes for digital asset dealing and custodian service providers.

“Despite the complex and ever-changing external environment, Hong Kong’s financial market has performed strongly and our financial system remains robust,” Mr Chan said. “We will continue to consolidate our existing strengths, tap into emerging fields, strengthen market systems and risk control and deepen financial co-operation in the GBA (Guangdong-Hong Kong-Macao Greater Bay Area).”

Noting that Hong Kong saw a year-on-year 12 per cent increase in visitor arrivals last year, which had created business and job opportunities for related sectors, the Budget will allocate $1.66 billion (US$212 million) to the Hong Kong Tourism Board (HKTB).

“The HKTB will scale up its flagship events and promotion, introducing new elements and extending event duration, and organise more signature festive events to highlight Hong Kong’s East-meets-West uniqueness,” Mr Chan said.

The Budget also earmarks an additional funding of $1 billion (US$128 million) for the Built Heritage Conservation Fund to enrich city culture. Elsewhere, the Government will launch the Northern Metropolis Urban-rural Integration Fund as a pilot scheme to support rural tourism projects.

To further promote sports development in Hong Kong, the Financial Secretary will inject $1.2 billion (US$154 million) to the sports portion of the Arts and Sports Development Fund.

Mr Chan said that the global environment has remained volatile over the past year, and Hong Kong has continued to undergo economic transformation.

“Technological innovation, in particular the development of AI, has brought us a mix of opportunities and challenges. Yet, Hong Kong has always thrived amid changes and progressed through innovation. We must make full use of our strengths and leverage the resolute support of our country to speed up and scale up our economic development sustainably for creating better development opportunities for the people and enhancing their quality of life,” Mr Chan said.

For more details on the 2026-27 Budget, click here.

Hashtag: #hongkong #brandhongkong #Budget #Inclusive #Growth #Innovation #Finance

![]() https://www.brandhk.gov.hk/

https://www.brandhk.gov.hk/![]() https://www.linkedin.com/company/brand-hong-kong/

https://www.linkedin.com/company/brand-hong-kong/![]() https://x.com/Brand_HK/

https://x.com/Brand_HK/![]() https://www.facebook.com/brandhk.isd

https://www.facebook.com/brandhk.isd![]() https://www.instagram.com/brandhongkong

https://www.instagram.com/brandhongkong

The issuer is solely responsible for the content of this announcement.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn