Media OutReach

Gaw Capital Partners and GFH Partners Form JV to Develop UAE Industrial and Logistics Development Platform

The developments will be led by Manrre Developments, a joint venture between GFH and Palmon Group, a seasoned UAE-based industrial conglomerate with over 40 years of institutional experience. This partnership unites proven regional expertise across acquisition, planning and design, development, execution, and operational readiness to deliver exceptional, future-ready warehouses and logistics centres.

Harry Ip, Managing Director of Gaw Capital, said, “We are thrilled to enter UAE’s flourishing industrial and logistics market, supported by strong fundamentals, the surge in structural demand driven by government-led initiatives, and heightened global interest in the logistics and industrial asset class. Leveraging the expertise from GFH Partners, this partnership positions us as one of Asia’s leading forerunners in delivering prime industrial facilities in the UAE, providing investors with exposure to a fundamentally undersupplied market.”

Nael Mustafa, CEO of GFH Partners, commented, “GFH Partners brings on-the-ground specialists, experienced local operators, and a strong track record managing logistics and industrial assets across the GCC. This joint venture allows us to scale that regional expertise even further, capitalizing on the UAE’s robust industrial growth trajectory. Through this partnership with Gaw Capital, we are combining regional insight with global capability to unlock new opportunities in the UAE’s expanding industrial and logistics sector.”

The Platform is being launched at a time of strong macroeconomic momentum, supported by the UAE’s long-term development strategies including the Dubai Industrial Strategy 2030 and the Dubai 2040 Urban Master Plan. Majority of these initiatives are aimed at accelerating industrial diversification, attracting FDI, and expanding logistics infrastructure. The local government offers a list of pro-business regulatory and fiscal policies, including tax exemptions, customs duty exemption, simplified regulations in 40+ free zones, and relaxed foreign ownership limitation, to accelerate logistics demand and investment. Furthermore, the population of the UAE has experienced dramatic growth and is expected to reach 12.2 million by 2030, driven by the long-term residency incentives (e.g. Golden Visa), competitive tax regime, openings of prestigious school campuses for expatriate professional and family relocation.

Demand for logistics and industrial assets remains robust, supported by a persistent supply–demand imbalance. Dubai’s warehouse and logistics occupancy currently exceeds 97%, with rental rates increasing 33% year-on-year. The formation of the Platform will mark Gaw Capital’s first geographic footprint in the logistics sector in the UAE, demonstrating its global network and cross-border expertise in accessing industrial and logistics investments ahead of the curve.

Gaw Capital has established a robust logistics footprint across China, Japan, South Korea, Vietnam and Australia, with investments in 39 projects totalling approximately 3.8 million sqm of GFA. As of Q3 2025, Gaw Capital manages over US$3.4 billion in assets under management in its global logistics portfolio.

Since 2014, the firm has acquired, developed, and managed a substantial portfolio of modern logistics facilities with over 3 million sqm of GFA across China, supported by a team of around 100 professionals through 4 investment vehicles. Leveraging its deep expertise, Gaw Capital has expanded into other APAC markets through strategic partnerships, acquiring high-quality assets in key metropolitan hubs. Recent investments include seven logistics assets in Greater Tokyo (nearly 250,000 sqm GFA), one in Seoul (over 75,000 sqm GFA), two in Vietnam (over 210,000 sqm GFA) and six urban industrial and logistics warehouses in Sydney (over 45,000 sqm GFA). The firm’s in-house teams and operating partners deliver value-added services across the logistics value chain, including development, construction, leasing, and property management.

Hashtag: #GawCapitalPartners #GFHPartners

The issuer is solely responsible for the content of this announcement.

About Gaw Capital Partners

Based in Asia, Gaw Capital Partners is a multi-asset investment management firm focusing on real estate, growth equity, private credit and infrastructure markets globally.

Since its inception in 2005, the firm has raised seven commingled funds targeting Asia Pacific, alongside value-add /opportunistic funds in the U.S., a Pan-Asia Hospitality Fund, a European Hospitality Fund, a Growth Equity Fund and a Credit Fund. It also manages credit strategies and separate account direct investments globally.

Gaw Capital has consistently generated high yields by revitalizing underperforming assets, enhancing value through creative financing solutions and leveraging deep expertise in capital allocation.

Since 2005, the firm has managed US$35.8 billion in assets and raised US$24.4 billion in equity as of Q2 2025.

About GFH Partners Ltd.

GFH Partners Ltd. (“GFH Partners”) is the DIFC-based global asset management subsidiary of GFH Financial Group B.S.C. (“GFH”). Headquartered in Dubai International Financial Centre and regulated by the Dubai Financial Services Authority, GFH Partners is dedicated to real estate investment and asset management across diverse markets. With assets under management exceeding US$7 billion and investments spanning the US, UK, and GCC. GFH Partners focuses on strategic partnerships and innovative real estate solutions, reinforcing its role as a leading player in global asset management.

Media OutReach

Southco Introduces New Folding T-Handle Compression Latch

The N5 Compression Latch is designed for ergonomic operation, even under harsh conditions. The folding t-handle is easy to grip and actuate, even with a gloved hand, so operators can prioritize their safety and still work efficiently. When not in use, the handle folds neatly into the latch housing for a low-profile look that eliminates catch points.

The folding T-handle is not the only low-profile aspect of the N5 Compression Latch. The entire device is designed to take up minimal space on a panel and protrude as little as possible into an enclosure. With these design choices, engineers can maximize their internal and surface space while still leveraging the ergonomic and sealing benefits of a t-handle compression latch.

Despite its compact design, the N5 is NEMA4/IP65 sealing compliant, and provides strong compressive force to protect valuable interior components. When paired with the right gasket, its compressive force forms a seal around a panel that guards against harmful outside elements like dust and water. Even without a gasket, compression also prevents the panel from rattling against its frame as interior components work, keeping your device quiet.

Finally, the N5 Lift-and-Turn Compression Latch has a variety of locking options and a non-locking variant to accommodate all security needs. These include key-locking cores and tool-operated options such as No. 2 Phillips recess, slotted recess, and hex recess. The N5 adapts to meet the security needs of each user without additional customization.

For more information about the N5 Lift-and-Turn Compression Latch, visit southco.com or email the 24/7 customer service department at in**@*****co.com

Hashtag: #Southco #N5COMPRESSIONLATCH

The issuer is solely responsible for the content of this announcement.

About Southco

Southco, Inc. is the leading global designer and manufacturer of engineered access solutions. From quality and performance to aesthetics and ergonomics, we understand that first impressions are lasting impressions in product design. For over 75 years, Southco has helped the world’s most recognized brands create value for their customers with innovative access solutions designed to enhance the touch points of their products in transportation and industrial applications, medical equipment, data centers and more. With unrivalled engineering resources, innovative products and a dedicated global team, Southco delivers the broadest portfolio of premium access solutions available to equipment designers throughout the world.

Media OutReach

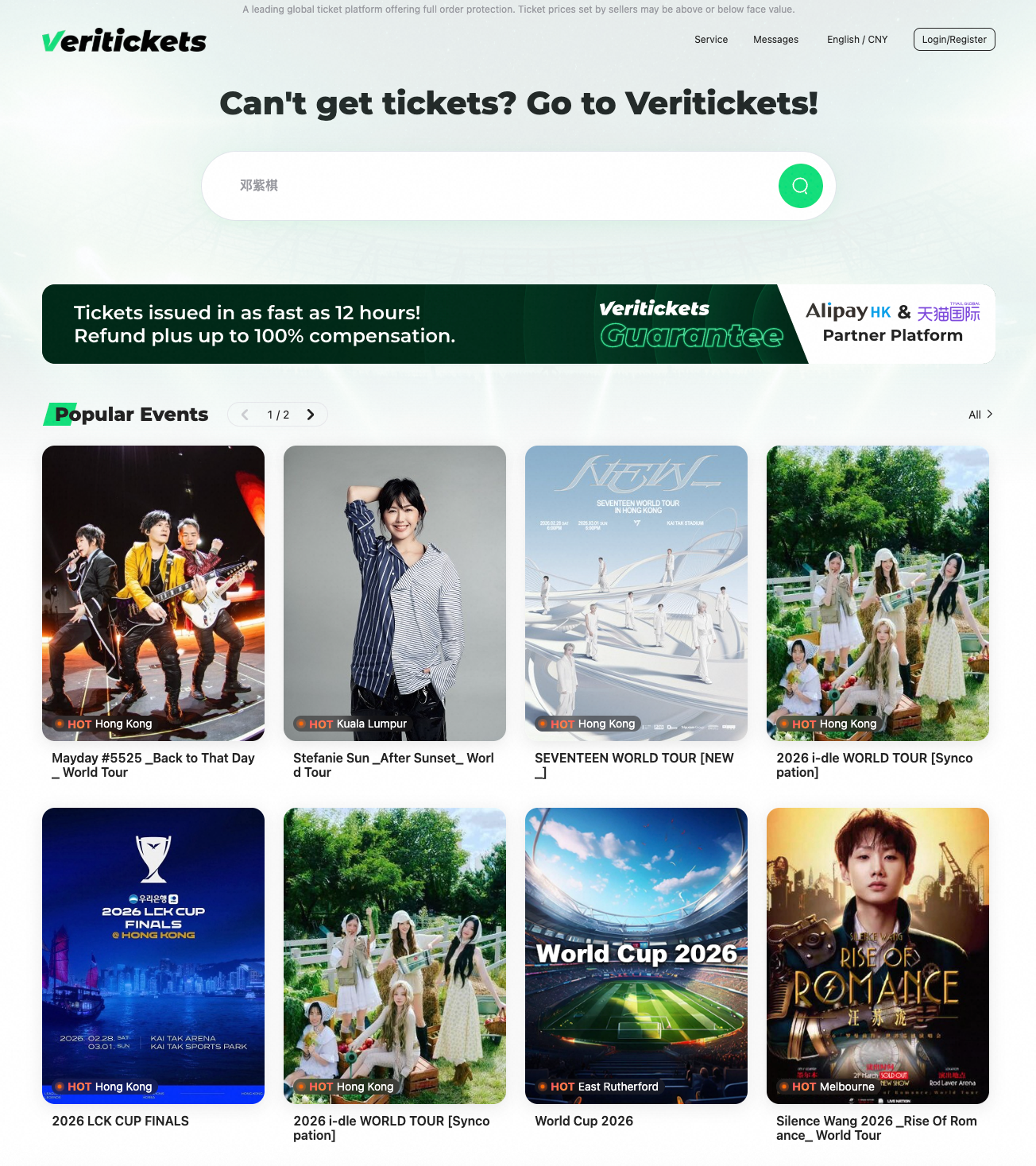

Global Ticketing Platform Veritickets Goes Live on Web and Mobile, Promising 100% Verified, Authentic Tickets with Delivery in 12 Hours

- Veritickets offers a ticket issuance promise as fast as 12 hours and guarantees that every ticket is verified and valid for entry.

- The platform is an officially certified partner of Alipay, China’s leading payments and digital services platform, and of the cross-border e-commerce platform Tmall Global.

- It provides multilingual interfaces and multi‑currency payment options.

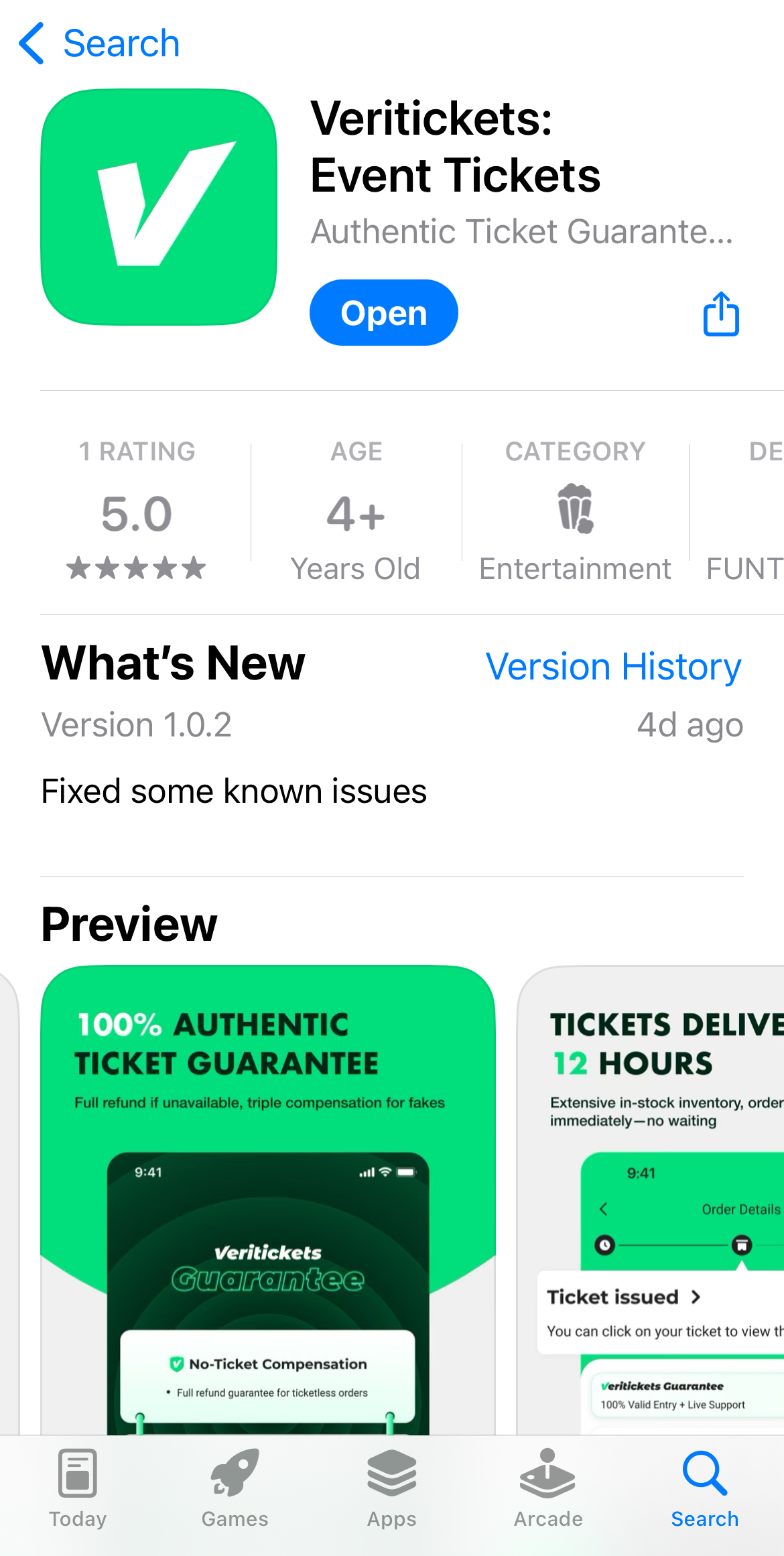

SINGAPORE – Media OutReach Newswire – 26 February 2026 – Veritickets, a next‑gen global ticketing platform, recently launched its website and mobile app. The platform pledges to issue confirmed, in‑stock tickets in as fast as 12 hours and offers multilingual interfaces and multi‑currency payment options to address major pain points for cross‑border buyers and streamline the purchase experience.

The platform also guarantees “100% verified tickets,” supported by a consumer‑protection policy that offers a full refund plus additional compensation of up to the ticket price if a ticket is not delivered. Users can access the service via the Veritickets website or by downloading the mobile app from various app stores.

Designed specifically for international buyers, Veritickets accepts major credit cards including Visa, Mastercard and JCB. It is also an officially certified partner of China’s leading payments and digital services open platform Alipay and of the cross-border e-commerce platform Tmall Global.

The platform has already listed multiple high‑demand events, including the BTS 2026-2027 World Tour, the World Cup 2026 and Stefanie Sun _After Sunset_ World Tour.

With an initial focus on Hong Kong, Macau and Southeast Asia, Veritickets is positioning itself as a global ticketing platform, aiming to deepen its presence across the Asia‑Pacific region while expanding into additional markets in phases.

To reduce search friction and enhance transparency, Veritickets aggregates official, vetted inventory into a single interface, enabling users to compare options efficiently. The platform provides real‑time availability and pricing, supported by an all‑in pricing model intended to minimize unexpected fees and last‑minute adjustments.

Its smart recommendation engine curates event suggestions based on user preferences. The platform also offers round‑the‑clock customer support and real‑time transaction verification as part of its agent supervision standards.

Veritickets is currently recruiting internationally qualified ticketing agents, requiring valid operating licenses, strong credit records and proven professional service capabilities. All agents must comply with stringent requirements, including real‑time ticket updates, instant transaction validation and round-the-clock customer support, ensuring a consistent and reliable experience for buyers worldwide.

Hashtag: #Veritickets

The issuer is solely responsible for the content of this announcement.

Media OutReach

Hong Kong 2026-27 Budget: Driving High-quality, Inclusive Growth with Innovation and Finance

The theme of the 2026-27 Budget, the fourth Budget of the current-term Government, is “Driving High-quality, Inclusive Growth with Innovation and Finance”.

“Over the past year, as a result of the booming economy and capital market, our tax revenue has increased. Coupled with the reinforced fiscal consolidation programme gradually bearing fruit, our public finances have improved sooner than expected,” Mr Chan said.

The Financial Secretary revealed that Hong Kong’s Consolidated Account was expected to register a surplus of $2.9 billion in the current fiscal year, instead of a deficit of about $67 billion as originally estimated. The Operating Account for 2025-26, which was originally estimated to record a deficit of about $3 billion, will register a surplus of $51.3 billion, he said.

It was also confirmed that Hong Kong’s economy expanded by 3.5% in 2025, with growth forecast to be between 2.5% and 3.5% for 2026.

Mr Chan noted that this year marks the beginning of the National 15th Five-Year Plan, and he stressed the need for Hong Kong to actively align with the Plan.

“Our country’s sustained high-standard two-way opening-up, coupled with scientific and technological innovation, have presented us with new opportunities,” he said. “We must embrace the 15th Five-Year Plan with an innovative mindset, fostering new quality productive forces in accordance with local conditions.”

Mr Chan set out a series of measures to drive I&T development, including establishing the Committee on AI+ and Industry Development Strategy; taking forward the Sandy Ridge data facility cluster project; promoting AI training; and accelerating digital intelligence transformation of the Government.

“We are pressing ahead with the industrialisation of AI and deepening its integration across various industries, while encouraging wider AI application, thereby achieving the target of adoption and utilisation by all,” he said.

The International Clinical Trial Academy will, he said, also be established to help enable the Chinese Mainland’s biomedicine technology to go global, attract foreign investment, and help develop Hong Kong into an international health and medical innovation hub.

To facilitate the development of new industrialisation, the Budget has earmarked resources for establishing in Hong Kong the first national manufacturing innovation centre outside the Mainland, and the New Industrialisation Elite Enterprises Nurturing Scheme will be launched.

The Government will promote the full integration of technological innovation and industrial innovation through key infrastructure, including the Hong Kong Park of the Hetao Shenzhen-Hong Kong Science and Technology Innovation Co-operation Zone, and the San Tin Technopole in the Northern Metropolis.

To support financial services, Hong Kong will proactively align with national development strategies, advance the internationalisation of the Renminbi, and continuously reform the securities market.

The Government will legislate this year to enhance tax regimes for family offices and funds, as well as establish licensing regimes for digital asset dealing and custodian service providers.

“Despite the complex and ever-changing external environment, Hong Kong’s financial market has performed strongly and our financial system remains robust,” Mr Chan said. “We will continue to consolidate our existing strengths, tap into emerging fields, strengthen market systems and risk control and deepen financial co-operation in the GBA (Guangdong-Hong Kong-Macao Greater Bay Area).”

Noting that Hong Kong saw a year-on-year 12 per cent increase in visitor arrivals last year, which had created business and job opportunities for related sectors, the Budget will allocate $1.66 billion (US$212 million) to the Hong Kong Tourism Board (HKTB).

“The HKTB will scale up its flagship events and promotion, introducing new elements and extending event duration, and organise more signature festive events to highlight Hong Kong’s East-meets-West uniqueness,” Mr Chan said.

The Budget also earmarks an additional funding of $1 billion (US$128 million) for the Built Heritage Conservation Fund to enrich city culture. Elsewhere, the Government will launch the Northern Metropolis Urban-rural Integration Fund as a pilot scheme to support rural tourism projects.

To further promote sports development in Hong Kong, the Financial Secretary will inject $1.2 billion (US$154 million) to the sports portion of the Arts and Sports Development Fund.

Mr Chan said that the global environment has remained volatile over the past year, and Hong Kong has continued to undergo economic transformation.

“Technological innovation, in particular the development of AI, has brought us a mix of opportunities and challenges. Yet, Hong Kong has always thrived amid changes and progressed through innovation. We must make full use of our strengths and leverage the resolute support of our country to speed up and scale up our economic development sustainably for creating better development opportunities for the people and enhancing their quality of life,” Mr Chan said.

For more details on the 2026-27 Budget, click here.

Hashtag: #hongkong #brandhongkong #Budget #Inclusive #Growth #Innovation #Finance

![]() https://www.brandhk.gov.hk/

https://www.brandhk.gov.hk/![]() https://www.linkedin.com/company/brand-hong-kong/

https://www.linkedin.com/company/brand-hong-kong/![]() https://x.com/Brand_HK/

https://x.com/Brand_HK/![]() https://www.facebook.com/brandhk.isd

https://www.facebook.com/brandhk.isd![]() https://www.instagram.com/brandhongkong

https://www.instagram.com/brandhongkong

The issuer is solely responsible for the content of this announcement.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn